Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Looks like a bit of hype beginning here. Best read the filings to see what they DID NOT ANNOUNCE.

$KLYG Kelyniam Global Announces Record Sales and Operating Profit in 2021 Financial Statements

Press Release | 02/14/2022

Kelyniam Global Announces Record Sales and Operating Profit in 2021 Financial Statements

PR Newswire

CANTON, Conn., Feb. 14, 2022

CANTON, Conn., Feb. 14, 2022 /PRNewswire/ -- Kelyniam Global (OTC: KLYG), a maker of custom cranial implants, today announced results for its year ended December 31, 2021.

"The company is excited to report that sales have increased for the fifth year in a row," said Ross Bjella, Kelyniam's CEO. "Despite Covid 2.0 shutdowns during the 1st quarter of 2021 and the Omicron variant shutdowns in the 4th quarter, Kelyniam achieved record operating profitability during 2021. This performance in the fourth year of our five-year plan confirms the company's ability to meet long and short term goals. Our objectives in 2022 are to accelerate profit and sales growth through our partnership with Fin-ceramica and the development and launch of organically-created complementary products."

Financial highlights for the year ended December 31, 2021the same period in 2020 includes:

Operating income of $180,445 compared to $49,683, an increase of 363.2%

Net Income $201,741 compared to $141,075, an increase of 43%

Total revenue of $ 2,664,434 compared to $2,512,101, an increase of 6.06%

The complete financials can be found on the company's website at www.Kelyniam.com.

Events that significantly affected the year and 4th quarter included:

The Company signed a new strategic distribution agreement with Fin-ceramica faenza Spa to market their CustomizedBone Hydroxyapatite Cranial Implant in the U.S.

Kelyniam received a patent on its Integrated Fixation System designs, marking a new level of intellectual property protection for its flagship product

Kelyniam is now issuing US GAAP-basis financials associated with a new SEC rule on the submission of current financial information through the broker portal of OTC Markets and is listed as a Pink Current Filer in OTCIQ

The company also hired Ms. Lisette Grunwell as the VP of Quality and Regulatory Affairs in January of this year.

"The addition of Lisette to our team is a testament to our commitment to quality and our ability to recruit high-talent professionals to our team. She brings a breadth and depth of knowledge about quality and regulatory matters to the company and will be an integral part of our executive team," said Bjella. "Kelyniam will continue to invest in infrastructure and partnerships necessary to achieve our objectives in 2022. While we cannot predict how Covid may affect the company in the future, we intend to have a solid platform to support continued growth."

Kelyniam Inc., specializes in the rapid production of custom prosthetics utilizing computer aided design and computer aided manufacturing of advanced medical grade polymers. The Company develops, manufactures, and distributes custom cranial and maxillo-facial implants for patients. Kelyniam works directly with surgeons, health systems and payors to improve clinical and cost-of-care outcomes. Kelyniam's web site address is www.Kelyniam.com.

As a cautionary note to investors, certain matters discussed in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such matters involve risks and uncertainties that may cause actual results to differ materially, including the following: changes in economic conditions; general competitive factors; the Company's ability to execute its service and product sales plans; changes in the status of ability to market products; and the risks described from time to time in the Company's SEC reports.

Cision View original content:https://www.prnewswire.com/news-releases/kelyniam-global-announces-record-sales-and-operating-profit-in-2021-financial-statements-301481317.html

soon news at $1.00++ klyg

KLYG~.1029,better load fellas now will be DOLLARS pps fast with the crazy news

KLYG~~Kelyniam Global, Inc., Announces Strategic Licensing Agreement with Fin-ceramica faenza spa to Market Hydroxyapatite Cranial Implant in the U.S.

https://www.finceramica.it/en/

KLYG~~.1099,soon HUGE UPSIDE TO DOLLARS PPS,,http://charts.stockfetcher.com/sfchart/oJog56JEff.png

KLYG~~.1099,will explode to dollars pps here,load up,,http://charts.stockfetcher.com/sfchart/t3Ii9tVwpU.png

Loading and waiting.

love the Company what is doing, soon will be FDA approved and millions of $$$ will pour into company,great to own big$$$

I agree. If not more! Huge buyout candidate also & it wouldn’t come cheap.

KLYG~~will see $2-$3 DOLLARS pps in 2022 easy

That’s good! No one’s selling. News imminent. Just signed that licensing agreement. Always follow up news on licensing.

SS updated. No change. 18 million floater will fly soon Imo.

$KLYG “Kelyniam became the first and only cranial implant manufacturer to offer U.S. surgeons this truly unique fixation option when the FDA approved Kelyniam IFS Tabs earlier this year.”

https://kelyniam.com

Very bottom here imo. Less than 1 million float! Just signed a huge licensing deal. It’s at a dime. Has seen .90. Made national news on FDA approval. I think it’s big.

$KLYG Kelyniam Global, Inc., Announces Strategic Licensing Agreement with Fin-ceramica faenza spa to Market Hydroxyapatite Cranial Implant in the U.S.

Press Release | 12/22/2021

Kelyniam Global, Inc., Announces Strategic Licensing Agreement with Fin-ceramica faenza spa to Market Hydroxyapatite Cranial Implant in the U.S.

European market leading implant now available in the U.S.

PR Newswire

COLLINSVILLE, Conn., Dec. 22, 2021

COLLINSVILLE, Conn., Dec. 22, 2021 /PRNewswire/ -- Kelyniam Global, Inc. (OTC: KLYG), a leading manufacturer of custom cranial PEEK implants today announced that it has entered into a strategic licensing agreement with Fin-ceramica faenza spa to market the company's hydroxyapatite patient specific implant. This bio-mimetic ceramic biomaterial is based on macro and micro porous Hydroxyapatite (HA), a major (70%) component of human bone. The specific bio-mimetic chemical composition combined with an elevated interconnected porosity play a role in the perimetral osteointegration process.

The innovative CustomizedBone Service™ implant is indicated for use in adult and pediatric patients (for children 7 years of age and above). The highly bio-compatible material, shows a reduced post-op infection incidence compared to titanium-based implants.

"We are extremely excited to partner with a technology leading company like Fin-ceramica," said Ross Bjella, Kelyniam's CEO. "Our companies share a mutual passion of working closely with neurosurgeons to design and build complex implants for cranial and maxillo-facial applications. The CustomizedBoneä implant will give our customers another terrific option to fill a specific patient need."

Kelyniam will distribute the implant through its active salesforce of more than 50 representatives starting in January. Representatives will carry both PEEK (polyether ether ketone) and hydroxyapatite products. The CustomizedBoneä implant was previously marketed in the U.S. by Integra Lifesciences.

Laura Reed, Kelyniam's National Sales Director said, "Fin-ceramica's unique implant is a great fit for our company, specifically because of integrative properties of hydroxyapatite and the implant's commercial success in Europe. Our corporate cultures are very similar, both focusing on state of the art, patient focused technology that provides excellent aesthetic outcomes."

Gabriele Esposito, Finceramica's Global Marketing & Sales Director said "It is a really important agreement for Finceramica. We are very proud to collaborate with a specialized company in cranioplasty like Kelyniam."

"Based on the large experience and success we have in EMEA markets with Relevant Clinical Data to support Product safety and efficacy, we are confident that this partnership with Kelyniam will allow the development of the CustomizedBoneä in U.S.," said Giorgia Conti, Finceramica's International Product Manager.

About Finceramica

Fin-Ceramica Faenza S.p.A. stands for Italian excellence. Established in 1992 in Faenza (Italy) as a spin-off of the Institute for Science and Technology for Ceramics (ISTEC-CNR), it was later taken over by the Tampieri Financial Group, which, though active in completely different sectors, understood its great added value and invested heavily to boost its growth. Finceramica combines the tradition of ceramic processes with the innovation of the biomedical field. It designs and manufactures medical solutions from organic material for the repair and regeneration of bone and cartilage tissues. The chemical composition and porous structure of the the biomaterials lead to its colonization from the human cells. This contributes to a speedier recovery. Concerning cancer care, CustomizedBoneä implants make it possible to perform cancer extirpation and cranial cavity reconstruction during the same surgery, thus optimizing resources. Finceramica boasts a wealth of international experience, focusing on niches of excellence worldwide.

About Kelyniam

Kelyniam Inc., specializes in the rapid production of custom prosthetics utilizing computer aided design and computer aided manufacturing of advanced medical grade polymers. The Company develops, manufactures, and distributes custom cranial and maxillo-facial implants for patients requiring the reconstruction of cranial and certain facial structures. Kelyniam works directly with surgeons, health systems and payors to improve clinical and cost-of-care outcomes. Kelyniam's web site address is www.Kelyniam.com.

As a cautionary note to investors, certain matters discussed in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such matters involve risks and uncertainties that may cause actual results to differ materially, including the following: changes in economic conditions; general competitive factors; the Company's ability to execute its service and product sales plans; changes in the status of ability to market products; and the risks described from time to time in the Company's SEC reports.

Cision View original content:https://www.prnewswire.com/news-releases/kelyniam-global-inc-announces-strategic-licensing-agreement-with-fin-ceramica-faenza-spa-to-market-hydroxyapatite-cranial-implant-in-the-us-301449764.html

SOURCE Kelyniam Global, Inc.

This company is going to be a monster imo. Or get bought out. Big bucks!

https://www.kelyniam.com/

Lol. I don’t think these otc traders realize how big that news was today. This stock will see new highs very soon imo.

This is going to fly into close. Bottom all over again. Chat rooms plotting.

NOPE! it was a pump n dump and the dumpin' aint over. Watch what happens when they have to raise $$$$ (and they will have to raise $$$)

KLYG gonna run very hard ,matter of time

NOPE... they have ZERO cash -- operating on credit line that's already drawn down tens of thousands. Did you even read the filings? THEY HAVE NO WORKING CAPITAL.

Watch what happens when they announce a capital raise.

KLYG~~.15,,BB bands width ,will explode here, http://charts.stockfetcher.com/sfchart/EmpZaYdi36.png

KLYG~~amazing chart to break Crazyy towards .90 cents,load fellas,,,,http://charts.stockfetcher.com/sfchart/Ysbq14rJgG.png

KLYG~~.14/.149 MM NITE on L2 parked on L2 @$5.49 pps,this is freaking huge,load before the crowd big time

KLYG~~.14,was .80++ cents,BOOMAGE breakout very shortly, load now,,

http://charts.stockfetcher.com/sfchart/n3zeUS3Paf.png

KLYG~~CRAZYY HUGE~Subsidiaries: Med-Ally LLC, M2 Systems LLC

Founded: 2005

Headquarters: Connecticut

Number of employees: 0 (2009)

Subsidiaries: Med-Ally LLC, M2 Systems LLC

D

~Med-Ally LLC~~~~~https://med-ally.com/

read here https://www.linkedin.com/company/kelyniam-global/

KLYG~~look here,bottom reversal http://charts.stockfetcher.com/sfchart/5JyFwaT5no.png

KLYG .14,,buy and HOLD<TARGET $5-$10.00 PPS,is a unique monster to break into dollars pps shortly,Unique business ,soon FDA approved for their patent business, NO dilution,look at the SS every day on OTC,, https://www.otcmarkets.com/stock/KLYG/security, ,same for multi months ago, I loaded and loading more every day

What's your latest take on this?

KLYG~soon $1.00++PPS,A/S 60M,O/S 25M,FLOAT,9.6M

,https://www.otcmarkets.com/stock/KLYG/security

KLYG~~will run very hard soon,loading more, http://charts.stockfetcher.com/sfchart/mtOjQy7Wd6.png

KLYG~~Business Summary

Logo Kelyniam Global, Inc.Kelyniam Global, Inc. is a medical device manufacturing company. The Company is engaged in the production of custom prosthetics utilizing computer-aided design and computer-aided manufacturing of medical-grade polymers. Its Engineering Division uses Bio-Computer Aided Design (CAD) Computer Aided Manufacturing (CAM) technology to provide replicated cranial implants to replace damaged bone structures. Its product, PEEK-Optima, is engineered for biocompatibility. Derived from the patient's computed tomography (CT) scan data, the Company's 3D BIO-CAD/CAM software is used to transfer the details found on the edge of the defect directly to the implant edge. Its K-Plans include ke24, ke72 and kp5day. The Company's emergency plan, ke24, provides precision-replicated, patient-specific cranial implants in approximately 24 hours. The ke72 plan provides the implants in approximately 72 hours. Its kp5day is a physical implant verification service.

Sales per Business

2019 2020 Delta

Custom Prosthetics 2.18 100% 2.51 100% +15.07%

USD in Million

Sales per region

2019 2020 Delta

United States 2.18 100% 2.51 100% +15.07%

USD in Million

Managers

Name Title Age Since

Ross Bjella Chairman & Chief Executive Officer - 2018

Terrance Kurtenbach Chief Financial Officer - 2020

Christopher Breault Chief Operating Officer - 2017

Mark V. Smith, Dr. Vice President-Business Development - -

Members of the board

Name Title Age Since

Ross Bjella Chairman & Chief Executive Officer - 2018

Equities

Vote Quantity Free-Float Company-owned shares Total Float

Stock A 1 25,150,645 16,022,500 63.7% 0 0.0% 63.7%

Shareholders

Name Equities %

Carret Asset Management LLC 27,500 0.22%

Company contact information

Kelyniam Global, Inc.

97 River Road

Suite A

Collinsville

Canton, CT 06019-3246

Phone : +1.800.280.8192

Fax : +1.501.641.2000

Web : http://www.kelyniam.com

https://www.marketscreener.com/quote/stock/KELYNIAM-GLOBAL-INC-120791561/company/

KLYG~~CEO Ross Bjella

About

Alithias is a healthcare technology that provides custom software, data analytics and patient advocacy support to self-insured employers, insurance companies, TPAs, brokers, health systems and benefit services providers to help employees make value based healthcare decisions, understand their clinical care path and get the most from their benefit plan design. Our solutions save our clients money by reducing the friction around making healthcare decisions and turning complex and confusing data into actionable information. Our technology is easy to use and can be quickly customized to accommodate client needs. Alithias saves our clients hundreds of thousands of dollars every day.

The Alithias team is made up of outstanding individuals with deep experience in human resources, insurance, patient advocacy, population health and big data analytics. Our clients are forward thinking employers, co-ops, TPAs, insurance companies and providers; all of whom are committed to finding real healthcare value.

In 2011 I helped Kelyniam receive FDA clearance for their first 510(k). In 2017, I helped restructure the company and now serve as Chairman and CEO. Kelyniam specializes in 3D printing technology and related software development to create innovative medical devices.

I am an angel investor focused on healthcare related software and early stage medical devices, especially those requiring leadership or strategic help. I typically take an active role in my investments, and have a proven history of taking declining or struggling companies and turning them into high growth businesses.

Specialties: Leadership, strategy, execution, branding and positioning, sales management, contract negotiations, business development, performance maximization and accelerating growth

…

see more

Featured

LMI Canada presents - The Productive Leadership Institute

YouTube

The su

Experience

Alithias, Inc.

Founder and CEO

Company NameAlithias, Inc.

Dates EmployedJan 2010 – Present

Employment Duration12 yrs

LocationMilwaukee, WI

Alithias - Employee Driven Healthcare. Alithias provides self-insured employers a program proven to reduce the healthcare costs. Our unique web based interface enables employers to understand their data and allows our Care Navigators to efficiently engage employees to support their healthcare decisions. The result is thousands of dollars in healthcare cost savings to both employers and their employees. We count TPAs, insurance companies, self-insured employers, business coalitions, school districts and consultants as our client partners giving us access to >80,000 lives. We can support most companies with employees across the U.S.

Kelyniam Global Inc.

Chairman and CEO

Company NameKelyniam Global Inc.

Dates EmployedDec 2017 – Present

Employment Duration4 yrs 1 mo

LocationCanton, CT

Kelyniam is medical device manufacturer specializing in 3D printing and CAD of medical devices, currently focused on the custom cranial implant market. In 2010-12 I helped Kelyniam through the 510K approval process, their ISO 13485 certification and setting up the sales organization. I re-engaged with the company in late 2017 to lead a turnaround effort and became Chairman and CEO in December. I am excited to again work with this team as we expand the product line and establish proper business controls to position the company for long term success.

…

see more

Pharmexsys

Principal

Company NamePharmexsys

Dates EmployedJan 2010 – Present

Employment Duration12 yrs

LocationGreater Milwaukee Area

Pharmexsys is a management consulting firm primarily focused on helping emerging pharmaceutical companies enter the U.S. market by select the right 3PL partner, State licensing support, packaging solution and supply chain strategy. Nearly all of my clients come from referrals and I will freely share my network of contacts and help prospective clients through immediate issues. Most initial engagements are at little or no cost - my goal is to have long term relationships. My clients also include 3PLs looking for strategic solutions, management support and leadership experience. Recent clients include Ionis Pharmaceuticals (specialty / orphan / 3PL), Apollo Pharmaceuticals (generic injectables / 3PL), Horizon Pharmaceuticals (branded / specialty / 3pL), Supernus (branded / 3PL), Relypsa (specialty / 3PL), Alkermes (3PL selection) Smith Medical Partners (strategy) and other 3PL service providers (strategy and management support).

…

see more

DDN Pharmaceutical Logistics

President

Company NameDDN Pharmaceutical Logistics

Dates EmployedApr 2004 – Jan 2010

Employment Duration5 yrs 10 mos

I was recruited by the President to lead the sales effort at this (then) $27M business process outsourcing company. The company had 22 clients and was adding 2 new clients per year but was not replacing lost clients fast enough.

• Restructured the sales organization and executed a new strategy that increased new client acquisition >1000% from 2 per year to >2 per month.

Promoted to President when the owner bought out other family members and took a corporate position overseeing other divisions. The company had two years of declining profits due to client losses and the brand was not differentiated in the market.

• Held all P&L responsibility for this 300 employee division that distributed >$7B of product annually from distribution centers in TN and CA.

• Increased service margins >20% and operating margins >50%; grew net profit >10X from <$500K to >$5M in 3 years

• Established a corporate presence in India that resulted in capturing >60% of the business from that country

• Led a rebranding campaign that repositioned the company from a warehousing and logistics support operation to a full-service business process outsourcer

• Executed a strategic planning process that resulted in launching new, profitable services

• Developed a management team that led DDN to become the fastest growing business in the segment while competing against UPS, Cardinal Health and Amerisource Bergen.

…

see more

Schwarz Pharma

Director, U.S. Sales, Marketing and Business Development

Company NameSchwarz Pharma

Dates EmployedFeb 1998 – Apr 2004

Employment Duration6 yrs 3 mos

Responsible for sales of all cardiovascular products for this $250 million subsidiary encompassing 22 Districts and 3 regions. Worked collaboratively with marketing, manufacturing, operations, finance, IT and HR to determine personnel needs, develop sales strategies and forecasts, create incentive programs, set and allocate sales objectives, identify market opportunities and resolve customer problems. Managed a 250 person national sales team through 5 direct reports. Developed and executed acquisition and partnership strategies for U.S. and international initiatives to build the product pipeline. Responsible for leading a Product

Management team in brand management and forecasting sales for 5 promoted brands and >100 SKUs with total sales >$70MM.

…

see more

Show 3 more experiences

Education

University of Southern California

University of Southern California

Degree NameMBAField Of StudyMarketing, Finance

Dates attended or expected graduation1993 – 1995

University of Minnesota

University of Minnesota

Degree NameBSField Of StudyBiology

Dates attended or expected graduation1981 – 1987

Activities and Societies: IRSEP scholarship winner, Rekjavik, Iceland 1985 - 1986

University of Southern California - Marshall School of Business

University of Southern California - Marshall School of Business

Degree NameMaster of Business Administration - MBAField Of StudyMarketing

Skills & endorsements

Strategy

See 178 endorsements for Strategy99+

person

Endorsed by Chris Efessiou and 6 others who are highly skilled at this

company

Endorsed by 11 of Ross’ colleagues at Schwarz Pharma

Cross-functional Team Leadership

See 127 endorsements for Cross-functional Team Leadership99+

person

Endorsed by Praveen Shah, who is highly skilled at this

company

Endorsed by 12 of Ross’ colleagues at Schwarz Pharma

Start-ups

See 118 endorsements for Start-ups99+

person

Endorsed by Alex Fair and 6 others who are highly skilled at this

company

Endorsed by 9 of Ross’ colleagues at Schwarz Pharma

Show more

Show all of Ross’ skills

Recommendations

Received (42)

Given (23)

NIGEL LEBLANC

NIGEL LEBLANC

Founder/CEO at Cyber Warrior Network

January 7, 2013, Ross worked with NIGEL in the same group

Ross is the definition of a mentor. I was fortunate to have him as my mentor during the Victory Spark Program (Only Veteran Business Accelerator). His guidance was instrumental in helping to develop our business model, some key strategic alliances and a rock solid revenue model that will help us achieve prof... See more

Dennis Breakstone

Dennis Breakstone

Senior Director, National Accounts Leader - DOD/VA, Public Health at Dynavax Technologies

October 8, 2012, Ross was senior to Dennis but didn’t manage directly

I write this letter of recommendation for Ross Bjella based on my business interaction with him. Ross did an excellent job building his sales and marketing teams including providing a strong understanding of team rather than individual. This allowed his team to remain focused on the company objectives of ... See more

Melinda Rodriguez- Tercius

Melinda Rodriguez- Tercius

RN at Aurora Health Care

June 17, 2012, Melinda reported directly to Ross

Ross is an exceptional mentor and leader who challenges his interns to take it to the next level. As Ross's intern his expertise in sales and business process has taught me a great deal. His passion for Alithias and the difference it will make is inspiring. I would recommend Ross in any capacity!

Theresa Rhoades Willerup

Theresa Rhoades Willerup

Manager, Account Management (Large, Major, ASO) at Blue Cross of Idaho

August 2, 2011, Theresa was a client of Ross’

Ross is extremely professional, dedicated, diligent, and a pleasure to work with. He has a keen sense for strategic planning, and is not afraid to recommend improvements or adjustments when he recognizes a need to do so. He is diligent and timely in his responses, always well prepared, and conducts himself... See more

Bob Weston

Bob Weston

Supply Chain Consultant

June 21, 2011, Bob was a client of Ross’

I have known Ross for almost ten years. Ross was President of DDN, and P&G Pharmaceuticals utlilized DDN capabilities when we (P&G Pharmaceuticals) selected the Memphis site as our Business Continuity Plan site. Ross possesses a broad knowledge base of the Pharmaceutical industry, and has the abilit... See more

Gregg Stanhope

Gregg Stanhope

Director, Professional Affairs

January 23, 2011, Ross was senior to Gregg but didn’t manage directly

Ross Bjella was a very astute Marketing Mgr who saw the big picture and then developed impactful strategies and tactics aligned to the overall corporate goal in order to achieve sales objectives. Ross was viewed at Allergan as a team player who would help anyone with their development in order to... See more

Anthony Barone

Anthony Barone

Director Of Business Development at EmployBridge

December 30, 2010, Ross was senior to Anthony but didn’t manage directly

During my tenure with Schwarz Pharma, Ross was the Director of US Sales. His knowledge and acume of our industry was unsurpassed, he has the skills to drive any business to the top. Truly one of the finest individuals I have had the pleasure to work with within the medical industry.

Cherie Godin

Cherie Godin

Regulatory Affairs

December 18, 2010, Cherie worked with Ross in different groups

Ross identified a market opportunity and successfully launched a new Medical Affairs business. His strong relationships with employees and customers enabled the company to quickly get established in the market. I enjoyed working in Ross' organization and would recommend him for any senior management position.

Bob DeBartolo

Bob DeBartolo

Healthcare & Life Sciences Strategist

November 20, 2010, Bob was senior to Ross but didn’t manage directly

I worked with Ross, at Allergan, back in the day. In addition to being a great guy, what I remember most about Ross is his intellectual curiosity. I believe that has taken him a long way. Conversations with Ross were always thoughtful. I remember when we were trying to figure out how to beat Timopt... See more

Sabine Harning

Sabine Harning

Director, Marketing Pipeline Products at Boehringer Ingelheim

November 13, 2010, Sabine reported directly to Ross

Ross was my first manager when I had moved to the U.S. Due to his international background he was very helpful making me feel comfortable in the US working environment. He is a structured thinker and is very goal oriented but is also making sure that people enjoy their work. I really enjoyed working with ... See more

Dave Riccio

Dave Riccio

Executive VP at MJH Life Sciences Inc.

November 13, 2010, Ross was senior to Dave but didn’t manage directly

Ross is a seasoned and experience marketing person able to provide keen insight and solutions to long term as well as day to day product marking challenges. He demonstrates solid leadership as well as compasion for the individuals he is respondsible for and he is one person you can trust to... See more

Terry Prime

Terry Prime

Executive Director, Biologics Global Marketing

November 8, 2010, Terry worked with Ross in different groups

I had the pleasure of working with Ross in the Marketing Department during his tenure at Schwarz Pharma, when he had several responsibilities in the commercial business. Ross was able to transition successfully through Marketing, Business Development and Sales leadership roles because of his drive and focus on achieving results. He applied strong skills in commercializing pharmaceutical products to each of his responsibilities and was able to adapt those skills to new roles as he progressed through the commercial organization. A decisive activator, Ross is excellent at identifying an opportunity, developing a plan to get results and implementing with excellence. It would be a pleasure to work with Ross again in the future. See less

https://www.linkedin.com/in/rossbjella/#

Guess no one cares about new patent lol

KLYG~~Williams % RSI(14) , http://charts.stockfetcher.com/sfchart/rTRdgnE03t.png

KLYG~~.145,chart, http://charts.stockfetcher.com/sfchart/g27VTxwEgs.png

KLYG~~huge news!! Kelyniam Global Receives U.S. Patent for Integrated Fixation Tabs

PR Newswire

COLLINSVILLE, Conn., Dec. 1, 2021

COLLINSVILLE, Conn., Dec. 1, 2021 /PRNewswire/ -- Kelyniam Global, a leader in the design and manufacture of custom cranial implants, is pleased to announce that the United States Patent and Trademark Office has issued the company an Issue Notification for a patent covering the company's Integrated Fixation Tabs, currently marketed as IFS Tabs or KwikTabs. The US patent covers the integration of fixation appendages into a cranial implant and their design. The patent was filed in 2014 and will run through 2037.

The company intends to vigorously defend the patent and will ensure the Company's historical and future interests in this innovative technology will be protected.

"The integrated fixation patent is one of many marketplace-leading firsts for Kelyniam," said Ross Bjella, Chairman and CEO. "The company was the first to use additive manufacturing to create custom PEEK implants, the first to receive FDA certification for temporal cutbacks and the first company to consistently deliver custom implants overnight. Receiving this patent validates Kelyniam's commitment to innovation and our ability to bring leading technology to the market."

Integrated fixation can eliminate the need for expensive plates and screws, saving patients thousands of dollars per procedure. Surgeons work with a Kelyniam Design Engineer to place the fixation tabs exactly where they are needed, which also facilitates surgical planning. Not having to place unwieldly plates and screws to secure an implant can reduce the amount of surgical time, an important benefit in cranial surgery. Fewer plates and screws can also result in a more cosmetically elegant fit for the patient.

Kelyniam Inc., specializes in the rapid production of custom prosthetics utilizing computer aided design and computer aided manufacturing of advanced medical grade polymers. The Company develops, manufactures, and distributes custom cranial and maxillo-facial implants for patients requiring the reconstruction of cranial and certain facial structures. Kelyniam works directly with surgeons, health systems and payors to improve clinical and cost-of-care outcomes. Kelyniam's web site address is www.Kelyniam.com.

As a cautionary note to investors, certain matters discussed in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such matters involve risks and uncertainties that may cause actual results to differ materially, including the following: changes in economic conditions; general competitive factors; the Company's ability to execute its service and product sales plans; changes in the status of ability to market products; and the risks described from time to time in the Company's SEC reports.

Cision View original content:https://www.prnewswire.com/news-releases/kelyniam-global-receives-us-patent-for-integrated-fixation-tabs-301435807.html

SOURCE Kelyniam Global, Inc.

Keep your day job. I suggest you read the filings.

Suggest you read the filings

Do you know how "WORKING CAPITAL" is defined?

Have you noticed that they only have $672 in cash?

They have a niche market but they are struggling. The filings are going to determine where this stock price settles --- not internet hype.

“This is from a guy over on Stock Twits: “

Please?

I heard from a guy Chick Fil-a is going into IH&AI

If filings were wrong, OTC would have kicked the application out and this would not be Yield sign current

But go with your gut.

You never know about these.

They put out the effort at the 11th hour for a reason.,

Good luck

Fink, here is the link to the Stock Twits Board.

https://stocktwits.com/symbol/KLYG

There is more happening over there.

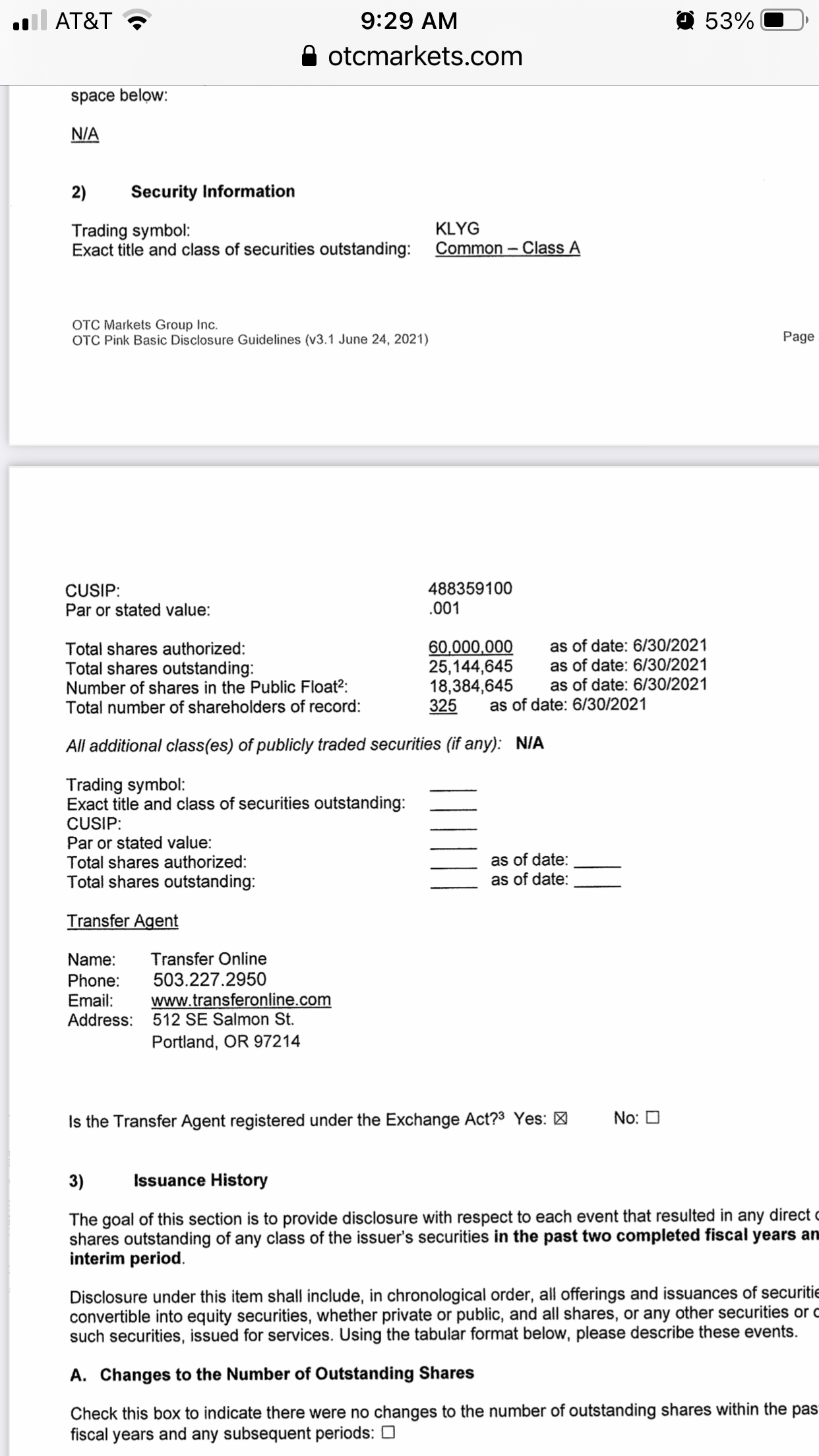

Fink, your screenshot clearly states that the O/S is 25m, and the public float is 18m, BUT, Like I said, the trade-able float is 9.567m

This is from a guy over on Stock Twits:

A/S = 60,000,000 (Authorized Shares = Maximum shares the company can issue)

O/S = 25,150,645 (Outstanding Shares = Total number of shares that have been issued to date)

Of the O/S, there are 6,766,000 shares restricted (can't trade) and 18,384,645 shares that are unrestricted.

The unrestricted shares can be traded. BUT, only 9,656,840 shares can be traded in the public market, the other 8,727,805 are on the books at the Transfer Agent, and if you wanted to trade those shares, it would have to be in private transactions.

Look at the chart, this thing moves fast and liquid.

I go by what the filings say.

If my information is good enough for them to get current with, I’m going with that.

OTC matches up filings with info from the T/A.

If the float went down, then who bought and retired them back into treasury?

It’s still a low floater play anyways.

I only invest in shell plays. Not Companies.

Good luck to all.

This should be a .60+ stock.

Maybe after they get Pink current snd everyone can buy.,

Hell I can always be wrong too??

|

Followers

|

52

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

2586

|

|

Created

|

07/10/08

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |