Replies to post #193917 on Tornado Alley (PROG)

11/20/12 1:42 PM

[excerpt] Let’s face it, the agencies and advertisers are how we survive. So to tell them that their clients are stupid for not staying in an atmosphere in which they don’t want to be is akin to the Republicans not reading the tea leaves about changing demographics.

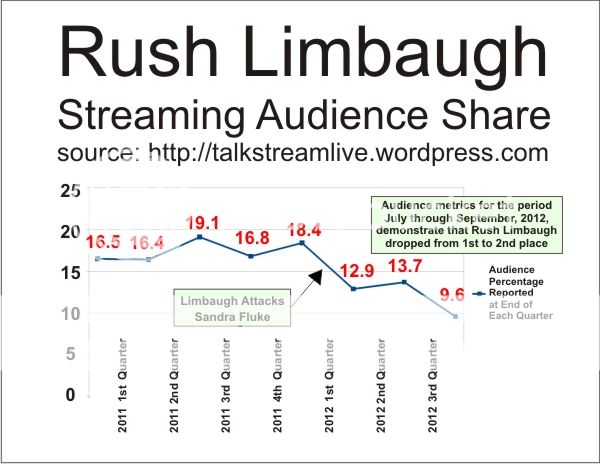

I’m not here to argue the point, but rather to tell you what this ONE incident has cost me as an independent in a sea of big corporate operators, who are obviously losing tens of millions of dollars due to this one event.

So far this year, my losses are in the hundreds of thousands of dollars. Cancellations, avoidance and decisions to just not buy across the whole format, no matter what the content...

I’m not looking for Limbaugh to send me a check (although that would be nice), but I do think we have to let it be known that his actions have been devastating to our survival. [emphasis added]

—Doug Stephan: Talk Must Expand Beyond Politics to Survive, November 19, 2012

http://www.talkers.com/2012/11/19/talk-must-expand-beyond-politics-to-survive/

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |