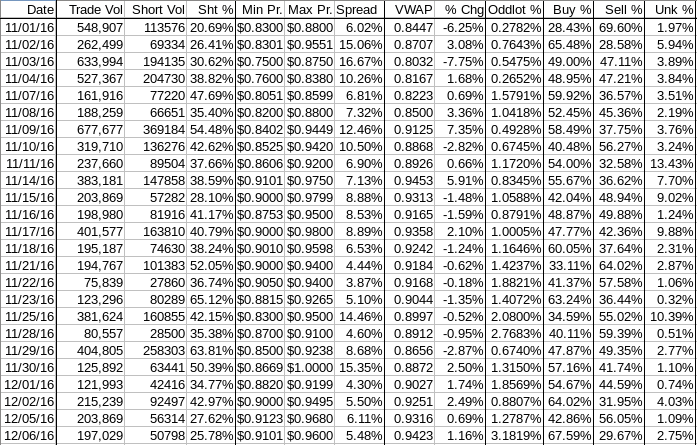

Buy:sell, daily shorts & pps 12/06 2016 EOD

Yesterday's assessment that today would weaken was woefully off the mark as very odd behavior appeared and pushed VWAP up noticeably. But today's very odd intra-day behavior, combined with mixed traditional TA signals - weakening suggested by the volume and OLHC movements, but for the close, and strengthening suggested by the oscillators I follow - leave me thinking that a re-trace, maybe to the leg up mid-point around $0.90, is most likely.

That is bolstered, somewhat, by mixed signals in my unconventional stuff, modified again with the intra-day observations.

I'm sticking with my so-far-wrong consolidation with a weakening bias.

Today "they" took a different tack - essentially push up early (common), hold it high mostly (less common), with a few ups and down, most of the day and then do a high-volume (~46% of day's volume) push higher buying spree late in the daa (last 45 minutes)y. The net result was a VWAP up by 1.16%, making me all wrong about yesterday's expectation of weakness today.

This behavior was implemented by an open lowish, start a big move up at 9:45ish, hit $0.95 by 9:53, retrace lower to the opening low by 10:12, do a very low-volume climb back to the high (well, actually $0.9499) by 10:56, and then go flattish $0.928x/$0.94 through ~12:09, very low-volume flattish $0.93/$0.949x through 15:46, and then a high-volume push up to hit $0.96 at 15:56-:59 and close at $0.9484.

There were no pre-market trades.

B/a at 9:18 was 200:1K $0.9102/$0.9699, 9:29 100:1K $0.9102/$0.9699.

09:30-10:12 opened the day with a 3,561 sell for $0.92 & $0.95 x 50, $0.92 x 10, x 12, $0.9102 x 100. B/a after open went 2.3K:200 $0.9101/$0.9199. Then came 9:31's 100 $0.9150, 9:41's 3.4K $0.9101/2/3, 9:43's 100 $0.9175, 9:45's 500 $0.9175, 9:46's 300 $0.9176/99, 9:50's b/a 500:100 $0.9120/$0.94, 9:51's 200 $0.94/2, 9:52's 400 $0.94/$0.9311, 9:53's 200 $0.95, 9:54's 100 $0.9499, 9:55's 100 $0.9499, 9:56's 100 $0.9311, 9:58's b/a 400:6.1K $0.9124/$0.9499, 9:59's 100 $0.9440, 10:00's 100 $0.9440, 10:01's 100 $0.9380, 10:02's 100 $0.9440, 10:03's 210 $0.9440/$0.9349, 10:04's 100 $0.94, 10:05's 300 $0.9400/$0.9392, 10:06's $0.94, 10:07's 100 $0.94, 10:08's b/a 300:2.6K $0.9391/$0.94, 10:08's1.2K $0.94/$0.9396/5, 10:09's 100 $0.9350, 10:09's b/a 1.3K:2.6K $0.9326/$0.94, 10:10's 5.1K $0.9328/9/$0.94, 10:11's 2.2K $0.9334/29/23/$0.94. The period ended on 10:10-:12's aggregate 12.1K $0.9323/$0.9400

10:13-10:52 began, through 10:22, very low volume, some no volume, $0.9156/$0.93 on 10:13's 5.5k $0.9366/20/00 (4k)/$0.9150/10/30. B/a at 10:19 was 300:500 $0.9151/$0.93. Volume went almost exclusively very low-volume (e.g lots of 100-share minutes) trades at 10:23. B/a at 10:33 was 300:200 $0.9153/$0.93, 10:46 800:2.1K $0.9286/$0.94. The period ended on 10:52's 900 $0.93.

10:53-12:08, after two no-trades minutes, moved the range up on 10:55's 100 $0.9399, 10:56's 100$0.9499 and then set it back on 10:58-59's 1.2K $0.9314 (1k)/$0.94/$0.9301 (100) to begin very low-volume $0.9286/$0.949. B/a at 11:00 was 400:600 $0.9302/$0.9490, 11:16 800:1.4K $0.9390/$0.94, 11:31 300:600 $0.9289/$0.94. Volume was interrupted by 11:36's 6.3K $0.9375/$0.9291/90/85/66. Lows began rising, on very low/no-volume at 11:45. B/a at 11:47 was 200:500 $0.9348/$0.94. 11:48 hit $0.9399. B/a at 12:04 was 500:300 $0.9399/$0.94. The period ended on 12:08's 100 $0.94.

12:09-13:01, after one no-trades minute, began extremely low/no-volume $0.9418/90 on 12:10's 200 $0.9488/$0.9409. B/a at 12:12 was 600:3.6K $0.9423/90 (MMs jiggling the bid a lot), 12:16 300:3.3K $0.9439/90, 12:32 400:400 $0.9485/96. Price and volume was interrupted by 12:35's 1.5K $0.9498/$0.9300/$0.9490/$0.9395. B/a at 12:47 was 500:2.1K $0.9435/90, The period ended on 13:01's 100 $0.9482.

13:02-14:20 had b/a at 13:02 of 200:1.7K $0.9475/90. After one no-trades minute, trade began mostly very low-volume $0.9318/$0.94, with slowly rising lows, on 13:03's 1.5K $0.9490/86/82/$0.93/4/3/$0.9490/$0.9301. B/a at 13:17 was 1.2K:500 $0.9327/$0.94 (MMs jiggling the bids). At 13:21 low was up to $0.934 and 13:23 $0.9399. B/a at 13:32 was 800:400 $0.9399/$0.94, 13:46 400:300 $0.9399/$0.94. Range was opened up again to $0.9288/$0.94 by 13:59's260 $0.9288/$0.9344. B/a at 14:04 was 200:460 $0.9291/$9400, 14:17 100:400 $0.9295/$0.94. The period ended on 14:20's 1.1K $0.9349/$0.9297/$0.9348/79.

14:21-15:14 began extremely low/no-volume $0.9417/$0.9490 on 14:21's 4K $0.9298/$0.9349/35/$0.94/$0.9386/$0.94/$0.9386/$0.9400/02/$0.9386/88$0.9298/$0.9454/$0.9297. B/a at 14:32 was 200:1K $0.9343/$0.9490. Range began falling at 14:43 going to $0.9343/$0.94 at 14:46. B/a at 14:48 was 200:700 $0.9297/$0.9499. Range went to $0.9297/$0.94 at 14:56. B/a at 15:03 was 200:600 $0.9297/$0.94. The period ended on 15:14's 7.4K $0.94/$0.9349/$0.94/$0.9297/86/$0.94/$0.9285$0.94/$0.9343/$0.9401.

15:15-15:47 had b/a at 15:17 of 400:700 $0.9285/$0.9490. Trading began the EOD volatility on 15:18's 7.6K $0.9490/50/$0.9499/$0.95/$0.9401/$0/95/$0.9401. Volume began very low and quickly rose doing $0.9285/$0.95 with most trades doing $0.94xx. B/a at 15:24 was 100:11.6K $0.93/$0.95, 15:32 1.1K:1.1K $0.9450/$0.9493. Volume fell back to low/no-volume at 15:33. B/a at 15:37 was 2:1.5K $0.9400/99 (bid backed by presented 1.1K $0.9286), 15:41 500 1.3K $0.9403/99, 15:45 1.1K:8.1K $0.94/$0.95. The period ended on 15:47's 10.6K $0.9410/$0.9318/$0.95/$0.9400/07/$0.95/$0.9313.

15:48-16:00 began a push up on low volume, which turned to high volume at 15:55, on 15:48's 2.8K $0.95/$0.9407/42/$0.9570/$0.9442/01/$0.9399/14/$0.9401. B/a at 15:49 was 200:100 $0.9317/$0.94, 15:52 300:1K $0.9450/99. 15:55 hit $0.95, 15:56 $0.96, and sideways $0.9486/$0.96 followed until the period and day ended on 15:59's 7.3K $0.96/$0.9484 ... $0.96/$0.9484 and 16:00's 912 buy for $0.9484.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 7 larger trades (>=5K & 5 4k+) totaling 33,164, 16.83% of day's volume, with a $0.9421 VWAP. Sans the 4K trades there were only two larger trades. There were no "larger larger trades". Even with the low trade volume the count of larger trades is poor and the percentage is well below normal. I think this is not indicating strength in this price rise, but that hasn't stopped the rise so far.

Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

10:12 24921 $0.9101 $0.9500 $23,141.19 $0.9286 12.65% 18.87% Incl 10:10 $0.9328 4,639 10:12 $0.9331 4,000

10:52 12876 $0.9110 $0.9366 $11,937.02 $0.9271 6.54% 35.70% Incl 10:13 $0.9300 4,000

12:08 18818 $0.9285 $0.9499 $17,635.91 $0.9372 9.55% 43.56% Incl 11:36 $0.9375 5,400

13:01 6770 $0.9300 $0.9499 $6,410.71 $0.9469 3.44% 45.12%

14:20 20018 $0.9288 $0.9490 $18,788.62 $0.9386 10.16% 54.47%

15:14 16111 $0.9285 $0.9490 $15,139.26 $0.9397 8.18% 58.21%

15:47 42639 $0.9285 $0.9500 $40,381.33 $0.9471 21.64% 64.13% Incl 15:47 $0.9500 5,925

16:00 48800 $0.9314 $0.9600 $46,510.35 $0.9531 24.77% 67.74% Incl 15:55 $0.9499 4,400 15:56 $0.9570 4,800

Note the big change from more common behavior - generally consistently rising VWAP and buy percentage and a big volume/price push the last 45 minutes of the day. This last period accounted for the majority of the day's VWAP gain along with ~46% of the day's volume.

On the traditional TA front, movements were: __Open_ ___Low_ __High_ _Close_ Volume_

Today -3.16% -0.24% -0.83% 2.98% -3.36%

Prior 5.56% 1.37% 1.95% -3.00% -5.28%

Notice that everything but the close looks weak. The close was produced as described above and one can view it several different ways. I view it as "Why?".

On my minimal chart we still can't get a close above the $0.94/5 resistance (actually $0.9414, but that's too picky) of the rising triangle (lower right orange lines). Giving the benefit of the doubt though, we could look for a close above $0.94 tomorrow and call it a confirmed breakout I guess.

Other than that, we had a lower open, low, high, and trade volume (second consecutive day). Looks like a recipe for success, no?

The fast EMA continues above the slow EMA and is widening the gap. This is a positive suggestion.

The experimental 13-period Bollinger limits are now diverging with the lower limit falling and the upper limit rising. The mid-point is rising.

Yesterday I said (ruefully) { It's unusual for us to see a consistent rise of more than just a few days, so a re-trace should be expected. Doing reversion to the mean of the resent leg up would take us back to ~$0.90.

Since I'm expecting the shorters to jump in here at some point, and today's intra-day short percentage is "low", I wouldn't be surprised to see them come in tomorrow. That's only a guess by me though - I don't know how they may operate this time of year (holidays, booking results, anticipated tax-loss selling by folks, ...). Just viewing the recent activity in the short interest reports I would expect them to be shorting into any good rise though. }

BIG FAIL! The unusual early behavior told me I'd likely whiffed this one, although in the middle of the day I was still in the game with the VWAP up only ~0.14%.

Moving on, based on this I'm sticking with weakness most likely, unless the price pushers appear again, because the lower everything-but-the-close tells me something abnormal is causing this and it's unlikely to continue.

On my one-year chart the 10-day SMA resumed rising, the 20-day SMA continued rising and the 50 and 200-day SMAs continued declining. If we hold this range the 10-day will continue rising nine days, the 20-day will again continue rising four of the next five days, the 50 will again drop another ~25 days, and the 200 about 17xish days.

Yesterday the oscillators I watch had weakening in RSI, Williams %R, momentum, and accumulation/distribution. Strengthening occurred in MFI, full stochastic and ADX-related. RSI, momentum and Williams %R were slightly above neutral, full stochastic was well above neutral and again just below overbought and the rest were below neutral.

Today improvement occurred in everything but ADX-related. Williams %R and full stochastic entered overbought. RSI and momentum moved above neutral.

The experimental 13-period Bollinger limits, $0.8708 and $0.9547 ($0.8735 and $0.9483 yesterday), are diverging with a rising mid-point.

All in, ignoring the intra-day behavior, these conventional TA indicators, although mixed, would suggest, due to the close, positive moves but for the weakening volume. Adding the the lower open, low and high adds to what the volume is suggesting - little strength in the move upward.

Given all that and adding in my intra-day behavioral observations, I remain in the camp of consolidation with a bearish bias as I believe we'll do a re-trace, maybe to the ~$0.90 middle of the leg up completed recently.

Percentages for daily short sales and buys moved in opposite directions with short percentage getting absurdly low and buy percentage absurdly high. Alone these two would suggest opposite things - short percentage too low to suggest positive movement and buy percentage suggesting upward movement most likely to follow.

The spread contracted a bit and is just above what I would think suggests consolidation. Being produced as it was it would most likely suggest more upward movement was available. I discount that based in the detailed intra-day behavior though - the last 45 minutes' 46% of day's volume and setting a noticeable higher intra-day high suggests we really have no upward strength.

The VWAP's last twenty-four readings improved, for the fifth consecutive day, to 11 negatives and 13 positives from 12 and 12 respectively. Change since 11/01 is $0.0976, 11.56%, and the averages of the rolling 24-day period seen in the last few days (latest first) are now 0.5016%, 0.1931%, 0.1218%, -0.4019, %-0.5046%, -0.7608%, -0.7208%, -0.6795%, -0.7820%, and -0.5530%.

All in, the negatives suggested by the short percentage and spread (considered in conjunction with intra-day behavior) offset the positives of the VWAP and buy percentage movements, the latter being too high anyway. I'll remain consolidating with a weakening bias here.

Bill