Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Will this stock ever come back

or are we forever screwed?

ARST: As of May 25, 2021, TD Ameritrade will restrict orders in Caveat Emptor designated OTC securities to liquidating trades only.

A Caveat Emptor security is a designation the OTC Markets Group places on a security after a determination was made surrounding the company that there may be potential risk to investors which include a questionable stock promotion, known investigation of fraudulent activity committed by the company or insiders, regulatory suspensions, or disruptive corporate actions, among other reasons.

The current list of Caveat Emptor restricted securities is below as of April 12, 2021 and is subject to change at any time.

Please visit www.otcmarkets.com for additional details and real time Caveat Emptor desiginations.

https://www.tdameritrade.com/retail-en_us/resources/pdf/cesecuritylist.pdf

$ARST alerted @.0001 yesterday, .001 hod today for 900% gain

I added to my ARST today at TD Ameritrade. They wouldn't let me add any the first day it came off suspension, but I tried again today and it went through

How did you buy it?

What Exchange did you use to buy shares??

Filled some ARST .0001

False he has always written articles about $ARST ...Paul’s Activity

All activity on Linkedln by Paul

Articles

Posts

Documents

Paul Patrizio posted this

Open control menu

ARST

Paul Patrizio on LinkedIn

Publish date June 4, 2018June 4, 2018

LIKE 5

Now we know why Paul does not have "ARST chapter" on his linkedin/experience page. He wants to forget it!

I am going on all social media platforms like linkedin, platforms and bringing Paul's neglect of ARST public so all can see the truth!!!

It is time to begin the complaint process. The more complaints the SEC gets from share holders, the better the chance to get a response/action from ARST to become current.

https://www.sec.gov/oiea/Complaint.html

Should send him a card for April Fool's day coming up....!

The CEO is a Fool!!

How much does shell like ARST cost? If they can get out of suspension that is.

http://www.globalbx.com/businesses-for-sale/buy-public-shell-companies-1.asp

Damned, must have sold. Holding the bag now.... 1.5 milly at .0028.

Many “dark/defunct” companies have went on to do great things.

I can't think of a single one.

Millionaires don’t give a shit about risking a thousand bucks for a potential hundred thousand dollar return.

Millionaires are rich because they don't waste money on junk.

The SEC having a list wouldn’t equate to “tipping off insiders”. You obviously aren’t very good with logic.

It would. That is, in fact, the explanation offered by the SEC. Which, like me, generally is pretty good at logic.

""considering who the CEO is and his connections.""...'M_1776'

That is very irresponsible for a CEO who calls himself a ""corporate and finance attorney""!!

....----> https://www.po-legal.com/attorneys

....----> https://www.linkedin.com/in/paul-patrizio-6a1a0245/

A lawsuit against him because he should know better would be justified and very strong!!

If this guy was responsible he should start dropping fillings from tomorrow and through-out next week!!

If not then he is the kind of Bad-Venture Capitalist who devours the commons and manipulates them by robbing them of their Wealth!!

There is no other way to Sugar-Coat the Silent behavior of the CEO -Paul Patrizio!!

He knew exactly what was about to happen, because the SEC never suspends without warning the Company!!

I bet you that his wife has been dumping her shares!!....

A law suit against a Lawyer would be very Strong ,for, he should know better!!

Many “dark/defunct” companies have went on to do great things. Should we miss out on the opportunity to get in on ground floor? Millionaires don’t give a shit about risking a thousand bucks for a potential hundred thousand dollar return. This disproportionately affects the 'have-nots'.

The SEC having a list wouldn’t equate to “tipping off insiders”. You obviously aren’t very good with logic. A public list would make things fair for everybody who does their DD.

I totally agree..

I emailed both Paul and John O'Leary, I do not expect a reply, but I did say if they do nothing and let ARST go, I will go after Paul, that he never again is allowed to hold a position with a public company, banned for life.

And they are both lawyers, and are their firm is the ARST service provider, so IMO their law licenses good standing are at stake.

And I said they need to begin communicating with shareholders immediately.

Next week I will begin my battle. My congressman, Andy Barr is on the house finance committee and his office is near me. I will start here....

Barr serves on the House Committee on Financial Services, and is the ranking member of the House Financial Services Subcommittee on Oversight and Investigation.

I might lose my $$$$ on ARST, but I will fight like hell against them!!!

You're welcome!

What you complain about is actually quite easy to determine. Delinquent filers--SEC registrants--are simple to identify. The SEC has a list. OTC Markets attaches a "delinquent filer" flag to those issuers at its website. It attaches a "dark or defunct" flag to non-registrants that haven't shown any signs of life lately.

That seems to me to be adequate warning to the public.

...there should be a framework in place to notify the public which companies have been put on notice and have or have not responded/complied with SEC notices.

Why? Would it be constructive for the SEC to tip off insiders, so they can dump their holdings and get outta Dodge? I don't think so.

Thank you for posting a 296 page document that (most) retail traders don’t have time to read. If the SEC is going to arbitrarily suspend companies from trading (yes, arbitrarily, because many other companies are also delinquent, some for longer periods of time, and yet they still actively trade) - under the guise of “protecting investors” and “doing the right thing” - then there should be a framework in place to notify the public which companies have been put on notice and have or have not responded/complied with SEC notices. By not having this information publicly available, the public, WHOM THE SEC IS SUPPOSED TO PROTECT, suffers at their very hand. That’s called logic.

What help do you want?? Again this CEO is a Slow Fool!!

The SEC is literally convoluting the system so much that it’s a mockery.

While they have their faults, they're not doing that. The SEC doesn't do Caveat Emptor designations; that's an OTC Markets thing. OTC Markets is not a regulator.

They stated companies had until June or September to get current, then they go on a suspension frenzy.

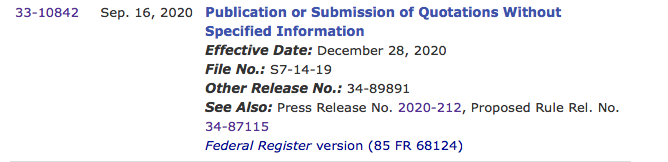

They didn't say that. The amendments to Rule 15c2-11 became effective on 28 December 2020:

https://www.sec.gov/rules/final.shtml

There is what the SEC calls a transition period, lasting from the end of December 2020 till the end of September 2021. Issuers unable to comply immediately are encouraged to contact the SEC and request relief from compliance.It's always a good idea to keep the regulators in the loop.

https://www.sec.gov/rules/final/2020/33-10842.pdf

You are eactly right. The shares of these empty shell scams like ARST are being illegally WASH TRADED, everybody knows it including the SEC and FINRA.

They arent stupid and in fact have a new special task force to track down the instigators of these illegal WASH TRADING conspiracies and thier first and easiest targets are non disclosure publicly traded entities like ARST where the shares are being maniplulated.

ARST would have already have received at least one warning letter from the SEC about their delinquent filings. ARST can now take comfort in the fact that they arent alone with about 150 similar SEC suspensions in the last two or three weeks.

It should also be noted the the OTC has put 50 tickers yesterday and over 30 tickers today on the grey sheets with the skull and cross bones.

There are only about 2,800 more OTC stale garbage tickers in jeopardy of having the exact same thing happen.

the sec was talking about form 211 compliance, not delinquency. there is no extension for delinquent filers.

The CEO is a lazy slow-fool!!

The SEC informed him before suspension!!

And he sat on the bad News!!

Should consider suing the SEC instead. They stated companies had until June or September to get current, then they go on a suspension frenzy. They say “social media manipulation” - yet GME continues to trade without caveat. ARST seemed like a (relatively) safe (speculative) bet, considering who the CEO is and his connections. Also, ARST wasn’t even as delinquent as other companies that continue to trade actively... The SEC is literally convoluting the system so much that it’s a mockery. It’s all about money and scaring retail traders in the OTC IMO.

He has been very unresponsive and I hated that part and almost sold all on account of that. However the did update the share structure and n February reflecting the restricted and nonrestricted shares which had never been done.

an 8k is not a financial filing. the company is delinquent in their filings. the last 10q was for the period ending 9/30/19.

https://www.otcmarkets.com/stock/ARST/disclosure

I am surprised that even though the profile was verified in 11/2020 and last fin update was in may 2020 they still got shut down. SEC contacts company first before shutting them down. Anyone got any word back from any of these entities?:

Patrizio & O'Leary LLP

300 Carnegie Center, Suite 150

Princeton, NJ 08540

(609) 786-2525

Paul Patrizio

Acting CEO, Acting CFO

ppatrizio@po-legal.com

John O'Leary

joleary@po-legal.com

ARST. GAME OVER.

Paul Patrizio is a licensed attorney that does this exact work, updating SEC/FINRA/OTC for companies. His firm Patrizio & O'Leary are the legal firm on ARST.

If ARST goes under, I will make it my mission to see that Paul Patrizio is never allowed to own or work for a public company again and I will go after his law license too.

I will contact crazy Alice Waters, Chairman of US House Financial committee and give her everything I can find to achieve my goal.

Any helpers?

move on to what? this was a dead company before they were suspended.

because questions have arisen as to their operating status, if any

This is a kick in the butt for ARST. Do they update or move on?

Oh well maybe it will be a wakeup call to get things done!

ARST SEC Suspension "because of questions regarding: the adequacy and accuracy of information concerning the securities of each of the issuers listed above because questions have arisen as to their operating status, if any; the recent, increased activity and volatility in trading in the securities of each of these issuers, in the absence of any publicly available news or recent information by these issuers; and certain social media accounts may have been or may be engaged in a coordinated attempt to artificially influence their share prices. The stock of each of the issuers above is quoted and traded on OTC Link whose parent company is OTC Markets Group, Inc. None of the issuers above has posted any information with OTC Markets Group, Inc. or filed any information with the Securities and Exchange Commission for at least nine months."

https://www.sec.gov/litigation/suspensions/2021/34-91296.pdf

Order:

https://www.sec.gov/litigation/suspensions/2021/34-91296-o.pdf

So you're saying I should bet my house on this? Lol! I hear ya

Ok unhappy one, average down or dump, it's your call

Yes, since a while, but down 40%.

But you are here,lol.

Nada... no news in years.

Risk what you can afford to lose. Im not betting my house on this.

Filings are long overdue and not even a peep out of Mr. Incompetent CEO Paul Patrizio

I have done my own homework and nothing shows me that they are doing anything. Paul has never responded to 1 phone call or email to even let us know if he is still behind the wheel or if the ship is without a captain lost at sea.

|

Followers

|

67

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

3233

|

|

Created

|

02/03/17

|

Type

|

Free

|

| Moderators | |||

| From 8K 5/2020 ITEM 5.02 | DEPARTURE OF CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS |

On May 5, 2020, William J. Caragol resigned from his position as the Chief Financial Officer of the Company effective immediately. The Company expects that Mr. Caragol will remain available to provide certain consulting services to the Company as needed. Mr. Patrizio, the Company’s Chief Executive Officer will assume the role of interim Chief Financial Officer until such time as a replacement can be appointed.

On May 5, 2020, Kenneth Mathews resigned from his positions as Director, Secretary and Treasurer of the Company effective immediately. On May 5, 2020, R. Scott Williams resigned from his position as Director of the Company effective immediately. As a result of these resignations, Mr. Patrizio is the sole director of the Company.

The Company has not been advised that these resignations are due to any disagreements with the Company’s policies, operations or practices.

Paul's LinkedIn Profie https://www.linkedin.com/public-profile/in/paul-patrizio-6a1a0245?challengeId=AQGt1UGq9bkxPgAAAXc7ss2MBZbLs0D6ThBkC6-tDni3LC8n77b1vPouvPGy4oumCQ621IBiid7VIS8PIKbjiyDtaL4zrFC4mQ&submissionId=af1775ff-ac9a-5d16-f848-07d9b455f73a

He has an active interest in SPAC and is part of the SPAC Opportunities group according to his LinkedIn Profile.

What is SPAC (Special Purpose Acquisition Company)?

https://www.investopedia.com/terms/s/spac.asp

Excerpt from link

What Is a Special Purpose Acquisition Company (SPAC)?

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. Also known as "blank check companies," SPACs have been around for decades. In recent years, they've become more popular, attracting big-name underwriters and investors and raising a record amount of IPO money in 2019. In 2020, as of the beginning of August, more than 50 SPACs have been formed in the U.S. which have raised some $21.5 billion.

KEY TAKEAWAYS

- A special purpose acquisition company is formed to raise money through an initial public offering to buy another company.

At the time of their IPOs, SPACs have no existing business operations or even stated targets for acquisition.

Investors in SPACs can range from well-known private equity funds to the general public.

SPACs have two years to complete an acquisition or they must return their funds to investors.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |