Thursday, March 06, 2014 10:04:32 AM

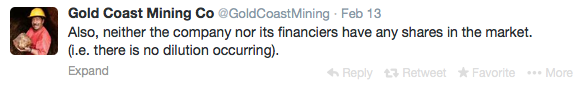

First thing NO DILUTION!!! Period.

Tweet From 3/5/14:

Another recent Tweet:

More from recent PR:

“Finally, the Company wishes to address its share structure. The current common stock outstanding is approximately 3.2 billion shares and has not changed in the last 90-100 days.”

GDSM CATALYSTS – 3/5 Lots of potential coming our way!

Heck yes -- this is not a one trick pony company here. This is going to be multifaceted and explosive for an extended period of time.

Looking at: (these are projected and/or being worked on by GDSM)

1. Golden Cross (just completed)

2. MMJ Subsidiary deal is completed

3. MMJ Subsidiary shelf offering and spin off

4. GDSM generates cash from shelf offering -- unloads debt burden + cash for asset acquisition

5. GDSM shareholders receive MMJ shares via spin off

6. Audits are completed

7. Uplisting to OTCQB

8. Divvy to GDSM shareholders

9. MMJ Wholesale/Distribution via grow facilities in CO is completed

There are a ton of potential catalysts here AND WE DON'T EVEN HAVE THE FULL PICTURE YET!

Take your pick.

.03-.05+ is a very realistic outcome here with all these catalysts in the pipeline!

____________________________________________________________________________________________________

COMPANY UPDATE 3/5/14 NEWS CLARIFICATION:

MMJ SUBSIDIARY -- All the DD is found in MGF's posts but it is not certain which one yet. It might be Artisanal Medicinals (or it could be a combination of several). Artisanal Medicinals has close links to Chris Chiari of Gelpid and fits but it could be one of his other connections as well, or a combination of several being brought together. Chris is very well connected in that arena -- i.e., Edipure, Medfresh, etc.

MGF's DD Post from 3/4/14 IS EXCELLENT!!!!! See here:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98261213

More GREAT DD FROM MGF from 3/5/14!!! See here:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98265376

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98307580

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98311193

READ THIS PLEASE!!!! The CO dispensary tweet has nothing to do with the MMJ accessories business that is being acquired via Gelpid.

That was an additional venture being pursued along with purchasing land and cultivating crops for wholesale distribution and supply. The land acquisition for GDSM is still being pursued but the dispensary that it would have supplied is off the table, for now. The company was trying to vertically integrate the entire business model.

____________________________________________________________________________________________________

CONCLUSION: (distilled down for easy reading and comprehension)

1. MMJ accessory business still finalizing and progressing very well. The closest the deal has been to completion to date.(THIS IS STILL A GO!!!)

2. Grow Facility acquisition for MMJ growing & wholesale being pursued. (THIS IS STILL A GO & NEW!!!)

3. The Dispensary idea (first announced today) is off the table due to CO law. (NEW IDEA 3/4/14 OFF THE TABLE FOR NOW - Might be another way to capture value here.)

4. AGAIN -- NO DILUTION BY THE COMPANY OR ANY STAKEHOLDER AFFILIATED WITH THE COMPANY (VERIFIED BY TWEET 3/5/14!!!)

____________________________________________________________________________________________________

ADDITIONAL INFORMATION

Shareholders received 3/4/14 Info -- Confirmation of the MMJ with an established company in accessories and looking for a turn key or bolt on acquisition for wholesale supply and distribution. THERE IS NOW MORE TO OFFER IN THE END ONCE THEY WORK IT ALL OUT.

Read the tweets below it. The deal is still the same for MMJ subsidiary -- the accessory business!

IT SAYS "NOTHING HAS CHANGED AND PROGRESS IS BEING MADE. THE R/E IS JUST ANOTHER WAY TO PARTICIPATE IN MJ" -- MEANING THE GELPID MMJ ACCESSORIES DEAL STILL ON, LEASED GROWER DISTRIBUTION STILL ON, DISPENSARIES ARE OFF THE TABLE. TWO OUT OF THREE AND BEFORE TODAY IT WAS ONLY 1 - GELPID MMJ ACCESSORIES.

Here is a ton of DD:

Accessories:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98196721

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98196795

Big DD Packet!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=97939454

1. They will use a shelf offering for the MMJ sub. -- to pay everything back. Since Gelpid (the MMJ business) issued roughly $5MM in debt to GDSM and they are going to do it all internally to then spin the company out with a shelf offering that will raise capital to play Gelpid back and to give Gelpid initial cash flow. Effectively there is not debt burden assumed by GDSM in this scenario. This is the only way for Gelpid to really get their $5MM back.

From PR February 18:

"legal discussions are occurring to determine the best strategy for establishing a subsidiary, spinning it off and arranging a registered shelf offering;"

2. The PR states from today that the land lease purchases (for wholesale supply and distribution) will be financed via private investor capital:

"Given the capital required to pursue this strategy, the Company, via its subsidiary, would propose to be the general partner and raise capital from private investors. Obviously, the Company would retain an interest and control.” (THIS IS HOW THEY WILL FUND THE NEW VENTURE -- GROW FACILITIES: PRIVATE CAPITAL FINANCING, NON-DILUTIVE TO GDSM SHAREHOLDERS!)

____________________________________________________________________________________________________

NO DILUTION – UPDATED 3/5 - This is going to help the share price elevate tremendously!

From the company website:

Finally, the Company wishes to address its share structure. The current common stock outstanding is approximately 3.2 billion shares and has not changed in the last 90-100 days. (CONFIRMED 3/5/14)

CONFIRMED ZERO DILUTION 3/5/14

(THIS IS 200M SHARES FEWER THAN FITX AND WE ALL KNOW HOW THAT ONE HAS TURNED OUT!)

AS Increase Explanation

The Company was looking at an acquisition that would have required the issuance of a significant amount of stock. (The AS was raised prior to the recent activity related to the share price. Mike recognizes this and maintains that the AS increase was initially pursued to help finalize a deal that ultimately did not work out – IN THE PAST!)

Mike has no intention of diluting shareholders given the recent proposed MMJ deal.

To accommodate this potential acquisition, the Company raised the authorized amount of common stock to 6.5 billion. In light of current events, the Company is no longer pursuing this acquisition but will reserve the authorized for settlement negotiations and future opportunities.

The underlined statement above conveys that the AS will be reserved for settlement negotiations (i.e., it will help facilitate the MMJ shelf offering) and for future activities (NOT PRESENTLY NEED – THE SHELF OFFERING WILL SIGNIFICANLTY POSTIVELY IMPACT GDSM’S CASH FLOW NEEDS AND REMOVE THE GELPID DEBT BURDEN!)

____________________________________________________________________________________________________

NO REVERSE SPLIT & UPLIST CONSIDERATION

I would like to touch on another topic, a reverse split. At this point in time, it makes no sense to do a reverse split. Without the benefit of a settlement, “uplisting” and clear path to growth, performing a reverse split is a guaranteed return to the triple zeros.

Mike Shea has reiterated this sentiment countless times.

Something that is missed in this statement is the desire to UPLIST!

The MMJ Subsidiary will help facilitate the uplist -- along with the completed audits that are being worked on right now by Corso & Company.

From recent PR (Audit info):

"From an internal perspective, the Company engaged Corso and Company to perform its audit. Corso and Company will provide audited financial statements for fiscal years 2011 & 2012, a reviewed statement for the six month period ended June 30, 2013, as well as, the completion and filing of corporate tax returns for the last four years. The audit is progressing and should be completed by the end of November, allowing the Company to file its Form 10, "up list" and regain its full reporting status."

____________________________________________________________________________________________________

MORE GREAT DD FROM MGF:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98150499

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98189549

COMPANY LINKS TO EXPLORE:

https://twitter.com/GoldCoastMining

http://www.gdsmholdings.com

http://www.otcmarkets.com/stock/GDSM/quote

Recent GRLF News

- Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • InvestorsHub NewsWire • 06/24/2024 12:30:00 PM

- Green Leaf Innovations, Inc. Engages Olayinka Oyebola & Co for Two-Year Audit • InvestorsHub NewsWire • 05/28/2024 12:30:00 PM

- Form 253G2 - • Edgar (US Regulatory) • 01/29/2024 06:37:20 PM

- Form QUALIF - Notice of Qualification [Regulation A] • Edgar (US Regulatory) • 11/07/2023 05:15:09 AM

- Form 1-A POS - • Edgar (US Regulatory) • 11/01/2023 08:02:30 PM

Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • GRLF • Jun 24, 2024 8:30 AM

Bemax Inc. Positions to Capitalize on Industry Growth with New Improved Quality of Mother's Touch® Disposable Diapers • BMXC • Jun 24, 2024 8:00 AM

Last Shot Hydration Drink Announced as Official Sponsor of Red River Athletic Conference • EQLB • Jun 20, 2024 2:38 PM

ATWEC Announces Major Acquisition and Lays Out Strategic Growth Plans • ATWT • Jun 20, 2024 7:09 AM

North Bay Resources Announces Composite Assays of 0.53 and 0.44 Troy Ounces per Ton Gold in Trenches B + C at Fran Gold, British Columbia • NBRI • Jun 18, 2024 9:18 AM

VAYK Assembling New Management Team for $64 Billion Domestic Market • VAYK • Jun 18, 2024 9:00 AM