Saturday, February 04, 2017 4:33:26 PM

As you can see from Carolyn Shiver's LinkenIn Page she is the President of The Black Shopping Channel Inc

https://www.linkedin.com/in/carolyn-shiver-1a059669

http://www.blacknews.com/news/black_shopping_channel_time_warner101.shtml#.WJYwQPJI6_4

As you can see by this lawsuit filed against Adam Tracy and Christopher Davies by Harvey Romanek (the person that bought the GOFF shell), Christopher Davies is a silent partner in the Adam Tracy shell hijacking/flipping scheme

https://promotionstocksecrets.com/wp-content/uploads/2017/01/GOFFTracyDaviesComplaint.pdf

The GOFF CEO sued Adam Tracy and Christopher Davies (the two people he paid to gain control of the GOFF shell) because they told him it was a clean shell when GOFF is far from clean. It is the subject of a Criminal Complaint.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124181041

Because of the dirty past of GOFF, Harvey Romanek couldn't get FINRA to approve any corporate actions for the ticker leaving him in control of a useless/worthless shell.

Christopher Davies was an attorney that facilitated a bunch of dilution scams back from 2010 - 2012 that I used to track.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69519392

After a 2012 drug arrest, Christopher Davies had his license to practice law taken away

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=113749574

https://www.iardc.org/ldetail.asp?id=679896128

More about Davies at the following link

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124226922

Carolyn Shiver previously showed up in ATHI which is a long, long time Christopher Davies shell.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124148895

Christopher Davies used ATHI for his own personal ATM machine converting debt into discounted free trading stock for years while going through several puppet CEOs (Carolyn Shiver, Jack Corn, Ian Stewart, Elaine Johnson/Claire Singleton) and changing business operations several times to support his share selling scheme.

Carolyn Shiver was the last CEO used by Christopher Davies in 2016 following the most recent reverse split for the ticker. First a big control block was issued to Shiver to raise the O/S then a big chunk of super discounted stock was issued to Christopher Davies to dump during some paid promotion activity.

The paid promotion activity and ridiculous press releases put out by ATHI finally got the attention of the regulators and ATHI was suspended on July 26, 2016 while the market awareness was still going on

https://www.sec.gov/litigation/suspensions/2016/34-78412.pdf

The Commission temporarily suspended trading in the securities of ATHI because of recent, unusual and unexplained market activity in the company’s stock taking place during a suspicious promotional campaign, and because of concerns about the accuracy of publicly available information, including but not limited to company press releases issued in June and July 2016.

Carolyn Shiver was the long time CEO/president of The National Indoor Football League which was allegedly being merged into the very toxic ATHI shell. During June and July 2016, Shiver put out a series of press releases touting The National Indoor Football League as some kind of multi-billion business expecting hundreds of millions in revenues (the following are just a few examples).

https://www.otcmarkets.com/ajax/showNewsReleaseDocumentById.pdf?id=21078

https://www.otcmarkets.com/ajax/showNewsReleaseDocumentById.pdf?id=21106

https://www.otcmarkets.com/ajax/showNewsReleaseDocumentById.pdf?id=21138

https://www.otcmarkets.com/ajax/showNewsReleaseDocumentById.pdf?id=21228

The SEC felt like those ATHI press releases were misleading/scammy/not accurate and suspended ATHI.

Cleveland Gary of The Black Television Channel was also a part of The National Indoor Football League becoming a part owner in the early 2000s.

https://en.wikipedia.org/wiki/Cleveland_Gary

http://www.oursportscentral.com/services/releases/cleveland-gary-updates-status-of-nifl/n-3468149

The National Indoor Football League went out of business in 2008

https://en.wikipedia.org/wiki/National_Indoor_Football_League

But it seems pretty likely that Cleveland Gary had some kind of presence in 2016 when Carol Shiver said she was relaunching the league so it could be used for the Christopher Davies ATHI share selling scam especially when you consider that they were also partners together in Healthway Shopping Network Inc at that time.

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001479014

It looks like Healthway Shopping Network Inc attempted to go public starting back in 2010 but has still yet to complete the going public process. Healthway Shopping Network INc was suppose to be some kind of shopping network for heath products, but that business never made any revenues - it ended up being yet another Cleveland Gary/Carol Shiver failed venture.

The Black Television Channel has a history of using the same misleading/scammy rhetoric in their press releases that The National Indoor Football League was using. I mean just reading these links throws up plenty of red flags.

http://blackshoppingchannel.weebly.com/black-shopping-channel-compensation-plan.html

http://www.prweb.com/releases/2014/01/prweb11465837.htm

https://www.complaintsboard.com/complaints/black-shopping-channel-scammed-me-for-one-thousand-dollars-c637534.html

http://www.ireachcontent.com/news-releases/morgan-stanley-calls-a-meeting-with-black-shopping-channel-bsc-191804071.html

The Black Shopping Channel Inc looks like an ultra failed venture that turned into some kind of cross between a bogus share selling scam and pyramid/Ponzi scam.

That last link about going public is interesting. I see that BSC did do a Form D filing in 2013 to sell some stock to the public. In that Form D filing, The Black Shopping Channel Inc lists its revenues at between $1,000,000 and $5,000,000 in 2013

https://www.sec.gov/Archives/edgar/data/1421159/000101054913000567/xslFormDX01/primary_doc.xml

Yet when they put out press releases in 2014, while they were probably selling that Form D stock, they touted themselves as a being a $750m company that would be airing nationally on Dish Network, Time Warner, Direct TV, and Comcast

http://www.prweb.com/releases/2014/01/prweb11465837.htm

At one time The Black Shopping Channel did air on Time Warner Cable in some areas of North Carolina and South Carolina in 2012

http://www.businessdailyheadlines.com/1334038431,black-shopping-tv-channel-sells-stock-to-public-black-shopping-channel.html

But not one single one of those cable TV providers ever announced that they were adding The Black Shopping Channel to their national TV listings. To date The Black Shopping Channel still doesn't air nationally on any of those major cable providers which is probably why there has been no follow up news from the BSC since 2014.

The most recent Black Shopping Channel youtube videos only talk about their online website business (hosting stuff on their website - virtual stores)

https://www.youtube.com/user/BSCAUTHORIZEDVIDEOS/videos

Obviously the TV Channel Venture failed and they have moved on to a new plan.

Besides the GOFF lawsuit, Adam Tracy has plenty of other problems including an SEC investigation and two more legal proceedings filed against him because of shells he hijacked then sold

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=128216683

https://promotionstocksecrets.com/wp-content/uploads/2016/07/AdamSTracyShamIPOs.pdf

https://promotionstocksecrets.com/wp-content/uploads/2016/08/SECAdamTracyExhibitB.pdf

https://promotionstocksecrets.com/wp-content/uploads/2016/07/AdamSTracy.pdf

https://promotionstocksecrets.com/wp-content/uploads/2017/01/TRONEx_Parte_Application_for_Order_Shortening_Time_to_Hear_Motion_to_Set_Aside_Order_Appointing_Custodi_Epap.pdf

https://promotionstocksecrets.com/wp-content/uploads/2017/01/GFOffshorevsTracyCIVSshell.pdf

http://investorshub.advfn.com/boards/replies.aspx?msg=128220404

Why somebody with as many problems as Adam Tracy would want to get involved with somebody like Christopher Davies I really don't understand.

But back to your original question..... make no mistake, RMGX is almost just as dirty as GOFF. Just look at a list of some of the players involved in RMGX in the past (Michael Spizzi, Rocco Di Fruscia, Roger Boileau, Jean-Francois Amyot, Louis J. Torres, Gilles Monette, Dominic Chiovetti, Daniele Brazzi, and Donald R Kee) and some of the other tickers RMGX was linked to (GWBU, LCOL, PGYC).

Like GOFF, I'll be surprised if FINRA approves any corporate actions for RMGX.

It is easy to see why The Black Shopping Channel would be merging into a super dirty shell like RMGX. The Christopher Davies/Carolyn Shiver connection combined with all the scamminess surrounding The Black Shopping Channel business operations explains that well. But it doesn't end there. Cleveland Gary doesn't seem entirely clean/honest either:

http://articles.sun-sentinel.com/2001-05-16/sports/0105150856_1_insurance-fraud-false-insurance-claim-fraud-charges

May 16, 2001

Cleveland Gary has been arrested on insurance fraud charges for allegedly submitting $18,000 in phony bills for medical treatments that never took place after a traffic accident in the Tampa area last year.

State Division of Insurance Fraud agents charged Gary, 35, of Palm City, and his girlfriend, Marilyn Walker, with one count each of filing a false insurance claim and a single count of grand theft. Both are felonies, punishable by a total of up to 20 years in prison.

I hope people are able to look at RMGX just as a trade and not start getting caught up thinking of RMGX as some kind of long term investment because of all the bogus hype. Besides RMGX being a shell with a dirty past, all Adam Tracy shells come with toxic convertible debt that Tracy puts on the books because of fees associated with the court process to gain control of the shell and fees to take care of the Nevada SOS filings. That debt leads to future dilution during pump&dump activity.

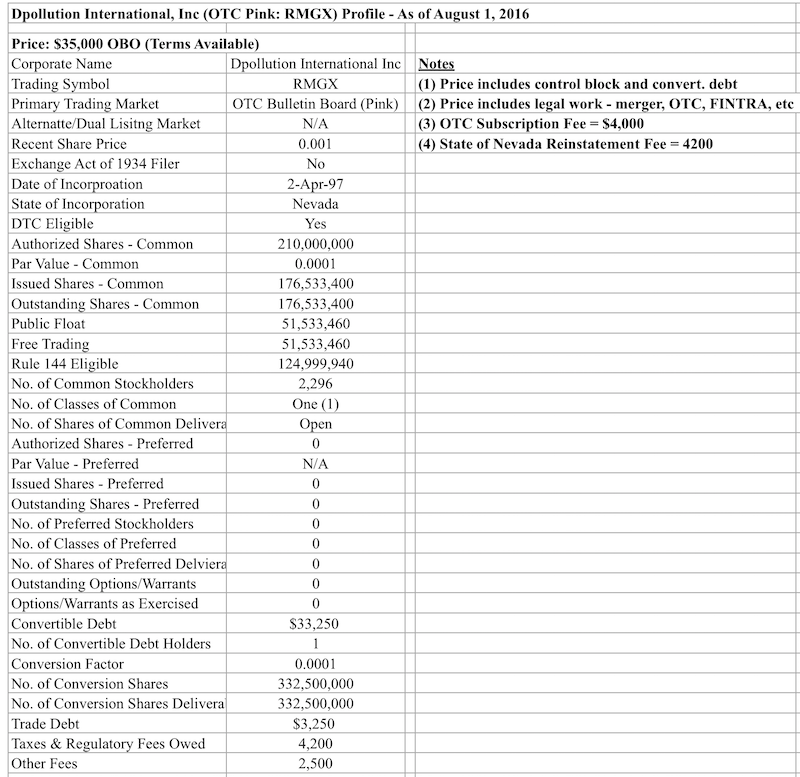

The RMGX shell came with $33,250 worth of convertible debt that Adam Tracy created which will become 332,500,000 free trading shares of stock at $.0001/share

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM

Avant Technologies to Implement AI-Empowered, Zero Trust Architecture in Its Data Centers • AVAI • Apr 29, 2024 8:00 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM