Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$AAGC 💪🔥💪💪 All the DD happening now folks! This is gonna moon imo take a peek! https://x.com/nickeli54/status/1868733828434739511?s=46&t=Cx3eH5ebwLlhhItIhOgIvg

BIEL: #3 Breakout Board, 911 Market Maker final trade Friday, NEWS PENDING!

_____________ Money - Our Followers Have Made ________________

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=169030954;

BIEL: HUGE VA NEWS - Flagship product RecoveryRX now available to all veterans at all VA's!

Ted Fienning

BioElectronics Corporation

Harvard University

Marine Corp Pilot

"Share with any veteran you know using the VA: RecoveryRX is an FDA-approved pain management device now available nationwide at every VA. Non-opioid, non-invasive, and available by asking your VA provider."

https://kellycovemobility.com/rrx/

An American hero gives a fantastic testimonial about Bioelectronics flagship product - RecoveryRX!

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174980584

Oops! Something gone wrong here!

Our engineers have noticed the problem and we are working on it now!

In the meantime, try logging out, clearing your cookies and cache for advfn.com (most browsers will let you clear a single domain instead of clearing all your cookies), then log back in. This cures a multitude of evils.

If the problem persists please let us know.

$ILST Global expansion and new celebrity partnerships on the way in 2025.

https://allcapresearch.com/f/ilst-poised-for-growth-in-cannabis-entertainment?fbclid=IwY2xjawHVZJFleHRuA2FlbQIxMAABHeoUWfrL5_3wixxhfnkJwX4eO4k_ECPrb8AOaGiSyNiLnF4eaKYyWUv_yg_aem_el9KR3CNv66gRm24Fua7Xg

Any targets for EEGI? Filings just dropped, should get out of expert soon...

BIEL GOLDEN CROSS BLUE SKY BREAKOUT! GONNA RUN LIKE 2021 - OTC HEATING UP!

$ILST I think we will get a solid boost this week!

Nice new article out:

https://allcapresearch.com/f/ilst-poised-for-growth-in-cannabis-entertainment?fbclid=IwY2xjawHVZJFleHRuA2FlbQIxMAABHeoUWfrL5_3wixxhfnkJwX4eO4k_ECPrb8AOaGiSyNiLnF4eaKYyWUv_yg_aem_el9KR3CNv66gRm24Fua7Xg

BIEL: HOT new pain relief product - Actipatch!

https://www.facebook.com/share/p/182kSvscPg/

$PRDL no Brainer here load and hold this one beat down trip play with zero dilution and tons of patients owned

$MJLB

lots of loading going into new year

https://x.com/7219Giangy/status/1867254782194307175?t=S_sseDOngC_uL10QW3YmYA&s=19

BIEL: 911 trade at the close Friday, NEWS!

BIEL: ActiPatch for Painsomnia!

https://www.facebook.com/share/p/1AhFGyNFqC/

INDR someone said the business still exists

BIEL: HUGE VA NEWS - Flagship product RecoveryRX now available to all veterans at all VA's!

Ted Fienning

BioElectronics Corporation

Harvard University

Marine Corp Pilot

"Share with any veteran you know using the VA: RecoveryRX is an FDA-approved pain management device now available nationwide at every VA. Non-opioid, non-invasive, and available by asking your VA provider."

https://kellycovemobility.com/rrx/

An American hero gives a fantastic testimonial about Bioelectronics flagship product - RecoveryRX!

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174980584

BIEL: ACTIPATCH HUGE IN TAIWAN!

https://www.actipatchtw.com/general-1?pgid=lw...d04755314e

$VGLS > News just hit OTC Markets.

BIEL: BUY RATING

https://www.barchart.com/stocks/quotes/BIEL/opinion

$ATIG Waiting on announcement about deal between AAPS and NFL HOF.

Will take some time to develop the STEAM centers.

Heard first will be in the Atlanta area.

Linda did say there will be a shareholder's meeting. Question is when??

BIEL RUMORS FLYING - #10 MOST READ BOARD LAST HOUR!

BIEL + DR. OZ + RFK = $$$

BIOELECTRONICS FLAGSHIP PRODUCT - ACTIPATCH - ON DR. OZ:

Dr. Oz devoted a whole program to explaining PEMF Pulsed ElectroMagnetic Field technology - with audience members wearing Actipatches (BIEL's flagship product) - saying it is changing the practice of medicine.

https://www.facebook.com/share/v/18NzZcGQVm

BIEL HUGE IN TAIWAN!

https://www.actipatchtw.com/general-1?pgid=lw...d04755314e

$TKMO still a hott one PAYIENCE it'll move fast

https://x.com/NotFinancialRep/status/1865049292110479807?t=AWG5nRKCaIcwcqc4aweBwQ&s=19

$VNUE bottom bunker opportunity

https://x.com/billsstocks1/status/1864737111535935709?t=_XixIIjQnd9aG0b7Drs7rA&s=19

INDR $132 market capitalization otc markets toll free number

BIEL: HUGE VA NEWS - Flagship product RecoveryRX now available to all veterans at all VA's!

Ted Fienning

BioElectronics Corporation

Harvard University

Marine Corp Pilot

"Share with any veteran you know using the VA: RecoveryRX is an FDA-approved pain management device now available nationwide at every VA. Non-opioid, non-invasive, and available by asking your VA provider."

https://kellycovemobility.com/rrx/

An American hero gives a fantastic testimonial about Bioelectronics flagship product - RecoveryRX!

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174980584

TGGI don’t let the shares outstanding scare you, this can run quickly

BIEL: BIOELECTRONICS ACTIPATCH ON DR. OZ:

https://www.facebook.com/share/v/18NzZcGQVm/

$AUNXF - Link to today's company update presentation. The future looks bright

AXP Energy (#ASX: #AXP.ax, #OTC: #AUNXF) is pleased to provide its Investor Webinar Presentation: https://lnkd.in/g6ZdM2EU

BIEL: BUY RATING

https://www.barchart.com/stocks/quotes/BIEL/opinion

BIEL READY TO POP!: MM's have removed about 80% (about 55 mil) of the shares available from the 4 ask since the close yesterday (69 mil down to 12 mil). If you're a betting man, this means the odds of the pps hitting 5 (the yearly high) improved by about 400%!

#10 Breakout Board #15 Most Read!

$BOTY recent news no dilution in in sight bottom buster

$PRDL insiders own 700 million also lots of patents bottom buster here

$RITE MineralRite Corporation (RITE) Refocuses from its Past to its Future

https://www.otcmarkets.com/otcapi/company/dns/news/document/78900/content

$AUNXF - Link to register for live investor update w/CEO. Dec 4 at 6:30 pm (Today!)

AXP Energy Limited (#ASX: #AXP.ax, #OTC: #AUNXF) invites shareholders to a briefing at 10:30 am AEDT (6:30 pm NY, 4 Dec) for an update on gas-to-power ops at Pathfinder Field & other projects. Submit Qs to alex@investorstream.com.au.

Register via: https://lnkd.in/gP2SWEq8 #gastopower #bitcoin #webinar

I developed this Board for "Six" reasons

1.

I wanted to create a Board

where "traders" could visit, and find, "Trips" stocks.

2.

I wanted to give those of us who are "Visual Traders",

a means of viewing multiple stocks quickly.

I have arranged all of the stock charts on this Board,

in alphabetical order, so that all visitors, and regular followers,

can quickly locate a stock that they want to Buy, Hold, or Sell.

A picture is, as they say, worth a thousand words.

No other Board is set-up in this manner.

3.

I wanted to "Alert traders" ,

of stocks that are in the "Accumulation Stage" of a stocks cycle,

getting them in at the bottom,

where they'll find the least amount of risk.

4.

I wanted to "Alert traders" ,

of stocks that are at the top of their cycle,

getting them out,

before they enter into "The Correction Stage",

which begins the downturn,

and can erase most of the stocks gains,

of "Penny stocks" especially,

where a 50% to 200% haircut, is very common!

5.

I wanted to "Alert traders" of stocks to avoid,

that are in "The Correction Stage".

6.

I wanted to "Educate" the followers of this Board,

with helpful and informative trading strategies,

that will help them make money !

Trading Trip-Zero Penny Stocks

A trip-zero stock is a penny stock

which has a price that includes a decimal point,

followed by three - 'trip' - zeros,

and then a single digit.

Because the lowest share fraction tradable by a retail investor is .0001,

the lowest a stock can go is just the same,

0.0001 dollars.

So, a trip-zero stock can be anywhere from 0.0001 to 0.0009.

After that the stock no longer has three zeros,

and simply becomes a "sub-penny" or "subber".

Ok, now let's just try to comprehend what 0.0001 dollars really means.

It is one ten-thousandth of a dollar,

or... perhaps a little easier to grasp,

one one-hundreth of a penny.

Chop a penny into 100 little pieces,

and you can buy yourself one whole share of a 0.0001 stock with just one piece!

So you may be asking yourself,

"How the heck does a stock go this low?"

Well, the answer to that depends on the stock,

but generally it is due to dilution,

and the subsequent supply of shares outpacing the demand for them.

If nobody is willing to buy the stock, and the selling continues,

the stock goes down down down, all the way to 0.0001…

and then, when nobody is willing to buy,

not even at 0.0001, the bid disappears.

These are "no-bid" stocks,

and typically their asking price,

or offer, then becomes 0.0001.

It's all about the up-tick...

After hearing this story of dilution and never ending spiral to .0001 with no bid,

you may be totally writing off the trip-zero stock.

If you are looking for a safe investment,

then that is your best bet. Stay far, far away.

However, the lure and potential of these stocks

lies back with the basic stock market rule mentioned above.

If the lowest share fraction tradable by a retail investor is 0.0001,

then that is also the smallest price increase that a 0.0001 stock can have.

So if you buy the stock at 0.0001,

and the price goes up just one tick to 0.0002,

you've just doubled your money!

This is the potential, the leverage,

behind these trip-zero penny stocks.

Of course, as the price gets closer to 0.0009 that leverage decreases exponentially.

However, it still offers incredible percentages in gains.

Also, if a trip-zero stock starts running from .0008,

for example, it may go on to hit .0019 or more,

just as easily as a .0002 stock would go to .0004.

Now, Imagine if you were able to catch a real runner,

grabbed shares at 0.0001 and were able to sell them at 0.0010

That's a 900% profit, or a "10-Bagger".

Every so often it happens, and that is the golden lure behind these stocks.

Now, the fact that you cannot trade in between the ticks

is the reason these Trip-Zeros have this potential.

At the same time it makes it difficult to sell them

because you can't work in between the spread.

That is, you can't offer the shares you bought at 0.0001 for 'just under 0.0002'

and beat the other sellers to the punch.

You have to get in line at 0.0002, or 0.0003 and so-on,

and wait for your sell to execute.

With a stock that is running up to $0.01,

for example,

you could put in your sell at 0.0099

and beat those sellers lined up on the $0.01 ask.

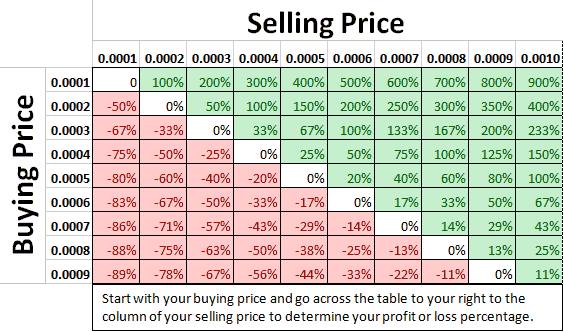

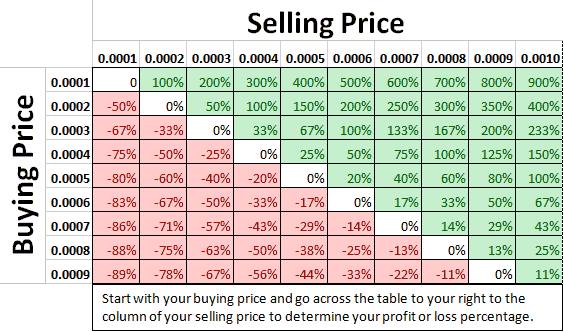

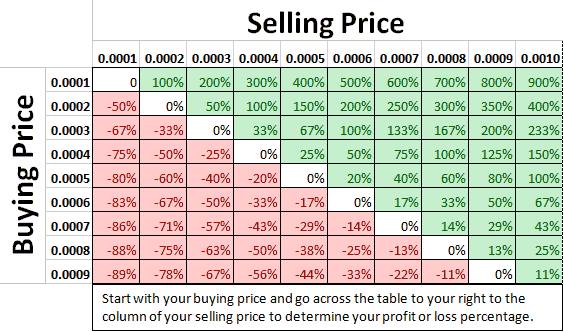

Trip-Zero Profit/Loss Potential Chart

Selling is the hard part...

So you might be thinking,

"What's so hazardous about a .0001 stock?

It can't go any lower."

Well.. that's not really true.

First of all,

if the stock has no bid and you buy at the ask of .0001,

you've immediately assumed a 100% loss. Why?

Because, with no bid,

you couldn't even sell the stock readily if you wanted to.

Remember, you can't sell it for less than .0001.

So, to simply get out of your position even,

you'd have to put your sell in at .0001,

and hope your shares are bought up by someone else.

Now the issue with this is you are now at the very back of a long line of people trying to sell shares for .0001.

That's the way the market works.

Orders sent to a particular market maker get filled first come, first serve,

and if you're at the back of a long line,

you are going to be waiting until the last of the shares offered at .0001 - yours - are bought.

Once in a while you might get lucky

depending on what market maker your broker uses.

Say you use E*TRADE, which has its own Market Maker (ETMM),

and you are the only one trying to sell shares through ETMM at 0.0001

If a fellow Etrader comes along and decides to buy shares,

they will most likely match your orders

and you'll get filled before the line of people waiting behind NITE or AUTO.

Chances are, your market maker already has a bunch of orders queued,

but every now and then this might work to your advantage.

Beware of the Reverse Split

There is yet another way your .0001 investment could dwindle to oblivion.

If a company can no longer drive demand for their stock,

and cannot get it off the metaphorical .0001 "floor",

their only recourse is the dreaded Reverse Split.

A Reverse Split, or RS,

if you don't know already,

reduces the number of shares outstanding

while simultaneously raising the share price at the same ratio.

If they enacted a 100:1 RS,

and you had a million shares at .0001,

you would be left with ten thousand shares at a price of $0.01

The share price goes up, (to dilutable levels…)

but you are left with fewer shares.

The problem with reverse splits

is they are seen as the worst possible event in the penny stock world,

and almost always lead to a massive selloff when they're announced,

and then often once they are executed.

In the aftermath the stock you own that started off at .01 post split,

might settle at .0035 or so.

You're left holding onto a 65% loss,

but the company is left with 35 ticks of share price to dilute…

Trip-zero stocks have the highest risk of reverse splits

because it is usually the company's only option to continue 'utilizing' the stock,

and most trip-zero stocks didn't get there

from solid management and profitable business plans.

Many are scams and dilution schemes that will dilute to oblivion,

reverse split, rinse and repeat.

To pull off a successful trip-zero trade,

here are some tips and rules to consider following:

http://www.pennystocknation.com/tripzeropennystocks.html

Paid Bashers / Short Attack

DEFINITION of Stock Basher

An individual, either acting alone or on behalf of someone else,

who attempts to devalue a stock

by spreading false or exaggerated claims against a public company.

After the stock's price has dropped,

the basher, or the basher's employer, will then purchase the stock at a lower price

than what he or she believes it is intrinsically worth.

This is an illegal activity that can carry significant legal repercussions.

The basher generally benefits on how effective the negative rumors are,

which can dramatically affect a stock's value.

If an investor believes the false claims,

he or she may sell off the stock at the higher price before it falls.

The basher will then purchase the stock and ride out the gains.

http://www.investopedia.com/terms/s/stockbasher.asp

Market Manipulation

Stock Bashing

"This scheme is usually orchestrated by savvy online message board posters (a.k.a. "Bashers")

who make up false and/or misleading information about the target company

in an attempt to get shares for a cheaper price.

This activity, in most cases,

is conducted by posting libelous posts on multiple public forums.

The perpetrators sometimes work directly for unscrupulous Investor Relations firms

who have convertible notes that convert for more shares the lower the bid or ask price is;

thus the lower these Bashers can drive a stock price down

by trying to convince shareholders they have bought a worthless security,

the more shares the Investor Relations firm receives as compensation.

Immediately after the stock conversion is complete

and shares are issued to the Investor Relations firm, consultant, attorney or similar party,

the basher/s then become friends of the company

and move quickly to ensure they profit on a classic Pump & Dump scheme

to liquidate their ill gotten shares

http://en.wikipedia.org/wiki/Market_manipulation

Paid Bashers

The shorts will hire paid bashers who “invade” the message boards of the company.

The bashers disguise themselves as legitimate investors

and try to persuade or panic small investors into selling into the manipulation.

This is not every dirty trick that the shorts use when they are crashing the stock.

Almost every victim company experiences most or all of these tactics.

The Anatomy of a Short Attack

Abusive shorting are not random acts of a renegade hedge funds,

but rather a coordinated business plan

that is carried out by a collusive consortium

of hedge funds and prime brokers,

with help from their friends at the DTC and major clearinghouses.

Potential target companies are identified, analyzed and prioritized.

The attack is planned to its most minute detail.

The plan consists of taking a large short position, t

hen crushing the stock price, and, if possible,

putting the company into bankruptcy.

Bankrupting the company is a short homerun

because they never have to buy real shares

to cover and they don't pay taxes on the ill-gotten gain.

When it is time to drive the stock price down,

a blitzkrieg is unleashed against the company

by a cabal of short hedge funds and prime brokers.

The playbook is very similar from attack to attack,

and the participating prime brokers and lead shorts are fairly consistent as well.

http://counterfeitingstock.com/CounterfeitingStock.html

Paid “Internet Bashers”

“CELLAR BOXING”

http://www.stockmarketcats.com/showthread.php?t=6903

Rules of the Trade

for stock promotion plays

Never trade more than you can afford to lose.

Assume the trade can result in a total loss.

When the promo is over,

the share price typically falls greater than 50%

within 1 hour and never recovers.

Never use the word "invest"

( "trade" micro caps never "invest" in micro caps).

Never take a "long position" on any micro cap

(attempt to exit within 1-5 days of entry,

99.99% of micro caps are scams & eventually drop to 0.0001).

Trade the ticker, not the company

(fundamentals are largely irrelevant).

Seek conservative gains of 10-50% per trade

(attempting gains in excess of 50% per trade will typically result in heavy losses).

Only enter a price dip

if there is forward momentum and high volume

and you have compelling market indicators

suggesting a quick recovery

(such as pending news or early promotion phase).

Seeking gains in excess of 50% per trade.

Trading late into the promotion

Trading greater than 50% of your account balance on any one trade.

Entering a position immediately following a large opening bell up gap.

Chasing an entry point over 25-50% from opening share price.

Failing to exit during high momentum and volume (exit when buyers are lined up)

Holding your position for greater than 5 days and holding a position over the weekend.

Holding your position for the pomotors promised price targets (they are all lies to encourage buying).

Entering any position after the first selloff "dump" of the "pump & dump"

Don't forget,

as the promo enters the later phases

or post selloff phase,

the promotors price targets become more and more exagerated

(don't fall for it, these are warning signs to the savvy traders that it's time to move on).

Stocks of many start-up companies,

bottom at the "Triple 000" price level,

before they begin their meteoric rise.

"Venture Capitalists"

like to buy the shares of these companies at these low levels.

Anytime you have the financial means

to buy a "Trip" for 0.0002 to 0.0009,

do it !!

Try to buy 10,000,000 shares, and "trade" them.

Your cost, to buy 10,000,000 shares of a stock at 0.0003 is $3,000.

Keep 1,000,000 shares in your account at all times,

to sell at a later date,

just in case your stock turns out to be a high flier

months down the road.

Many times,

these companies shares can end up selling for 0.50c, or, $1.00.

Enough said !!

Elliott Wave Theory interprets market actions

in terms of recurrent price structures obedient to the Fibonacci sequence.

Basically, Market cycles are composed of two major types of Wave :

Impulse Wave and Corrective Wave.

For every impulse wave,

it can be sub-divided into 5 - wave structure (1-2-3-4-5),

while for corrective wave,

it can be sub-divided into 3 - wave structures (a-b-c).

The attractiveness of Elliott Wave Analysis is :

Three impulse wave forms

and six corrective wave forms are conclusive.

All we have to do

is to identify which wave form is going to unfold

in order to predict future market actions.

http://www.acrotec.com/ewt.htm

http://stockcharts.com/help/doku.php?id=chart_school:market_analysis:elliott_wave_theory

IMPORTANT !!

View this Video before you invest your money !!

"Wave One" is the Wave right after a prolonged downtrend.

This stock has been going down,

but now it is starting to trade sideways , forming a base.

The sellers who once had the upper hand,

are now beginning to lose their power,

because the buyers are starting to get more aggressive.

The stock just drifts sideways without a clear trend.

Everyone hates this stock!

This is the time to be Loading the Boat !!

Example:

SUGO

This stock had a prolonged downtrend in November and December,

and finally found its "Key-support" at 0.0003 in January.

(This is the area where Promoters were accumulating their shares.)

It then had an "Attention-Pop",

then a "Drop",

formed a base,

then began its "Run",

to complete its "cycle".

Dec-Jan-Feb

( The QTR ended Feb 29th )

Two Promoters announced their Promotions

after the QTR ended,

igniting a "Run".

When you see the "Promote",

time to exit the Boat.

Sunday, March 11, 2012

SUGO (Sungro Minerals Inc) -

Our Next GDSM Gold Runner Poised For .02+ Cents ?

SUGO .0014 -

We first alerted our VIP Subscribers SUGO

with the bid at .0005 and the ask at .0006 cents several weeks ago.

This week we alerted our FREE members at .0011 cents.

The stock suddenly broke out this week

giving our VIP Subscribers and easy 200% in gains potential

from our alert when it hit an intraday high of .0018 cents on Thursday.

The good part is there appears to plenty of gas left in its tank for SUGO

to do what many investors failed to realize it is capable of

as it attempts to take a shot at making history once again.

This Gold stock caught our attention

after seeing its dramatic fall

from last years .02 + cents trading range.

http://www.pennystockgeeks.blogspot.com/

Finally, stocks "break out" into "Impulse Wave 3", which begins the uptrend.

This is where the majority of the money is made in the stock.

The fundamentals are bad, the outlook is negative, etc.

You'll be aware that the stock is climbing.

The following "Signs" show you, that you should be "Selling" your stock.

1. Your stock is listed on the Top of the "Breakout Boards" List.

2. Your stock is listed on the "Top 10 Active Stock Market Forums".

3. The number of posters on your stocks board are increasing every day.

The number of followers are increasing each day.

The number of posts are increasing each day.

4. Everyone is cheering and celebrating !!

You'll see "Stock Promoters" promoting your stock,

at the top of "Waves 3 and 5".

This is your "Sign" to consider "Selling" your stock!

Example:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=73014587

Promoters are paid to promote.

They become visible at the top of "Waves 3 and 5".

This is your First Sign to get out !

When they Promote, time to jump out of the Boat !

They announce price targets that seem unreal.

Both they themselves and their clients, own large amounts of the stock,

so they want to raise the attention level on the stock,

so the stock goes higher,

allowing them to sell both their shares,

and their clients shares, to you, at the higher price level.

Posters are telling everyone that the stock is going much higher.

Posters are naming price targets that seem unrealistic.

You are getting "Greedy".

You believe the stock can climb higher,

and you are getting caught-up in the greed emotion.

The enthusiasm over the stock is enormous!

Ahhh, but professional traders know better !!

Traders, who had accumulated shares at the lows, weeks, and months earlier

are getting ready to "dump it off " to those getting in late.

Get ready to "Sell and Unload" as the stock is climbing.

As the stock is climbing, you should be considering taking your profits!

This sets up "The Corrective Waves",

the "WARNING" stage!!

Finally, after the glorious advance of "Waves 3 and 5",

the stock begins to trade sideways again and starts to "churn".

Novice traders are just now getting in!

This stage is very similar to Wave 1.

Buyers and sellers move into equilibrium again

and the stock just drifts along.

The stock is "Topping-Out" ! Last chance to Sell !

You want to Sell your stock in "Wave 3 or 5",

before if falls below the "highest moving average".

It is now ready to begin the next Wave,

Corrective Waves b,c

"The Dump"

The Final Stage.

Nobody believes the downtrend!

Everyone still loves this stock.

They think the downtrend is just a "correction".

Wrong!

They hold and hold and hold,

hoping it will reverse back up again.

They probably bought at the end of Wave 3 or 5,

or during Corrective Waves a,b.

Good chance that the stock will now revisit the lows of the base.

If you held the stock all the way down,

from Waves 3 and 5,

into this Corrective Wave a,b,c,

you have lost a large part,

if not all of the profits,

that you had made from Waves 1,3 and 5.

All of your money, is not totally lost though !

There is a light, at the end of the tunnel !

Every cloud has a silver lining !

The market often times gives you a second chance,

to get your money back.

You can begin to re-evaluate and accumulate at the base,

where most new runs begin.

Suggested Strategy for Playing the "Trips"

Sell what's HOT !

Buy what's NOT !

When you see the Promote !

Time to exit the Boat !

Buy on the Capitulation !

Sell on the Celebration !

Buy after the Dump!

Sell on the Pump !

Buy on the Rumor !

Sell on the NEWS !

Buy on the Fear !

Sell on the Cheer !

Buy after an Elliott Wave 5-Wave Decline

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=141851365

Sell after an Elliott Wave 5-Wave Advance

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=141851368

IMPORTANT !!

First,

never chase a running stock.

Second,

" trading emotion" is the easiest way to loose money.

"Trips" stocks

can have huge price percentage moves up, and down.

In general,

"Buy" them, when they are down,

and "Sell" them, when they are up !

This strategy applies to

"the day trade",

"the weeks trade",

as well as

"the monthly trade".

Always

"Buy when the stock is down",

and always

"Sell when the stock is up".

When your stock moves-up,

and goes through a "key resistance" price level,

and the stock is registering

a better than + 50% increase in price

from the previous days close,

it is wise to consider taking some profits,

by selling a portion of your holdings.

"Today's winners",

are often times,

"tomorrow's losers".

When a "Trip" stock climbs + 50% today,

it can, and often does,

lose - 50% to -100%

of that gain,

over the next several days.

So remember the "old adage"...

"You'll never go broke, taking a profit !"

Glossary

Bullish Divergence

A Bullish Divergence exists,

when the price is down trending

and either the RSI, or the PPO blue bars, are up trending.

Divergence means that 2-indicators,

are moving in opposite directions.

Example: ENTB

Fibonacci Retracement

Percentage Levels

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=141214221

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

Fibonacci Retracements

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77145842

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

Dilution

What is Dilution?

Is it good, or bad ?

Dilution is when the company moves shares

from the AS (authorized shares)

to the OS (outstanding shares) or tradeable inventory,

for cash investments in the company.

This means there are more shares at the same market price

and reduces the size of the EPS.

It doesn't reduce the price or value of the stock.

But many pennylanders think it does.

Dilution doesn't change price,

it changes EPS.

Creating loss in company value,

not stock value.

Hardly 1 in a 1000 OTC companies

have an EPS to effect.

So, dilution can't effect their company value in the first place.

Whats the value of no earnings,

thus no EPS.

But, the value of more cash to a startup is huge!

Cash gives them the ability to attempt to grow.

Without the cash it can't.

So logic says,

the retail herd should be happy about dilution.

After all,

they want the comapny to grow don't they.

On the OTC,

"dilution" is the best news one can hear !

Not only does it give the company a chance at growth,

it doesn't effect their EPS value one bit.

They have no EPS to effect.

Plus,

every time VCs get there hands on large amounts of shares,

they buy a run,

and we can trade for profits !

So,

"dilution" is a win for the company,

a win for the Venture capital firm,

and a win for the educated pennyland trader,

on the OTC.

Funding

Remember,

"start-up companies"

have no business except "selling stock".

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=75262048

One of the easiest ways,

for a "start-up company"

that trades on the OTC,

to gain the attention it wants, i

s to get "promoted".

In many cases,

the compensation to the

" Promoter " is "in shares".

To be more precise,

the shares are "restricted shares" by the company,

and "free trading shares"

from an undisclosed third party.

In the "start-up stage",

the Promotion will give the company some publicity,

however, it may not lead to the desired results,

due to the "share-based compensation".

That's not necessarily a bad decision

on the part of the company's management.

They just may not have the option to pay in cash.

The thing about "promotions",

is that they tend to work better,

when "paid with cash".

Venture Capitalist - VC

A "venture capitalist"

is a person who invests in a business venture,

providing capital for start-up or expansion.

"Venture capitalists"

are looking for a higher rate of return

than would be given by more traditional investments.

A "venture capitalist"

can be a "professional investor" ,

or "Market Maker".

The "venture capitalist"

may have no business experience

applicable to the industry your company is involved in,

and

is focused on "the potential rate of return"

your company can provide.

http://sbinfocanada.about.com/cs/financing/g/ventcap.htm#

"Promoters"

are "Venture Capitalist" firms.

"Venture capital"

(VC)

is financial capital

provided to early-stage,

high-potential,

high risk,

growth startup companies.

The "venture capital" fund

makes money

by "owning equity-shares"

in the companies it invests in.

http://en.wikipedia.org/wiki/Venture_capital

Price "Pull-Down"

where the price falls HUGE

over a relatively short period of time.

All "you" need to remember,

is that with ALL "pull-downs",

the "accumulation" starts.

This is just the first step!

As with all of these,

it's early before any play can be expected.

A "pop",

and possible

"double bottom",

then a basing of volume

to within the OTC volume range for "big guy" plays,

then a breakout and play,

if anything happens at all.

Just look at your stock,

and read some of the old saved posts in the sticky post area.

Price pull downs are OTC game stock.

They hover higher for months and months,

with NO retail interest or volume.

The insiders "pull the price down",

for the funding of their operations,

by increasing the "shares outstanding"

and "authorized shares",

and when the price of the stock,

reaches the price level

where the "VC"s want to "Buy",

the stock finally bottoms,

and you then see the accumulation.

Most every stock "pennylanders"

like these types of stocks.

There is another term for trading these OTC sub & Micro stocks.

"Bottom feeder" stocks.

The accumulation is "bottom feeders" moving in.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=72284717

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=74348830

"Bottom Bounce"

"Bottom Bounce Plays",

are where you will see strong volume accumulation

at the bottom level.

Thats how you know the bottom is reached.

The volume surges, and the price stops falling.

"Price Pull-Down", and "Bottom Accumulation"

is an OTC "tell" or "signal", that "funding" may be taking place

"Bottom Volume Surges"

are insiders and friends, buying before a "bought manipulated OTC funding run"

"Darkside Play"

> Volume accumulation at bottom.

> Signaling it's really the bottom.

This is when most "VC", "Venture Capital", funding deals start.

So, it normally takes weeks, to a month, or so, before any "Darkside Play" can be expected.

Keep an eye on "volume build", as retail interest increases.

Remember the big guy volume rule of thumb for starting a "Darkside Play".

This will help in guessing if any pop works, because sometimes a "second" or "third" pop is needed, to get the interest levels high enough, for them to actually act on their "Planned Play".

"Attention-Pop"

Example:

SUGO

If it looks like a "pop", its a "pop".

If it looks like a "run", its a "run".

SUGO has just given the "first", of several "Attention-Pops" ,

taking the average daily volume, from under 10 mill, to above 50 mill,

the goal of all "Attention-Pops" !

SUGO's "Pop" action,

is the "attention getting move",

before the "real thing",

which is the "Run".

"Share Shifting"

is important to OTC stocks

It shows a setup, before a "bought price run".

To get this run, big guys need to accumulate large amounts of shares at LOW cheap prices.

So, when they buy and manipulate,

to sell to "retail emotion" shareholders, they make large profits from their funding investments.

"Pond-Fishing Play"

aka "The Patience Play"

This is a 6-month waiting period play.

Called a "pond", because it starts from a dead still pond surface in price.

This means that there is a long period of time with no price movement at all.

There are 3-volume surges during this time to signal random accumulation at these low prices.

That one action, of 3-volume surges, without price change, is an OTC "tell" or, "signal", that funding may be taking place.

You can weekly watch, to see what happens in the future.

http://www.youtube.com/watch?v=J1BpICTP9jA

Trading "Gaps"

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:gaps_and_gap_analysi

Example: SUGO

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76226544

In the January and February "Walkdown",

you will notice 3 - "Breakaway Gaps" .

0.001

0.0007

0.0005

ALL of the "gaps" got filled

as the stock started climbing into March.

Breakaway Gaps are usually closed over time.

You see them in a multiday "emotion run" ,

or "walkdown" ,

where the stock price is trending around,

over several months.

The retail mindset returns to logic,

and fills the gap with the retrace.

Example: UCPA

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76226544

In the January and February "Walkdown",

you will notice 3 - "Breakaway Gaps" .

0.0007

0.0005

0.0004

ALL of the "gaps" got filled

as the stock started climbing into March.

Breakaway Gaps are usually closed over time.

You see them in a multiday "emotion run" ,

or "walkdown" ,

where the stock price is trending around,

over several months.

The retail mindset returns to logic,

and fills the gap with the retrace.

Example: DKSC

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76226544

In the June 2011 thru February 2012 "Walkdown",

you will notice multiple - "Breakaway Gaps" .

0.0009

0.0005

0.0003

0.0001

ALL of the "gaps" got filled

as the stock started climbing into March.

Breakaway Gaps are usually closed over time.

You see them in a multiday "emotion run" ,

or "walkdown" ,

where the stock price is trending around,

over several months.

The retail mindset returns to logic,

and fills the gap with the retrace.

The "Flat Liner" Chart

This is a "very risky" chart pattern,

and NOT a good chart pattern to trade !

The RSI and the Price both go flat.

Your stock looks like it's sleeping, or dead !

Some charts will resemble the "Pond-Fishing Play".

This chart pattern may be caused by either a "manipulated walk down",

by Market Makers, and/or Insiders,

or, the company is going under,

effecting a "Reverse Stock Split" ,

or, will soon be delisted.

Despondency and Depression describe this situation,

as shareholders watch their account value drop to nearly zero !

This is "the lowest level" that a stock can get to,

in an accumulation phase.

The stock will have a

Bid 0.00 - Ask 0.0001

in most cases.

The "negative news"and aggressive sellers,

have now over powered any "positive news" and buyers.

Most everyone hates this stock.

Shareholders who are still holding shares,

are referred to as "Bagholders".

Just as the patient without a pulse,

when everyone thinks the patient is dead,

shareholders start to believe their shares are dead,

and will never move again.

Some of these stocks will stay flat for a few weeks,

while others will stay flat for months.

You don't want to tie your money up for this lengh of time !

The price is pulled down to anywhere from

0.0001 to 0.0005,

usually with some sort of negative event,

being associated with the drop.

Some of these plays will "recover" and come back to life,

after some kind of positive news is announced,

but, most will NOT recover !!

They are just NOT worth trading !!

Examples

GOHG

http://ih.advfn.com/p.php?pid=squote&symbol=gohg

EVCA

June 5 - A " reverse split " > holders will receive 1 Share for every 500

to take effect on or after June 20, 2012

http://ih.advfn.com/p.php?pid=nmona&article=52661475

http://ih.advfn.com/p.php?pid=squote&symbol=evca

GARB

April 5, 2012

GARB announces agreement to restructure, " reverse split "

http://www.otcmarkets.com/stock/GARB/news

PSRU

http://ih.advfn.com/p.php?pid=squote&symbol=psru

SUGO

March 2012

the Company increased the authorized shares of common stock of the Company

from 750,000,000 to 2,500,000,000 shares.

http://nvsos.gov/SOSEntitySearch/corpActions.aspx?lx8nvq=sckzhSFMshhHTv%252bezK7qFA%253d%253d&CorpName=SUNGRO+MINERALS+INC.

http://ih.advfn.com/p.php?pid=nmona&article=51663577

http://ih.advfn.com/p.php?pid=squote&symbol=SUGO

http://www.otcmarkets.com/stock/SUGO/financials

After a New prolonged downtrend, below the previous 0.0003 "Key-support",

the stock has now hit "rock bottom" at

Bid 0.00 - Ask 0.0001

Bid / Size 1.5 Mill - Ask / Size 216 Mill

and has traded sideways for 7-weeks.

If you are buying shares of SUGO,

you are most likely buying them from a " Market Maker "

who has a large inventory to unload to buyers.

The "shares are illiquid",

and you may not be able to sell your shares,

since the Bid is at 0.00

"Shareholders may be unable to sell their shares.

There is currently a limited market for our common stock,

and we can provide no assurance to investors that a market will develop.

If a market for our common stock does not develop,

our shareholders may not be able to re-sell the shares

of our common stock that they have purchased

and they may lose all of their investment in the company".

March 2012

the Company increased the authorized shares of common stock of the Company

from 750,000,000 to 2,500,000,000 shares.

Then look at what suddenly happened in September,

to everyones surprise !

All of a sudden this No Bid stock jumped to Bid 0.0001 Ask 0.0002

Traders started Buying up shares like crazy,

in June, July and August, at 0.0001,

because the Authorized Shares had increased,

then in September the company made a surprise announcement,

and traders saw a Run develope out of nowhere,

lifting the stock to a High of Bid 0.0007 Ask 0.0008

UCPA

March 12, 2012

to terminate the registration of its common stock and suspend its reporting obligations

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8473906

http://www.otcmarkets.com/stock/UCPA/financials

RIGH: Recovered

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76900417

STHG : Recovering

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76498921

TLAG: Recovering

http://www.otcmarkets.com/stock/TLAG/company-info

http://www.otcmarkets.com/stock/TLAG/financials

PDOS: Recovering

KRMC: Recovering

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76470209

CBYI: Recovering

http://ih.advfn.com/p.php?pid=squote&symbol=cbyi

April 30 - Signs LOI for Joint Venture Ownership

http://ih.advfn.com/p.php?pid=nmona&article=52209363

April 16 - Appoints New CEO

http://ih.advfn.com/p.php?pid=nmona&article=52021215

March 28 - Retires 400 Million Shares of Common Stock

http://ih.advfn.com/p.php?pid=nmona&article=51802399

March 23 - DTCC Chill Clarification

http://ih.advfn.com/p.php?pid=nmona&article=51752600

DKSC: Recovering

http://ih.advfn.com/p.php?pid=squote&symbol=dksc

DUTV: Recovering

http://ih.advfn.com/p.php?pid=squote&symbol=dutv

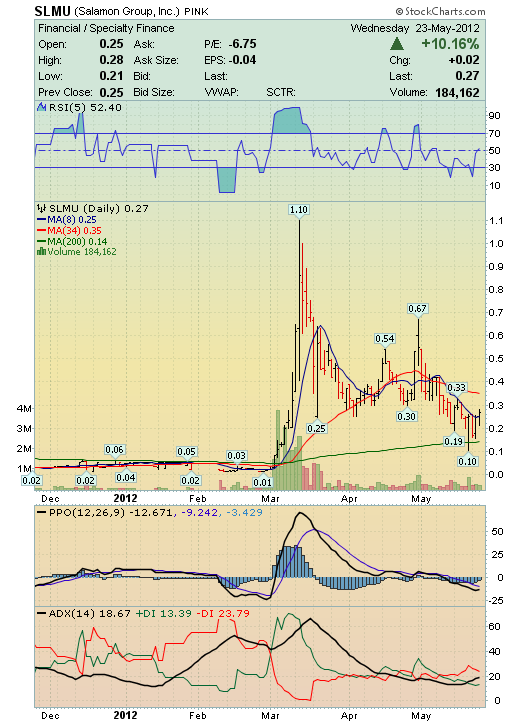

The "Pincher" Play

The "Pincher Play",

is an "early" method of getting in before the "pump" starts.

The PPO and ADX "Pinch"

MrBigz Pincher Video Lesson

http://www.screencast.com/t/7FR3BYxeD

Examples

ATRN "Pincher",

The ADX and PPO "Pinched" in late December

made a "45-fold move",

from 0.008 to 0.3599 !!

ALZM "Pincher"

made a 10-Fold move,

from 0.0056 to 0.0559 !!

Price "Pull-Down"

HRTE "Pincher"

made a 10-Fold move,

from 0.0001 to 0.0018 !!

Price "Pull-Down"

Trading Chart Patterns

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns

http://www.thestockbandit.com/chart-patterns/

Bullish Chart Patterns to look for

Double Bottom Buy

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:double_bottom_revers

Cup & Handle Buy

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:cup_with_handle_cont

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |