Replies to post #764614 on Fannie Mae-No Politics (FNMA)

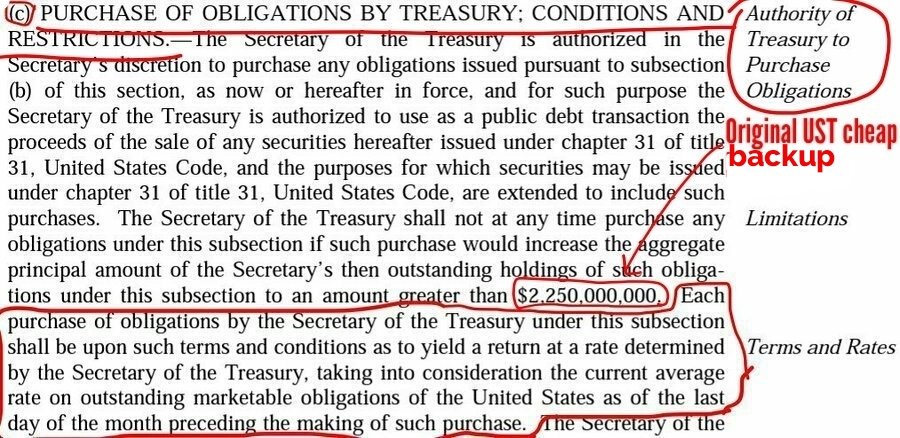

What Dr. Calabria and the “conversion crowd” don’t seem to understand (and I’m being kind with that characterization) is that converting the senior preferred stock to common shares does absolutely NOTHING to resolve the negative balance in each company’s retained earnings (i.e., accumulated deficit). The glaring accumulated deficit numbers will, at the very least, cause rational investors to question how and why these billion-dollar companies have these adverse amounts on their equity statements.

08/22/23 9:46 AM

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |