Monday, December 14, 2009 12:25:59 AM

Be sure to Sign Up for the JBII EMail Alerts List here: http://investorshub.advfn.com/boards/chairmail_sub.asp?board_id=15341

Must Hear. CEO Interview by Wallstreet Reporter: http://www.wallstreetreporter.com/2009/12/jbi-inc-otc-bb-jbii-ceo-interview/comment-page-1/#comment-2034

Interview Excerpts: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=44426026

Direct Link to Interview: http://LighthouseNova.com/WallStreetInterview.mp3

Rawnoc's Excellent Summary: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=44082776

Stock Price Matrix by Estimated_Prophet: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=44378428

JBI Global Video Presentation: http://www.genuan.com/JBI-InvestorUpdate-Nov2009.wmv

=========== Hot Posts ===========

CEO Communicatons Summary from Estimated_Prophet: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=44153235

Conference Call Q+A

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43871790

Latest News/Developments:

CEO takes 20% (12M) out of the OS.

JBII on Motely Fool: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=44422708

=============================================================================================

CEO quotes:

John Bordynuik's 12/13 consolidated FB posts. (from Estimated_Prophet)

Company Owned/JV/Franchisee Open Discussion (please comment): I have received many requests for P2O JV's and so if you are considering one this might help. First, FL,NY,and PA is out of the question. NY is all company & R&D, FL is exclusive JV, PA is company. Structure: JV1 (op to pay $50k and receive 10% revenue), operate site. JV2 (op to pay $400k and receive 35% revenue) -- very few of these will be considered.

--Florida is out - sorry - too many land rushes start in FL(Outback, Checkers, etc..) so there are great operators there already to go.

I have been approached to allow funds to equity invest in large blocks ($100M+) to roll out sites (stock price must be significantly higher). They like this because all revenue stays within company, we like it because of above. Massive land rush would require $2.5B of fund equity, all agree this must be a massive concurrent implementation.

--I wouldn't be issuing much at $2.50, I wouldn't start equity financing until above $18 in any sort of volume.

--We have an inhouse cost/rev/earnings model for the P2O. Now it's applying it to the various options and building a dynamic model. Ie: PIPE at $4/share (3M shares) -- to ladder to $8/share (5M shares) -- etc... It's finding the right model + take into consideration state tax credits (then monetize them upfront), then JV's (funds prefer wholy owned due to earnings growth).

--And.. how long does it take to get the earnings to take it to $xxx/share , or for that matter, how long it takes the analysts (Funds) to push it there.

Outback Steakhouse structured 90/10's, 50-50, etcc, and manager agreements because they did not have the capital to go to market. We can head this off on the pass with equity funds & a few key JV's. Suggestions? I'll provide the math -- our mgmt is working out the gotomarket strategy as well.

Lockup of plastic is simple: pay me less for 10 years or continue to pay $80/ton and continue to lose money and you're not green. Very simple. As no one else can convert it, I will not allow a market to be created.

Please do the math and explore other similiar business models where a national rollout was required (ie: Checker's restaurants). Case studies like Lowen Funeral Homes don't apply because the costs of the funeral homes increased due to competition to buy clusters. We can benefit from clustering but not essential.

We are exploring the right balance: company (through equity PIPEs), JV's (10% and 35%), and franchisee (last resort).

In any event, FL should be a good quick test. I'll supply the math and maybe someone has some creative ideas to determine the ladder financing required to take it through (we are doing this inhouse but shareholders may think of something we have not).

BTW, the numbers presented (10%) is net revenue. Outback has a similiar model whereby they allow a JV to come in for $XXX at get 10%, the manager also must pay for his position (I believe $25k) for another %. Overhead is low.

Previous Quotes:

Our stock now has the interest and investment from institutional funds, not retail. That is where this activity is coming from. No stock promoters, just good old fashioned Funds. They couldn't get in before and now we cont...rol our business model unlike most other public companies.

Thank GOD - we are finally getting off this &^&*^ exchange!

We (JBI - stock ticker JBII ) received the PakIt manufacturing equipment today and 17 pallets of supplies to begin PakIt Canada.

Answers to common questions pouring in (no, I'm not paying $1000 to issue a PR to answer info already in the public domain): 1. There will be no stock split. 2. Applications for P2O will be on the web site hopefully today. 3. Volume? Some funds found us. All bets are off after mainstream media covers us.

The Pakit fundraising kits are for school fundraisers, sports, etc.. It includes bottles: glass cleaner, autumn (fabreeze), and a heavy duty surface cleaner). 3 pakits for each and laundry soap. We sell for $12 and they can resell for $18 to 25.

We are doing a major rollout in Canada (test) with full page advertising and we actually have Heart Niagara and other non profits using to kits to fundraise now.

We are running 3 shifts in Niagara on tapes and soon 3 shifts on PakIt here. We are doing laundry soap here in volume.

A lot of funds are now supporting the stock (analyst coverage).

"Certain municipalities and companies have agreed to provide raw materials to the Company at no cost, or in some instances, the Company is compensated to accept the raw materials. The catalyst costs less than $0.01/litre. There is no guarantee that the raw materials will continue to be available in the amounts and upon terms satisfactory to the Company in every location that would support a Plastic2Oil processor. Consequently, the cost of feedstock is a variable that the Company will have to contend with."

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43264482

=============================================================================================

Realistic Outlook for JBII from Estimated_Prophet:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43364361

buenokite sees the LIGHT:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43297366

Pak-It Products - Tests and Results:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43326373

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=42529019

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43326524

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43326714

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43329897

CEO John Bordynuik Speaks:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43303970

Gold in Tires: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43377140

Got any ideas to help promote Pak-It?: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43303606

JBII Revenue Sources:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43267255

Misc Hot Posts:

Reading Tapes: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=43356426

=========== Executive Summary ===========

JBII. Awesome longer term investment here. Fully reporting. 13M Float. Zero dilution,

Audited financials, the works:

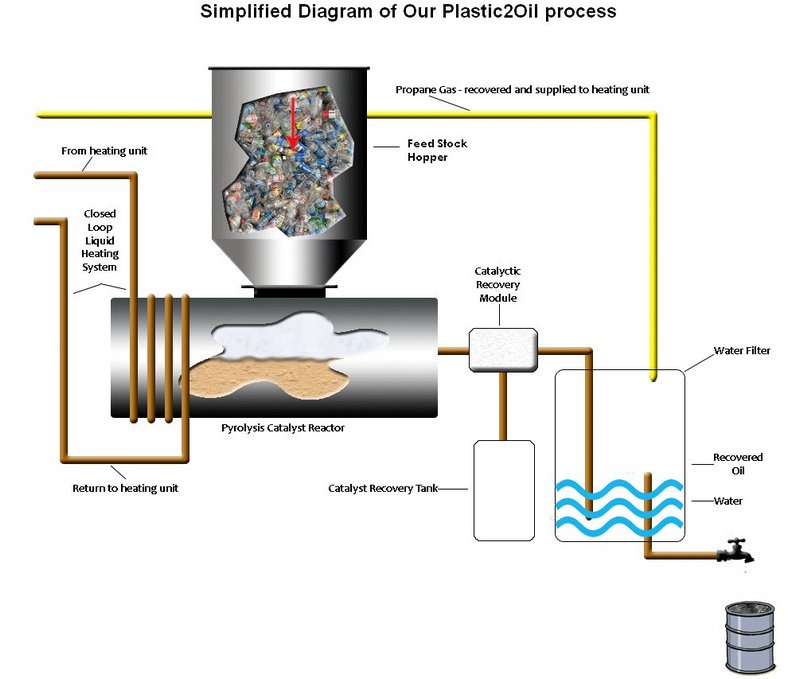

Plastic2Oil. ===

Video, Prototype:

1. Existing machines are used in China, Thailand, Taiwan, etc to convert Plastic to oil.

2. Bordynuik discovered a catalyst that makes this process much more efficient.

3. After the data is recovered from these tapes (they weigh about 5 lbs each), they will be fed into the machine and converted back to the oil from which they came from in the first place.

4. The oil (in the gasoline range from independent analysis) needs minimal refining, and will be sold into the refining market. He already has buyers.

5. The whole process will be franchised across the country/world. The first franchise has already been bought. 25 additional Joint Ventures are being negotiated.

6. The process will also recover oil from used tires.

7. Of course there is an unending amount of other waste plastic available to be converted to oil.

Roughly 8 lbs of plastic = 1 Gallon of fuel.

8. In larger metropolitan areas, the company will run it's own machines.

9. The first big production machine is currently being assembled in Niagra Falls.

NASA Tape Reading

Watch this Video of the CEO John Bordynuik demonstrating his new technology of reading computer tapes from NASA.

They get $22/tape. NASA has Millions of tapes to be read. Other companies also need these tapes read. Oil companies have a huge number of old seismic data tapes that can be reanalyzed with current software.

Board: http://investorshub.advfn.com/boards/board.aspx?board_id=15341

Be sure to click on "Show iBox".

CEO: http://www.johnbordynuik.com

Company: http://www.310holdings.com. New website coming soon.

CEO Article: http://www.johnbordynuik.com/BusinessNiagaraMagazine.pdf

Full DD: http://www.Lighthouse57.com/JBIIBrochure.doc

1. CEO, John Bordynuik, is a very well respected scientist with close ties to NASA, MIT, numerous Fortune 100 companies, United Nations, US Army. Website: http://JohnBordynuik.com .

2. Bordynuik has a very profitable private company, John Bordynuik Inc. (JBI) that reads the 'unreadable', i.e. the over 50 million computer tapes from the early computer era (60's-80's). There is a wealth of information on those tapes, and he developed his own tape drives to read these degraded tapes.

3. He has an exclusive contract with NASA and gets paid $22 per tape to recover the data. They are currently processing about 700 tapes a day, but will be processing many more due to new tape drives coming online very soon.

4. Their process can be used on any tapes, both legacy and current.

5. They have recently revolutionized data recovery methods (and Patented these methods), increasing the throughput tremendously, and are exploring applying the technology to disk hard drives as well.

6. A new office in Cambridge, MA has been leased, and will open soon.

310 Holdings (old symbol: TRTN) is now JBI Inc.(JBII) ===

In April 2009, Bordynuik bought a public shell company (310 Holdings), and moved most of the assets and production facilities from his private company (JBI) into the public company. The public company now has a positive balance sheet, with revenues. The transaction was independently audited. The new name of the company is JBI Inc.

The company is fully reporting and compliant. Stock Symbol: JBII

The goal of the company is to move to the NASDAQ exchange within a few months.

Recent Acquisitions:

1. Pak-It: http://pakit.com

2. DCL Solutions: http://dclsolutions.com/

2. Javaco: http://javacoinc.com

z

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM