Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

That would be great eagle, 'cept I think he's on X now.

We want $heff back back here! :)

Prior post deposited here in error.

I respect that $heff has ended his great board and it should be left alone, imo

What Gives?

Breitbart Business Digest

by John Carney - Breitbart Economics Editor

and Alex Marlow - Breitbart Editor-In-Chief

November 28, 2023

Fed Is Fighting Itself on Rates and Inflation

Does the rule that you cannot fight the Fed apply if the Fed is fighting itself?

Tuesday saw a clear demonstration that the mixed signals on the economy are dividing the Fed. In speeches given thousands of miles apart, two Trump-appointed Federal Reserve governors appeared to be sharply divided on the question of whether interest rates are likely already high enough to bring inflation back to the central bank's two percent target.

Fed Governor Chris Waller, who for years ran the economics research program at the St. Louis Fed and was brought to President Trump's attention by then St. Louis Fed president Jim Bullard, said in a speech in Washington that the pace of the economy appears to have slowed enough to suggest monetary policy is tight enough.

Waller's talk Tuesday was titled "Something Appears to Be Giving," a reference to a speech he gave in mid-October with the title "Something’s Got to Give." In that speech, Waller argued that the recent combination of falling inflation and accelerating growth was likely to be unsustainable. "Either growth moderates, fostering conditions that support continued progress toward our 2 percent inflation objective, or growth doesn't, possibly undermining that progress," Waller said.

Waller's speech Tuesday said that growth does appear to be moderating, which would allow disinflation to continue.

Federal Reserve Governor Christopher Waller at a Fed Listens event in Washington, DC, on Sept. 23, 2022. (Al Drago/Bloomberg via Getty Images)

“I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2 percent,” Waller said Tuesday in remarks delivered to an event at the American Enterprise Institute in Washington, DC. “I am encouraged by what we have learned in the past few weeks — something appears to be giving, and it’s the pace of the economy.”

Waller argued that data on economic activity in October indicated that spending is cooling.

"Retail sales fell 0.1 percent, the first drop since March. Spending was down on motor vehicles, an interest-sensitive sector, which may be evidence that that the FOMC's tightening of monetary policy is having some effect. Spending was also down at gasoline stations, mostly because of a sizable decline in gas prices, often a larger factor for this segment of retail than shifts in demand. But even without motor vehicles and sales at gas stations, retail sales barely increased in October, which may reflect a broad-based moderation in demand," Waller argued.

Although Waller did not point it out, in real terms the decline was even more marked. After adjusting for the change in consumer prices, real October spending fell 0.2 percent. Consumer demand for goods fell 0.2 percent from the month prior in nominal terms. In real terms, goods spending fell 0.6 percent, according to the Conference Board.

Waller also pointed out that the labor market appears to be cooling off and there are signs that manufacturing and non-manufacturing activity by businesses slowed in October.

Bowman Stands Ready to Hike Further if Inflation Stalls

Fed Governor Michelle Bowman, in a speech to bankers and businessmen in Utah, was far less sanguine, describing the recent economic data as "uneven."

“My baseline economic outlook continues to expect that we will need to increase the federal funds rate further to keep policy sufficiently restrictive to bring inflation down to our 2 percent target in a timely way,” Bowman said.

In her speech, Bowman went through an extensive list of reasons to be wary that the disinflationary pressures that brought inflation down in recent months will continue to dominate. She noted that much of the progress in the past year has come from the supply side—including supply chain improvements, increases in labor force participation, and falling energy prices—but that it is unclear if they will keep putting downward pressure on prices. The inflation-dampening improvements from supply side, she implied, may run out of steam.

Federal Reserve Governor Michelle Bowman (right) and Chairman Jerome Powell at Fed Listens event in Washington, DC, on Oct. 4, 2019. (Zach Gibson/Bloomberg via Getty Images)

Bowman also pointed to the risk that higher services consumption could create sticky inflationary pressures and the lack of fiscal restraint in government spending was an ongoing danger. What's more, households still have significant excess savings that could continue to drive consumer spending at high levels.

She seemed to be directly addressing her Fed colleagues and the Biden administration by warning against "prematurely" declaring victory over inflation.

“We should keep in mind the historical lessons and risks associated with prematurely declaring victory in the fight against inflation, including the risk that inflation may settle at a level above our 2% target without further policy tightening,” Bowman said.

The Market Sides with Waller

Financial markets liked Waller's message much better than Bowman's. Stocks rose for the day, and long-term Treasury yields fell. The odds of a rate cut at the Fed's May meeting, as read by the CME FedWatch Tool, moved from around 50 percent earlier this week to near 65 percent on Tuesday.

This likely says more about the bullish mood of Wall Street than the quality of the economic assessments of Waller and Bowman.

$BIOL - EARNINGS BEAT

2021 Second Quarter Operating Highlights (all comparisons are on a year-over-year basis unless specified otherwise):

Net revenue grew 211% to $9.1 million:

Over 70% of U.S. laser sales came from new customers, continuing a positive trend

Over 35% of U.S. Waterlase sales came from dental specialists

Net revenue was 6% higher than the pre-pandemic revenues during the second quarter of 2019

Laser system sales increased 424%

Consumables and other revenue increased 173%

U.S. and international revenue increased 167% and 340%, respectively, as more dental practices were operating during the 2021 second quarter compared to the year-ago second quarter due to the COVID-19 pandemic

Gross margin was 44%, up 1,200 basis points, due to the higher year-over-year revenue, favorable revenue mix and higher average selling prices for products sold during the quarter

Net loss was $702,000 or $0.00 per share, compared to a net loss of $4.7 million or $0.12 per share a year ago

Maintained strong balance sheet, as cash and cash equivalents totaled $37.1 million at quarter end

$ATVK

$ATVK there it is 🔥🔥🔥 pic.twitter.com/3E6HEeifag

— MOMO (@pennystockmomo) November 17, 2020

$PSTI The force is strong with this one...

COVID-19

1. kENUP Foundation is currently supporting the following product developments, listed here in alphabetical order, all with the aim to reach patients during 2020:

ChAdOx1 nCoV-19

a replication-deficient simian adenoviral vector vaccine candidate ready for rapid clinical testing.

Under development by the European-based operations of Vaccitech Limited, Oxford and the University of Oxford, with initial vaccine manufacturing anticipated to take place at facilities in the UK and Italy.

COVAX

a measles vector vaccine candidate.

Under development by Themis Bioscience GmbH, Vienna, in cooperation with Institut Pasteur, Paris, with manufacturing anticipated to occur in Germany.

Hydroxychloroquine

repurposing of Hydroxychloroquine for COVID-19 prophylaxis to protect medical staff.

Under development by Pharmakina SA, Democratic Republic of Kongo, in cooperation with the Institute for Tropical Medicine, Travel Medicine, and Human Parasitology, Prof. Dr. Peter Kremsner, of Eberhard Karls Universität Tübingen.

mAbCo19

a therapeutic and prophylactic human monoclonal antibody candidate.

Under development by AchilleS Vaccines Srl Siena, in cooperation with the

laboratory of Dr. Rino Rappuoli, with manufacturing anticipated to occur in Italy

NVX-CoV2373

a RNV vaccine candidate.

Under development by Novavax Inc., and Novavax AB, Uppsala, with both antigen-manufacturing and adjuvant-manufacturing anticipated to occur in the EU.

plant-based protein production

a proprietary plant-based expression platform to mass-produce recombinant antigens and antibodies for use in diagnostics.

Under development by Cape Bio Pharms (Pty.) Ltd., Cape Town.

PLX-PAD

a cell therapy candidate for the treatment of severe pneumonia due to COVID-19.

Under development by Pluristem Ltd., Haifa, and Pluristem GmbH, Berlin.

VPM1002

usage of novel, recombinant BCG vaccine for the prevention of COVID-19 via the induction of trained immunity.

Under development by Serum Institute of India Pvt. Ltd., Bilthoven Biologicals B.V. and Vakzine Projekt Management GmbH (VPM), in cooperation with the Max Planck Institute for Infection Biology, Berlin.

Please dont hesitate to get back to us with any questions or comments you may have. The team can be reached at covid19@kenup.eu.

Last updated on April 9, 2020 at 07:30h

MIST bottomed? can it go any lower?

MIST Daily chart

$ALPP They Just Canceled the R/S. Repeat no R/S. BOOM.

https://www.sec.gov/Archives/edgar/data/1606698/000144586620000348/alpp_8k.htm

$PSTI Pluristem Changes the Game with Strong Preliminary COVID-19 Results; Analyst Says ‘Buy’

TipRanks•April 8, 2020

With the war against COVID-19 waging on, Wall Street focus has locked in on the names at the frontline. Battling a formidable opponent capable of spreading without a trace, innovative technologies will be required to arm the world’s population. As such, market watchers are standing at the ready, hoping to identify the healthcare companies that can deliver effective weapons against the deadly virus.

Pluristem Therapeutics (PSTI) has a fighting chance. On April 7, the company reported its treatment for acute respiratory failure and inflammatory complications caused by COVID-19 had demonstrated robust preliminary results from the compassionate use program, sending shares 21% higher in response. Back in March, its PLX cell treatment, which uses allogeneic mesenchymal-like cells with immunomodulatory properties, got the go ahead from the Israeli Ministry of Health for use in treating severe COVID-19 patients on a per-patient basis. The therapy was designed to prevent or even reverse the harmful over-activation of the immune system.

The results have been promising to say the least. Management stated that so far, seven patients in the ICU with Acute Respiratory Distress Syndrome (ARDS) have been treated. All of the patients are alive, meaning that the survival rate is 100%, and six out of seven have progressed through at least one week of follow-up. On top of this, four patients saw respiratory parameters improve, one remained stable and only one demonstrated deterioration. Three are also in the advanced stages of being taken off ventilators.

Weighing in for H.C. Wainwright, analyst Swayampakula Ramakanth calls the early data “encouraging” and thinks the treatment could drive substantial gains for PSTI, with the next step being a regulated and multinational clinical study.

“In our view, with the ongoing pandemic affecting nearly every country and stressing healthcare systems around the world, new, effective treatments are urgently needed. Therefore, we believe that both the FDA and the EMA may expedite the approval for clinical studies and simply the regulatory paths going forward. With regulatory expediency and patients only needing a 28-day follow-up, we believe the company could complete the initial studies and report results in 2H20,” Ramakanth explained.

In line with this optimistic take, Ramakanth left a Buy rating on the stock. At $15.50, the price target puts the upside potential at a whopping 277%. (To watch Ramakanth’s track record, click here)

As for other analyst activity, it has been relatively quiet when it comes to PSTI. Only one other call has been issued recently, but it was also bullish, so the analyst consensus is a Moderate Buy. The $11.75 average price target is less aggressive than Ramakanth’s and implies 173% upside potential. (See Pluristem stock analysis on TipRanks)

$PIRE is undiscovered right now volume picking up I think will break $1 next week!

BXRX =MC $52 M --FDA Decision in Q1 for a BIG Drug -- unknown low float stock =500%++ UPSIDE .LIFETIME OPP

Janney starts Baudax Bio at buy; fair value estimate $12

https://biotuesdays.com/2019/11/22/janney-starts-baudax-bio-at-buy-fair-value-estimate-12/

Baudax’s key product is Anjeso, a long-acting intravenous formulation of meloxicam, an established non-opioid pain reliever, available through an oral formulation. “We see a high probability of FDA approval in the first quarter of 2020, which would be a meaningful catalyst to drive the stock towards our fair value,” writes analyst Ester Hong.

She estimates peak U.S. sales of $355-million for Anjeso but sees “upside from increased demand for a potent non-opioid that allows patients to recover and go home faster.”

$RLBY could Gap and Run Huge 14f-1 filing, likely uplist here

https://t.co/9sjIf1thMS

$MGI- on fire possible buyout

MKGI - Monaker Group Acquires Key Inventory and Travel Services from IDS Technology for $5.5 Million

www.monakergroup.com

WESTON, FL – August 22, 2019 – Monaker Group, Inc. (Nasdaq: MKGI), a technology leader in the travel and vacation rental markets, today announced it has completed an asset purchase with leading travel technology provider, IDS Technology to enhance its Monaker Booking Engine (MBE) and nexttrip.biz platform, adding new capabilities and an additional 500,000 properties in North America.

The terms of the agreement include the purchase by Monaker of key assets and technology - from IDS - along with software development and integration services for a total of $5.5 million. The consideration payable to IDS is $634,000 in cash and 1,968,000 restricted shares of Monaker’s common stock valued at $2.50 per share.

“This technology acquisition and transaction with IDS creates an opportunity to dramatically enhance our travel technology platform and accelerate our transaction growth,” said Monaker CEO, Bill Kerby. “The IDS assets will also help us to further strengthen our nexttrip.biz business travel solution with a broader selection of vacation rentals suitable for corporate travel, and are expected to capture higher margin revenue streams.”

Mr. Kerby noted that, with IDS accepting mostly restricted equity in this transaction and at an above-market valuation, “It is an indication of their confidence in Monaker’s ability to enhance shareholder value, and to be a true partner in this endeavor. It also validates the power of Monaker’s existing MBE and nexttrip.biz platforms and their greater potential.”

The purchased assets and services include:

API software development to provide for instant-booking access to more than 500,000 North American vacation rental properties. This access will more fully round out Monaker’s existing vacation rental inventory which has been located primarily in Europe and Asia. Additional Alternative Lodging Rental (ALR) products, commonly referred to as vacation rentals, will also be added, including wholesale access to exclusive high-value offerings.

Exclusive ownership of IDS booking engine software technology for air, car, and hotel reservations, including proprietary API connections to travel providers and distributors. This will make MBE a more complete B2B solution for the simultaneous booking of air, car and hotel, rather than relying upon integration with existing client booking systems. It will enable MBE and nexttrip.biz to capture new revenue streams from the booking of air, car and hotel, as well as broaden Monaker’s addressable market of B2B clients.

Exclusive access to key supplier contracts, including those for air, car, and hotel rentals, which will be accessed via the booking engine technology acquired from IDS.

The agreements are designed to acquire access to specialized, and in some cases unique, inventory for distribution through the company’s booking engine and nexttrip.biz.

A robust, cloud-based customer relationship management (CRM) platform to manage travel customer relationships and allow a more complete service offering.

Access to special merchant accounts that can support between $500,000 and $1 million per month in merchant processing capacity.

Mr. Kerby added that this important acquisition and stronger relationship with IDS was a “strategic extension” of the earlier engagement with IDS for the development of Monaker’s nexttrip.biz platform, which began last year.

Following the IDS technologies enhancement for nexttrip.biz, Monaker plans to commercially launch subscription-based, direct-to-consumer access to the site. For $19 per month or $150 per year, travelers worldwide will be able to gain access to wholesale-level pricing for all their travel needs, and create air, car, lodging - including vacation rentals -and tour packages, for additional savings.

About IDS Technology

IDS Technology is a software development company with nearly three decades of experience in the hospitality industry. As a leader in travel inventory aggregation and distribution, its Internet Distribution Systems empower more than 100 leading travel companies worldwide to stay competitive in the rapidly evolving travel industry. Its cloud-based travel software solutions help distributors and suppliers increase their revenue and boost efficiency through automated mapping technology, API connectivity, and profit optimization tools. Always at the forefront of travel technology development, its solutions perform across the entire distribution chain to support travel product suppliers, distributors and meta searches. For more information, visit www.ids.technology.

About Monaker Group

Monaker Group is a technology-driven travel company focused on delivering innovation to the alternative lodging rental (ALR) market. The Monaker Booking Engine (MBE) provides access to more than 2.6 million instantly bookable vacation rental homes, villas, chalets, apartments, condos, resort residences, and castles. MBE offers travel distributors and agencies an industry first: a customizable, instant-booking platform for alternative lodging. The company’s contracted travel partners include travel aggregators, consolidators, tour companies, airlines and more than 250,000 travel agents. For more about Monaker Group, visit?www.monakergroup.com.

About nexttrip.biz

Nexttrip.biz is customizable business travel booking and management solution for small and medium-sized businesses. Through a branded and customized website, business owners and employees can search for and securely access exclusive discounted pricing across air, hotel/ALR, car, and other ancillary travel services. Nexttrip.biz can be configured to an SMB’s particular travel policies, with bookings recorded for easy corporate expense tracking and reporting. For more information, visit www.nexttrip.biz.

Important Cautions Regarding Forward Looking Statements

This release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements give our current expectations, opinions, belief or forecasts of future events and performance. A statement identified by the use of forward-looking words including “will,” “may,” “expects,” “projects,” “anticipates,” “plans,” “believes,” “estimate,” “should,” and certain of the other foregoing statements may be deemed forward-looking statements. Although Monaker believes that the expectations reflected in such forward-looking statements are reasonable, these statements involve risks and uncertainties that may cause actual future activities and results to be materially different from those suggested or described in this news release. All forward-looking statements are expressly qualified in their entirety by the “Risk Factors” and other cautionary statements included in Monaker’s annual, quarterly and special reports, proxy statements and other public filings with the Securities and Exchange Commission (“SEC”), including, but not limited to, the company’s Annual Report on Form 10-K (as amended) for the year ended February 28, 2019 and the company's subsequently filed Quarterly Reports on Form 10-Q, which have been and will be filed with the SEC and are/will be available at www.sec.gov. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected. The forward-looking statements in this press release are made as of the date hereof. The company takes no obligation to update or correct its own forward-looking statements, except as required by law, or those prepared by third parties that are not paid for by the company.

Richard Marshall

Director of Corporate Development

$TRBO will be adding on monday below 10 cents

$TRBO looking awesome for a bottom bounce next week

Well, he's moved to bigger venues.

Hate to see the junk on the board now.

Should have just shut it down, imo. Preserve the integrity and reputation.

GLTA

MG

$GXXM

PROFITABLE COMPANY LOW OS

COME CHECK THE BOARD FOR NEW DD

AMAZING RUN COMING

Transcript of AMRN CEO Thero presentation at JPM:

https://seekingalpha.com/article/4232454

The transcript follows the text of slides[previous post] reasonably well.

AMRN: Presented Vascepa at JPM Health today, 12:30, CEO Thero:

https://tinyurl.com/y9shcxeh Dr. Bhatt

https://tinyurl.com/y7qp2yy3 Panel after AHA, November 10-12

https://www.amarincorp.com/

https://tinyurl.com/yaajygmp

https://tinyurl.com/y76z86ga

http://tinyurl.com/jnx6w6p

http://tinyurl.com/yb5cnzgq

https://investor.amarincorp.com/static-files/ace3d85c-408a-4322-b52c-9e2506f5558b

Last link corresponds to slide deck at JPM

Many $$$ Billion market for Vascepa is forecast

I have been prescribed Vascepa, off label, since April 2013. I currently co-pay $9 for a 3-month supply

$NSPX .0041? SEE WHAT DOCTORS ARE SAYING ABOUT ITS DRUG. SHOULD BE NO LESS THAN 10 CENTS DO U TRADE TO MAKE MONEY??!!

$NSPX 0041?! SERIOUSLY?!https://t.co/1PKOV8DPxx??? ; ;

LIKE HOW CAN PEOPLE LOOK THIS GIFT HORSE in the mouth like this???!! NSME AN OTC STOCK YOU KNOW trading at 0046 on the ask with only 150 million A/S. Now add that it's a pharmaceutical. NAME A PHARMACEUTICAL OTC STOCK with 150 million O/S trading less than 2 cents anywhere. AM I THE ONLY TRADER WHO DOES A COMPARATIVE MARKET ANALYSIS OF stocks???!!

Some say it went dark. Yes NSPX went dark after they purchased Lewis and Clark Pharmaceuticals A PRIVATE cancer biotech company with state of the art labs. Yes they went dark and silent but DID YOU SEE THE MASSIVE NEWS they silently released LESS THAN 3 MONTHS AGO???!! DID YOU???!

$NSPX eligible $12 MILLION from Transaction. Not 12 cents, 12 dollars, TWELVE MILLION DOLLARS!!!! Like this is nuts

https://t.co/2iNhYy7KfE ; ;

LOOK AT NSPX BREAKTHROUGH DRUG THAT COULD REPLACE CHEMOTHERAPY. This was on the NEWS. Cancer research/cures dont happen over night and MISPARGARIN HAVE ALREADY CURED PATIENTS that everything else failed. .0046????! What???!! LOOK.

$ATLS 0069!!??? Was $7 three years ago, $50 before that. FORMER NASDAQ once did 400 million in SALES. Dont sleep on 0072 on the ask. BADLY OVERSOLD 52 week high 10 cents!! ATLS only this low because its unknown. Not for long!

https://ih.advfn.com/stock-market/USOTC/atlas-energy-group-llc-ATLS/stock-news/78722130/quarterly-report-10-q

ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS ATLS

$SURG $0.40 Breakout is coming here

Check the weekly chart on it also

Hey Pete... $MLHC could use a chart bud ;)

Thank you sir !!

ACAD Sold 5000 $15 JAN19 PUT contracts and bought 5000 $27 Jan19 CALL contracts.

I admired it because the trade basically cost him nothing to put on by using the money he got paid on the PUTS he financed the cost of buying the calls. Of course this "Big Dog" obviously has the deep pockets necessary to satisfy the margin requirements of a trade this large.Re: JAN 2019 strike 27 vol.1.5 MILLION dollars risk at 1.80 vol. 7954

$BWMG New Dive system hits market,makes Kickstarter goal.

Yes! $40,965pledged of $40,000 goalKickStarter

69 backers 32 days to go

Not bad 30 hours and it made the goal, not bad at all. this is the smallest lightest dive system ever https://www.kickstarter.com/projects/diveblu3/nemo-by-blu3-the-worlds-smallest-dive-system?ref=discovery&term=nemo

$349 for whole product dive 1 hour+ to 10 feet with rechargeable battery.

It is BWMG product (Brownies)

The 6 packs are gone, so they raised price $300 for the 6 pack and made new a offer. If you read comments on KickStarter people are amazed at price.

BTW just who are buying 6 packs? Its dealers, scuba shops, they know a good deal when they see it, they will resell them.

If this goes viral, BWMG stock will go viral. Cool videos on the KS link above.

$AIMH..O/S of 133 mil,suspected float of 7 mil and THIS CHART=WOW!>>>>>https://www.barchart.com/stocks/quotes/AIMH

XXII: Tobacco/nicotine addiction control

https://content.equisolve.net/xxiicentury/news/2018-08-21_22nd_Century_Receives_Order_for_3_6_Million_351.pdf

BIOAQ melt up in progress. Legendary Q play in progress.

$XALL Loading Zone $0.045 Level 2 Looking Ripe

Thanks. Moved up then down and a giant move up today.

IZEA Awesome call bro.

$ALKM daily chart res .0022 and breakout

HRTX:

Brief summary of today's news and SEC filings:

"About HTX-011 for Postoperative Pain

HTX-011, which utilizes Heron’s proprietary Biochronomer® drug delivery technology, is an investigational, long-acting, extended-release formulation of the local anesthetic bupivacaine in a fixed-dose combination with the anti-inflammatory meloxicam for the management of postoperative pain. By delivering sustained levels of both a potent anesthetic and a local anti-inflammatory agent directly to the site of tissue injury, HTX-011 was designed to deliver superior pain relief while reducing the need for systemically administered pain medications such as opioids, which carry the risk of harmful side effects, abuse and addiction. HTX-011 has been shown to reduce pain significantly better than placebo or bupivacaine alone in five diverse surgical models: hernia repair, abdominoplasty, bunionectomy, total knee arthroplasty and breast augmentation. HTX-011 was granted Fast Track designation from the FDA in the fourth quarter of 2017 and Breakthrough Therapy designation in the second quarter of 2018. In the second half of 2018, Heron expects to submit a New Drug Application (NDA) to the FDA for HTX-011."

Dead board now from Top of the boards . oOPS

CMG weekly room to 400 than 420-440 than 450-500

Chipotle Mexican Grill Q1 EPS $2.13 vs. $1.57 Est.; Q1 Revs. $1.15B vs. $1.15B Est

CMG has 15% shorts,

new former TacoBell ceo,

no debt,

high cash flow,massive growth potential

no BWLD premium built in.. squeeze is on...

2018 reversal year

restaurants to benefit more than avg from tax plan

3. 7 million shorts

chart:

WRFX HUGE in APRIL- expecting>>> Reg A filing, Chat app demo (also used for a sales tool), possible contracts to be announced, more LOI's expected and I suspect there may be other surprises............

THERF gets FDA approval

https://ceo.ca/@nasdaq/theratechnologies-announces-fda-approval-of-breakthrough

Foot Locker making moves off base

mb

Monaker to Present at the 30th Annual ROTH Conference on March 13, 2018

MKGI

https://globenewswire.com/news-release/2018/03/01/1409088/0/en/Monaker-to-Present-at-the-30th-Annual-ROTH-Conference-on-March-13-2018.html

WESTON, FL – March 1, 2018 – Monaker Group (NASDAQ: MKGI), a travel and technology company focused on the alternative lodging rental (ALR) market, has been invited to present at 30th Annual Roth Conference being held on March 11-13, 2018 at The Ritz-Carlton in Dana Point, California.

Monaker CEO Bill Kerby is scheduled to present on Tuesday, March 13 at 2:30 p.m. Pacific time. He will be joined by the company’s director of corporate development, Richard Marshall, for one-on-one meetings with institutional analysts and investors held at the conference.

Management will discuss the Monaker Booking Engine (MBE), the first customizable, alternative lodging reservation system with instant booking of vacation homes, villas, chalets, apartments, condos and castles.

The presentation will be also webcast live and available for replay here and via the investor relations section of the company’s website at monakergroup.com.

This year’s Roth Conference will feature presentations from hundreds of growth companies, along with Q&A sessions, expert panels, and thousands of one-on-one and small group meetings. As one of the largest of its kind, the event is designed to provide investors with a unique opportunity to gain insight into emerging growth companies across a variety of industry sectors.

For more information about the conference or to schedule a one-on-one meeting with Monaker, please contact your Roth representative at (800) 678-9147 or via e-mail at oneononerequests@roth.com.

About Roth Capital Partners

ROTH Capital Partners, LLC is a relationship-driven investment bank focused on serving emerging growth companies and their investors. As a full-service investment bank, ROTH provides capital raising, M&A advisory, analytical research, trading, market-making services and corporate access. Headquartered in Newport Beach, CA, ROTH is privately-held and employee owned, and maintains offices throughout the U.S. For more information on ROTH, please visit www.roth.com.

About Monaker Group

Monaker Group is a technology-driven travel company focused on delivering innovation to alternative lodging rentals (ALR) market. The Monaker Booking Engine (MBE) delivers instant booking of more than one million vacation rental homes, villas, chalets, apartments, condos, resort residences and castles. MBE offers travel distributors and agencies an industry-first: a customizable, instant-booking platform for alternative lodging. For more information, visit www.monakergroup.com.

Important Cautions Regarding Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties concerning the plans and expectations of Monaker. These statements are only predictions and actual events or results may differ materially from those described in this press release due to a number of risks and uncertainties, some of which are out of our control. The potential risks and uncertainties include, among others, the expectations of future growth may not be realized. These forward-looking statements are made only as of the date hereof, and Monaker undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are expressly qualified in their entirety by the “Risk Factors” and other cautionary statements included in Monaker’s annual, quarterly and special reports, proxy statements and other public filings with the Securities and Exchange Commission (“SEC”), including, but not limited to, the company’s Annual Report on Form 10-K for the period ended February 28, 2017, which has been filed with the SEC and is available at www.sec.gov.

Richard Marshall

Director of Corporate Development

VRX Valeant news out: Valeant Pharmaceuticals International Inc. (VRX.T) announced that it had secured a licensing agreement for a potential psoriasis drug Tuesday afternoon, just hours before the company is scheduled to announce quarterly earnings. Valeant said it reached an exclusive agreement with Kaken Pharmaceutical Co. Ltd. for KP-470 to develop and commercialize topical products with the compound in the U.S., Canada and Europe. "Medical dermatology remains a key therapeutic area of focus for the Company, and we are dedicated to developing new treatment options," Valeant Chief Executive Joseph Papa said in Tuesday's announcement (http://ir.valeant.com/news-releases/2018/02-27-2018-234521731). Valeant shares gained about 1.8% in after-hours trading Tuesday as investors awaited the company's fourth-quarter earnings report, scheduled to be released Wednesday morning before markets open.

Dr. Gottlieb and Surgeon General before Tobacco Industry Trade Association, SRNT, last week:

Nearly, not totally...: Useful article, blog

http://blogs.wsj.com/venturecapital/2014/06/26/doctor-founder-billionaire-talks-about-biotech-investment-stocks/

That was written a number of years(2.5) ago. Look at what has happened to the likes of his IPOs since, particularly NH and NK.

What happened to this board? DEAD now . WOW

ANTH AND AGEN taking off.Maybe short squeeze

Must Read Before Posting. Important Full Disclaimer from Sheff on 8/25/12 http://bit.ly/OlN9DB

Must Read Before Posting. Important Full Disclaimer from Sheff on 8/25/12 http://bit.ly/OlN9DB

Follow Me on Twitter: http://twitter.com/SheffStation/

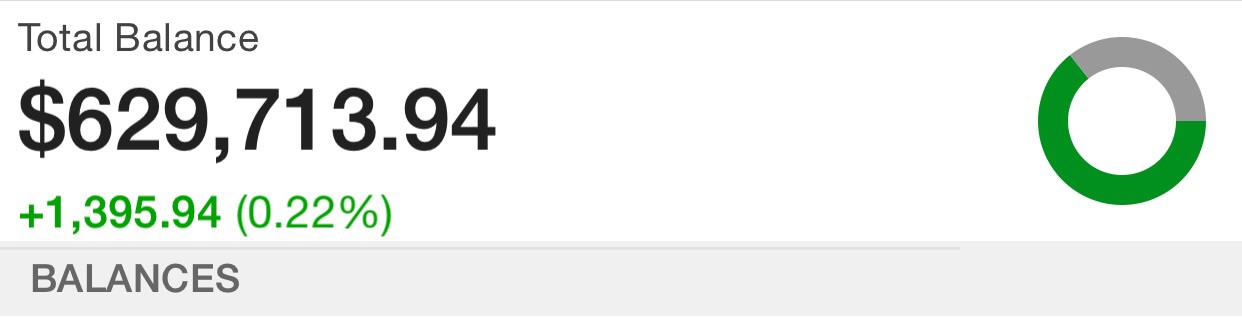

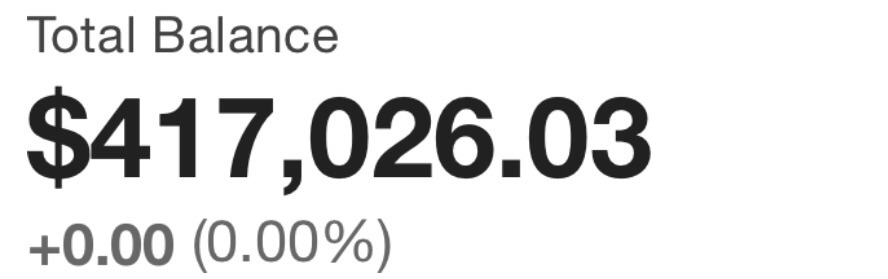

New Economy Portfolio: Larger Cap stocks for slower but more consistent gains. Some Longer-Term Plays (30-60 days maybe longer)

Beginner Portfolio: Scalp Plays & Low Float Biotechs for potential explosive Growth. Quick Turnover 1-30 days (smaller balance want aggressive growth)

Position Size: STARTER: (1-5% Portfolio Balance) SOLID: (6-10% Portfolio Balance) FULL : (11-20% Portfolio Balance)

| NEW ECONOMY PORTFOLIO | Sell Date | Ticker | Buy PPS | Sell PPS | Gain/Loss | Notes | % + or - | ||

|

| |||||||||

|

|

| ||||||||

|

|

| | |||||||

|

|

| ||||||||

|

|

| | |||||||

|

|

| | |||||||

| | |||||||||

| | | ||||||||

| Beginner Portfolio Economy | | ||||||||

| BUY DATE | SELL DATE | TICKER | BUY PPS | SELL PPS | Gain/Loss | NOTES | % + or - | ||

|

|

| ||||||||

| | | ||||||||

| | |||||||||

| | |||||||||

| | |||||||||

$HEFF LEARNING STATION-LINKS

$HEFF LEARNING STATION-LINKS

REAL-TIME Futures Quotes: http://www.sgxniftydowfutureslive.com/index_files/DOWFUTURES.htm …

JANNEY HEALTHCARE NEWSLETTER-http://www.janney.com/institutions--corporations/investment-banking/industry-groups/healthcare/life-sciences-newsletter

Traders: Develop Your Mental Edge by Dr. Andrew Menaker http://j.mp/1phyFIY

Jesse Livermore-Reminiscences Of A Stock Operator-Great Book http://bit.ly/VOObyM

LIFE SCIENCES MARKET : http://www.thelifesciencesreport.com CHMP Decisions Here: http://t.co/7jjqFyn3tx

E-booklet onTrend Determination: A quick accurate and effective methodology using RSI. http://bit.ly/17PmHZ8

The Original Turtle Trading Rules: Rules of the “Turtle Traders;” one of the greatest trading experiments conducted.

http://bit.ly/17jXegf

FAVORITE QUOTES:

"Compounding interest is the eighth wonder of the world. He who understands it, earns it..he who doesn't.. pays it." - Albert Einstein

"Your actions speak so loud I can't hear your words! When that happens, you have found a certain level of success others haven't." Sheff

"IF YOU ARE NOT TAKING YOUR PROFITS, SOMEBODY ELSE IS !" SHEFF

A good name is more desirable than great wealth. Respect is better than silver or gold. -Proverbs 22:1

Don't brag about yourself let others praise you. -Proverbs 27:2

Do not brag about tomorrow, because you do not know what another day may bring. -Proverbs 27:1

One man pretends to be rich, yet has nothing. Another pretends to be poor, yet has great wealth. Proverbs 13:7

You can easily judge the character of a man by how he treats those who can do nothing for him. -James D. Miles

Favorite Sheff Quote: "You can't let praise or criticism get to you. It's a weakness to get caught up in either one." -John Wooden

Favorite Sheff Quote: Talent is God given. Be humble. Fame is man-given. Be grateful. Conceit is self-given. Be careful.

A Trading Plan = Study. A watch-list. Position Sizing. Entries. Exits. Records. Discipline. h/t @sjburns

5 Things I didn't come on twitter to do: Convince anyone of anything , Argue Defend myself Battle Trolls Waste time @sjosephburns

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |