Good grief. Even the least savvy of penny stock gamblers can connect the dots:

1) The SEC alleged that JBI and Bordynuik are guilty of SECURITIES FRAUD and ACCOUNTING FRAUD.

2) The SEC demanded CIVIL PENALTIES, OFFICER and DIRECTOR BANS, and DISGORGEMENT.

3) JBI and Bordynuik caved in rather than going to court, giving the SEC two out of the three things they sought.

4) JBI and Bordynuik are not allowed to deny their guilt.

5) An independent Certified Fraud Examiner shares the opinion of the SEC, that JBI and Bordynuik are guilty of fraud:

"INFLATING THE BASIS OF ASSETS ACQUIRED IN NONCASH TRANSACTIONS

There are many methods of inflating the basis of an asset. One category of transaction especially prone to this treatment involves assets acquired in non- cash transactions.

U.S. GAAP for these transactions is found in ASC 845. Nonmonetary Transactions.

In general, the accounting for nonmonetary transactions is based on the fair values of the assets (or services) involved, similar to monetary transactions. Accordingly, the initial basis of a nonmonetary asset acquired in exchange for another nonmonetary asset is the fair value of the asset surrendered to obtain it. A gain or loss may be recognized in connection with the exchange. The fair value of the asset received should be used to measure the cost only if it is more clearly evident than the fair value of the asset surrendered.

In some cases, such as the one involving JBI Inc., described next, the asset received is in the form of barter credits. These barter credits can be used to purchase goods or services, such as advertising time, from either the barter entity or members of its barter exchange network.

In reporting the exchange of a nonmonetary asset for barter credits, it is presumed that the fair value of the nonmonetary asset exchanged is more clearly evident than the fair value of the barter credits received and that the barter credits should be reported at the fair value of the nonmonetary asset exchanged.

This presumption can only be overcome if an entity can convert the barter credits into cash in the near term. There should be evidence of this right, such as a historical practice of converting barter credits into cash shortly after receipt. Alternatively, if independent quoted market prices exist for items to be received upon exchange of the barter credits, this could also overcome the p resumption that the credits should be valued based on the value of asset surrendered. It also is to be presumed that the fair value of the nonmonetary asset does not exceed its carrying amount unless there is persuasive evidence supporting a higher value.

Similar to the impairment criteria described in other chapters, an impairment loss on the barter credits must be recognized if it subsequently becomes apparent that either of the following conditions exists:

1. The fair value of any remaining barter credits is less than the carrying amount.

2. It is probable that the entity will not use all of the remaining barter credits.

In 2012, JBI, Inc. was charged with an accounting fraud stemming from its purchase of "media credits' comprised of prepaid print and radio advertisements to be used for future marketing activities. The media credits purportedly had a value of $9,997,134. However, the agreed upon price for the credits was $1 million, payable in the form of 1,000,000 shares of common stock valued at $1 million (a $1.00 per share market price) on August 24, 2009, by JBI (then known as 310 Holdings).

Instead of reporting the purchased media credits at the purchase price of $1 million, JBI recorded an asset of $9,997,134 (with the credit side of the entry going to additional paid -in capital). This inflated the assets and net worth of JBI substantially. The company reported assets of $24.1 million and stockholders' equity of $22.9 million as of December 31, 2009.

The $9.997.134 valuation was not entirely without basis. It could be traced to a transaction between the original acquirer (who sold them to JBI) and a company called Media4Equity LLC in August 2008. However, according to the SEC's complaint, this original valuation was "severely flawed.' And under no circumstances, even if the valuation was proper, was there any basis for recording the credits on JBI’s books at $9,997.134 when the consideration paid reflected 'the perceived value of the media credits at the time of the transaction.'

In addition, the SEC alleged that the media credits were actually worthless and should, after being initially recorded at $1 million, have been subsequently remeasured to zero on September 30 and December 31. 2009. The SEC based this conclusion on "the unreliability of the probable future economic benefits attributable to the media credits."

The motive behind this scheme was to "use JBI and its valuation as a vehicle for acquisitions.' according to the SEC. In fact, when JBI restated its 2009 financial statements, the removal of the media credits was just one (albeit the largest) of several adjustments that were made. Among the other adjustments were two related to reallocating the purchase prices of two subsidiaries - discussed further in Chapter 11.

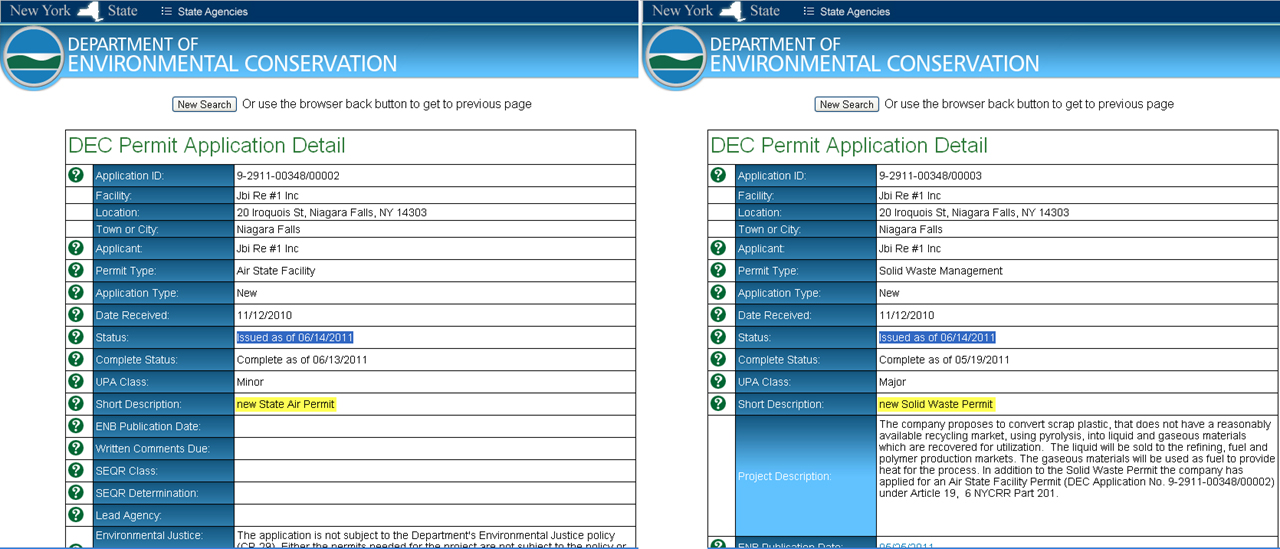

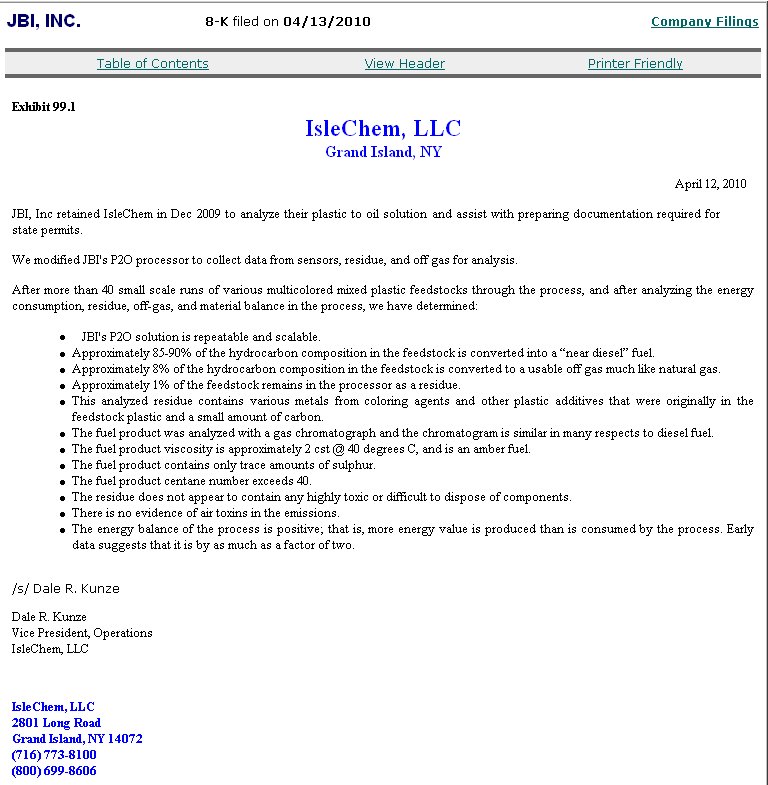

JBI was primarily a technology company, focusing on data restoration and recovery, and it had several large clients, like NASA. However, its founder, John Bordynuik, became involved in the research and development of a process designed to convert plastic waste into oil. This process was called '"Plastic20il" or "P20." It is this process, and the need for capital to pursue the process that really motivated Bordynuik to engage in financial reporting fraud.

As a result of JBI's inflated financial statements, more than $8.4 million was raised from investors. Soon after raising these funds, JBI announced it would be restating its 2009 financial statements.

But the story leading up to the restatement is even more interesting. JBI hired an accountant who was not a certified public accountant, and in fact only had six credit hours of accounting classes, to prepare its financial statements using the $10 million inflated figure for the media credits. According to the SEC complaint, at one point Bordynuik sent an instant message to the accountant stating, "please get the pro formas as juicy as you can so I can acquire a chemical company for less.' a reference to JBI's plans to use the inflated financial statements as a means of acquiring other companies needed to pursue the Plastic20il venture. In this case, 'pro formas' is a reference to unaudited financial statements that would be presented to (and designed to deceive) investors.

IFRS for nonmonetary transactions is found in two standards. In IAS 18, Revenue, it is stated that revenue should be measured at the fair value of the consideration received or receivable. However, there is an important caveat. When goods or services are exchanged or swapped for other goods or services of a similar nature and value, the exchange is not regarded as a transaction that generates revenue.

When goods are sold or services are rendered in exchange for dissimilar goods or services, the exchange is considered to be a transaction that generates revenue. The revenue is measured at the fair value of the goods or services received, adjusted by the amount of any cash or cash equivalents transferred. When the fair value of the goods or services received cannot be measured reliably, the revenue is measured at the fair value of the goods or services given up, adjusted by the amount of any cash or cash equivalents transferred.

IFRS also includes SIC-31. Revenue –Barter Transact ions Involving Advertising Services. And this document takes the opposite approach from IAS 18.

In some cases, an entity may enter into a barter transaction to provide advertising services in exchange for receiving advertising services from a customer. This may involve printed advertising, radio or television advertising, Internet advertising, or any other form. SIC-31 states that revenue from a barter transaction involving advertising cannot be measured reliably at the fair value of advertising services received. However, a seller can reliably measure revenue at the fair value of the advertising services it provides in a barter transaction, by reference only to nonbarter transactions that:

• Involve advertising similar to the advertising in the barter transaction

• Occur frequently

• Represent a predominant number of transactions and amount when compared to all transactions to provide advertising that is similar to the advertising in the barter transaction

• Involve cash and/or another form of consideration that has a reliably measurable fair value (such as marketable securities)

• Do not involve the same counterparty as in the barter transaction

While IAS 18 and SIC-31 frame their explanations in the context of revenue recognition, the logic would be similar for measuring the value of an asset conferred (such as advertising benefits not yet received) to an entity in a barter transaction. "

from Financial Statement Fraud: Strategies for Detection and Investigation by Gerard M. Zack, 2012

It's not as if anyone on the planet believes that JBI and Bordynuik did not willfully defraud investors, just because JBI and Bordynuik settled out of court.