Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

LQMT getting some attention lately...new tech which I am just discovering

-OXIHF at .005 cents is another sleeper - they are growing hemp in Florida as that industry starts to increase in size- plus they have a CBD franchise store set-up for USA United States and Canada

LQMT after 20 years, an industry is born. For the first time in the companies extended history it began shipping volume orders in July. It took 20 years to commercialize this space age material, but now it's here .

REI 1.39, fill-er-up, lil oil needs

your biz...LJ

https://ringenergy.com/

Yes I saw that. Nice.

DCGD just filed their first 10q after this summer's 10-12g.

IPTK has a unique approach to inflight connectivity. It doesn’t allow streaming of video, which everyone seems to want, especially for long haul flights. So they’re concentrating on the destination discounts for the long haul carriers. It would be integrated into the airline’s own app so would be very easy to use, and programmed to the destination. But for short flights it’s a great option, and would allow browsing, email, texting. The recent shareholder financing to build out the ground system tells me there’s a deal in the works. In my opinion if one airline put it in use others would as well. With hundreds of millions of passengers available and little or no installation cost for the airline, IPTK is a potential cash cow. Worth holding, imo.

Thx that‘s interesting. I wonder if they can really get into airlines, that‘s some hard competitive space.

While there have been no significant press releases IPTK not without significant developments this year. Especially to the fflya system for airline use. Description of fflya from their 10k

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=137093924

http://airfax.com/blog/index.php/2016/10/20/the-bluetooth-connectivity-solution-fflya/

Major fflya developments:

Now can be integrated with the airline's mobile app.

Lufthansa has "whitelisted" their fflya system and has it in use.

"Next, ASI Group is also bringing a new Bluetooth-based e-commerce platform to airlines. The fflya system, which is being pitched as an alternative to classic wifi connectivity on board, can be installed at little or no cost. The product sounds almost too good to be true, but Chapman insists it’s possible, and says the low-bandwidth offering has already been effectively whitelisted by Lufthansa Systems, and will be rolled out by other IFEC players to boot."

Details in a November podcast with the widely followed "runway girl network."

https://runwaygirlnetwork.com/2017/11/29/paxex-podcast-bending-bluetooth-to-become-an-onboard-network/

Bizjetmobile about doubled the the number of business jets using Chiimp smart. While not enough to cover their marketing expenses for fflya it's a help.

Update to the bizjetmobile website

New Website Launch!!! BizjetMobile's brand new and improved website is online just in time for Christmas! We have added an awesome new arm to our business - selling last minute cheap empty leg flights worldwide via our partners. Come check it all out here" https://bizjetmobile.com/

Twitter followers for bizjetmobile from 400 to 750.

Instagram followers for bizjetmobile from 600 to 18,900

fflya's "aeros" system partnered with Viator

https://www.partner.viator.com/en/20161

Details of the "aeros" here

http://www.fflya.com/

Inflight connectivity/text messaging/email licensed to the Australian military, available to other government/military organizations

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=12165674

Military interested because of the security

"The security is quite unique not only for the way it switches channels, but is a closed network and when combined with encryption and proprietary protocols is more secure than open Wi-Fi as there is no external way to access it."

I'm expecting that it will be put in use by multiple airlines in the coming year. Installation does not require FAA certification since it's bluetooth based and bluetooth has been deemed safe for use in aircraft. The hardware is so cheap they are willing to give it to the airlines in exchange for revenue sharing. It's a great fit for the low cost carriers and for any airline with short flights.

If you're interested listen to the November podcast; it's about 1/2 hour

https://runwaygirlnetwork.com/2017/11/29/paxex-podcast-bending-bluetooth-to-become-an-onboard-network/

Recent shareholder funding to build the ground system for fflya

Silver sponsor and speaker at the just completed large Aviation Festival Asia show in Singapore

http://www.terrapinn.com/exhibition/aviation-festival-asia/index.stm

Description from the IPTK president earlier this year

"I am glad you raised this point, as that is the perception of Bluetooth particularly when compared to Wi-Fi. So let me clarify why we went down the Bluetooth path when the rest are spending billions on Wi-Fi.

In regard to Speed, you can pair your laptop to your phone via Bluetooth and surf the net at up to 2 Mbps and up to 36Mbps with BT3. You can stream music at better quality than Spotify and voice at better quality than VOIP.

The reason this is possible is quality of data transmission not quantity. Bluetooth has dedicated profiles custom built for each type of service (38 in total)

Bluetooth Profiles

Wi-Fi only has the one transmission format TCP/IP, which is classified as a lossy protocol. i.e. the more you transmit the more data you loose and the more it has to re transmit. As it was conceived to send data down cables when you transit over Wi-Fi the data loss increases due to interference and adding a satellite into the mix makes it even worse. So the theoretical transmission speed to an aircraft versus the actual passenger experience can vary dramatically.

What we developed is our own Bluetooth characteristic optimised for aircraft networks and satellites. The justification was all our communications and all modern communication platforms are short burst data, including Email, SMS, IM, Google, Twitter, Banking, News, Booking, Billing, Weather and the back end of all Social Networks.

The end result is an aircraft platform that is up to 90% cheaper than Wi-Fi and does not have the certification/installations complexities of Wi-Fi, plus is up to 98% more data efficient which directly translates to user cost.

As only 6% of passenger are prepared to pay for Wi-Fi ( GOGO Inc 10K Filing)

GOGO Inc 10K filing

That tells us the other 94% expect it for free or regard it as to expensive.

As Wi-Fi has been available since 2010 and only 18% of airlines now have it, that also tells us cost is the issue.

airlines with WiFi

When people move they communicate in short burst, no more so than today’s generation and that’s where we see the future of communication in aircraft. When compared to on the ground the cost of satellites will always be expensive, so that's why we believe optimised custom protocols for short burst interfaces are the ideal solution in the aircraft environment.

Our solutions are not for everyone, but the industry needs a low cost alternative. We have been able to prove it with corporate jets, the military seems to think it has potential, so the challenge now is to translate it to airlines.

Hope that helps clarify why Bluetooth.

Regards

Ron Chapman – President

ASIP Tech Inc.

Whatever happened to this one here? Still interesting?

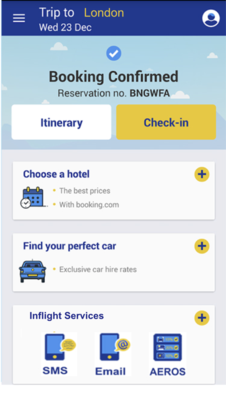

The evolution of the fflya app with integration into the airline's app. Note that "booking.com" is available, as well as car rental deals. And of course the free sms, email and the "aeros." Link back for more fflya info. I'm looking forward to positive news from the big London Show next week

website - http://www.fflya.com/

"aeros" info

https://www.partner.viator.com/en/20161

fflya website updated with new information. Check it out. I think we'll see it in use soon. Could snowball nicely

http://www.fflya.com/

Followers of fflya at instagram have tripled in the last week (to 178, lol). But many of the new followers are businesses and resorts with large amounts of followers. Link back for what fflya is. Maybe an announcement is forthcoming - IPTK

https://www.partner.viator.com/en/20161

http://www.prweb.com/releases/2016/10/prweb13784676.htm

http://www.fflya.com/

PRKA - Nice breakout, new 52 week high today

CNRR in deep sleep mode. New bid this morning though, about $2,600 worth at .041. First L2 change I've seen in a long time

ASNB 10q with results through 6/30 will be out soon. If it shows another bummer quarter I'll add. Their patented Chronoflex C is now being used in multiple new FDA approved products from Access Scientific, and Access Scientific has two new distribution agreements this year with large medical supply companies. At some point ASNB will be supplying Chronoflex C to Access Scientific in large amounts, imo, because whether or not these new catheters succeed long term Access Scientific has to have a supply to deliver. If the new Powerwands do succeed long term now is the time to be accumulating ASNB, imo

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=131217608

http://www.msa.com.au/news/msa-introduces-the-powerwand-the-vad-without-equal/

And there's always the chance that with ASNB products chosen for so many studies a new product will flourish

https://www.google.com/search?q=%22chronoflex%22+and+%22advansource%22&safe=active&source=lnt&tbs=qdr:y&sa=X&ved=0ahUKEwi2zZzrvMLVAhURySYKHYHPDsEQpwUIHw&biw=1507&bih=713

GTNM - .0226 x .04 Worth a small play since no one is in it and there's new developments:

Reinstated last November with new owners. T/A confirmed share structure at otcmarkets.com

Authorized Shares 100,000,000 a/o Jul 31, 2017

Outstanding Shares 30,022,739 a/o Jul 31, 2017

Float 3,755,924 a/o Nov 16, 2016

News from company website, not released on any of the wires yet. Google translate not the best but you get the idea :)

"

2017-7-28 23:40:38

The company has set up "GTR Design & Management Company Limited" in Hong Kong on April 28, 2017. We plan to develop our business chain. And in April 28, 2017 in the two places at the same time to establish its own GTR & CKR brand tea restaurant, the development of Chinese and Western food combined with the restaurant chain business.

The first phase of the "Golden Age Catering Planning Management Limited" program was to run three "GTR Golden Era Restaurants" and three "CKR Cuisine Wong Kok Restaurants" in Hong Kong and China.

Has been in the domestic Zhongshan City, successfully and registered to open three "GTR Golden Age Tea Restaurant"; business is ideal. At the same time, the Hong Kong Special Administrative Region (HKSAR) has registered a "GTR Cuisine Restaurant" in Tuen Mun District. There are two "Cuisine Wong Tea Restaurants" in Tuen Mun District which are being renovated and are expected to start all business in October 2017.

The second phase of the business plan is in the country, Zhongshan City, the creation of three "GTR Golden Age Tea Restaurant"; and then launched the GTR brand stores to join the business, is expected to develop ideals"

Old company deregistered in 2012 so there's no financials. But in my opinion worth a small play on an all or nothing basis since I believe that a news announcement or filing could make for a nice buying rush. Many thanks to my good friend ShellKing for discovering this one

I've always felt the key to success at ASNB lies here:

"ADVANSOURCE BIOMATERIALS ANNOUNCES MULTI-MILLION DOLLAR AGREEMENT WITH ACCESS SCIENTIFIC"

http://www.businesswire.com/news/home/20110426005794/en/Access-Scientific-AdvanSource-Biomaterials-Announce-Agreement-ChronoFlex

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=131752770

Access Scientific recently looking to hire a field service rep. So maybe their Powerwand will finally sell

Added 160000 CNRR @$.035, up to 500K now

CNRR - .02 x .044 Cheap at this level. Here's why

Market cap $2.2 million at .04. Still have over .08 per share in cash/liquid investments and no debt to speak of. Made a callable at any time investment that generated over $30,000 in interest income in the last quarter. With that investment and their one remaining oil well interest they're not losing money while we wait for this:

"CN Resources Inc. is an independent energy company engaged in the exploration, development, production, and sale of crude oil. Our operations are conducted through a 100% wholly owned Ontario Corporation (also named CN Resources Inc.) which owns a producing joint venture oil well in the Redwater area in Alberta, Canada. The Company’s immediate core strategy is to create and enhance shareholder value by acquiring sustainable business with stable cash flow. The Company will not acquire any business in early stage of development."

"At February 28, 2017, we have cash and cash equivalents on hand of $2,883,145 (May 31, 2016 - $4,980,735), oil revenue receivable of $26,089 (May 31, 2016 - $26,351). We have short-term investment of $2,037,960 (May 31, 2016 - $ nil). We have accounts payable of $1,416 (May 31, 2016 – $7,448) and we have no other material debts to anyone."

They have no convertible debt or preferred stock outstanding

A/S 100,000,000

O/S 56,100,000

86.45% insider held as of the last 10k

Some ASNB dd

http://www.advbiomaterials.com/

Here's their patent

http://www.businesswire.com/news/home/20100825005505/en/AdvanSource-Biomaterials-Announces-Patent-Antimicrobial-Polyurethane-Resins

Here's their deal with Access Scientific, the company that makes the innovative catheter called the Powerwand

http://www.businesswire.com/news/home/20110426005794/en/Access-Scientific-AdvanSource-Biomaterials-Announce-Agreement-ChronoFlex

Here's the Powerwand website

http://accessscientific.com/powerwand/

Here's the January 2017 deal Access Scientific signed with Intalere

http://www.prnewswire.com/news-releases/access-scientific-llc-awarded-intalere-choice-agreement-for-powerwand-line-of-catheters-300396266.html

This is Intalere

http://www.intalere.com/

This is the latest Powerwand study

http://www.avajournal.com/article/S1552-8855(16)30127-1/fulltext

And an excerpt from it:

"Contrast these outcomes with the predictable consequences our patients would have had if PICCs had been mandated for all vancomycin administrations. At the low end of the reported PICC-associated bloodstream infection rate, approximately 16 patients in our cohort would have had catheter-associated bloodstream infections, and 1 or 2 of these patients quite possibly would have died. The unreimbursable cost of treating 16 patients with CLABSI would have been $896,000 Compare this with the actual hard-cost savings of $97,740 (1086 patients × $90 savings per procedure) that resulted from using the study midline catheter (the Powerwand) instead of a PICC for vancomycin administration."

CLABSI stands for Central Line Associated Bloodstream Infection. Since CLABSIs are acquired in the hospital insurance and Medicare don't pay for cost of treatment

One of the things I've always liked about ASNB is management's ability to control costs

Revenues -

2012 $1.86 million

2013 $2.19 million

2014 $2.63 million

2015 $2.57 million

2016 $3.18 million

Gross profit

2012 $969 thousand

2013 $1.38 million

2014 $1.62 million

2015 $1.65 million

2016 $2.10 million

SG&A expenses

2012 $1.84 million

2013 $1.61 million

2014 $1.43 million

2015 $1.22 million

2016 $1.38 million

Profit (loss) from operations

2012 ($1,496,000)

2013 ($671,000)

2014 ($207,000)

2015 $68,000

2016 $404,000

You can see that this multi year trend is outstanding. They maintained their level of research and development spending throughout that period. They have never accessed the markets for capital so there's no shares held by "investors" waiting to be sold. But the problems at Access Scientific have put their revenues back down to about 2012 levels. So it's sold off down to about .06 and is now forgotten again. My opinion is that the Access Scientific deal with Intalere will cause Access Scientific to again order large amounts of Chronoflex C from ASNB and we'll go back to profitability. We'll get an idea when the annual report comes out in mid July with results through 3/31/17. The quarterly with results through 6/30/17 I think will be more telling.

ASNB has no "toxic" debt. When they needed some money back in 2011 they did a sale/leaseback with their land and building to a friendly investor. They pay about $90,000/year which is manageable. They have no other debt other than payables in the ordinary course of business. Market cap at .06 is about $1.25 million. If they return to profitability they should have a market cap of at least 1 year's revenue which would price them at about .25. Similar, larger, profitable companies, though, have market caps at least 5-6 times annual revenues. And if the Powerwand sells very well I think ASNB would be a very attractive takeover target. Most likely a stock swap deal with CR Bard, J&J, Teleflex or Boston Scientific. Any of those or another similar company could acquire them with "couch change."

Anything traded over the counter is basically an all or nothing proposition. They're there because they're very small, aren't profitable, so they are unnoticed. But this is one of the very, very few ones I've found that I believe to be competent, real, and with good prospects.

IPTK .03 x .04 Getting some notice, some general news issued today

"BizjetMobile Solves Low-cost Connectivity Conundrum

by Matt Thurber

- May 23, 2017, 11:34 AM

BizjetMobile’s inflight systems use Bluetooth to display on personal devices.

BizjetMobile has approached the problem of low-cost airborne connectivity by offering portable Iridium satellite systems that can easily be moved from aircraft to aircraft. There are two systems available from BizjetMobile (Booth M115), the Chiimp device with Bluetooth for aircraft that already have an Iridium satcom installed, and the Chiimp Smart system, which includes the Iridium satcom and Bluetooth connectivity.

While Iridium satcoms are currently limited in bandwidth, with a network speed of 2.4 Kbps, they can be used for voice calling, texting and light emailing. But Iridium’s Next satellite constellation is being built now, with launches already underway. This will increase the network’s speed significantly, although new satcom transceivers will be required to take advantage of the higher-speed network.

To use the basic Chiimp system, all that is required is connecting the device to aircraft power and to the existing Iridium satcom’s standard data port. According to BizjetMobile, “In some cases, the data port may need to be wired from the satcom system, which is a very simple process and a minor modification.” Chiimp costs $599 per month, and that includes unlimited texting, email and inbox checking via BizjetMobile’s GetMail email system in the Chiimp mobile app.

For aircraft without an existing satcom, BizjetMobile offers the Chiimp Smart system, which includes the Iridium transceiver and Bluetooth connectivity in one portable box. Chiimp Smart does require connection to aircraft power and to an Iridium antenna. BizjetMobile sells the system for $9,990 (not including the antenna), and this includes one year of unlimited texting, email and GetMail. After the first year, the service costs $599 per month.

The BizjetMobile Konng system is designed to help operators and passengers manage airborne connectivity costs, with a router that connects via Ethernet cable or Wi-Fi to the aircraft’s existing inflight connectivity system. This provides passengers and crew with unlimited texting, email and GetMail service plus instant feedback on how much airborne connectivity service they are using and the cost of that service. This helps eliminate bill shock, according to BizjetMobile, “at the end of the flight, and disputes on data used.” Konng costs $1,000, plus $599 per month.

BizjetMobile also includes its Chiimp tracking service for free with any system purchase. The tracking service allows operators to monitor the position of aircraft equipped with Chiimp systems and also view previous flight location data.

http://www.ainonline.com/aviation-news/business-aviation/2017-05-23/bizjetmobile-solves-low-cost-connectivity-conundrum

ASNB - I'm expecting substantially increased product sales, and a return to profitably this year. I've always felt the key to ASNB's success lies here:

"ADVANSOURCE BIOMATERIALS ANNOUNCES MULTI-MILLION DOLLAR AGREEMENT WITH ACCESS SCIENTIFIC"

http://www.businesswire.com/news/home/20110426005794/en/Access-Scientific-AdvanSource-Biomaterials-Announce-Agreement-ChronoFlex

That agreement plus ASNB's financial trend (and some other results from my dredging of the internet) is what got me interested in the company. But it's been a bumpy road for Access Scientific over the last few years. I believe now, finally, Access Scientific's revolutionary "Powerwand" catheter will begin selling and sales will snowball over time. Clinical results are outstanding. Using ASNB's patented antimicrobial coating, the Powerwand will save lives and money. This is a result at just one hospital:

"Contrast these outcomes with the predictable consequences our patients would have had if PICCs had been mandated for all vancomycin administrations. At the low end of the reported PICC-associated bloodstream infection rate, approximately 16 patients in our cohort would have had catheter-associated bloodstream infections, and 1 or 2 of these patients quite possibly would have died. The unreimbursable cost of treating 16 patients with CLABSI would have been $896,000.23 Compare this with the actual hard-cost savings of $97,740 (1086 patients × $90 savings per procedure) that resulted from using the study midline catheter (the Powerwand) instead of a PICC for vancomycin administration."

http://www.avajournal.com/article/S1552-8855(16)30127-1/fulltext

I did very well when the increased product sales resulted in profits and a nice spike in the process. I do believe the increased product sales were for Chronoflex C to Access Scientific. I also believe that ASNB's Executive VP for Commercial Operations, who's been with them for many years, bought over $40,000 worth of shares on the open market (at .14) expecting the increased sales to continue. But the sales did not continue, filings later said there were "anticipated reductions" from one customer. I believe that customer was Access Scientific encountering more bumps on their road to marketing the Powerwand. But I believe now that their road has smoothed out. The news below is from January with the deal effective 12/1/16. Latest financials from ASNB are as of 12/31/16 so there's no way any increased sales have shown up yet. ASNB also announced a deal with an Israeli company that started in December 2016. Next filing for ASNB will be the annual report due out in mid-July. That will have sales through 3/31/17. Then we'll see a quarterly in August with sales through 6/30/17. I do believe ASNB will be back on track by then. Here's the Access Scientific news from January. I'm re-accumulating a large position here.

January 25, 2017

Access Scientific, LLC, Awarded Intalere Choice®

Agreement for POWERWAND™ Line of Catheters

SAN DIEGO – Access Scientific, a privately held medical device manufacturer of

the “evidence based, best in class” POWERWAND catheters, was awarded an

agreement with Intalere as a supplier of its valued Intalere Choice program.

Intalere is a leading group purchasing and total cost management organization

that serves 3,716 acute care facilities nationwide along with 37,356 clinics and

11,598 long term care facilities. For premium products, Intralere offers Intalere

Choice to provide their members the highest quality medical products in growing

sectors such as vascular access. The agreement became effective Dec. 1, 2016.

The agreement provides Intalere Choice member facilities access to Access

Scientific’s proprietary line of POWERWAND catheters, which have demonstrated

unparalleled performance in clinical outcomes:

3Fr, 4Fr and 5Fr (16Ga, 17Ga and 19Ga) catheter offering

Reduce overall central lines and central line days

12,000 catheter-days with no bloodstream infection

Highest flow rates

Excellent blood drawability

Cost savings (clinical and material)

The POWERWAND line of catheters has been proven to help facilities reduce

central line days and CLABSIs while improving quality care at a lower cost, all of

which are core to value-based purchasing.

“The Access team looks forward to partnering with Intalere and their members to

improve patient care and lower the overall cost of care through implementation

of our evidence-based Powerwand products and processes,” said Phil Royston,

President of Access Scientific.

About Access Scientific, LLC

Access Scientific is dedicated to the development and commercialization of

breakthrough, proprietary devices that make vascular access safer for patients

and reduce the cost of care. The company pioneered the power-injectable midline

market with the POWERWAND™. Made of proprietary ChronoFlex™ C, the

POWERWAND midline has been the proven, evidence based, best-in-class, with

over 12,000 catheter-days of published scientific data attesting to the lowest

complication rate and highest completion-of-therapy rate of any vascular access

device ever studied. The POWERWAND offers a unique approach to reducing

hospital-acquired infections. Visit www.accessscientific.com to learn more.

– END –

A more recent study shows 20,000 days of results.

"March 14, 2017

New Study Pushes POWERWAND Midline IV Catheter

to Over 20,000 Catheter Days with Zero BSIs"

http://3g033q44pk4o4eo9td3bwjsx.wpengine.netdna-cdn.com/wp-content/uploads/20000-Catheter-Days.pdf

New "CrewX" app from IPTK. Could be the right product at the right time

http://nebula.wsimg.com/2e8af1f03125948fe338fb6a7c82601a?AccessKeyId=5CF385B637FB587C4546&disposition=0&alloworigin=1

Klever Marketing Inc. Announces the Release of its Innovative eLoyalty Program

Posted March 20, 2017

Klever will soon be announcing the selected retailer who will be the first retail user demonstrating the advantages of our new eLoyalty program

CNRR - 10q out. No changes. Market cap $3.7 million at .06. Still have over .08 per share and no debt to speak of. Made a callable at any time investment that generated over $30,000 in interest income in the last quarter. With that investment and their one remaining oil well interest they're not losing money while we wait for this:

"CN Resources Inc. is an independent energy company engaged in the exploration, development, production, and sale of crude oil. Our operations are conducted through a 100% wholly owned Ontario Corporation (also named CN Resources Inc.) which owns a producing joint venture oil well in the Redwater area in Alberta, Canada. The Company’s immediate core strategy is to create and enhance shareholder value by acquiring sustainable business with stable cash flow. The Company will not acquire any business in early stage of development."

"At February 28, 2017, we have cash and cash equivalents on hand of $2,883,145 (May 31, 2016 - $4,980,735), oil revenue receivable of $26,089 (May 31, 2016 - $26,351). We have short-term investment of $2,037,960 (May 31, 2016 - $ nil). We have accounts payable of $1,416 (May 31, 2016 – $7,448) and we have no other material debts to anyone."

Out PPMT on the promos

More IPTK info. .05 x .07. Confirmation of what I've bolded below would make for some short term profits and a nice long term hold.

"AS-IP Tech President speaking at the "Technology Showcase Seminar" at this month's Asia Aviation Festival

http://www.terrapinn.com/exhibition/aviation-festival-asia/World-Low-Cost-Airlines-Congress-Asia.stm

"How Bluetooth will revolutionise LCC connectivity for airline PAX and crew.

Find out why major airlines are selecting it, the military are testing it and corporate jets are already using it. Up until now airlines have only had one connectivity option and that’s Wi-Fi. Learn why less than 6% of PAX are prepared to pay for Wi-Fi and how the latest generation Bluetooth can solve the LCC connectivity conundrum. Find out how to leverage this new technology off low cost narrowband satellites to deliver secure free PAX and Crew communications including, live credit card processing and enhanced PAX merchandising and booking services. Learn how to interconnect your crew iPad or Tablets with a Bluetooth App that requires no onboard server. Every modern communication device has Bluetooth 4 and the latest Bluetooth 5 makes it even better. Bluetooth is the next wave of technology.

Ron Chapman, President, AS-IP Tech Inc

- See more at:

http://www.terrapinn.com/exhibition/aviation-festival-asia/technology-showcase-seminar-theatre.stm#sthash.Nlcac4Bm.dpuf

"Bluetooth as a connectivity radio frequency has slipped under the radar and since most connectivity devices have the capability and the corporate jet world has adopted it, we expect an inflight commercial airline installation this year."

http://airfax.com/blog/index.php/tag/ron-chapman/

ERMS - splitting 1 for 50. Interesting, CEO owns a lot of shares, there's no convertible debt, A/S not anywhere near maxed. Hoping it tanks a bit on the r/s news; I'll add some.

http://archive.fast-edgar.com//20170126/A8ZXF22CZ222P2Z222292CZZ4E5LZ6T7G292/

CNRR - .06 x .107 Still a safe hold imo. 10q out. Tidbits from it:

The Company’s immediate core strategy is to create and enhance shareholder value by acquiring sustainable business with stable cash flow. The Company will not acquire any business in early stage of development.

At the end of quarter, the Company made an investment in DX Mortgage Income Fund, an unrelated party, in the amount of CAD $2,700,000 (USD 1,986,810), with an annualized interest rate payment of approximately 6%. The investment is redeemable at anytime by written notice to the fund manager.

At November 30, 2016, we have cash and cash equivalents on hand of $2,847,785 (May 31, 2016 - $4,980,735), oil revenue receivable of $21,036 (May 31, 2016 - $26,351). We have short-term investment of $1,986,810 (May 31, 2016 - $ nil). We have accounts payable of $12,481 (May 31, 2016 – $7,448) and we have no other material debts to anyone.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 56,100,000 as of January 23, 2017

They installed it in an A340. Might be Qantas. I think if one airline picked up on it most would follow. A potential deal with the military could be very meaningful. Also, imo, a potential buyout candidate. Would be a good fit with Iridium or gogo

perhaps we should be looking for a deal with Qantas or Air New Zealand or another long-haul trans-Pacific carrier?

Victoria Australia, near Melbourne

It's caught some attention for sure. Not here, though. Nobody talking about it except those of us already owning some. There's a 16 hour time difference between company HQ and New York. Maybe we'll see some after hours news

Me either - but this is a HUGE amount of volume out of nowhere for IPTK

Not that I can find

Saw the move and volume in IPTK today - any explanation?

IPTK - .075 x .085. Good volume today. Still expecting some news soon. Link back for recent info

Enjoy this wonderful time of year sleepers. Best wishes

Peter

IPTK - .03 x .05 Some info. Up to you to decide how meaningful it is. fflya is IPTK's airline product, and it includes sms text messaging. Wouldn't it be nice to sms text in flight? No airline has yet announced they will use it. I feel the partnership with Viator is extremely important. Viator app has over 3,000,000 downloads and over 1,000,000 likes on Facebook.

"fflya opens the inflight imagination of airline passengers by delivering never-before-seen exciting destination opportunities before they land, and reconnecting them with family and friends through free messaging.

fflya builds a relationship with passengers by providing free messaging and destination sponsor discount coupons available in the fflya App that deliver travel savings in hundreds of destinations including the passenger's hometown.

fflya is the integration of the latest generation app technology, Bluetooth Smart capability, and narrowband satellite protocols."

"Bluetooth Smart keeps everyone connected as it maintains a status of what devices are onboard and active. What makes it unique is the link automatically activates when a user sends a message or processes a transaction, completing these events in milliseconds. As a result, no one person can occupy a large portion of the bandwidth at any point in time. The end result is an uncomplicated secure system that does not require expensive broadband satellites to deliver free communications or AEROS.

The other great thing is that all modern mobile devices are equipped with Bluetooth Smart that is tested and documented as safe for use in aircraft so anyone can log on.

Proven Technology

fflya technology is flight proven over two years having been commissioned on 56 business jets operatings across the Asia Pacific, the America's, Europe, and the Middle East. Our world's first Bluetooth Smart platform is in operation on European charter fleet operator Jetfly and on USA fleet operator Emergency Airlift.

Airline Testing

To test the Bluetooth Smart coverage on an airline we initially conducted live testing on an Airbus A380 and Boeing B777 with successful results.

fflya was also commissioned on an Airbus A340 for network validation testing."

"AS-IP Tech, Inc. (OTCMKTS: IPTK) announced today that fflya, the world’s first Bluetooth Smart airline connectivity solution, has been commissioned on an A340.

fflya is an inflight connectivity revolution that provides free app messaging and destination savings that will enhance the passenger’s flight experience and allow the airline to earn revenue without having to charge.

fflya substantially reduces equipment costs and eliminates the high cost of satellite transmission by combining a proprietary satellite protocol with a Bluetooth Smart network capable of connecting every passenger on-board with a single Bluetooth hotspot.

Company CEO Ron Chapman said, “fflya is a game changer because until now airlines have had only two expensive ways to connect via satellite in an aircraft – a proprietary link for the cockpit and Wi-Fi for the cabin. On the ground people are communicating more than ever using apps, with the common belief that messaging is free. fflya now meets this societal expectation in the air by delivering free app messaging and more for passengers.”

fflya provides value-added services that allow the airline to promote its brand, extend the digital reach and generate revenue in a way never seen before.

Significantly, airlines can test the unique fflya platform without any modification to the aircraft. fflya is a self-contained portable system including Satcom and custom window antenna that classifies as a carry-on device so there is no aircraft certification required."

Travel Partner of Viator, a TripAdvisor company.

https://www.partner.viator.com/en/20161

Some info on Viator:

"Viator, a TripAdvisor company, is the world leader in finding amazing tours, activities, and travel experiences in destinations worldwide. When planning a trip, why start anywhere else?

Download our free app for access to your vouchers, exclusive deals, and on-the-go booking. The Viator app is one of National Geographic’s “Favorite On-the-Road-Apps.” Here’s why:

DISCOVER THE BEST TOURS AND ACTIVITIES

• Explore thousands of things to do across the globe—from museum and attraction tickets, to day trips and food tours, to helicopter rides and guided walking tours

• Browse more than 1 million traveler reviews and photos

• Watch videos of our top activities to get a sneak peek before you go

• Read guides and recommendations from our experienced travel insiders

• Locate top attractions near you by searching our interactive maps

BOOK INSTANTLY AND EASILY—ANYTIME, ANYWHERE

• Find the perfect things to do for your family vacation, romantic vacation, business trip, or other adventure

• Plan ahead and book in advance or grab last-minute tickets when you’re on the go

• Get the best deals with our low price guarantee—even unlock exclusive mobile-only deals

TRAVEL WITH AN INSIDER NO MATTER WHERE YOU GO IN THE WORLD

• Skip the long lines at popular attractions such as the Eiffel Tower and Empire State Building

• Get VIP treatment with once-in-a-lifetime experiences, like private viewings of the Sistine Chapel

• Save time and trees by accessing vouchers right from your phone or tablet

• Contact our Customer Care team directly from the app—24/7 from any time zone

Whether you’re planning a trip to Paris, Rome, Las Vegas, Sydney, New York, or anywhere else in the world, let us be your guide. Viator, a TripAdvisor company, is here to help you book the best things to do and plan the perfect trip.

We’re humbled by some great press and awards we’ve received:

“Viator is the most venerable and polished of the tour-and-activity sites.” – BBC.com

“Viator gives you ideas about what to do when you get to a particular location – whether it’s a themed tour or a party in a park, the app...is packed with tips for wherever in the world you happen to be.” – MSN

"Whether it’s San Francisco or Bora Bora, everyone wants to travel like a local. Viator offers “insider” deals on tours and activities around the world. It promises to let users “skip the lines” at a discount, and happy reviewers back that claim." – Fast Company

Travel Weekly's Magellan Award has awarded us:

• Gold for Trip Planning

• Gold for Travel Apps

Viator has been a proud member of the TripAdvisor family since 2014."

Other IPTK company websites

http://www.asiq.com/

http://www.asiptech.biz/

http://www.fflya.com/

http://www.bizjetmobile.com/

https://twitter.com/BizjetM

Bizjetmobile and fflya also on instagram

For those that have gotten to the bottom here, this article is comprehensive

http://airfax.com/blog/index.php/2016/10/20/the-bluetooth-connectivity-solution-fflya/

My thoughts

The system is simple, easy and cheap to install, hooks up to the worldwide iridium satellite network and is designed to target the airline passenger who is most likely much more destination focused inflight than he/she would be on the ground. It's been proven in the business jet world over the last two years as a less expensive way to provide passengers and crew with sms text messaging and basic email service. The destination services are for potential airline use and will be added to the business jets later. Other benefits:

More secure - remember the reporter's hacked emails when hooked up to gogo?

http://www.usatoday.com/story/tech/columnist/2016/02/24/got-hacked-my-mac-while-writing-story/80844720/

"The security is quite unique not only for the way it switches channels, but is a closed network and when combined with encryption and proprietary protocols is more secure than open Wi-Fi as there is no external way to access it."

There has been mention that the military will use their bluetooth system for communication but there are no further details as of yet.

IPTK - .03 x .05 Expecting news soon for their fflya program. Website updated with new info

http://www.fflya.com

Thanks! Between flights at the moment. Best wishes and glty

Have a good one.

Vacation time, back 12/19. Good luck to all!

"2015 ASI lists BizjetMobile brands on the OTC Market under AS-IP Tech, Inc."

Symbol is IPTK

Complete history and company info here

http://www.asiq.com/history.html

Recent SWHN news. Good to see they're getting contracts, $6.8 million worth! Can't believe they seem to have ignored the US stock. Surprising to me with the CEO owning over 60 million shares.

"Offering unmatched efficiency

The world’s first coloured solar panels maker Emirates Insolaire is making significant inroads in Europe and the Gulf as demand for energy-efficient solar technology surges

November 2016

Emirates Insolaire, a pioneer in the development of new solar technologies, has till date achieved sale of 38,000 sq m of glass, about 15,000 panels of Kromatix solar glass and 28,000 panels of black glass/glass panels across the globe.

“There is a strong latent demand for building integrated photovoltaic solar glass, which is one of the specialities of Emirates Insolaire and we expect the growth trajectory to continue,” said Rafic Hanbali, managing partner of Emirates Insolaire.

Emirates Insolaire, a joint venture of Dubai Investments and SwissINSO Holding, manufactures the world’s first coloured solar panels. The company offers three families of products, namely: the Kromatix coloured solar glass for solar panels manufacturers (photovoltaic and thermal); finished ready-to-install photovoltaic solar panels, coloured and traditional non-coloured and consultancy and execution of turnkey projects for roofs, facades, carports and ground mounted panels – coloured as well as traditional non-coloured.

Hanbali: committed to growth

“In Dubai, where all our Middle East projects are located for the time being, we have to deliver two facades, three roof tops, three carports and two ground-mounted installations, with total projects’ worth Dh25 million ($6.80 million),” Hanbali said.

The total projected capacity contracted to Emirates Insolaire in the Middle East region is about 5 megawatts (MW), representing 26,000 sq m.

“No installation has been finished yet in the Middle East, but the installations done in Europe are showing equal or better efficiency yield than projected as well as perfect integration and robustness. The first-of-its-kind coloured solar panels by Emirates Insolaire not only cuts down on greenhouse gas emissions but considerably reduces the utility bills. Each photovoltaic module of Emirates Insolaire offers unmatched efficiency, as it is capable of generating 170 to 190 watts per sq m for roof or 110 to 130 watts per sq m for facades,” he said.

“The solar panels are in line with the Dubai government’s initiative to use solar power as a renewable source of energy, and integral to the Dubai Clean Energy Strategy 2050. The strategy aims to provide 7 per cent of Dubai’s energy from clean energy sources by 2020, 25 per cent by 2030 and 75 per cent by 2050,” he added.

Emirates Insolaire’s growth strategy is three-fold, in view of the potential for its products in the region. These include:

• Geographical expansion particularly with finished products and turnkey projects, depending on the maturity of the country in the solar field;

• Focus on turnkey projects for housing, commercial and residential buildings as well as carports; and

• Producing the entire supply chain in Dubai as of February 2017.

Emirates Insolaire coloured solar panels

Since its products are first-of-its-kind in the world, Emirates Insolaire is committed to growth across the globe. The company’s expansion is currently focused on the region, North and South Americas, and introducing new solar products by mid-2017.

GLOBAL MARKET

Emirates Insolaire is making significant inroads in Europe and across the Gulf as demand for energy -efficient solar technology surges. The company is expecting sales of 50,000 sq m of coloured Kromatix solar glass during the year. Global installations of photovoltaic modules are forecast to surge by 43 per cent in 2016 to hit a record level of 73 gigawatts (GW).

Emirates Insolaire has completed the installation of Kromatix Solar PV modules in Lausanne, Basel, Leysin, Austria and is currently installing 12,000 solar glass panels covering 6,600 sq m at Copenhagen International School Nordhavn in Denmark to create one of the largest photovoltaic buildings-of-its-kind in the world.

http://www.gulfindustryworldwide.com/news/14014_Offering-unmatched-efficiency.html

Progress at the new Copenhagen school

"All the 12,000 solar panels have been mounted - and they're producing electricity, even in November! Check the live feed above and you will see the blue-green panels spreading like a mosaic on the facade at the center of the building, two stories up"

http://www.cis.dk/welcome/the-new-campus

IPTK - .0301 x .035. Cheaper than it's been in a while. I'm still a believer so I added a little today. Link back for some dd. Hoping this pans out in addition to their growing fleet of business jets

http://www.fflya.com/

Other company sites

http://www.bizjetmobile.com/

http://www.asiptech.biz/

CNRR - Looking good at .10 x .13

|

Followers

|

53

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1271

|

|

Created

|

11/24/12

|

Type

|

Premium

|

| Moderator e-ore | |||

| Assistants Money_Train | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |