Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

here is the rss feed from his blog.

http://feeds.bizradio.com/mikenorman

for what it is worth I can't find the list he is talking about either.

http://www.newyorkfed.org/newsevents/news/index.html

Does it seem like somebody is ignoring the secondary market in this "debate?"

I heard Mike Norman (again, sorry -- it's just the TOD I am in the car) on the radio going ballistic over a Bloomberg story being "destructive" to the economy...

was it this story?

He said people are complaining about the Fed not being transparent, when the list is on the internet?

I can't find the guy's blog, but he says it's all on his blog.

Fed Defies Transparency Aim in Refusal to Disclose (Update2)

By Mark Pittman, Bob Ivry and Alison Fitzgerald

So when id the Treasury and Fed going to give up some of their opaqueness? Maybe they will show you their when you show us yours Bernanke\Paulson

Nov. 10 (Bloomberg) -- The Federal Reserve is refusing to identify the recipients of almost $2 trillion of emergency loans from American taxpayers or the troubled assets the central bank is accepting as collateral.

Fed Chairman Ben S. Bernanke and Treasury Secretary Henry Paulson said in September they would comply with congressional demands for transparency in a $700 billion bailout of the banking system. Two months later, as the Fed lends far more than that in separate rescue programs that didn't require approval by Congress, Americans have no idea where their money is going or what securities the banks are pledging in return.

``The collateral is not being adequately disclosed, and that's a big problem,'' said Dan Fuss, vice chairman of Boston- based Loomis Sayles & Co., where he co-manages $17 billion in bonds. ``In a liquid market, this wouldn't matter, but we're not. The market is very nervous and very thin.''

Bloomberg News has requested details of the Fed lending under the U.S. Freedom of Information Act and filed a federal lawsuit Nov. 7 seeking to force disclosure.

The Fed made the loans under terms of 11 programs, eight of them created in the past 15 months, in the midst of the biggest financial crisis since the Great Depression.

``It's your money; it's not the Fed's money,'' said billionaire Ted Forstmann, senior partner of Forstmann Little & Co. in New York. ``Of course there should be transparency.''

Treasury, Fed, Obama

Federal Reserve spokeswoman Michelle Smith declined to comment on the loans or the Bloomberg lawsuit. Treasury spokeswoman Michele Davis didn't respond to a phone call and an e-mail seeking comment.

President-elect Barack Obama's economic adviser, Jason Furman, also didn't respond to an e-mail and a phone call seeking comment from Obama. In a Sept. 22 campaign speech, Obama promised to ``make our government open and transparent so that anyone can ensure that our business is the people's business.''

The Fed's lending is significant because the central bank has stepped into a rescue role that was also the purpose of the $700 billion Troubled Asset Relief Program, or TARP, bailout plan -- without safeguards put into the TARP legislation by Congress.

Total Fed lending topped $2 trillion for the first time last week and has risen by 140 percent, or $1.172 trillion, in the seven weeks since Fed governors relaxed the collateral standards on Sept. 14. The difference includes a $788 billion increase in loans to banks through the Fed and $474 billion in other lending, mostly through the central bank's purchase of Fannie Mae and Freddie Mac bonds.

Sept. 14 Decision

Before Sept. 14, the Fed accepted mostly top-rated government and asset-backed securities as collateral. After that date, the central bank widened standards to accept other kinds of securities, some with lower ratings. The Fed collects interest on all its loans.

The plan to purchase distressed securities through TARP called for buying at the ``lowest price that the secretary (of the Treasury) determines to be consistent with the purposes of this Act,'' according to the Emergency Economic Stabilization Act of 2008, the law that covers TARP.

The legislation didn't require any specific method for the purchases beyond saying mechanisms such as auctions or reverse auctions should be used ``when appropriate.'' In a reverse auction, bidders offer to sell securities at successively lower prices, helping to ensure that the Fed would pay less. The measure also included a five-member oversight board that includes Paulson and Bernanke.

At a Sept. 23 Senate Banking Committee hearing in Washington, Paulson called for transparency in the purchase of distressed assets under the TARP program.

`We Need Transparency'

``We need oversight,'' Paulson told lawmakers. ``We need protection. We need transparency. I want it. We all want it.''

At a joint House-Senate hearing the next day, Bernanke also stressed the importance of openness in the program. ``Transparency is a big issue,'' he said.

The Fed lent cash and government bonds to banks, which gave the Fed collateral in the form of equities and debt, including subprime and structured securities such as collateralized debt obligations, according to the Fed Web site. The borrowers have included the now-bankrupt Lehman Brothers Holdings Inc., Citigroup Inc. and JPMorgan Chase & Co.

Banks oppose any release of information because it might signal weakness and spur short-selling or a run by depositors, said Scott Talbott, senior vice president of government affairs for the Financial Services Roundtable, a Washington trade group.

Frank Backs Fed

``You have to balance the need for transparency with protecting the public interest,'' Talbott said. ``Taxpayers have a right to know where their tax dollars are going, but one piece of information standing alone could undermine public confidence in the system.''

The nation's biggest banks, Citigroup, Bank of America Corp., JPMorgan Chase, Wells Fargo & Co., Goldman Sachs Group Inc. and Morgan Stanley, declined to comment on whether they have borrowed money from the Fed. They received $120 billion in capital from the TARP, which was signed into law Oct. 3.

In an interview Nov. 6, House Financial Services Committee Chairman Barney Frank said the Fed's disclosure is sufficient and that the risk the central bank is taking on is appropriate in the current economic climate. Frank said he has discussed the program with Timothy F. Geithner, president and chief executive officer of the Federal Reserve Bank of New York and a possible candidate to succeed Paulson as Treasury secretary.

``I talk to Geithner and he was pretty sure that they're OK,'' said Frank, a Massachusetts Democrat. ``If the risk is that the Fed takes a little bit of a haircut, well that's regrettable.'' Such losses would be acceptable, he said, if the program helps revive the economy.

`Unclog the Market'

Frank said the Fed shouldn't reveal the assets it holds or how it values them because of ``delicacy with respect to pricing.'' He said such disclosure would ``give people clues to what your pricing is and what they might be able to sell us and what your estimates are.'' He wouldn't say why he thought that information would be problematic.

Revealing how the Fed values collateral could help thaw frozen credit markets, said Ron D'Vari, chief executive officer of NewOak Capital LLC in New York and the former head of structured finance at BlackRock Inc.

``I'd love to hear the methodology, how the Fed priced the assets,'' D'Vari said. ``That would unclog the market very quickly.''

TARP's $700 billion so far is being used to buy preferred shares in banks to shore up their capital. The program was originally intended to hold banks' troubled assets while markets were frozen.

AIG Lending

The Bloomberg lawsuit argues that the collateral lists ``are central to understanding and assessing the government's response to the most cataclysmic financial crisis in America since the Great Depression.''

The Fed has lent at least $81 billion to American International Group Inc., the world's largest insurer, so that it can pay obligations to banks. AIG today said it received an expanded government rescue package valued at more than $150 billion.

The central bank is also responsible for losses on a $26.8 billion portfolio guaranteed after Bear Stearns Cos. was bought by JPMorgan.

``As a taxpayer, it is absolutely important that we know how they're lending money and who they're lending it to,'' said Lucy Dalglish, executive director of the Arlington, Virginia- based Reporters Committee for Freedom of the Press.

Ratings Cuts

Ultimately, the Fed will have to remove some securities held as collateral from some programs because the central bank's rules call for instruments rated below investment grade to be taken back by the borrower and marked down in value. Losses on those assets could then be written off, partly through the capital recently injected into those banks by the Treasury.

Moody's Investors Service alone has cut its ratings on 926 mortgage-backed securities worth $42 billion to junk from investment grade since Sept. 14, making them ineligible for collateral on some Fed loans.

The Fed's collateral ``absolutely should be made public,'' said Mark Cuban, an activist investor, the owner of the Dallas Mavericks professional basketball team and the creator of the Web site BailoutSleuth.com, which focuses on the secrecy shrouding the Fed's moves.

The Bloomberg lawsuit is Bloomberg LP v. Board of Governors of the Federal Reserve System, 08-CV-9595, U.S. District Court, Southern District of New York (Manhattan).

To contact the reporters on this story: Mark Pittman in New York at mpittman@bloomberg.net; Bob Ivry in New York at bivry@bloomberg.net; Alison Fitzgerald in Washington at afitzgerald2@bloomberg.net.

Last Updated: November 10, 2008 15:08 EST

Deflation and Disinflation. What they really mean and where we are int he Secular Market.

Deflation. based on the contraction of the global money supply. started with the asian currency crisis and then the dot com bust. lot of money invested on development stage companies with no revenue. that was borrowed money on future revenue that did not appear. When it all busted the global money supply contracted.

Deflation is what you call disinflation when the disinflation goes from slowing positive growth down to below the zero line. its still the slowing of growth but its gone inverse and starts eating at the existing economy. the IT industry contracted severely in 2000 and resulted in a massive industry wide contraction, or targetted deflation. That reverberated through the global economy slowing inflation. That is one of the reasons that Greenspan lowered rates. To dislodge a lot of foreign bank money in US treasuries and get it circulating through the world economy to jump start inflation again.

Let me explain. The difference between disinflation, deflation, depression, recession, contraction, is a matter of point of view. In an period of positive inflation, defined as growth in an economy's GDP and money supply any event or action that reduced the growth rate of that supply or the size of the economy as defined by those two metrics is disinflationary. It is also defined as a contraction of growth. It can also be defined as any targetted deflationary pressure in a section of an economy that is in overall inflation.

So say that there were not any deflationary effects on the economy until now is a mistake in the understanding of the secular market we are in. If you only want to look at the 2002-2007 bull market and look at it as an inflationary period I'll agree with you. It was an inflationary cycle but a cyclical one inside of a secular contraction that has been on going since 2000. There will always be periods of inflation inside the secular one that run counter to the overall trend.

It is usually through monetary policy devoted to countering or preventing the severity of the contraction. In the short term it's effect is successful and over inflate but over the course of the secular trend it only results in lowering potential\future expansion for the sake of a short term recovery or "soft landing". This reinforces that the next contraction will be more severe. You think you are looking at THE big picture but there is an even bigger picture that spans generational trends. Let me repeat that.... Generational.

Picture a balloon that an economy of 10 people are blowing up. Each of 10 men are an inflationary pressure. If 1 of the 10 men decides to stop blowing, he is disinflationary. He is not contributing but not hampering the other 9 who are inflationary. If another of those men decides to instead to poke a hole in the balloon then he is deflationary. He has the impact of not only stopping his contribution, but to also hinder the inflationary of 1 of the others. The economy is still in net inflation because you have 8 men inflating but 1 who is not working and 1 who is counter productive. So your net inflation is 7 men.

You see over the period of the secular market the 15-20 contraction will need to have a massive generational shift in sentiment on the participants of that economy. The tulip bulb mania that we had in 1990-2000 was the culmination of a secular trend. That mania of daytrading and speculation does not easily get weeded out as survivors have not learned their lesson. They only see the next contraction as a new opportunity to profit on the next big run up. Instead of reducing risk exposure then instead leverage up, take more risk to counter the losses in the previous contraction. They become more speculative and the effects of following contractions become more severe. More participates are punished. Over the course of the secular cycle the survivors and most successful are those who took the least risk and focused on capital preservation.

We are now at the lows of the cyclical contraction inside of a secular contraction. This is the second one in the secular trend since 2000. We may be in for 1 or 2 more depending on how how it is managed and how severe the damage was from the recent credit contraction. The inflationary pressure of dumping trillions of dollars into the banking system to shore it up is helping again in the short term but the money supply growth was so tremendous that I think this next cyclical recovery (?2009-2013?) will be the weakest of all. It potential is lost. We borrowed the money supply that would be produced in that expansion to pay for the recovery today. So when we get to 2012, 2013, 2014 a portion of growth in GDP, money supply will be used to pay that money borrowed. And it is a lot of money. So when that next cyclical contraction (?2014-2016?) comes after the cyclical expansion (?2009-2013?) we are going into ends its going to hit hard... very hard. Its gong to so a lot of damage to the bond markets that will run interest rates like it ran volatility this past year. I only hope Volker is around and in charge of the Treasury when that happens again.

But don't worry, as we muddle through the contraction in 2014-2016 the following recovery will probably lead to a new secular expansion. We will not realize it because by that time everyone will have excepted we are in some kind of deflation or depression and will be griped with financial fear. Those who are ahead of the curve will ignore the media and the sentiment of participants and engage in long term investment despite the multitude of recessions and high unemployment that will exist through out the 2020s.

? - Treasury Calls On Financial Cos To Report Tsy Note Positions

Last update: 11/7/2008 9:19:06 AM

By Maya Jackson Randall

Of DOW JONES NEWSWIRES

WASHINGTON (Dow Jones)--The U.S. Treasury is calling on financial firms that hold $2 billion or more in certain Treasury notes to immediately report their positions to the government.

Specifically, Treasury is calling for so-called Large Position Reports from entities whose reportable positions in either the 2% Treasury notes of September 2010 or the 3 1/8% Treasury notes of September 2013 equaled or exceeded $2 billion as of Thursday.

This is the first time Treasury has called for large position reports on two securities. Last year, Treasury conducted a test of large position reports for holdings of Treasury notes to guage {sic} the ability of companies to report their holdings to the government.

Treasury Friday said reports must be sent to the Government Securities Dealer Statistical Unit of the Federal Reserve Bank of New York before noon on Nov. 14.

Business cycle is still alive and well, lol

note 2005-2006 was supposed to be the end of the previous business cycle which peaked in 2004. The artificial expansion of credit and delayed monetary tightening resulted in extending the cycle and thus causing an even greater contraction going forward.

so I'm reading a Conversation with Ben Graham,

http://www.bylo.org/bgraham76.html

one of the last interviews with the father of value investing, and I'm surprised to find that he discarded his whole methodology that he wrote in Security Analysis

excerpt:

In selecting the common stock portfolio, do you advise careful study of and selectivity among different issues?

In general, no. I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook "Graham and Dodd" was first published; but the situation has changed a great deal since then. In the old days any well-trained security analyst could do a good professional job of selecting undervalued issues through detailed studies; but in the light of the enormous amount of research now being carried on, I doubt whether in most cases such extensive efforts will generate sufficiently superior selections to justify their cost. To that very limited extent I'm on the side of the "efficient market" school of thought now generally accepted by the professors.

40 years ago was 1936. He has jumped on the band wagon of indexing because you can't outperform the market. You have to wonder what he would have be able to say if he were still alive. If he would have held fast to his original principles if he lived 5-25 more years. I am of the camp that most humans cannot fathom what exists before or beyond their lifetimes. The baby boom generation never lived through the depression era. They barely lived through the 70s as investors. They only started to actively pursue investment and business in the 1980 when they came down off their drug induced highs and realized they need to get a life. The peak of the boomers where born in the 1950s. At 30 is when most people actively accelerate investment.

It is sad to see what the current generations X and Y have to go through when they saw how easy it was for their parents to generate wealth and as they enter the markets they find that they are suffering heavy losses as the carpet is pulled out from underneath them. The peak of generation X births occurred in the 1970s and they would be actively accelerating investment at the start of 2000. They will probably look back some 20-30 years from now and see how they only were able to capitalize about 4-5% year over year and no social security system to support them and not the 15-20% their parent received.

Generation Y may fair better because they will be putting their money into the market actively by the turn of this decade. Births in that generation peaked in 1990s so they will be investing heavily in 2020. They are also called the echo boomers.

Maybe if Ben was alive today he could have received his confirmation that his Security Analysis did work and that we are now going 3 for 3 with value opportunities going forward from here. I just hope this new generation shakes off the day trader mentality and really tries to invest their money going forward. There are incredible opportunities to fire and forget letting your money run for the next 25-35 years.

Clearing houses in UK and US agree link

By Jeremy Grant

well there is one good thing about this contraction, centralizing everything on one world market. The closer these two organizations come to merging would mean that we get faster clearing of transactions between the US and Europe. That means cheaper and broader access to each others markets for everyone. I'm sure that as it stands right now. the intermediaries on these transactions are getting killed in this highly volatile market.

Published: October 22 2008 20:24 | Last updated: October 22 2008 20:24

Consolidation of the back-office industry that underpins most stock and derivatives trading took a big step forward on Wednesday when The Depository Trust & Clearing Corporation of the US and Europe’s LCH.Clearnet signed a preliminary agreement to combine their businesses.

The deal – if consummated as expected by early next year – promises to deliver significant cuts to the overall cost of trading multiple kinds of assets, ranging from shares to derivatives.

It would create the world’s largest clearing house and the first transatlantic one.

The plan comes as the role of a clearing house and settlement systems have been thrust to the forefront of regulators’ concerns amid the financial crisis.

A clearing house stands between two parties to a trade and protects against one of the parties being unable to pay in the case of default.

Under the proposed deal – codenamed Bicycle – DTCC will take over LCH.Clearnet by acquiring, over a three-year period, all of the European clearer’s ordinary shares. LCH.Clearnet shareholders will receive up to €10 a share, funded by LCH.Clearnet’s revenues over the period, implying a value for LCH.Clearnet of €739m (£574m).

LCH.Clearnet is owned 73.3 per cent by investment banks, brokers and other market participants, 10.9 per cent by exchanges, including Euronext, and 15.8 per cent by Euroclear, Europe’s largest provider of settlement services.

The combined group will cover equities, fixed-income instruments, exchange-traded derivatives and commodities, mutual funds, annuities and over-the-counter products such as interest rate swaps, credit default swaps, carbon emissions and freight contracts.

Clients served globally would include several thousand broker-dealers, banks, institutional investors, hedge funds, trust companies, mutual funds and insurance carriers and other third parties that market financial products.

DTCC offers clearing and settlement of almost all US equities, corporate and municipal bonds, government and mortgage-backed securities, money market instruments and over-the-counter derivatives.

Don Donahue, its chief executive, said the deal would create “very meaningful synergies between the two organisations” so both could “take costs for clearing in our respective markets down further”. The US and Europe would for the first time, be “supported by a common infrastructure”.

Merrill Lynch advised LCH.Clearnet, while Goldman Sachs acted for DTCC.

On Wednesday Eurex, the derivatives arm of Deutsche Börse, was among exchange and clearing groups meeting Charlie McCreevy, EU internal markets commissioner.

Copyright The Financial Times Limited 2008

Deleveraging and forced selling make market unsafe

By Neil Hume

Published: October 24 2008 23:07 | Last updated: October 24 2008 23:07

City traders did not need to wait for the release of third quarter gross domestic product figures at 9.30am on Friday to get an idea of how quickly the domestic economy was shrinking. A quick look at the performance of the FTSE 250 told them all they needed to know.

Following Friday’s 5.5 per cent slide, the mid-cap index, which is considered a better reflection of the domestic economy than the FTSE 100, has now halved from its May 2007 record high.

Of course, it hardly needs saying that such a decline reflects fears that the UK is heading for an economic recession. But what sort of downturn will it be? A short, sharp recession or a long and painful downturn. And how far will corporate earnings fall?

They are good reasons for thinking the slowdown is going to be much more severe than anything in the past 40 years

Fortunately, there are several rough and ready ways to measure what is being reflected by current share prices. One method is to take the current forward price/earnings ratio of an index such as the FTSE 100 or FTSE 250 and compare it to its average forward p/e over history. The difference between the two, expressed as a percentage, is a calculation of the expected decline in earnings. James Montier, of Société Générale, undertook this exercise this week and found US market levels were implying a 20 per cent fall in earnings and Europe a 34 per cent drop. He says this decline is in line with the most recent of recessions.

Merrill Lynch has come to a similar conclusion. It has compared the trailing p/e for European equity markets to their 36-year average, adjusted to exclude the dotcom bubble years of 1999 and 2000. The difference between the two implies a 38 per cent drop in earnings, four percentage points more than in the previous four recessions.

However, they are good reasons for thinking the current slowdown is going to be much more severe than anything in the past 40 years. Indeed, history shows that slowdowns that follow periods of financial and banking distress are longer-lasting and deeper than normal.

The International Monetary Fund found that the average recession in developed countries since 1980 had lasted for just longer than three quarters. However, downturns preceded by financial stress have lasted for an average of almost seven quarters.

Robert Buckland, of Citigroup, thinks the current earnings downturn could be among the worst in the past four decades. In his view, global corporate profits will fall by as much as 40-50 per cent over the next two years.

A peak-to-trough fall of that size is by no means outlandish, given the recent credit binge that inflated the sales, earnings profits and earnings of companies.

Mr Buckland thinks this fall is fully discounted by the market. Over the long term, he says the global equity market p/e has been 17. Current valuations are closer to 10, which means investors are discounting a 40 per cent fall in earnings. Add on the 9 per cent fall already seen in this bear market and it means investors are pricing in a peak-to-trough fall of 50 per cent. So, whichever way one cuts it, a lot of bad news is now “in the price”. But what is not “in the price” is a depression such as that seen in the US in the 1930s or Japan in the 1990s. During the 1930s, US listed companies’ earnings plummeted by 75 per cent in just over three years, while in Japan they slumped 130 per cent into loss in a downturn that lasted a decade, according to Citigroup.

Of course, there are people, such as Nouriel Roubini, the New York University economics professor, who believe this could happen. He thinks it is possible that the S&P 500 index could fall from its current level of 875 points to 500-600 points.

Clearly, anybody selling at the moment has to believe that such an economic doomsday scenario will come to pass.

Unfortunately for those who do not, this is still not the time to be wading into the market. There is still too much forced selling and deleveraging by hedge funds, banks and other investors for the market to be considered anywhere near safe.

Until that process is complete – and nobody has any idea how long it will take – the only safe place to be is on the sidelines, preferably with a large pile of cash.

Copyright The Financial Times Limited 2008

Heed the harsh lessons of history to find value

By John Authers, Investment Editor

Published: October 10 2008 18:48 | Last updated: October 10 2008 18:48

“A day like today is not a day for, sort of, soundbites, really – we can leave those at home – but I feel the hand of history upon our shoulders, I really do.”

It is easy to see how Tony Blair felt as he responded to the agreement that led to peace in Northern Ireland.

It is now plain that we are living through what history will almost certainly call the second great crash in stock markets. The hand of history is so heavy on our shoulders that it is hard to respond with more than soundbites, or to see any opportunities that this appalling loss of wealth may have given us.

My life with Benjamin Graham over the past month illustrates this.

Graham was an academic at Columbia University in New York. In the worst days of the 1930s, he worked out a way to invest profitably in the stock market, now known as “value investing”. Rather than attempt to time the market, he said investors should look at exactly what a company was worth, and how much it would be worth if the worst came to the worst.

This meant you should look at a company’s assets on the balance sheet, and also look at its ability to produce cash. If the company is so cheap that its value would scarcely be less if it were to go out of business, then you have what Graham called a “margin of safety”. And if the company looks cheap compared with a conservative forecast of the cash it will generate, then the chances are that “Mr Market”, as Graham would say, has mispriced it, and that you will make a lot of money once that mispricing is corrected.

Thus you have an asymmetric bet; heads you win a lot, tails you do not lose much.

This was a great way to profit in the Depression. Confidence had collapsed, but in the process it had brought down the prices of many companies that were still healthy.

Value investing still has many adherents, but also detractors. The most common line against the strategies Graham, and his colleague David Dodd, laid out in a classic tome called Security Analysis, is that the measures he uses worked in the extreme conditions of the 1930s, but were no longer relevant.

To address this, a sixth edition of Security Analysis came out last week. Each chapter had a preface by a current-day investment manager on how to apply Graham’s insights today.

It was a big publishing event, but I could not get along to the launch. The book remains unread on my desk. The “hand of history” – watching the historic collapse in share prices – kept me at my desk.

This is ironic. The very extremity of last week’s crash made it hard to keep an eye out for bargains in the methodical way Graham laid out 75 years ago.

A deeper irony is that there may not have been any need to update the book. Stock market conditions look ever more like the 1930s.

The noughties are much more similar to the 1930s than commonly thought. In morning trading on Friday, the S&P 500’s fall for the decade was almost identical to its fall for the decade on the same date in 1938. The pattern of the two decades is freakishly similar, with a big sell-off followed by a prolonged rally and then a fresh bear market. The key difference is that the sell-off in this decade before the “fools’ rally” began was far less severe than in the 1930s.

This, we can now see, was because cheap credit had inflated a new bubble.

This is what followers of Graham had argued. They said the market during the twin lows of the WorldCom crisis in 2002 and the invasion of Iraq in 2003 was still not cheap. Dividend yields, for example, were still barely half their level of the mid-1990s, before the tech bubble took hold.

But the similarities between the market tops in 1929 and 2000 are compelling. Both saw wildly overvalued stock markets and economies that were still in decent shape.

Measures based on cash, such as dividend yield or cash flow multiples, show that the market is now much cheaper than it was during the false bottom of 2002-03, even if overall indices are still higher.

We are not, therefore, in a new 1929. Our position is more similar to that of the late 1930s. That is not so encouraging: in the decade after October 10 1938, the S&P gained 5 per cent.

But at least we have a clear historical comparison, and a clear guide for how to proceed. Providing you are not using borrowed money, and you can afford to wait a matter of years for Mr Market to thrash out his problems, then Security Analysis is all you need.

Do not try to work out how long the market will take to recover or when it will hit bottom – that task is impossible. Use basic balance sheet methods to work out how much a stock is worth and how much it would be worth if the worst came to the worst. If that calculation leaves you with a margin of safety, then buy it. Don’t let the hand of history gripping your shoulder stop you.

Copyright The Financial Times Limited 2008

I'm wondering what the onset of this was in the markets. financials don't report audited filings until after January. This is when this all started and why earnings collapsed for the S&P at the end of 07 and recovered the following quarter.

Baltic Dry Index continues fall, but signs of recovery are

Wednesday, 22 October 2008

Although not at the freefall pace of last week, the Baltic Dry Index (BDI) has continued its dropping sessions both yesterday and Monday. It is now at levels as low as six years ago, standing at 1,292 points, since yesterday marked another plunge by 63 points or 4.65 percent. It is the lowest level since October 2002 and the index is fast approaching the levels of the Asian “Tigers” financial crisis, back in the years 1997-98. Among the reasons for this fall, at least according to analysts has been the deteriorating health of the Chinese steel market, where output fell 9% year-on-year in September and was down 7% from August. In addition, slowing Chinese demand for Brazil iron ore has contributed to the weakness in the Baltic index.

It’s obvious to many that global trade has come to a halt with effects noticed in other markets as well, particularly in container trade. Traders and importers have all become increasingly wary of the global financial crisis, putting a deadlock on almost all shipments. Also, the few active traders are facing problems receiving the necessary letters of credit.

Letters of credit assure a shipper of payment for a cargo after it is loaded on a ship, but before the buyer receives it. Banks all over the world are cautious and limiting their activities, placing different priorities. The squeeze on trade credit is also restricting commodities shipments. Around 90% of the world’s $14 trillion trade is handled via trade credit.

Of course, this situation can’t be continued for long, with psychology playing a major role in the recovery. Once a more positive sentiment is cemented, cargoes are expected to flow again, especially with the holiday’s season coming soon.

Already, some market sources have indicated that things are bound to get better on the banking sector area, with recent activity indicating that interbanking rates are falling. This will allow more banks to achieve better financing, besides the huge amounts that are granted by Central Banks worldwide. This in turn will help trade, as well as financing for shipbuilding orders. Recovery is expected for other reasons as well, with rates cut playing a major role. When trade will begin again, many will be benefiting from these lower rates, thus speeding the process of the global economy’s healing.

S&P500 PE historical + forward

based on the numbers put out by S&P. First chart is earnings per quarter from 88 to projected 2009

second chart is P/E through the same time frame.

moral of the story, don't trust price to earnings in a secular bear market. its going to mess with your head trying to find the right price to buy. prices are falling faster than earnings so P/E goes up. While investors are panicking out of stocks the economy is recovering and earnings start to climb resulting in a falling P/E.

maybe there is something to be said for the spread between reported and operating earnings. Seems when they reach an extreme seems to be a time to buy. But what defines that extreme.

also of note writeoffs are considered in the reported and not the operating. could they be that much of an impact in the spread going forward. I think companies are still being overly optimistic. I'm waiting for that high P/E relative to reported earnings.

What's the Real P/E Ratio?

http://online.barrons.com/article/SB121158260488318589.html?mod=9_0031_b_this_weeks_magazine_main

By CHARLIE MINTER and MARTY WEINER | MORE ARTICLES BY AUTHOR

The bearish view on earnings makes the most sense.

IF YOU WATCH OR READ OR LISTEN TO BUSINESS NEWS, you must be getting very confused about whether the stock market is undervalued or overvalued. The bulls who appear on the financial shows assert that the stock market is inexpensive: "This market is as cheap as it has been for the past two decades -- or the past 18 years." They also may state that the price-earnings ratio, at 13 to 16 estimated earnings for 2008 or 2009, is below the long-term norm.

Their statements are correct.

At other times during the same day, you may hear a bearish market maven try to convince the interviewer that the market is substantially overvalued and has a long way to go on the downside before it gets to fair valuation. The bearish interviewee will either discuss why the P/E ratio at over 21 times 2008 earnings estimates or 24 times the latest 12-months earnings is closer to valuations found near market tops, rather than market bottoms.

These analysts are also correct.

Interviewers seldom if ever question the disparities in the various market analysts' approaches to valuation. But we will try to clear it up.

Few stock-market research organizations are equipped to estimate the earnings of every company in the Standard and Poor's 500. It would require having analysts in every sector to study each individual stock and come up with the best guess possible. Virtually no institution or money-management firm does this. We generally rely on organizations such as Standard & Poor's to do the work for us.

Standard & Poor's has done more than enough work. Visit its Website and you will find a myriad of different earnings estimates from which you can choose. S&P shows reported earnings, operating earnings, core earnings, earnings with pension-interest adjustment, and other formats.

There are two main earnings numbers that Wall Street uses when discussing valuations -- "reported earnings" or "operating earnings." Typically, the bulls use "operating earnings," and the bears use "reported earnings" because operating earnings are higher and reported earnings are lower. Also, it makes sense for the bears to use the past 12 months of earnings because they are usually lower, and for the bulls to use forward operating earnings to help make their case. Using the last 12 months is much more consistent, since it avoids dependence on estimates of earnings.

Operating earnings exclude write-offs, while reported earnings include write-offs. That is the only difference, but it's a difference that is getting much more important. As recently as the early 1990s, operating and reported earnings were virtually the same. But then we entered the greatest financial mania of all time, and the earnings numbers diverged.

There were so many write-offs by companies making unwise investments and then undoing them that operating earnings grew much faster than reported earnings. The write-offs that had been sporadic and unusual became common for many companies.

Using operating earnings is now like playing in a golf tournament that doesn't count any penalty strokes for hitting the ball into a water hazard or out of bounds.

Look at the numbers. Reported earnings for the S&P 500 for 2007 were just over $66. The operating earnings for 2007 were $84.54. The estimated numbers for 2008 are about $69 for reported earnings and about $90 for operating earnings.

By the way, these reported numbers have just recently been revised downward drastically, due to the slowdown in the U.S. economy.

Now you can see why there is such discrepancy in the market mavens' points of view. If you are a bull, you will say that the market is trading at a very reasonable 16 multiple on the $89.44 of earnings in 2008 and 13 times the 2009 estimate of $110.44. On the other hand, if you are a bear or just a reasonable person you can see the market is trading at 24 times trailing earnings and about 21 times the estimate of 2008 reported earnings.

Unless you believe that we will be trading at a "permanent plateau," as did the noted economist Irving Fisher in 1929, you might want to consider some more distant peak and trough multiples.

Over the past 75 years, most market peaks topped at around 20 times reported earnings, and the troughs occurred at around 10 times earnings. The financial mania of the late 1990s pushed P/Es to over 40 times reported earnings, and the following bust never brought P/Es below 18 times reported earnings.

There's more we can do to make sense of earnings: The best way to measure present earnings and future earnings is to smooth them out over long periods. Earnings can grow at only approximately 6% a year over the long term. The trend is limited by the growth in real GDP plus inflation. And long term, real GDP cannot grow faster than the increase in the labor force plus the increase in productivity.

If you don't accept this, look at a long-term chart and draw a 6% growth line through the earnings. It is clear that earnings sometimes rise above the line and sometimes fall below it, but earnings always revert to the 6% mean.

Going back to 1950, every instance where actual earnings rose above trend-line earnings was followed by a period where actual earnings went well below trend-line earnings.

Comstock Partners believes that we have entered such a period now, and that the market is trading at such a high multiple of trend-line earnings that it will be difficult to make money.

You could even lose a lot of money.

CHARLIE MINTER and MARTY WEINER are the chairman and president of Comstock Partners, investment managers in Yardley, Pa. Website: www.comstockfunds.com

Barron's welcomes submissions to "Other Voices". Essays should be about 1,000 words in length, and sent by e-mail to the Editorial Page editor at tg.donlan@barrons.com.

there is a lot to not like at the moment

So you either get credit or you don't. I dunno, i think that people should be allowed to take on as much risk as they are willing to as long as they are aware that that is what they are doing.

never likes usury laws, they are like price fixing products. it also hurts those that are trying to start credit because it is a catch 22. you can get credit without having credit.

we are helicopter parenting the economy right now and I don't like it.

THE CASE FOR DEREGULATING

INTEREST RATES ON CONSUMER

CREDIT

MICHAEL E. STATEN, PH.D.

DIRECTOR, CREDIT RESEARCH CENTER

KRANNERT GRADUATE SCHOOL OF MANAGEMENT

PURDUE UNIVERSITY

ROBERT W. JOHNSON, PH.D.

SENIOR RESEARCH ASSOCIATE, CREDIT RESEARCH CENTER

KRANNERT GRADUATE SCHOOL OF MANAGEMENT

PURDUE UNIVERSITY

November 1995

PART IV: CONCLUSIONS

This study has explained the theories underlying the discussion of how credit markets work and the

effects upon consumers of government intervention in those markets. Again and again, the data drawn from

studies of credit markets with and without restrictive rate ceilings support the theories that have been

advanced and accepted by economists over the centuries. The basic conclusions of this study are

summarized below.

· The U.S. experience of the past 25 years has validated the faith of the National Commission on

Consumer Finance in the power of free and competitive markets to regulate and moderate the price

of credit. The legal ability to raise rates does not correspond to the economic ability to

sustain higher rates. Rates for various types of consumer credit do not necessarily rise to a

regulatory ceiling and are less likely to do so, the higher the ceiling. Instead, knowledgeable

consumer and unrestricted entry are the economic forces that make credit available at prices

commensurate with the costs and risks of providing the credit.

· In the absence of restrictive rate ceilings, competition expands the range and variety of

credit products available to consumers and broadens the risk spectrum of consumers that

can benefit from these products. For example, deregulation of bank credit card rates over the

past 15 years spurred entry into the industry and expansion of credit card offers. As a result, both

high- and low-risk consumers are now being served within a highly competitive environment where

prices adjust to reflect customers' costs and risk.

· Risk-based pricing, which is difficult or impossible under binding rate ceilings,

substantially broadens consumer access to credit. This is nowhere better demonstrated than in

the bank card industry. Deregulation of bank card rates over the past 15 years spurred entry into

the industry and expansion of credit card offers. For millions of households who were too risky for

bank cards in the 1970s, the rate deregulation of the 1980s gave them access to the most powerful

payment mechanism on the planet. Entry spurred dramatic innovations in card features, and

ultimately brought us cards that pay us to use them.

· Risk-based pricing removes the hidden subsidies of high risk borrowers by low risk

borrowers, which occurred when all borrowers were charged a rate equal to the average risk of

the entire group. Both groups are served more efficiently when creditors can charge rates

commensurate with risk.

· Restrictive rate ceilings are most harmful to the citizens they were apparently designed to

protect. Regardless of where a ceiling is set, some higher risk consumers needing cash credit are

rationed out of the market because the cost of serving them is too high for the creditor to absorb or

to pass on as higher rates to lower risk customers. Excluded customers are typically young, have

short-time-on-the-job or at their residence, are relatively unskilled workers, have relatively low

incomes, or poor credit histories because of past illness or unemployment.

· Restrictive ceilings on sales credit (credit offered by merchants for purchase of goods or

services) are basically a sham. Denied an adequate return for their credit services, retailers push

shortfall into higher cash prices. Higher cash prices affect not only customers who borrow, but

those who have been unable to get credit, presumably a group who are less able to afford higher

cash prices than the more affluent credit buyers.

· In the end, consumers obtain the credit they need from sources that are inconvenient and

at higher prices that do not efficiently reflect cost and risk.

In short, rate ceilings that are thought to "protect" consumers do not protect consumers and do clear

harm to those who are generally at the bottom of the economic ladder. The most reliable way to protect

higher risk borrowers is to ensure that they have alternative sources of financing from which to choose. This

is accomplished by facilitating the unrestricted entry of new competitors into a market in which the price of

credit is free from artificial constraints.

http://www.gwu.edu/~business/research/centers/fsrp/pdf/Mono31.pdf

I post here for entertainment. Apparently, many people post here to promote their business. I am entertained by making fun of your business. Seriously.

V. PRACTICAL IMPACT: WHETHER STATE LEGISLATURES ARE

WELL SERVED BY RETAINING STRICT USURY LAWS

Federal preemption of state usury laws has long been a

source of disagreement and debate.96 Scholars have noted that

“[c]onflicts inhere in permitting a meaningful role to fifty state

governments despite a constitutionally mandated supremacy of

federal law.”97 Traditionally state governments have regulated

usury laws with the intent of protecting consumers from high

interest rates, but the modern trend has favored federal

preemption.98 As a result of this preemption, banking rules are

becoming more standardized and there is movement towards a

uniform nationwide banking system.99 Therefore, in light of the

current banking market, it may be necessary for state legislative

bodies to reexamine whether strict usury laws are actually

beneficial, burdensome, or inapplicable to their citizens.100

While many bankers and economists recognize that strict

usury laws can be harmful to state economies, citizens perceive the

state usury limitations as protective.101 Often it is difficult to

educate millions of voters who are unfamiliar with banking and

business practices about the unintended consequences of

restrictive usury limits.102 This public perception makes it

politically difficult for elected officials to recommend removing

restrictive usury limits.103 Additionally, depending on the climate

in a state, it can be detrimental to a political career to advocate for

less restrictive usury laws.104

Prior to the level of federal preemption that exists today,

national (and some state) banks were disadvantaged regarding

interstate branching and interest rates that could lawfully be

charged.105 Disadvantaged banks were unable to compete with

their dual banking system counterparts because they were

competing against other banks that had imported more lenient

usury restrictions.106 Today, however, preemption has reached a

level in which the various banks operate on a more even playing

field.107 The question remains, however: are usury laws meeting

their purpose of consumer protection?

For example, usury laws do not apply to all financial

transactions.108 Payday lenders and other non-traditional lenders

circumvent usury laws and charge customers outrageous amounts

of interest by forming partnerships with banks that hold national

charters.109 The loans are technically issued through the national

bank; therefore, state usury laws are largely avoided.110

Consumers with less than desirable credit and a lack of financial

knowledge are the primary customers of nontraditional banking

services; therefore, usury laws are not meeting the goals of

protecting the disadvantaged.111 Perhaps the current emphasis on

predatory lending practices and proposed legislation to regulate

sub-prime lending practices would help to protect the public;

however, this must be done in a manner that does not restrict

credit availability or unduly burden the financial community.

The usury laws, however, are not altogether inapplicable.

In-state lenders that are not banks, such as Household Finance

Corporation, are still required to follow state usury laws and are

not part of the group of banks covered under GLBA.112 This

means that these non-bank lenders are unable to compete on a

level playing field with traditional lenders and may be forced out

of business.113 Ultimately, competition among various lenders is

suppressed and the market suffers.

Therefore, even though State legislatures have a noble goal

in protecting their citizens, strict state usury limits have not

actually achieved this intended goal. Moreover, states with strict

usury limits have seen capital and jobs leave their states.114 For

example, the North Carolina Deputy Commissioner of banks

estimated that the state has experienced a loss of several thousand

jobs over the years as state legislators refused to loosen credit card

regulations.115 In 1997 alone, Branch Banking and Trust Company

(BB&T) (a bank based in Winston-Salem) moved its credit card

business from North Carolina to Georgia, and Raleigh-based First

Citizens Bank opened their credit card operations in Virginia.116

These observations suggest that state legislatures may be

well served to reevaluate the current laws and reconsider their grip

on usury limits. Unfortunately, there are no simple solutions to

the complex problems that have surrounded usury limits for

decades. Furthermore, the difficult challenge of reforming usury

laws would be most effective if each state participates. Ultimately,

in light of the current economy, it might be advantageous for state

legislatures to revisit usury laws in search of an ideal system that

would strike a balance between serving the public policy goal of

consumer protection and allowing businesses to make a fair profit.

AMANDA KATHERINE SADIE HILL

NORTH CAROLINA BANKING INSTITUTE

http://studentorgs.law.unc.edu/documents/ncbank/volume6/amandahill.pdf

Outsourcing Patient Bills Benefits NLR Firm

By Mark Friedman

1/21/2008

http://arkansasbusiness.com/article.aspx?aID=102385.82176.114520&view=all

In an attempt to handle the rising accounts of the uninsured and underinsured, many hospitals are outsourcing their billing chores the moment the patient walks out of the building.

That's good news for companies like CompleteCare Inc. of North Little Rock, which handles the billing for 60 hospitals and 1,000 physician groups nationwide.

"For the first time, we're getting hospitals calling us ... looking for information," said CompletCare's president and CEO, Steve Owen.

He wouldn't release revenue figures, but the company is growing at about 25 percent in revenue and clients annually as hospitals are becoming overwhelmed by underinsured and uninsured patients.

The medical bills are getting higher and patients can't pay the balances all at once, Owen said. So the hospitals turn to CompleteCare for help.

CompleteCare's success rate for collecting on the hospitals' accounts is between 35 and 40 percent. "And that sounds low, but the industry average for hospitals is around 20 percent," Owen said.

As a way to motivate patients to pay faster, CompleteCare charges a 5.75 percent interest rate on about 10 of the 60 hospitals. (CompleteCare couldn't charge more than 17 percent interest under any circumstance because of Arkansas' usury law.)

Owen said the hospitals are the ones that decide if interest is going to be charged. But, he said, hospitals are moving away from charging interest.

During the last two years, about 15 hospitals that had charged interest stopped because patients were being pinched by high gasoline prices and the sluggish economy.

One of those hospitals that started charging interest but then stopped was Hot Spring County Medical Center of Malvern, which had signed a contract with CompleteCare in June.

Owen said HSC Medical Center asked CompleteCare to quit charging interest sometime in November. HSC Medical officials didn't return calls for comment.

In a news release on Nov. 28, the hospital said collecting money is vital to the financial health of the hospital.

"Since HSC Medical Center receives no tax assistance and operates solely off our collections for services, it is important that we assist our patients in identifying payor sources for their hospital accounts," Phillip Gilmore, the hospital's CEO, said in a November news release.

The hospital said it would work with patients to help them pay their bills and it could refer the account for charity consideration.

'Medical Debt Revolution'

In a Dec. 3 article, Business Week magazine called CompleteCare "one of the many small firms fueling the little-known medical debt revolution." It said financial institutions are now getting into the medical collection industry.

But CompleteCare has been around for nearly 25 years.

In the early 1980s, CompleteCare did studies that showed paying off medical bills were a low priority for patients. Higher priorities included rent or mortgage payments, utility bills, car payments and credit cards.

Only after those obligations were met would patients pay doctors and hospitals. Most of the time, however, medical bills were blown off because the amount due was more than the patient anticipated.

"Most hospitals are not set up with payment plans, so they would send out another bill a month later for payment in full," Owen said. When the payment didn't arrive, the hospital might send another bill before turning the account over to a collection agency.

In stepped CompleteCare.

CompleteCare can combine all of a patient's bills from the doctor to the hospital - all that have contracts with CompleteCare, at least - into one bill in an attempt to make payments easier. CompleteCare also tried to make paying the medical bill less painful by setting up payment schedules. The standard payments are $35 a month or 10 percent of the account balance, whichever is higher.

Most of the patients CompleteCare deals with are middle-income individuals who didn't plan on having a medical emergency and might need some help with handling a payment, Owen said.

If the patients don't pay, the account is handed back to the client or in some cases turned over to CompleteCare's collection division, Mayfair Solutions.

The patients pay CompleteCare, which then hands the money over to the hospital or physician group, minus a fee that ranges from 5 to 9 percent.

As an incentive to get patients to pay faster, some hospitals authorized CompleteCare to charge interest on the accounts. Owen said the interest payment is split between the hospital and CompleteCare.

In the late 1990s and early 2000s, CompleteCare noticed more hospitals outsourcing their health care receivables.

"Historically, hospitals only would outsource the bad debt side of it," Owen said. "But they are realizing to really be able to work with the patients ... they need to outsource."

CompleteCare's typical clients are the independent community hospitals.

Owen said CompleteCare's staff can review the patient's account to determine if the claim could qualify for charity care or Medicare or Medicaid payments.

"You have to do everything that you can to work with those patients," Owen said.

http://arkansasbusiness.com/article.aspx?aID=102397.54928.114520&view=all&link=perm

Arkansas has usury laws. I'm in favor of that debate coming back.

Peg everything prime + 2% and the bankers will have less to work with. This would be very unpopular right now with the banks.

"Blank" Lincoln is a shill:

http://www.arkansasnews.com/archive/2008/07/11/WashingtonDCBureau/346996.html

http://www.arktimes.com/blogs/arkansasblog/2008/07/lincolns_usury_bid_dead.aspx

http://www.arkansas.gov/bank/MemorandumOpinion.htm

...19. Arkansas is the only State of the United States which has a constitution which contains a provision which sets a maximum lawful annual percentage rate of interest on any contract at not more than 5 percent above the discount rate for 90-day commercial paper in effect at the Federal Reserve Bank for the Federal Reserve district in which such State is located...

http://www.arkattorneys.com/questions

Usury: What is an illegal interest rate in Arkansas?

September 8th, 2008

Usury is defined by Black’s Law Dictionary as “…the charging of an illegal rate of interest.” In Arkansas, Courts have held that usury occurs when a lender charges more than the legally permissible maximum rate of interest, defined by Article 19, section 13 of the Arkansas Constitution, as amended by Amendment 60. Amendment 60 provides that the interest rate on “general loans” could be a maximum of five percentage points (5%) above the federal discount rate.

Further, under Arkansas law, for an agreement to be usurious, it must be so at the time it was entered into. The party asserting usury has the burden of proof, and the proof must be sustained by clear and convincing evidence. The intention to charge a usurious rate of interest will never be presumed, imputed, or inferred where the opposite result can be fairly and reasonably reached.

The penalties under Arkansas law for violating the above-referenced usury provisions are rather harsh. Specifically, usurious contracts are void as to the amount of usurious interest, and a party who has been subjected to usurious interest is entitled to recover double the amount of such interest.

However, the applicability of the above usury restrictions as applied to Arkansas State-Chartered Banks has recently been severely constricted by federal legislation. On November 12, 1999, President Clinton signed into law the Gramm-Leach-Bliley Act (also referred to as the “Financial Services Modernization Act”). Section 731 of the Gramm-Leach-Bliley Act (codified at 12 U.S.C. § 1831u(f)) (“Section 731”) Section 731 functions to permit Arkansas banks to import the interest rate from other states in certain circumstances.

Section 731, as applied in Arkansas, states that the highest interest rate allowed in Arkansas will be the greater of either: (a) the maximum rate allowed by the home state of any branch bank located in the Arkansas or (b) the rate established by Arkansas’s usury law. Thus, if an out-of-state bank opened a branch in Arkansas and the home state of the out-of-state branch bank had no capped interest rate limit, there would, in effect, be no usury limit in Arkansas.

The Eight Circuit Court of Appeals has had a couple of opportunities to interpret the effect of Section 731 on Article 19, section 13 of the Arkansas Constitution, as amended by Amendment 60. In the lender-friendly opinions of Johnson v. Bank of Bentonville, 269 F.3d 894 (8th Cir.2001) and Jessup v. Pulaski Bank, 327 F.3d 682 (8th Cir.2003), the Eight Circuit affirmative ruled that Section 731 preempted the Arkansas Constitution as to defining the legal interest limits charged by Arkansas banks. Going one step further, the Jessup Court permitted an Arkansas bank to charge a an 18.5% interest rate as non-usurious because an Alabama bank (Regions Bank) maintained a branch in Arkansas and because Alabama law permits an interest rate at any rate agreed to by the parties.

While Courts have interpreted Section 731 to permit greater freedom in the usury rates charged by Arkansas banks, it should be noted that the usury limits in the Arkansas Constitution survive and remain in full-effect as to other institutions and retailers (e.g. used-car dealers).

The attorneys at KMBSP have significant experience in consulting financial institutions in the applicability and interpretation of Arkansas usury laws. If you have any questions about the current state of usury law in Arkansas, we encourage you to contact us.

I post here for entertainment. Apparently, many people post here to promote their business. I am entertained by making fun of your business. Seriously.

Wow everyone is jumping on the bandwagon to point fingers now.

I don't see how a trade can be in a bubble itself without some underlying factors. All BDI did was show that there was a tremendous amount of money flow regardless of there that money was coming from, if it was asset backed or borrowed it wasn't the trade that was the problem. The real bubble? The dependency on credit to fund operations. There was a time when the need for assets required actual capital. When we went down the road of borrowing to manage our operations we became entirely too dependent that the credit would always be there. That interest rates would always stay low offering large sums of cash to move business forward with nothing but the faith of the credit borrower.

I don't think we are done yet. These secular credit cycles take about 15-20 years to resolve and we are only in the second of three major contractions in this secular cycle. The next one in about 5-7 years is going to be the one that seals the deal on credit. Layaway plans will come back as the best way to buy products as retailer will not trust their consumers anymore.

`Biggest Bubble of Them All' Is Globalization: Chart of the Day

By Michael Patterson

Oct. 24 (Bloomberg) -- The 90 percent tumble in the global benchmark for commodity shipping costs since May exceeded the Dow Jones Industrial Average's plunge during the Great Depression, signaling globalization is ``the biggest bubble of them all,'' Bespoke Investment Group LLC said.

The CHART OF THE DAY shows the rise and fall of the Baltic Dry Index, a measure of freight costs on international trade routes, along with three other bubbles during the past decade identified by Bespoke: The Nasdaq Composite Index of technology stocks, the Standard & Poor's Supercomposite Homebuilding Index and the CSI 300 Index, a benchmark for Chinese equities.

The Baltic Dry Index's drop from its peak just five months ago surpassed all of those, along with the Dow's 89 percent retreat from 1929 to 1932, according to Bespoke.

``The Baltic Dry Index had a meteoric run since the start of the decade, as it became one of the key symbols of the `globalization' trade,'' Paul Hickey, co-founder of the Harrison, New York-based research and money management firm, wrote in a report yesterday. ``It now appears that like any `new thing,' the globalization trade went too far.''

The Baltic Dry Index fell yesterday for a 14th straight session as the freeze in money markets curbed traders' ability to buy cargo on credit.

The Nasdaq plunged 78 percent from 2000 to 2002 as investors concluded high-priced Internet stocks weren't supported by profits. The S&P index of homebuilder shares has dropped 82 percent from its 2005 peak as the U.S. suffers its worst housing slump since the 1930s. China's shares have fallen in the past year as slowing economic growth and new regulations prompted traders to shun stocks that had climbed to the most expensive valuations among the world's 20 biggest markets.

To contact the reporter on this story: Michael Patterson in London at mpatterson10@bloomberg.net.

Last Updated: October 24, 2008 09:02 EDT

http://www.bloomberg.com/apps/news?pid=20601109&sid=asRq2L_zxsS0&refer=home

CDS auctions for 2008

Notice the gap down in the market son Oct 6ht when FNM and FRE auctions were held. Markets swung deep that day and going forward.

Quebecor - 19th February 2008 - COMPLETED

Tembec - 2nd October 2008 - COMPLETED

Fannie Mae and Freddie Mac - 6th October 2008 - COMPLETED

Lehman Brothers - 10th October 2008 - COMPLETED

Washington Mutual - 23rd October 2008 - COMPLETED

Landsbanki - 4th November 2008 (TBC)

Glitnir - 5th November 2008 (TBC)

Kaupthing Bank - 6th November 2008 (TBC)

The Beginning of the Middle

The suspected U.S. recession is increasingly confirmed by the data

Hussman Funds is spot on. Looking at employment numbers to gage recessions. After all if you notice your paycheck is getting smaller don't you think you are going to start cutting some of those expenses and consumer spending. Simplest solution is usually right.

William Hester, CFA

August 2008

All rights reserved and actively enforced.

Investors may soon learn that the economy is officially in recession. That's because since 1980, the arbiter of that decision – the NBER – has marked the economy's peak publicly an average of 7 months following each contraction's start. The group has marked recessions as early as 5 months from the economy's peak, and no later than 9 months after. Looking at the data most clearly exhibiting recession-like behavior implies that the economy entered into recession late last year or early this year. That suggests an announcement from the NBER may come sometime over the next couple of months.

The actual announcement will matter less than how deep the recession turns out to be, and how long it lasts. In some ways this recession is atypical. House activity turned down long before it typically has prior to previous economic contractions. Corporate earnings – mostly as a result of write downs in the financials – have also turned down earlier than usual. But other indicators are on time when compared to previous recessions.

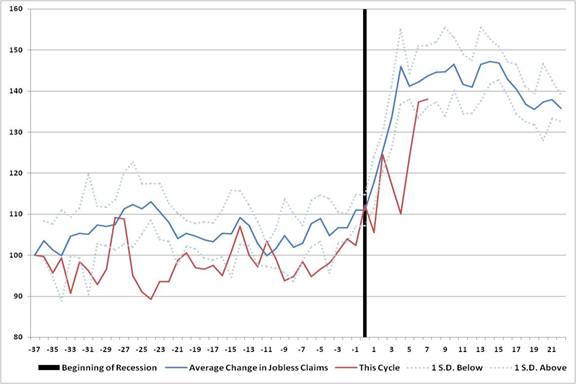

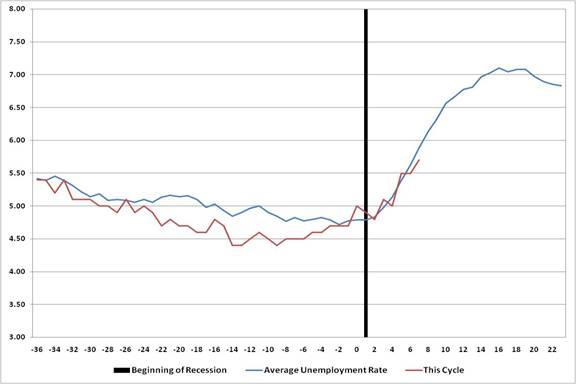

Below I've updated a few of the charts that I've written about in previous research pieces. The first set of charts is from a March report titled Recession and the Duration of Bad News. The charts show the average change in this set of economic indicators around the peaks of the business cycle. The blue line in each chart represents the average change in the data series over a five-year period, beginning 36 months prior to the beginning of each past U.S. recession. The light blue lines represent one standard deviation above and below the change in the data series. The red line shows the change in the data for the current cycle, assuming the economy entered into recession in January. In the first chart the average and current cycle lines are cumulative changes from a base of 100. The second chart shows the average unemployment rate. The vertical black line marks the start of a recession. The last 9 recessions are included, where data for the economic series is available.

If we date the beginning of the recession in January, Jobless Claims data are a few weeks behind schedule, but they've been rising quickly of late (dating the beginning of the recession in March overlaps recent data with the average nearly perfectly). After rising gradually through the first part of the year, the data have now jumped above 400 thousand for four straight weeks. Jobless claims may slow the rate of their ascent from these levels and begin to level off. If the data matches the typical behavior during previous recessions , jobless claims may stay elevated through the beginning of next year.

The unemployment rate is also sticking close to history. After bottoming early last year at 4.4 percent, the unemployment rate rose to 5.7 percent in July. If the data continues to match previous recessions, the rise is only about a third of the way through. This poses risks to the outlook of consumers and business executives (both with already fairly dismal expectations). This is because the peak in the unemployment rate expected by economists differs substantially from the trends of previous recessions. In Bloomberg's survey of more than 70 economists the median forecast for next year's second quarter unemployment rate is 5.9 percent. If the unemployment rate continues to trace history, a 7 percent rate is implied.

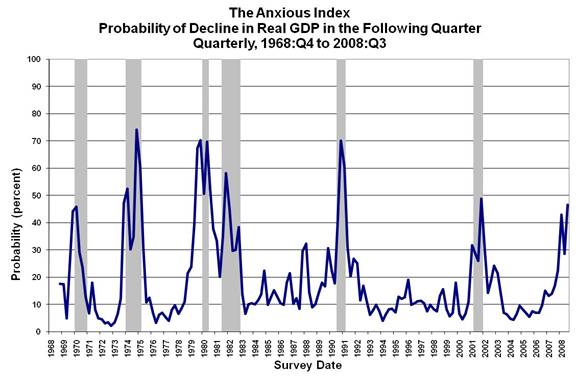

Economists are coming around to the idea that the economy is in recession, or will soon be heading into one. This week the Philadelphia Federal Reserve released its quarterly Survey of Professional Forecasters which collects forecasts from a diverse - and importantly, anonymous group of economists. The question in the survey that tracks the forecasted probability of negative growth in the next few quarters – colloquially named The Anxious Index - showed an important change in this week's release. The survey reported that forecasters believe that there's a 47 percent chance of negative growth in the fourth quarter of 2008, up from just 30 percent in the last survey. The probability has never been this high outside of a recession. (Data is courtesy of the Philadelphia Fed.)

It's difficult to make the case that stock analysts are anywhere near as anxious. In the fourth quarter of 2008 – the same 3-month period for which economists are expecting the economy to contract – stock analysts are forecasting that S&P 500 Index earnings will grow by 46 percent, according to Bloomberg data. A bulk of that is derived from an expected rebound in earnings from the financials group. But even ex-financials, earnings are expected to grow 14 percent in the fourth quarter, and then by 16 percent in the first quarter of 2009.

Earnings may not trough until the first quarter of next year, if this recession matches the average change in earnings around recessions. Other indicators are pointing in the same direction. The graph below is from Record Profits Don't Excite Corporate Executives and it shows that there is a correlation between the outlook of executives and subsequent profit growth. Corporate executives (blue line, left scale) haven't been this downbeat since the last recession. Based on the scales in the graph, corporate profit normally overshoots executive pessimism on the downside.

Recession-induced Bear Market Update

Even though some of the economic data is closely following traditional recessionary patterns, the stock market has historically demonstrated more variation from one recession to the next. Even so, it can be helpful to put the current decline in context by comparing it with previous recession-induced bear markets. The bar charts below update the data from September's research, Recessions and Stock Prices .

Since the market's top in October, 224 days have passed. This makes the duration of the current bear market shorter than the average recession-induced bear market, which tend to be longer in duration than ‘stand alone' declines. If this decline runs the average duration of past recession-induced bears, we could observe the bottom in October. It would be in good company, as a third of all recession-induced bear markets since 1953 have ended in October, but of course, there is far too much variation to place much faith in that outcome.

Recession-induced bear markets not only tend to last longer, but the average decline is also greater. The decline during the current bear market thus far is still well short of the average loss for prior bears.

The last bar chart is the least encouraging, especially for investors who assume that the market's July low represented a favorable valuation for a bear market bottom. If July turns out to be the low point for this bear market, it will then mark the second highest level of valuation that a cyclical bull has ever started from (the highest starting valuation level was in 2003). The risks are material if this bear market was to end at the average price-to-peak earnings multiple of past recessionary troughs. For the price multiple on peak earnings to touch the long-term average of 10.4, the S&P would need to fall to 885.

Overlaying current trends in economic data with past recessions implies that the economy is entering the beginning of the middle stages of an economic contraction. Weak job-related data should be expected until at least early next year. Also, earnings may be slower to rebound than analysts expect, putting pressure on stock valuations that are better, but are still uninspiring.

WAMU is today and 10 business days to settle that one I think. Just after the election?

The fear is still there because this is not a very transparent process. Everything is still being done in a a less than public market with only select information begin leaked out. Plus no word as to who is up next after WAMU and when the next auction date is.

so, we are on to the next fear of "incident"

Tracking Firm Says Bets Placed on Lehman Have Been Quietly Settled

By MARY WILLIAMS WALSH

October 23, 2008

saw it thanx.

http://www.nytimes.com/2008/10/23/business/23lehman.html?_r=1&oref=slogin&pagewanted=print

Hundreds of traders who placed bets on Lehman Brothers’ creditworthiness before it went bankrupt have settled their positions “without incident,” according to a company that tracks derivatives contracts.

The company, Depository Trust & Clearing Corporation, processes large numbers of investment transactions. It said that only $5.2 billion had to change hands for all the traders to close out their positions, a much smaller amount than had been predicted a week ago.

The settlement process had been seen as a major test of the market for credit-default swaps, and whether it could handle the unprecedented stress of a big Wall Street firm going bankrupt. The overall system appears to have borne the shock successfully, although individual firms might have taken painful losses they have not yet disclosed.

At the same time, the contrast between this week’s orderly settlement process and last month’s financial turmoil, which also involved credit-default swaps, raised anew policy questions over the market for credit derivatives and its failure to limit systemic risk. Because the swaps are private contracts between two parties, there is still almost no information in the public domain over who holds which positions, or who might be left teetering the next time there is a major default.

The lack of information is thought to have fueled the general panic in mid-September, when Lehman Brothers went bankrupt and the American International Group came to the brink of collapse before being rescued by the Federal Reserve.

As if to underscore the opacity of the market, American International said this week that it had to pay only $6.2 million to settle all of its credit-default swaps on Lehman’s debt. The amount was much smaller than had been expected, given A.I.G.’s big presence in the market for credit-default swaps, and given that A.I.G. required an emergency line of credit worth $85 billion from the Fed.

A spokesman for A.I.G., Nicholas J. Ashooh, said that the company had needed the big loan from the Fed because of its high level of exposure in other areas, but not on its derivatives trades on Lehman’s debt. He said that A.I.G. had written many derivatives contracts on Lehman’s debt, but because they took opposing trading positions they almost completely canceled each other out during the settlement process.

“Lehman was not the source of our problem,” Mr. Ashooh said. “Our issue really preceded that. We were already having problems when Lehman went under.”

He said most of A.I.G.’s problems with the credit derivatives involved swaps that covered the financial strength of complex debt securities linked to the housing market.

Credit-default swaps are similar to insurance, providing coverage to investors who hold a company’s bonds or other fixed-income instruments. In the event of a default, the one who sold the protection has to pay the one who bought it.