Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$TRBO interesting volume something might be coming

ADOM Gapper? Up after and premarket 11%. Target price $2.17 Dollars

ADOMANI(R) Reports First Quarter 2019 Results

ACCESSWIRE ACCESSWIREMay 2, 2019

CORONA, CA / ACCESSWIRE / May 2, 2019 / ADOMANI, Inc. (NASDAQ: ADOM), a provider of advanced zero-emission and hybrid vehicle drivetrain solutions and purpose-built electric vehicles, today announced its results for the first quarter ended March 31, 2019.

Quarterly and Recent Highlights

Backlog of $18.9 million at April 30, 2019, an increase of 46% from the previously reported April 4, 2019 backlog of $12.9 million, and a 120% increase over the $8.6 million backlog we reported at December 31, 2018.

Visited the Philippines and China in February to assess opportunities and are currently exploring prospective alliances.

Showcased its all-electric commercial trucks and vans in California ride-and-drive events, including the annual Advanced Clean Transportation (ACT) Expo held in Long Beach, California in April.

Retained Roger Howsmon, a 40-year veteran of trucking and manufacturing industries, as an expert consultant to assist with sales and marketing efforts for its all-electric truck and van products and other new products.

Presented at the Roth 2019 Conference in Laguna Beach, California in March.

Entered into a mutual sales and marketing agreement with Zeem Solutions, a commercial electric vehicle (CEV) service provider. It is expected that Zeem will serve as an important sales representative and partner with respect to its all-electric truck and van products, including providing value-added support and service for ADOMANI's products.

Received initial order from GerWeiss EV USA LLC for zero-emission all-electric e-trikes, the three-wheeled vehicles widely used in the Philippines. The purchase order represents a revenue opportunity of approximately $1.7 million and will give ADOMANI access to a market where approximately 3.5 million e-trikes are currently in service.

Jim Reynolds, CEO of ADOMANI, commented, ''We've made a lot of progress thus far in 2019. Backlog at March 31, 2019 was $12.9 million, a 50% increase over the December 31, 2018 backlog of $8.6 million. As of April 30, 2019, it has increased by an additional $7.2 million, or by 46%, to $18.9 million. We began marketing our all-electric trucks and vans, and hired truck industry expert Roger Howsmon as a consultant. We entered into a sales and marketing agreement with Zeem Solutions which we believe will have a positive impact on our ability to generate sales in 2019. Additionally, we received our first order from the Philippines for all-electric e-trikes, a market we believe represents a significant opportunity for us. Unfortunately, delivery timing creates volatility in our quarterly results in terms of revenue recognition. Due to delays from both major sub-contractors that extended beyond 2018 through the first quarter of 2019, we were not able to ship significant amounts of product. Nevertheless, due to recent improvements in the supply chain, we are confident that we will be able to convert the majority of our existing backlog to sales revenue in 2019, and, if successful, we would be well positioned to meet or exceed analyst consensus revenue estimates for full year 2019. Moreover, we continue to believe that, if we are able to effectively execute our business plan and capitalize on the opportunities that are presented to us, we will be profitable by 2020. We also feel that we have adequate cash to fund us to profitability.''

First Quarter 2019 Financial Results

Sales were $420,320 for the three months ended March 31, 2019, compared to $463,731 for the three months ended March 31, 2018. Cost of sales were $390,845 for the three months ended March 31, 2019 compared to $478,731 for the three months ended March 31, 2018.

General and administrative expenses in the first quarter of 2019 were approximately $1.4 million compared to approximately $3.9 million in the first quarter of 2018, a decrease of $2.5 million. The decrease was primarily due to a $2.7 million decrease in non-cash stock-based compensation expense compared to the prior-year period, and was partially offset by increases in legal, professional and insurance expenses during the current-year period. The first quarter 2019 general and administrative expenses include approximately $275,000 in non-cash charges, including $253,000 in stock-based compensation expense. The decrease in stock-based compensation expense in the current-year period was primarily due to the forfeiture in 2018 of options to purchase shares of common stock by certain employees and directors.

Consulting expenses increased by $34,455 for the three months ended March 31, 2019 as compared to the same period last year as a result of increased activity in the sales and marketing area in the current-year period.

Research and development expenses decreased by $110,933, to $45,000, in the first quarter of 2019 compared to the first quarter of 2018, due to the timing of certain expenditures made for research and development activity.

Total net operating expenses for the first quarter of 2019 decreased by $2.6 million compared to the first quarter of 2018 primarily due to the expense reductions discussed above.

Net loss in the first quarter of 2019 was approximately $1.4 million, a decrease of approximately $2.6 million as compared to a net loss of approximately $4.1 million in the first quarter of 2018 for the reasons discussed above. The total non-cash expenses included in the net loss for the quarter ended March 31, 2018 were approximately $3.0 million.

As of March 31, 2019, the Company had cash, cash equivalents, and short-term investments of $7.7 million and debt of $2.5 million, as compared to $8.2 million of cash, cash equivalents and short-term investments and no debt as of March 31, 2018. Working capital at March 31, 2019 was $6 million as compared to $10.5 million at March 31, 2018.

GBHL Ready to Run - Nice looking bottom play here->

Chart:

https://www.barchart.com/stocks/quotes/GBHL/technical-chart?plot=BAR&volume=total&data=DO&density=M&pricesOn=1&asPctChange=0&logscale=0&indicators=SMA(10);SMA(50);SMA(200);RSI(14,100);ACCUM;MFI(14,100);SMACD(12,26,9)&sym=GBHL&grid=1&height=500&studyheight=100

$EPAZ . BoxesOS provides many of the web-based applications organizations would otherwise need to purchase separately. Epazz's other products are AgentPower™

I miss the APS days. It looks like the big promo plays are gone. It was always fun trying to figure out what the next APS play would be.

Is this real or fake? https://twitter.com/APSisBack

Tanke Inc. About to run. Numbers look good!! Time to LOAD! Go TNKE!!

$PVSP has a big volumes today. Maybe it will be run hard next week

$FEGR /\ Oil and Gas production 2014 value of 2,304,843 US Dollars that would be 0.0717 price per share!!!

Oil/Gas Production 2014: 2,304,843 US Dollar / Shares Outstanding: 32,140,807 = 0,0717108005408825 Price per Share!!!

FEGR potential:

Shares Outstanding: 32,140,807

Current PPS: $0.0011

Current Market Cap: $35355

Possible PPS and Market Cap/Value:

$0.005 = $160,000

$0.01 = $320,000

$0.03 = $1.0 million

$0.05 = $1.6 million

Friendly Energy Services Gas production 65295 MCF to November 2014!

NYMEX Natural Gas USD/MMBtu 4.28

http://www.bloomberg.com/energy/

GAS 65295 MCF * 4.28 US Dollar = 279463 US Dollar

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=108343249

Field Gas District 7b January - November 2014 Friendly Energy Services, Inc, GAS 33231 MCF!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=108342577

Gas Purchasers W District 7b January - November 2014 Friendly Energy Services, Inc. Gas 32064 MCF!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=108510790

FRIENDLY ENERGY SERVICES, INC. 286572 Oil and Gas Production Ledgers for January to July 2014 Oil District 7B !!! 27370 bbl !!!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=106875345

Crude Oil (WTI) USD/bbl. 74

http://www.bloomberg.com/energy/

Oil 27370 bbl * 74 USD/bbl. = 2025380 US Dollar

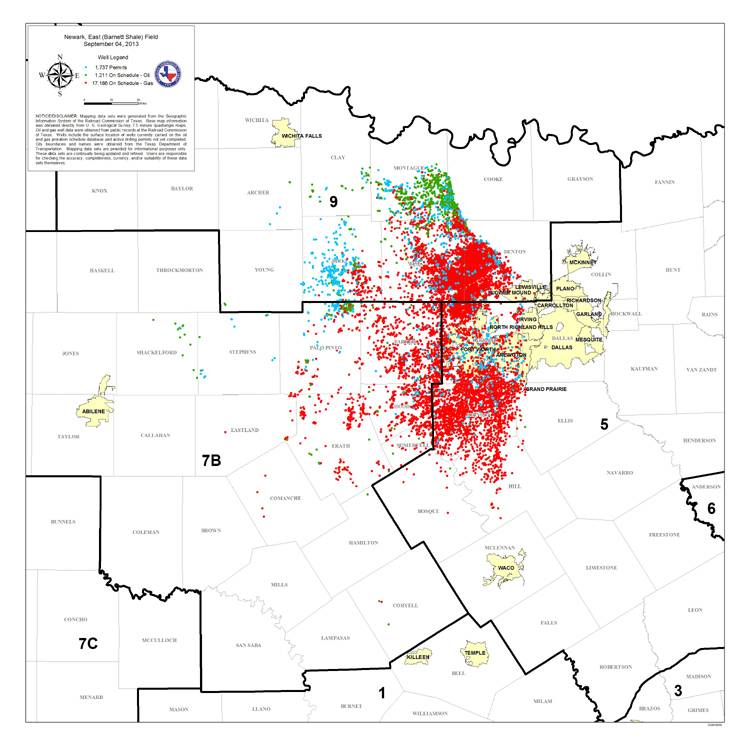

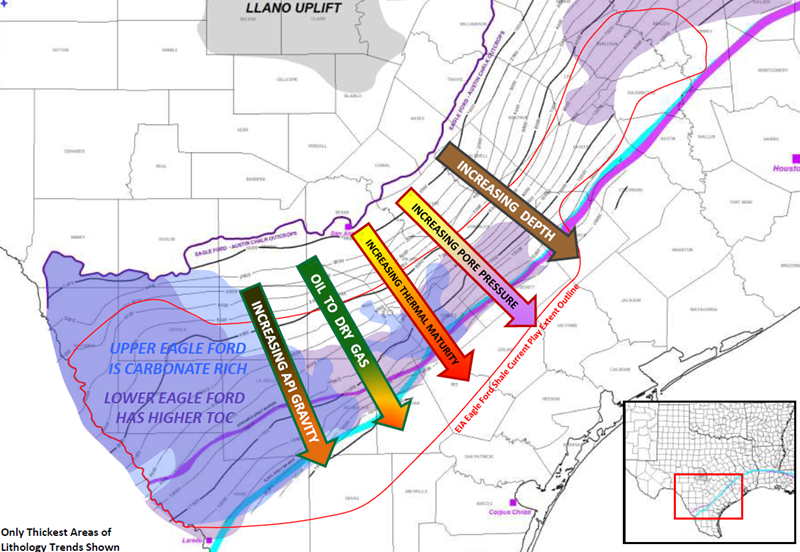

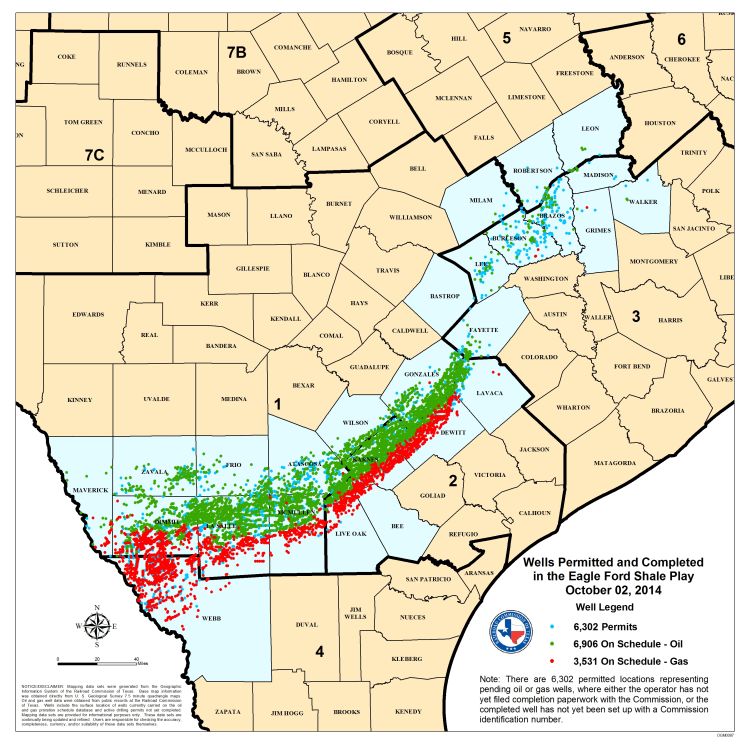

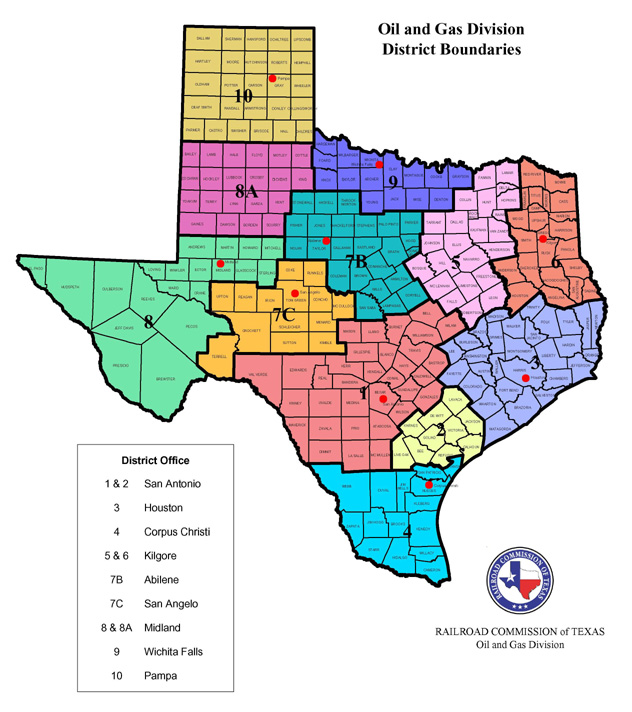

Friendly Energy Services, Inc. / Eagle Ford Shale: District 4 Corpus Christi / Barnett Shale: District 7B Abilene and District 9 Wichita Fells

District 9: Wichita Fells

Oil-field services firm to open Mississippi-based facility

Posted: Thursday, October 16, 2014 12:00 am

By Staff and Wire Reports

A Houston-based oil-field services company is locating a new facility in Summit, Mississippi, that will warehouse and eventually manufacture drilling fluids for oil drillers in the Tuscaloosa Marine Shale formation.

Newpark Drilling Fluids officials say the project will create 40 new jobs.

Tuscaloosa Marine Shale formation is located in southwest Mississippi and central Louisiana.

The announcement was made Wednesday by Mississippi Gov. Phil Bryant and local and company officials.

Newpark Drilling Fluids is locating in the old Kellwood Building owned by Pike County. The company will use the town’s rail spur to bring in both tanker cars and boxcars with ingredients to manufacture drilling mud specifically designed for the TMS drilling.

The Mississippi Development Authority provided assistance for rail and roadway improvements. The town of Summit also provided assistance.

http://www.tulsaworld.com/business/energy/oil-field-services-firm-to-open-mississippi-based-facility/article_ce268947-03f5-537e-affe-a7907e1f84fb.html

Friendly Energy Exploration / Services, Inc.

Hutchins Lease: The Hutchins lease totals 194 acres of which approximately 30% is in defined oil fields. The Company’s lease is for the upper production zones included the Fry Sands. There were four Fry Sand wells which were plugged in 2001 when the operator had financial problems and oil and gas prices were very low. We expect to reenter the one of the Fry Sand wells. There is good potential for in-field drilling. A new tank farm and other infrastructure are needed on the Hutchins lease. As at December 31, 2012, there was no production on the property. The Hutchins #1 was drilled in May 1983 as a Wildcat. After drilling through three zones indicating excellent potential, the Hutchins encountered a hydrocarbon bearing formation at 2,280 feet. This had not been encountered in any other well in Brown County. The Hutchins well is credited with being the discovery well for one of the largest productive Mississippian reefs in the state of Texas. It is also credited as the discovery well for one of the most productive fields discovered in Brown County in the last half of the century. In 2009, the Company purchased, through its wholly-owned subsidiary, a 100% interest in oil and gas properties in central Texas for $2,400.

District 7B: Abilene

>>> East Chalker Lease: Top Oil production of Friendly Energy Services <<<

FRIENDLY ENERGY SERVICES, INC. 286572 Oil Production Ledgers for January to July 2014 Oil District 7B / EAST CHALKER LEASE !!! 8008 bbl !!!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=106875345

Field Gas District 7b January - November 2014 Friendly Energy Services, Inc, GAS 33231 MCF!!!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=108342577

Gas Purchasers W District 7b January - November 2014 Friendly Energy Services, Inc. Gas 32064 MCF!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=108510790

District 4: Corpus Christi

FRIENDLY ENERGY SERVICES is an oil operator located in CORPUS CHRISTI, Texas.

According to the Texas Railroad Commission, FRIENDLY ENERGY SERVICES, INC. has Texas Oil Operator Number 286572. Many companies listed as operators with the TRRC are Oil and Gas Exploration Companies in Texas. As an Oil and Gas Operator, FRIENDLY ENERGY SERVICES is listed as having an involvement in the Texas oil industry through operations, exploration and/or production of crude oil and natural gas. Representatives of FRIENDLY ENERGY SERVICES, INC.

Eagle Ford Shale goes to San Patricio Counties Corpus Christi Texas!

FRIENDLY ENERGY SERVICES, INC. STATUS DATE 09012014

2610 LINN STREET UPDATED THRU 10/28/2014

CORPUS CHRSTI TX 78410 DAYS 30 FACTOR 100

OIL-WELLS 09-1 WELL # DAILY-ALLOW MONTHLY-ALLOW

DIST FIELD/LEASE NAME LSE MOV-BAL REC # OIL(BBL) GAS(MCF) OIL(BBL) GAS(MCF)

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

04 WHITE POINT, EAST

KIRK, J. R. 03334 13 14B DENY

KIRK, W. E. 03335 4 14B DENY

6 14B DENY

TEETER, J. A. 03345 1 14B DENY

2 14B DENY

WHITE POINT, EAST (HET 4600)

KIRK, J. R. 03695 3-U 14B DENY

WHITE POINT, EAST (5000 SD.)

KIRK, J. R. 12090 5 14B DENY

7B TEAGUE-SAGE (ELLENBURGER)

A. HUNT 29786 2 14B DENY

3 14B DENY

TEAGUE (ELLENBURGER)

GOBBLER HOLLOW 29479 -43 2 14B DENY

KELLER 29787 -56 1-B 14B DENY

2B 14B DENY

THRIFTY, S. (CHAPPEL REEF)

EXPLO-THOMAS 24966 1 14B DENY

THOMAS 29788 56 1-R NO PROD

09 GOREE

TYRA, SAM 26439 1 14B DENY

3 14B DENY

GAS-WELLS GAS ALLOW

DIST FIELD NAME I.D. LEASE NAME WELL MO. MCF STATUS

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

04 WHITE POINT, EAST (2300)

117781 KIRK GAS UNIT 9 14B DENY

04 WHITE POINT, EAST (3400)

169310 J. R. KIRK GU 7 14B DENY

7B TEAGUE-SAGE (ELLENBURGER)

187486 HUNT, A. 1 H15 VIOL

7B THRIFTY, S. (CHAPPEL REEF)

121450 BOHANNON 1 H15 VIOL

127892 SAGE-KELLER 1 H15 VIOL

128588 SAGE-KEPLER "A" 2 H15 VIOL

128817 EXPLO-THOMAS "A 2 14B DENY

129836 EXPLO-KELLER 1 H15 VIOL

130606 SAGE-KELLER "A" 2 H15 VIOL

130607 SAGE-THOMAS 1 H15 VIOL

130980 EXPLO-OTT 1 H15 VIOL

131193 SAGE-BREEDLOVE 1 0#

131364 SAGE-KELLER "B" 3 14B DENY

133769 ATC THOMAS 2 14B DENY

138793 RAMAGE, T. C. 1 14B DENY

OIL AND GAS PRORATION SCHEDULE LISTED BY OPERATOR NOVEMBER 2014

FRIENDLY ENERGY SERVICES, INC. STATUS DATE 09/01/2014

GAS-WELLS GAS ALLOW

DIST FIELD NAME I.D. LEASE NAME WELL MO. MCF STATUS

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

7B THRIFTY, S. (CHAPPEL REEF)

202387 GOBBLER HOLLOW 1 0#

206658 GOBBLER HOLLOW 3 14B DENY

Operators F = Friendly Energy Services, Inc.

http://www.rrc.state.tx.us/oil-gas/research-and-statistics/proration-schedules/operator/november-2014/

$DSCR: Hemp Legalization Passes TN Senate (TNReport.com)

$CGRW, $DSCR, $MEDT: "2 Of My Favorite Things Are Smoking A Pipe of Sweet Hemp & Playing My Harmonica" President Lincoln

Not anymore.......et z

anyone know when the next Stock market authority pick is coming? do they have a website?

UBQU Ubiquitech Software through our main division Blue Crush Marketing Group LLC is an incredibly dynamic, multi-media, multi-faceted and cutting-edge corporation utilizing highly effective state-of-the-art global Internet marketing to drive sales to our growing divisions.

Wow! Does that mean 20x revenue ?

I would sure think so!

NEW YORK, NY--(Marketwired - Aug 12, 2014) - Eyes on the Go, Inc. (OTCQB: AXCG) ("Eyes"), a virtual broadcasting company with a proprietary video streaming network providing live and recorded content from top New York City nightlife venues, has developed an expansion plan in concert with Amazon Web Services (AWS) experts and estimates that the company will add 20 times the servers now in use to handle forecasted demand. The company expects to see concurrent users on its web sites grow from 5,000 to upwards of 100,000 within the next month.

https://finance.yahoo.com/news/eyes-finalizes-expansion-plan-amazon-120000832.html

Concurrent means "to serve at the same time"

AXCG is a buy and hold! Wait till these 2 guys start producing on Gander.TV, big money will be coming in ![]()

Eyes on the Go Enters Into Live Broadcast Agreements With Teen Internet Sensations Cameron Dallas and Nash Grier

"Grier has more than nine million Vine followers, surpassing Miley Cyrus, Justin Bieber, One Direction and Taylor Swift. His fan base is growing exponentially each week with more than six million Instagram followers and 3.6 million Twitter followers. Dallas' social media numbers are as impressive, with more than three million Twitter followers and 5.4 million followers on Vine. Both Dallas and Grier have appeared on numerous TV shows, including Good Morning America and Good Day New York, and have recently signed with AwesomnessTV for a feature movie."

https://finance.yahoo.com/news/eyes-enters-live-broadcast-agreements-123341924.html

check out SWET nice chart! big week ahead

VEND is crashing... wonder why??

In other news: http://www.independent.co.uk/news/uk/crime/police-swoop-on-110-suspected-boiler-room-fraudsters-in-international-crackdown-9159339.html

TSNP is in breakout mode! RECORD VOLUME IN TWO DAYS!

SOMETHING BIG IS BREWING!!!

Setting up for a possible entry into the hot MMJ market.

Fastest growing market around! Faster than the cell phone market ever was.

Read the stickies! Ground floor opportunity!

http://investorshub.advfn.com/Tesoro-Enterprises-Inc-TSNP-14605/

This video is well worth your time. This guys strategy works great for working professionals, its more swing trades than daytrades. Also if your still weary of penny stocks from all the APS / SEC halts etc etc.. He trades NASDAQ small caps. Let me know what you guys think!

First link:

http://profit.ly/guru/superman?aff=895

Second link:

Guys! I just figured out APS's new strategy:

NO APS

chris NOW WHAT do you do?

ALL THINGS NO AWESOME

Not exactly pennys, but has this been priced into amazon stock yet?

http://www.usatoday.com/story/news/nation/2013/12/25/ups-delivery-christmas/4199967/

btw, congrats on your new gig!

you guys are cracking me up!

LOLOLOL!!

I knew it!!!

JS- "How can anyone be expected to have a "favorite editor"? I wonder who's running the Pennystocks.com show now... "

me- "Janice Shell?"

JS- "yes?"

I finally caught you red handed!!!

How can anyone be expected to have a "favorite editor"? I wonder who's running the Pennystocks.com show now...

Pennystocks.com (known aps affiliate) just put out the following email. Ive been concentraring pn toms prepromo strategy, and superman has been a money printing machine lately (nyse stock picks).

Dear members,

You have not heard from us in a while and we apologize about that...We have been working overtime to bring you the next hot pick and it is here in time for Christmas.

Our last Christmas pick soared more than 200% before the calendar switched to 2013.

You should be excited about this next one as we believe it is bound to produce tremendous results for all of us.

Call your friends, family, acquaintances and co-workers immediately to tell them to be ready for it when it is announced.

This may be our last pick ever and potentially your last chance to make a killing one last time.

Stay tuned it is coming very soon!

Your favorite editor,

PennyStocks.com

Edit: this "future" depends on the SEC not suspending pumps left and right (as they should). Good luck with that happening...

Also, could it be profitable for a scammer to set up a pump and bigtime short it in hopes the SEC suspends it?

The future of pump n dumps:

http://online.wsj.com/news/articles/SB10001424052702304607104579212122084821400

Im not sure about the legality of things like this, but scammers never worried much about the law anyway.

Anyone know what's up with "Top Investment Report"?

...and.... ...your banned

If anybody ever wants to lose some money they will pm you.

Reason 1: you want to teach and help people, and you have something real to contribute to the ppl who read this

Reason 2: your a scum bag scam pumper about to spew some crap on this board in a vain attempt to steal peoples money. In which case your about to get banned...

Reason 3: your a newbie who doesnt know he is getting scammed yet, and you think you are helping. In which case your still banned, but once you figure out what is actually going on your welcome to come back.

ok copy and paste to url.

www.docstoc.com/docs/163240342/Nevada-Gold-Corp-(NVGC)-Hard-Mailer

trust. well worth the wait to load.

Chris, I think I found the writers crutch that the touts use

to come up with some of the pump in their newsletters!

If they don't use it, maybe they should, as I might make

some of their trash more believable. ![]()

http://www.joe-ks.com/archives_feb2001/ManualMSG.htm

ahh, gotcha. I agree with what your saying, and i think that is why most NASDAQ pumpers stick to low float picks that can move a higher %.

I was commenting that you said they would only go up by a few %. If they only go up by a few % (when you say few % I am assuming < 5%), I am saying it will fail.

I think we can all agree they need to go up a lot more than a few % for them to be successful.

|

Followers

|

909

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

72024

|

|

Created

|

04/07/12

|

Type

|

Premium

|

| Moderator chris8sirhc | |||

| Assistants ryannazz AlexanderBVo | |||

ATA

(the board formerly known as ALL THINGS AWESOME)

Welcome to

ATA!

Here, we concentrate on teaching everybody how to trade. Following other peoples calls will never make you rich. Learn to think for yourself by educating yourself! If you havent already, make sure you sign up for the email list in the bottom left hand corner! Also, please follow us on twitter! @ATAinsiders.

At ATA, our philosophy is simple. We focus on teaching. When everyone can make their own calls, everybody will make money!

Remember, it's not us against each other - it's us against "The House."

TOP WEBSITES FOR LEARNING

Pre Promotion Alerts - This site is run by Tom McCarthy, an ex stock promoter himself. It is amazing the kinda stuff this guy digs up. I can't remember a single major promo that he did not spot well ahead of time. I recently joined pre-promotion elite, and it has been worth its weight in gold already. Tom was nice enough to make several free video lessons for you guys, be sure to check them out below!

http://bit.ly/VErw1F

Tim Alerts - This is where I personally started my education. Tim turned 14k into several million while still in college trading penny stocks. He was featured in the tv show, Wall Street Warriors as well. Back in college, he mostly went long, but today he is the king of shorts in the penny world. Tim has created the most extensive knowledge base in all of penny land with over 700 training videos that are all included with TimAlerts Silver. One of my favorite traders, who I actually learned the most from, Michael Goode, is the moderator in the TimAlerts Chat room. The best part is that you can try it out for free for two weeks.

http://bit.ly/PR44uO

Investors Underground - This is run by Nateee, who I'm sure you have seen around ihub. Nate is another veteran, and an awesome trader. He mainly daytrades, and he is pretty diverse. Everything from pumps to big board stocks.

http://bit.ly/VVPJT6

Vo Alerts - This is run by Alex Vo. A full time student, and personal friend of mine, who turned just under $1,000 into over $100,000.00 in less than two years. He trades everything from futures to options, but he focuses on trading weekly options on fridays. I subscribe to his mentor service, and I have been making an extra 10% on my account almost every friday with him.

http://bit.ly/UYpiwS

FREE Pre Promotion Stocks videos by Tom McCarthy (ex stock promoter)

1) The Big Picture for Buying and Selling Pre Promotion Stocks: http://bit.ly/UAfWcV

2) Free video lesson on GNIN http://bit.ly/YxqVAz

3) Free video lesson by me on pump n dump resistance: http://t.co/qZROKfOWzC

http://www.promobuyer.net

http://www.goodetrades.com

http://www.siliconinvestor.com/subject.aspx?subjectid=56743

http://promobuyer.net/mailers/

http://timlento.blogspot.com/

Victory Mark Websites:

HeroPennyStocks.com (PennyStockHeroes)

PreferredPennyStocks.com

SelectPennyStocks.com

STOCK MARKET AUTHORITY WEBSITES

http://www.stockmauthority.com

http://www.thestockdetective.com

http://www.superstockhunter.com

STOCK MARKET AUTHORITY RUMORED WEBSITES

This board is about making us money - not feeding a gambling addiction!

Control your impatience! You're probably not going to die tomorrow! There will be another play just around the corner. Don't take low risk/reward trades. At best, you're just feeding your broker commissions, at worst - you can lose your shirt! You have many more years to live and trade.

Warren Buffet: "I became rich by selling too early"

BE CAREFUL WHO YOU LISTEN TO!

Many people who run boards are nothing more than high schoolers! There are even people on ihub who are dumb enough to think that a single poster can influence AAPL's stock prices!!

ex: Re: a trader who trades AAPL stock by Kaiser Soze

"he goes short THEN alerts his flock so they go short, moving the price in a direction favorable to the alerting party. If they know they can influence the price action, it removes all their risk. They win on the trade plus bank subscription fees"

madaznfootballer says:

Make your own decisions. Do NOT buy just because the promoter or anyone else told you to! Don't be a kool aid drinker!

Before executing a trade, ask yourself, "Why am I buying/selling this stock?" If you can't answer that question logically and rationally, you probably shouldn't be making the trade. No ifs or buts.

Play the MOMO. When there's no volume/liquidity, its very hard to get in or out of a stock. Also, when theres no volume (i.e. during consolidation periods), there's no sellers but there's also no buyers . This allows for a good opportunity for someone with a large position such as the promoter or the company to dump shares and cause instant panic selling. This is how you avoid dumps on promoted stocks, by selling on the way up while there is still liquidity!

Always be prepared and know the stock you're playing like the back of your hand. Study the charts, know key support and resistance levels and note the volume. Is the volume increasing? Is it decreasing? Playing a stock unprepared is like attempting to taking the university final exam without studying.

"In a sideways trading market, no one wins."

"Sometimes the best trade, is no trade."

All traders must develop trading rules and trading rules must be followed.

Some of my rules include:

Only trade when the odds are in your favor. If you are not sure, then do not trade. Never chase the price up, never trade on emotions, always cut losses early, do not over trade, and never trade with more than you can afford to lose. A small gain is always better than any loss. If you do have a big loss, forget about it, remain logical and move on.

If you plan to trade beyond the first few days of a big promo you must study and understand all aspects that influence the PPS. Some of these examples include the newsletters, PRs, previous ticker history, chart patterns, L2, bid support, outside catalyst, and (most important) understand how other traders will react to these factors. It is important to realize that APS promos work in stages and different types of traders influence the price during each of these stages.

The dump does not happen at the end of these big promos, it starts with the first person who buys. The crash occurs when they stop supporting the bid.

Never invest more than what you are willing to lose. Although the big promo groups can be very profitable, you might never know what will happen in the future, and might lose part of your investment.

Set a goal of how much money you want to make with your investment, and try to bleed as less as possible the account, until that goal has been reached. This will ensure you get to that goal much faster.

Greed kills. If you are up big you need to either exit the position or have a target price. If you keep thinking, "oh just a few more moves up and I will sell...", eventually you will get caught in the dump and not be able to exit your position since everyone else is selling. Gains will be lost at an extremely fast rate.

Almost every penny stock is a scam. No matter what anyone on ihub tells you, the company is still likely a scam. What I mean by scam is that the company is in the business of selling shares to the public. No matter how good the company sounds, it is likely it is just in the business of selling shares. This is why the next rule is important...

Going "long" (long term hold) on any penny stock is stupid. Get in, turn profit, and get out! Most of these stocks eventually head down to .000x or file for bankruptcy. If you want a long term hold look at the big boards for them.

NEVER AVERAGE DOWN. Set a tight stop, mental or stop order, and execute it. Averaging down usually leads to more losses. If you have a tight stop, you can cut losses and worst case only be out a small amount of money.

Penny stocks are not for investing, they are for gambling. Don't use money you can't afford to lose and expect to lose it all, just like a casino.

KnownProphet says:

I'll give you a little sign to tell you that you should know it's time to take some out of the game. When you start picking up a calculator multiple times a day, and multiplying out wild fantasy share prices by the number of shares you hold- you're losing your grip on reality, and you best take some of your profits. That kind of thinking blocks rational decision making and will have you losing money on these things every time. Good Luck, there aint a reason in the world to not come out of these green, 100% of the time.

Chubs says:

Yabba Dabba Doo!

Ragnarokstocks Says:

If everyone used common sense and didn't get so impatient, everyone would be rich. That's not possible, so it's obvious that some people are naturally going to be better at this than others.

THINGS THAT HAVE MADE ME MONEY IN STOCKS:

- Anticipating a big play, and buying in big and quickly, and then patiently waiting for it to increase in value. Current promotions that suddenly become undervalued work as well.

THINGS THAT HAVE LOST ME MONEY IN STOCKS:

- Trying to front run promoters and being impatient, flipping position every day or multiple times a day - buying the ask, and selling on the bid. Generally, being Hammy the Squirrel.

Dude Iligence says:

Concerning TBX plays:

1. Don't buy into the hype of the first day when the pps is already up several hundred percent.

2. If you violate rule 1 and do buy the first day and it goes up several hundred percent sell with a profit.

3. If you violate rules 1 and 2 and the pps drops till your flat, SELL IMMEDIATELY.

4. If you violate rules 1,2, and 3 and the pps drops below what you paid for it. SELL IMMEDIATELY THE TRADE IS NOT GOING AS YOU PLANNED. Take a small loss. You can always buy back cheaper. And with more shares.

5. If you violate rules 1,2,3,and 4 look in the mirror and say I'm a stupid bagholder and this sucks and I don't ever want to be a bagholder again.

6. If you violate rules 1,2,3,4 and 5 you need remedial bagholder training and should consider Mutual Funds.

PacoLoco says:

10. Never trust anything a promoter promises you

This one is pretty much common sense but all promoters lie. They will tell you the stock is going to $200 a share when it currently is trading for 50 cents. Take their emails with a grain of salt and only uses them to gage how the masses will react to it and whether or not the promoter is throwing in the towel.

9. Limit your greed

We all want that 1000% profit but the truth is that doesn't always happen. The motto of the board is make 50% each trade which is a very good guideline.

8. Ask for help

We all want to make a lot of money in the market but you would be surprised, there are a lot of good people out there that will be glad to help you.

7. Learn who to trust!

This goes a long with #8. Yes there are a lot of good people but there are also a ton of scum on message boards with agendas.

6. Make your own decisions!

Again going along with #8 and #7. Ultimately you are responsible for your own actions even with good guidance. You have to take their advice as a tool on your belt and not as gospel.

5. Never trade without L2

I kinda already knew that I needed this in the beginning but the posts about L2 activity really helped confirm what I was seeing and helped me judge the ebb and flow of each ticker.

4. Do not chase a promo!

I fell victim to this recently in PVTA where I get the ticker at .36 and before I was able to place my order for .40 (3 seconds) it was already at .45 and climbing. I finally got in at .586 and sold at .525. I lost money because I chased.

3. All Promoters are not created equal

There is a huge difference in the quality of promoters. When I first started I didn't know APS from my elbow. I would have fell victim to many lower grade promoters if I didn't have this board. I would have been thinking their promos would run at least a few days and not 5 minutes. Luckily I never had this problem.

2. Do not drink the Kool-Aid

The very first stock I played I lost out on 400% gains because I bought into all the Kool-Aid of the ticker board. Ticker boards are not to be trusted and should only be used to gage the overall atmosphere of the masses. Any amount of pumping is to be expected there. If there is aggressive pumpers bashing anyone that says anything less then to da moon or weeee you should probably run. 80% of those on tickers have agendas, 10% are future bag holders, and 10% are honest people in my opinion.

1. LOCK IN PROFITS!

Almost every trader has had a stock where they were up big at some point. I am not going to tell you how to trade but if you aren't comfortable with riding free shares and taking your profits off the table then you should probably be selling the whole shebang before most.

Recap of APS Promos with details:

http://www.promobuyer.net/awesome

Current APS Promotion With Compensation Amounts:

http://stockpromoters.com/

A Good Level 2 Tutorial

Tim Alerts Chat Room:

(Great way to get alerts and to know when that stock you are in is about to get the shit shorted out of it)

http://profit.ly/?aff=895

|

Posts Today

|

0

|

|

Posts (Total)

|

72024

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |