Tuesday, August 22, 2023 1:56:51 AM

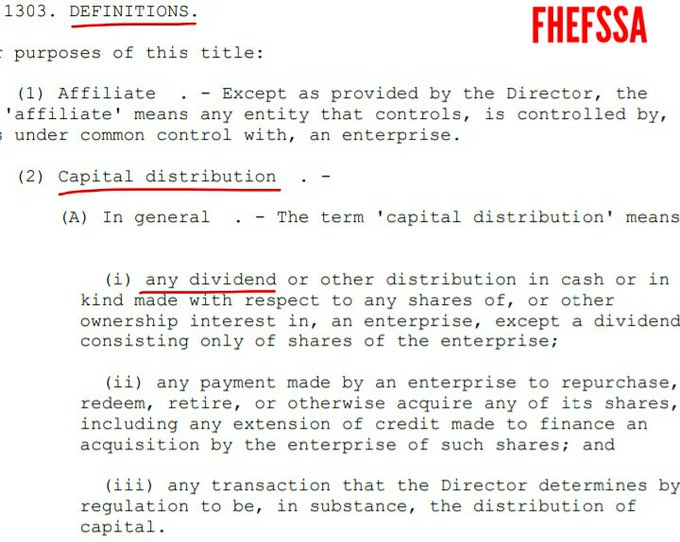

This is why any dividend is a capital distribution. Restricted in the FHEFSSA's Restriction on Capital Distributions, as amended by HERA Subtitle C - PROMPT CORRECTIVE ACTION.

Today's SPS LP increased for free every quarter and the payments of Securities Litigation claims (added to the definition of capital distributions in (3) CFR1229.13, are capital distributions too.

Then, RESTRICTED. PROHIBITED. BARRED. ACHTUNG!

Because the payments to UST existed, we can't say that they were actual dividends, as they are prohibited while undercapitalized by law.

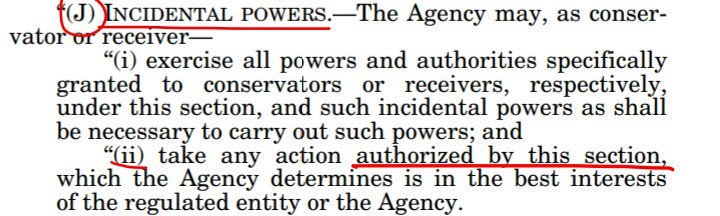

Instead of bringing them to Justice accused of violating the law, there is another statutory provision that authorizes the conservator to lie and carry out a different plan behind the scenes: The conservator's Incidental Power: "Take any action authorized by this section,...."

Whatever it wants if the endpoint is the rehabilitation of FnF. Taking in account that it may take actions that reduce the profitability in the best interests of FHFA ("May" also in the FHFA-C's Power), but it's not an authorization to be excused from complying with its Power, neither with "may" nor with the "best interests", that is, once the capital is built, it's kept by FnF (or this Common Equity is held in escrow and lie about it if you wish. Just so that you know, at some point in time, it will be returned to their Balance Sheets, for the normal functioning of a corporation). It's called Retained Earnings (Core Capital) for a reason.

Then, you can't claim that there is a non-repayment provision of the SPS, because that's related to the dividend to UST, and no actual dividend existed but capital distributions under the guise of dividends.

Actually, the law authorizes the capital distributions for the repayment of the SPS (An exception to this restriction)

The problem with the "and" in the exception "(A) and (B)" was recently solved by simply acknowledging that the intention of the legislator was to raise fresh cash in the same amount as the redemption of the SPS and he didn't know that by building Common Equity (Comprehensive Income + OCI), there is also cash accounted for, due to the double-entry accounting. This is how the SPS were reduced with cash, at the same time the Common Equity increased and as seen in my signature image below.

In 2011, the FHFA added up another exception: a capital distribution (deplete capital) for .... wait for it... for their recapitalization (build capital: "Meet the Risk-Based capital and Minimum Capital requirements") in the CFR 1237.12 (Separate Account wording right there)

Above all, it would comply with the conservator's Rehab power: "Put (restore) FnF in a sound (build capital) and solvent (reduce the obligations SPS. Debentures) condition". Another statutory provision covered up by the plaintiffs and Co.

Hence, no one can say that nowadays FnF have been rehabilitated, with:

- $-216 billion Retained Earnings accounts. The only account that absorbs future losses.

- $304 billion SPS outstanding that will have to be paid back.

- $-194 billion Core Capital.

- $402 billion capital shortfall over Minimum Leverage Capital requirement.

You can't claim that the SPS are converted to Commons and that's it. Problem solved. Primarily, the Net Worth is only $111 billion and the rest of SPS are wiped out. Secondly, you must acknowledge that the FHFA-C has failed in its Rehab power, which would put into question the entire conservatorship. The "for cause" removal restriction of the director that was constitutional, is activated and the Fanniegate trials would kick off. Unless, it's announced the Separate Account plan: the Common Equity is held in escrow. The FHFA has lied to us all along.

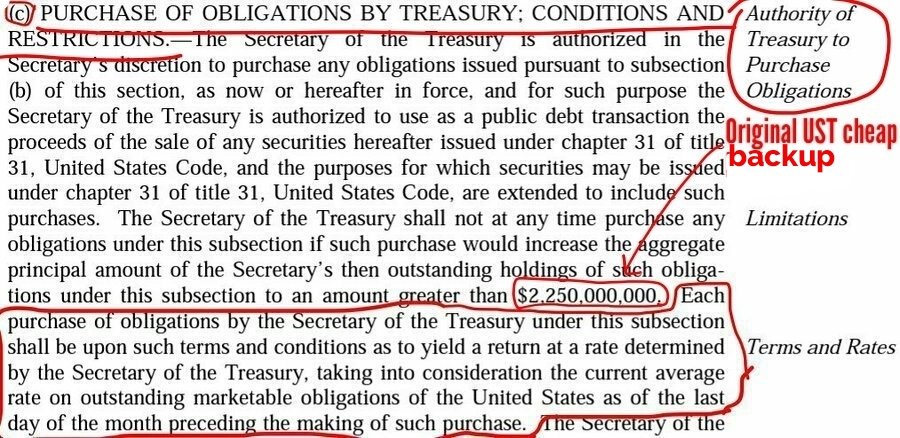

Then, the dividend rate on SPS was authorized in a provision inserted by HERA in the Charter Act, with the same name as another one just above it in the Charter, with a rate that "takes into consideration the Treasury yields as of the end of the month preceding the purchase", also known as cheap UST backup of FnF, in exchange for their Public Mission.

This is why the plotters repeat "HERA, HERA, HERA". (Even the alleged jury asked for the HERA text). So, you don't see the Charter Act in its entirety with the original cheap UST backup of FnF.

So, quit repeating like mad that there is a 10% contractual rate. FnF aren't governed by contracts between Federal Agencies to begin with. It must uphold the laws in force. Again, the Incidental Power allows the conservator to mess around with the dividend rates, and eventually, its Rehab power and the special borrowing right from UST must be respected.

Finally, the Fee Limitation of the United States clause, tells us the Charter dynamics (the spirit of the Charter): the UST can't make profits off the securities and assets of FnF, other than the a low rate on redeemable obligations, in exchange for their Public Mission (section Purposes). Although it's been broken with the TCCA fees, HERA's 4.2 bps to UST/HUD and, likely, the CRT expenses (prohibited in the Credit Enhancement clause too) that might be being syphoned off to UST.

Numerous attorneys and social media influencers, funded by the hedge funds, play the fool over and over again. The thing is that the coverup of a material fact is a crime of Making False Statements, stock price manipulation and, in court, abuse of court process.

FEATURED ZenaTech, Inc. (NASDAQ: ZENA) Launchs IQ Nano Drone for Commercial Indoor Use • Oct 10, 2024 8:09 AM

FEATURED CBD Life Sciences Inc. (CBDL) Targets Alibaba as the Next Retail Giant for Wholesale Expansion of Top-Selling CBD Products • Oct 10, 2024 8:00 AM

Foremost Lithium Announces Option Agreement with Denison on 10 Uranium Projects Spanning over 330,000 Acres in the Athabasca Basin, Saskatchewan • FAT • Oct 10, 2024 5:51 AM

Element79 Gold Corp. Reports Significant Progress in Community Relations and Development Efforts in Chachas, Peru • ELEM • Oct 9, 2024 10:30 AM

Unitronix Corp Launches Share Buyback Initiative • UTRX • Oct 9, 2024 9:10 AM

BASANITE INDUSTRIES, LLC RECEIVES U.S. PATENT FOR ITS BASAFLEX™ BASALT FIBER COMPOSITE REBAR AND METHOD OF MANUFACTURING • BASA • Oct 9, 2024 7:30 AM