Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Everyone making money in the stock market today and these paid bashers are stuck on their shift grinding away on a stock forum of a stock that is not trading per contract . Bwahahahaha!!! Fools

MAJORITY HOLDING SHARES VERY STRONG$$$

Nope. Hundreds just like this one all over IHUB. On every board, someone is claiming, "this one is different!"

Oh no for sure not, Bioamber isn’t in business at all with no employees and no assets of any kind.

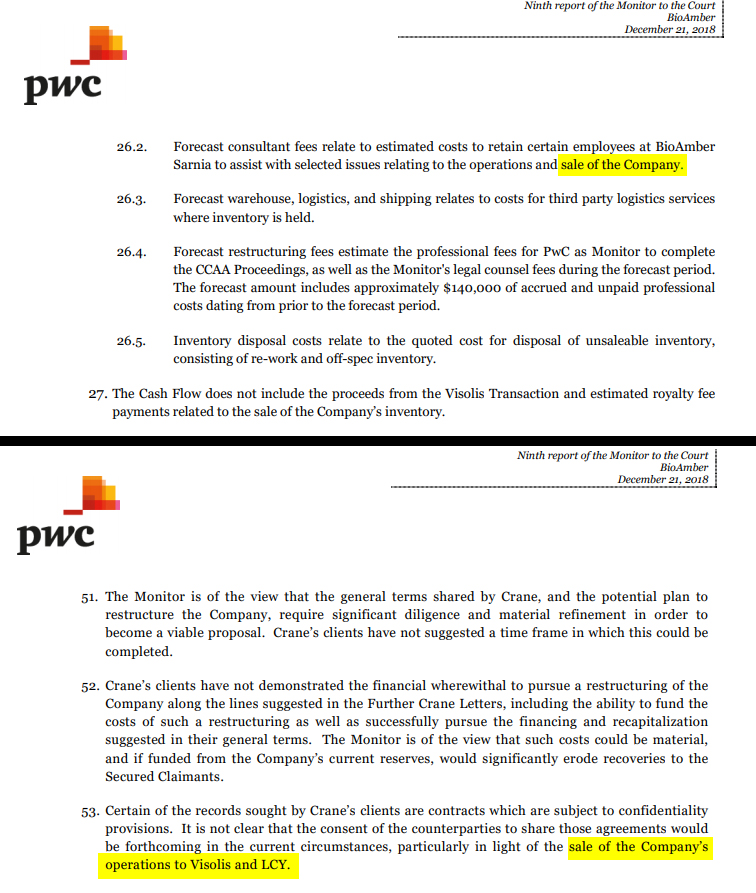

A JV between LCY and Visolis bought the Bioamber assets.

No one wanted Bioamber Inc. Had too much debt and operated at a loss.

Who bought Bioamber's Canadian assets? And who bought Bioamber Inc?

https://www.utech-polyurethane.com/topic/bioamber

https://www.businessinsider.com/y-combinator-ginkgo-partner-give-startups-access-biology-tools-2019-9

How's that "sale as a going concern" working out for you so far?🤪

Making your rich I bet huh?

The market is in turmoil and this paid lot still focusing on a stock that doesn’t trade. Hahahahah

MAJORITY HOLDING SHARES VERY STRONG$$$

Why would shareholders receive anything from the company that bought its old assets?

Why would anyone create new shares?

Because Bioamber got sold to create another company with it's assets or patents and Bioamber shareholders are waiting to receive new shares, Verde bioresins is interesting because it is already partners with Vinmar and enerkem and might also team up with Origin materials or Lcyb or both in the future

https://www.icis.com/explore/resources/news/2023/06/22/10898681/us-verde-bioresins-to-go-public-grabs-deals-with-braskem-vinmar/

"The company is fermenting sugars to make ethanol then dehydrate it into powder to produce ethylene" this is biosuccinic acid recipe

Yes of course it’s dead so why are you coming on to talk about another company?

Former Bioamber has no patents. It was liquidated.

Cool, thanks so much for the reminder!!!

What brings you back here? Because I mentioned Verde Bioresins bothered you?

Might be connected to Bioamber's patents? Thanks for being worried about our Bioamber shares and the next step transaction whatever that might be, newco shares??could become Verde?? Anything is possible, Bioamber shares are attached to it's technology / license

The Stock certainly is that of a Zombie ticker and we know the Company has been liquated so it is also dead.

If you understood real DD you wouldn't be so horrible at connecting the dots.

If you see an article from 2012 and it mentions Bio - anything you try to convince investors it is about bioamber.

What date was the last trade?

Here more of your pumping BS:

"biowin

Saturday, 04/03/2021 1:02:05 PM

BlackRock Inc? Could be behind all $$"

How's the Blackrock going?

More nonsense:

"biowin

Friday, 04/02/2021 10:33:34 PM

China approved merger of chemical giants one day ago of 150B, we are connected with bioambers technology with this deals, Canada bioamber build plants doing business in Asia and other countries for years to commercialize bio plastics, and so many other products made bio, including textiles, leather, rubber etc, so we should get paid soon, stop the delays and cover ups, the government raised money from selling us shares to build factories internationally, stop holding us hostages pay us for our shares"

Another of your failed pumps.

IG

Isn't Bioamber dead company or dead stock for you? Verde Bioresins has been funded by Genome Canada for biodegradable plastics projects which have a connection to Bioamber's patents

Isn’t that for the verde board?

Verde Bioresins has collaborated with genome canada and has bio nylon as part of their products

https://biozone.utoronto.ca/news/new-genome-canada-project-genomics-driven-engineering-hosts-bio-nylon-krishna-mahadevan-bioamber/

https://www.ontariogenomics.ca/awarded-project/genomics-driven-engineering-of-hosts-for-bio-nylon/

Former Bioamber has no technology due to the liquidation.

I am not aware of a transaction involving LCYB and Verde Bioresins…

Verde Bioresins???who's technology? Bioamber's?? Biodegradable plastics, was previously planned to go public with Tilgly and is partners with Vinmar?

https://www.globenewswire.com/news-release/2025/04/08/3057605/0/en/Shareholder-Approved-Merger-with-Verde-Bioresins-Inc-Progressing-Towards-Close.html

https://ca.marketscreener.com/quote/stock/MIZUHO-FINANCIAL-GROUP-IN-6496086/news/Verde-Bioresins-Inc-cancelled-the-acquisition-of-TLGY-Acquisition-Corporation-from-a-group-of-shar-46227738/

The company was created 2020, California

It sure will be epic for Bioamber's shareholders

https://clean50.com/projects/bioindustrial-innovation-centre-sarnia-biochem-cluster/

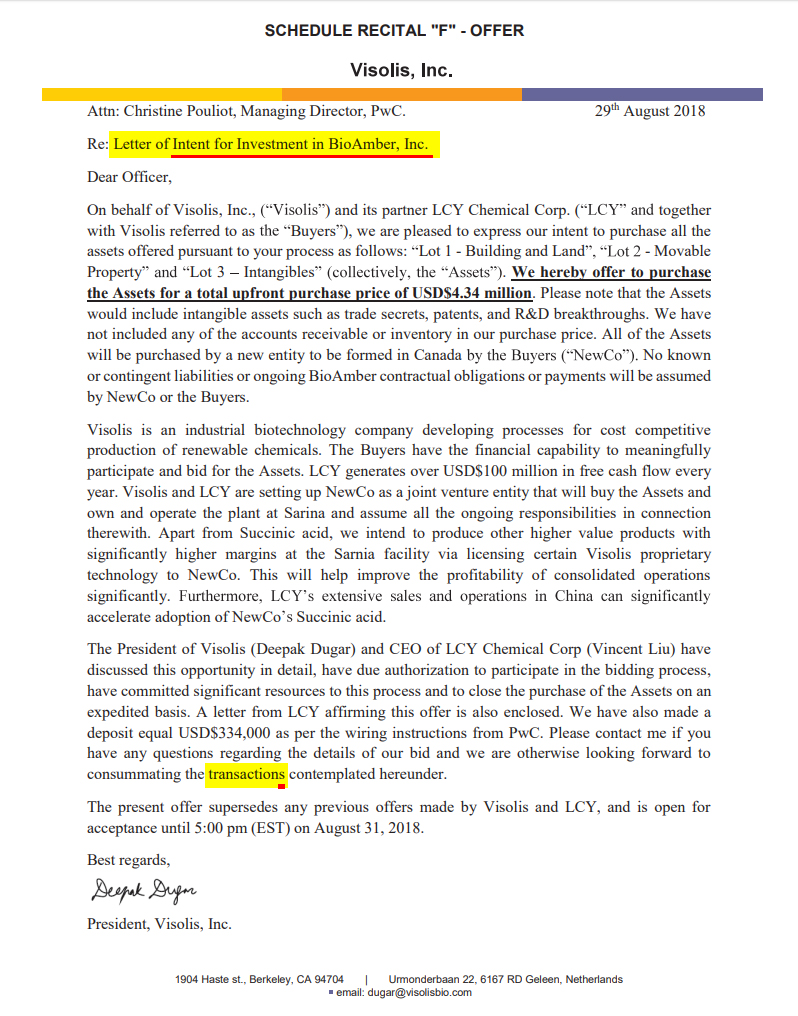

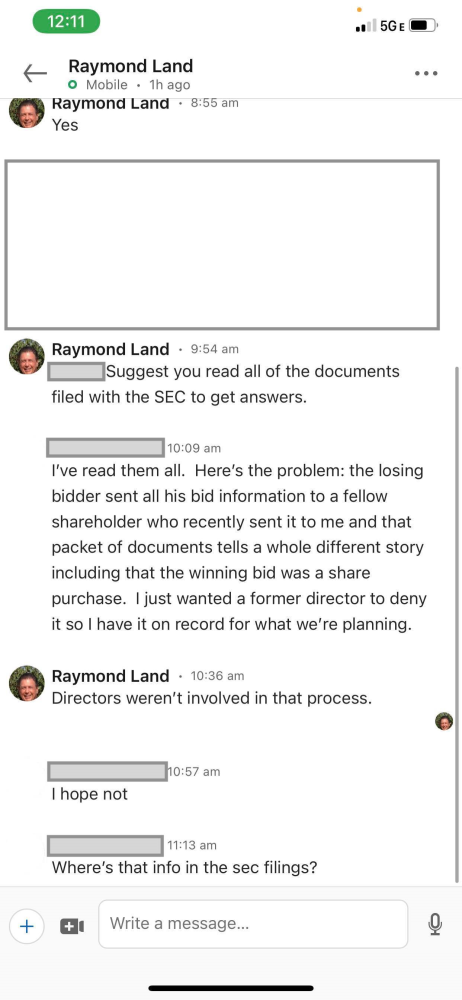

Yes as has been stated many times, there were 2 tranches that comprised the aggregate 4.34m upfront purchase price. The first was a 10% deposit.

Got it now?

No joke, they used the word AGGREGATE in their wording. Others use words like INVESTMENT and UPFRONT. Let's see how this plays out...

Lcy chemical semiconductors business expanding billions in US into 2025

https://www.azcommerce.com/news-events/news/2024/7/arizona-home-of-america-s-semiconductor-resurgence/

https://www.lcycic.com/en/product/industrial-solution/article/common-sodium-formate-application-and-what-to-look-for-during-purchases

All because of Bioamber

https://www.lcycic.com/en/product

https://www.lcycic.com/en

Looks like you all better jump on a boat to the Cayman Islands!!

To exercise your redemption rights, you must demand that the Company redeem your public shares for a pro rata portion of the funds held in the Trust Account, and tender your shares to the Company’s transfer agent prior to 5:00 p.m. Eastern time on April 11, 2025.

Approval of each of the Charter Amendment Proposals require a special resolution under the Companies Act (As Revised) of the Cayman Islands (the “Companies Act”), which requires the affirmative vote of the holders of a majority of at least two-thirds of our ordinary shares who attend and vote at the Extraordinary General Meeting, including the Founder Shares. Notwithstanding shareholder approval of the Charter Amendment Proposals, our Board will retain the right to not implement the Charter Amendments at any time without any further action by our shareholders.

Our current Sponsors beneficially own an aggregate of 4,126,215 Founder Shares and Jin-Goon Kim, the Chairman of our Board of Directors and the manager of the manager of our former sponsor, TLGY Sponsors LLC, beneficially owns 981,552 Founder Shares. Our Sponsors, the former sponsor, and all of our directors and officers are expected to vote any ordinary shares owned by them in favor of each of the proposals presented at the Extraordinary General Meeting. On the record date, our Sponsors, former sponsor and our directors and officers beneficially owned and were entitled to vote an aggregate of 5,107,767 Founder Shares, representing approximately 54% of the Company’s issued and outstanding ordinary shares.

shareholders will be rich

If the Extension Proposal is approved and the Contingent Right Proposal is not approved, immediately after the initial business combination redemption time and immediately prior to the closing of our initial business combination, we will effect a pro-rata distribution to our public shareholders of distributable redeemable warrants, as described in our Annual Report on Form 10-K filed with the SEC on March 5, 2025. Public shareholders who elect not to redeem some or all of their shares in connection with this proxy solicitation, and on any later redemption date, would be entitled to their pro rata portion of the distributable redeemable warrants upon such distribution. The aggregate amount of distributable redeemable warrants available for distribution would remain unchanged. Therefore, any redemption requests made in connection with the Extension Proposal and the initial business combination would increase the pro rata share of distributable redeemable warrants to be distributed to each public shareholder with respect to any shares not redeemed by such shareholder. Notwithstanding the conversion of the Founder Shares to Class A ordinary shares that may occur if the Founder Shares Amendment Proposal is approved, none of the former Founder Shares will be entitled to receive any distributable redeemable warrants upon a distribution.

If the Extension Proposal is approved by the requisite vote of shareholders, the remaining holders of public shares will retain their right to redeem their public shares when a business combination is submitted to the shareholders, subject to any limitations set forth in the Charter as amended by the Charter Amendments. In addition, if the Extension Proposal is approved, public shareholders who do not make the Election would be entitled to have their public shares redeemed for cash if the Company has not completed a business combination by the Termination Date.

To exercise your redemption rights, you must demand that the Company redeem your public shares for a pro rata portion of the funds held in the Trust Account, and tender your shares to the Company’s transfer agent prior to 5:00 p.m. Eastern time on April 11, 2025.

Because we are quoted on the OTCPINK, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange. As such, we cannot assure shareholders that they will be able to sell their Class A ordinary shares in the open market, even if the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in its securities when such shareholders wish to sell their shares.

Criminal lawyers behind Tlgy acquisition corp, new sec filings with a threat if there is no extension they dissolve, they had over 3 years with a deadline April 16th with the new sec rules, they moved to OTC Market to cheat more and lie to shareholders, someone doesn't want Lcyb to go public and release Bioamber's shareholders money, they are pure criminals, lawyers don't want to lose their paychecks

https://www.sec.gov/Archives/edgar/data/1879814/000110465925032443/tm259943-2_def14a.htm

No way you believe that. No one is that dumb. No way.

You're right BioAmber will have a new name and ticker symbol. But you should still call all of these people using the name since you're lifetime interested along with the real stooges.

Biofuels being implemented by General Motors (BioAmber).

Former Bioamber is dead, right?

Zeon ventures has Visolis in their portfolio

https://www.zeon.ventures/portfolio

Click on collaboration news and also find Visolis

https://www.zeon.co.jp/en/

I will play along.... if it was so profitable; why did they have to liquidate?

The process that BioAmber discovered during there time in Sarnia was where all the value was. Not in the facility etc etc etc . I wander what They charged to license the proprietary process. We can make as much as you can sell is an interesting situation especially with how rampant the use of it has been increasing . Never broke the supply chain . Proprietary on purpose prior to bankruptcy. Argue all you want , somebody is going to make a boatload of money using BioAmber process . Those billion dollar contracts are being fulfilled . They already built the supply chain prior to bankruptcy. They already had a facility processing it .

Didnt you hear? In bizarro BIOAQ land, some random website trumps SEC filings and court records.

Don't have to call anybody, just read the whole post about the purchases. It says Bioage Labs at the bottom.

So are you going to be the one to call and tell them???

Come on lets refute negative Nancys, call them!

Visolis inc news yesterday

https://www.zeon.ventures/collaborations/visolis (go to collaboration news)

https://www.zeon.co.jp/en/news/assets/pdf/250404.pdf

https://www.zeon.ventures/

Seems you don’t know the difference between an LOI and a signed APA and which one controls.

So, no one knows the difference between an loi for INVESTMENT and a loi to PURCHASE? 1e+100 incoming, e reorganization!!! Loi for INVESTMENT=????? Look it up

So, no one knows the difference between an loi for INVESTMENT and a loi to PURCHASE? 1e+100 incoming, e reorganization!!! Loi for INVESTMENT=????? Look it up

Another project with ARD researchers (Europe) (partners with Bioamber) is running until September 2025

https://www.wane.com/business/press-releases/globenewswire/1000798052/e6-2-million-in-funding-allocated-by-ademe-to-global-bioenergies-prenidem-project/

Bioamber in France, Active

https://opencorporates.com/companies/fr/824688576

FKA bioaq Do you read anything legitimate or are you a pathological liar that just makes stuff up as they go along?You know full well neither the parent or it's subsidiaries were sold. That is clear as day in the court documents.Further more, as of December 2024 it's official finished forever, concrete.There is no NewCo, never was and never will be.The corporation has "ended", along with the former equity - shares.

No the Canadian plant was sold in the liquidation and is owned by LCYB free and clear.

|

Followers

|

418

|

Posters

|

|

|

Posts (Today)

|

9

|

Posts (Total)

|

150230

|

|

Created

|

04/26/13

|

Type

|

Free

|

| Moderators Homebrew Lucky77Dice TheRealMrPirate trader59 Real McCoy dalesio_98 | |||

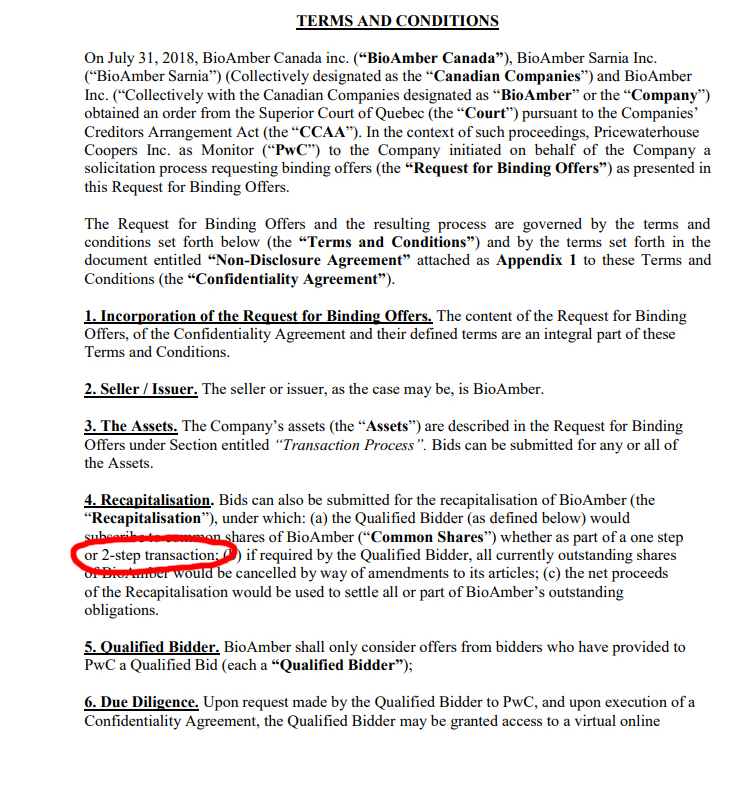

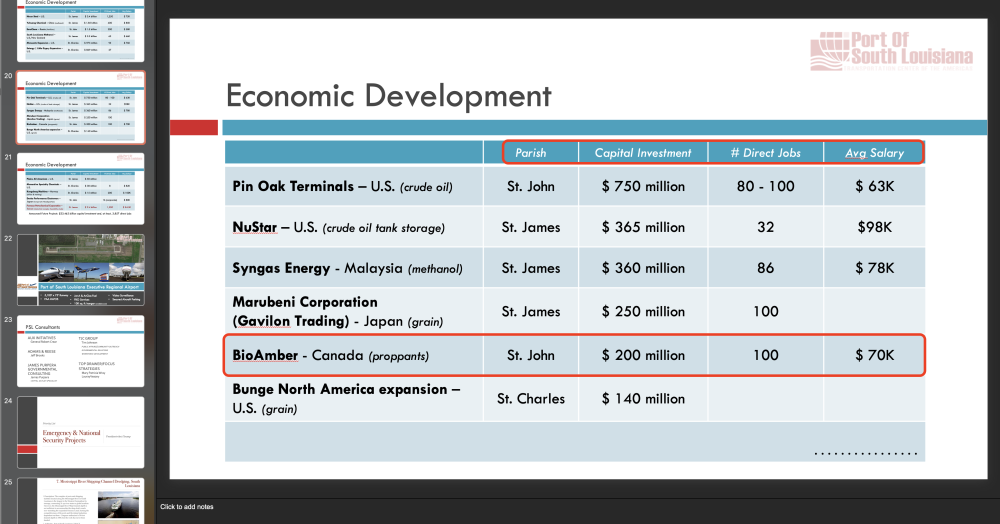

BioAmber completed the CCAA proceedings (Companies Creditor's Arrangement Act), on December 23, 2019 upon the filing of the Discharge Certificate. Under CCAA, (Canada law, not US) BioAmber was not in liquidation, receivership, or bankruptcy. Learn more about CCAA here. The monitor was PwC (PriceWaterhouseCoopers) with extended powers from the Canadian court, and facilitated sales transactions with Visolis and LCY Chemical Corp, which together formed the joint venture LCY Biosciences "LCYB", the designated purchaser that purchased and will now continue to operate the Sarnia plant. These transactions must include both assets of the Companies and shares of BioAmber Inc. (the US Parent company), in a multi-step transaction, which aims to take advantage of BioAmber's IP, trade secrets, patents, R&D breakthroughs, Vinmar contracts, and tax benefits of BioAmber's NOLs.

LCY Chemical itself was just recently purchased by KKR in a 1.5 billion dollar acquisition, whereby LCY Chemical Corp is now a private company. Learn more about that transaction here.

PwC's various updates can be found on their website here.

PWC RELEASES AUGUST COURT MOTION ON FEBRUARY 14, 2019 - CONFIRMS SALE FOR

====================================================================================

FEB 8, 2019 Evening Update

NEWS !! PWC Updates Shares Worthless, FINRA Notified

Stick a fork in BIOAQ's common shares. They are DONE.

Today's Tenth Monitor's Report, issued by PwC specifically to dispel the internet rumors of the common shares having value, proves the common shares are not only worthless, but will be cancelled.

See Sections 16, 18, 19 below.

http://www.pwc.com/ca/en/car/bioamber/assets2/bioamber-049_020819.pdf

Anyone holding the common shares when FINRA (who has been notified by PwC) will lose 100% of their investment. Assuming they have a chance to sell, of course. FINRA could decide to delete the ticker at any time from this point forward.

=====================================================

IMPORTANT NOTICE !!

Company Liquidation is COMPLETED

Ticker Deleted by FINRA on 11-21-2019.

They will no longer exist for trading.

|

Posts Today

|

9

|

|

Posts (Total)

|

150230

|

|

Posters

|

|

|

Moderators

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |