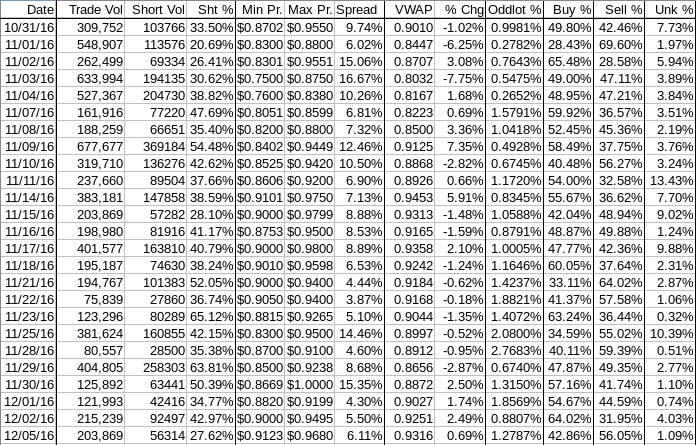

Buy:sell, daily shorts & pps 12/05 2016 EOD

I'm expecting near-term weakness within our consolidation. Our rise has been longer than we normally get, the (un)conventional stuff is suggesting near-term weakness, we hit and failed to close above our known resistance ($0.9414, really $0.94/5) and volume was flat (~only ~11K difference from yesterday).

This doesn't mean we aren't going to break out soon (nor that we are!), but a re-trace, maybe to ~$0.90 (reversion to the mean) would seem to be both in order and likely based on what was seen today.

Notably absent today was the pushing of price higher in a low-volume environment, which would have been a perfect time to do so, just like we've been seeing recently. Maybe "they" take Monday's off? After all, wouldn't want to be so obvious as to catch the attention of the authorities.

It was an all-too-typical "open high and drop" scenario through early afternoon and then a mostly extremely low/no-volume flattish behavior through most of the rest of the day.

There was 1 pre-market $0.9600 x 100 trade.

B/a at 09:12 was 3K:4.1K $0.95/$1.00, 9:22 2.9K:500 $0.9600/$0.9998,

09:30-10:20 opened the day with a 3,439 sell for $0.95 & $0.95 x 405, $0.9501 x 100, and $0.9607 x 100. That put b/a at 30:6K $0.9501/$0.9680 (bid backed by presented 4.2K $0.95). Then came 9:32's 3.2K $0.9680 (2K)/$0.9500/01/$0.9630, 9:33's 6.3K $0.9664/65/31/30/$0.9500, 9:34's 100 $0.9501, 9:37's b/a 200:1K $0.9501/97, 9:39's 100 $0.9501, 9:42's 3.2K $0.9500/$0.9404/01/$0.9310, 9:44's b/a 1.2K:700 $0.9301/99, 9:44's 100 $0.9301, 9:48's 9.5K $0.9302/05/08/03/05/49/12/02/05/01, 9:49's 1.9K $0.9307/08/89/04, 9:50's 500 $0.9303/08/09, 9:51's 650 $0.9303/04/51, 9:59's b/a 700:200 $0.9316/97, 10:01's 122 $0.933, 10:02's 200 $0.9330, 10:04's 100 $0.9399, 10:08's 100 $0.9594, 10:10's 100 $0.9584, 10:12's b/a 400:2.4K $0.9341/$0.95, 10:13's 250 $0.9404, 10:15's b/a 675:2.1K $0.9344/$0.94, 10:16's 100 $0.94, 10:17's 100 $0.94, 10:19's b/a 275:2.4K $0.9350/$0.94, and the period ended on 10:20's 4.3K $0.9400/01/$0.9399.

10:21-10:39 began a mostly very low/no-volume sideways $0.9367/45 with a narrowing range on 10:22's 1.6K $0.9450/99. 10:22's b/a was 675:700 $0.9354/$0.9499, 10:25's 7.7K $0.9450 (1.5K)/$0.9367, 10:27's 500 $0.9411/50, 10:29's 2.2K $0.9379/99/$0.94, 10:31's 100 $0.94, 10:32's 500 $0.9399, 10:35's b/a 300:2.4K $0.9399/$0.94. The period ended on 10:39's 7K $0.94/$0.9399.

10:40-10:56 began a move lower on 10:40's 11.1K $0.9399/00/03 and doing very low/no-volume there through 10:54. 10:45's b/a was 1.6K:600 $0.9326/$0.94. The drop came and the period ended on 10:55-:56's aggregate 11.4K $0.9344/33/18/00/$0.9299/03/01/00/$0.9126.

10:57-13:03 began falling again, after doing extremely low/no-volume $0.9307/$0.94, with 10:57's b/a of 300:1.8K $0.9124/$0.94. The sideways began on 10:58's 200 $0.94. B/a at 11:04 was 1.1K:1.2K $0.9308/$0.94 (bots jiggling bid a lot), 11:17 1.2K:1.1K $0.9310/$0.94. 11:23/:24 ~12.5K moved range to $0.9249/$0.9375. B/a at 11:25 was 100:1.8K $0.9201/$0.9375. 11:34 moved the low to $0.9201. 11:39-:40's 18K moved range to $0.92/$0.932. B/a at 11:47 was 600:600 $0.9201/$0.9373, 11:54 moved range to $0.9201/$0.9372.

Volume fell of the cliff, although it there wasn't far to fall, with long no-trades periods mostly interrupted by sporadic high-volume single minutes. B/a at 12:19 was 400:500 $0.9203/$0.9370, 12:33 200:400 $0.9206/$0.9386. 12:43's 9/7K moved range to $0.9278/$0.9375. B/a at 12:47 was 500:600 $0.9282/$0.9375. 12:59's 8.6K opened range to $0.9225/$0.94. B/a at 13:02 was 300:2.3K $0.9225/$0.94. The period ended on 13:03's 145 $0.9225.

13:04-15:11 began extremely low/no-volume $0.9126/$0.9300 on 13:10's 25.1K $0.9225/20/17/06/00/$0.9300/$0.9123/24/26/$0.9205. B/a at 13:17 was 400:14.3K $0.9125/$0.9300, 13:32 300:900 $0.9126/$0.9298. Range narrowed to $0.9128/$0.9298 at 13:46. B/a at 13:47 was 600:400 $0.9127/$0.9298, 14:01 200:400 $0.9128/$0.9290, 14:16 100:200 $0.9131/$0.9290, 14:32 300:200 $0.9132/$0.9290, 14:47 200:200 $0.9133/$0.9290, 15:02 600:200 $0.9137/$0.9290. The period ended on 15:11's 100 $0.922.

15:12-16:00 began extremely low/no-volume $0.92/3 on 15:12's 100 $0.922. B/a at 15:16 was 800:13.4K $0.9202/$0.9300, 15:32 1.8K:12.4K $0.9205/$0.93. Range tightened at 15:36 when low was raised to $0.9207. At 15:40 volume went ot mostly low volume. B/a at 15:46 was 400:13.6K $0.9212/$0.93. The day and period ended on 15:59's 2.6K $0.9212/11/$0.93/$0.9212/1 and 16:00's 639 $0.9210 sell.

The period ended on

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 9 larger trades (>=5K & 6 4K+) totaling 56,703, 27.81% of day's volume, with a $0.9260 VWAP. With volume similar to yesterday's we see an improved, and more normal, count of larger trades, although they did get help from more 4K+ trades than I would like. But that's just be cause of the low intra-day volumes forcing MMs to break up larger trades into chunks and average out the prices to meet the buy/sell orders from customers. Alternately, it could be the MMs just servicing themselves that cause this chunking - they make money by getting fees from the exchanges plus whatever they make from arbitrage on the buys and sells they can accomplish.

Take note that the percentage of day's volume was much higher too - more than double yesterday's percentage. This looks reasonably healthy. Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

10:20 34953 $0.9301 $0.9680 $33,039.92 $0.9453 17.14% 34.60% Incl 09:48 $0.9312 7,300

10:39 13800 $0.9367 $0.9450 $12,988.45 $0.9412 6.77% 46.17%

10:56 26814 $0.9126 $0.9400 $24,921.19 $0.9294 13.15% 32.04% Incl 10:40 $0.9300 8,525

13:03 63928 $0.9200 $0.9400 $59,652.74 $0.9331 31.36% 45.84% Incl 11:39 $0.9360 4,300 12:43 $0.9345 4,000

12:59 $0.9363 4,360

15:11 39943 $0.9123 $0.9300 $36,693.50 $0.9186 19.59% 42.42% Incl 13:10 $0.9123 14,800 $0.9200 4,200

13:11 $0.9300 4,250

16:00 21857 $0.9200 $0.9300 $20,224.01 $0.9253 10.72% 42.72% Incl 15:45 $0.9299 4,968

Unfortunately, today couldn't make the strong buy percentages seen yesterday but the VWAPs were generally higher anyway and the day's ending VWAP ended higher. So in spite of the close being down 3% the VWAP was up ~0.7%. Since the close is an arbitrary, AFAICT, artifact of the MMs actions I consider the VWAP much more important.

Since we didn't see the recently common very low volume hitting the offers to push price up I think the higher VWAP is also an artifact of the MMs market control. I think putting the open up ~5.6% (see below) above yesterday's open (+0.05% from the close) had, in the absence of strong directional market pressure, the effect of setting the day's range such that VWAP would be higher. It also likely aided the MMs in profiting from any short-term long positions, which I estimate were not large.

On the traditional TA front, movements were: __Open_ ___Low_ __High_ _Close_ Volume_

Today 5.56% 1.37% 1.95% -3.00% -5.28%

Prior 2.04% 2.04% 3.22% 5.50% 76.44%

The close is a concern here since it often strongly correlates with the following open, sans any catalyst. The volume decline is not much of a concern today as it's really more flat than declining (11,370 shares difference is nothing - just magnified by the low volume). One could have concern that volume was not rising when the other metrics, but for the close, were rising. This would give one a less bullish following day outlook.

On my minimal chart we just can't seem to get above that $0.9414 ($0.94/5) resistance and stay there. We penetrated above, as so many times in the recent past, and came right back down and stayed below it by 10:20. Regardless, we had the fourth consecutive day of higher open, low and high. We also have the fast EMA above the slow EMA for the second day, often a bullish indication.

The experimental 13-period Bollinger limits are both rising, marginally, and are quite near parallel with a mid-point ~$0.905. Our price range is completely above the mid-point and the range is "pushing" the upper limit.

It's unusual for us to see a consistent rise of more than just a few days, so a re-trace should be expected. Doing reversion to the mean of the resent leg up would take us back to ~$0.90.

Since I'm expecting the shorters to jump in here at some point, and today's intra-day short percentage is "low", I wouldn't be surprised to see them come in tomorrow. That's only a guess by me though - I don't know how they may operate this time of year (holidays, booking results, anticipated tax-loss selling by folks, ...). Just viewing the recent activity in the short interest reports I would expect them to be shorting into any good rise though.

On my one-year chart yesterday we got a high enough close to turn the 10-day SMA upward but it couldn't hold with today's lower close. The the 20-day SMA continued rising while the 50 and 200-day SMAs continued declining. If we hold this range the 20-day will continue rising four of the next five days, the 10-day will rise nine days, the 50 will drop another ~25 days, and the 200 about 180ish days.

Yesterday the oscillators I watch, but for MFI (untrusted by me), all improved substantially but for accumulation/distribution and ADX-related. RSI, momentum, Williams %R and full stochastic were above neutral and Williams %R was just below overbought while full stochastic was nearing it. I noted another good day would likely get full stochastic there though as %K moves relatively rapidly.

Today, thanks to the lower close, weakening was seen in RSI, Williams %R, momentum, and accumulation/distribution. Strengthening was seen in MFI, full stochastic and ADX-related. RSI, momentum and Williams %R are slightly above neutral, full stochastic is well above neutral and again just below overbought and the rest are below neutral.

The experimental 13-period Bollinger limits, $0.8735 and $0.9483 ($0.8734 and $0.9475 yesterday) are almost parallel and rising slightly. Our trading range is "pushing" the upper limit.

All in, I wouldn't be surprised to see a re-trace begin, maybe to ~$0.90(?), as we've had four consecutive days of rising range, which is pushing the limit of what we normally see. We also again penetrated the known strong resistance at $0.94/5 and retreated, adding more support for a re-trace beginning.

So color me (here it comes again!) thinking consolidation with a near-term mild bearish bias based on this stuff. This is at risk if the folks that have been pushing price up during low-volume periods return.

Percentages for daily short sales and buys moved in the same direction, indicating normalcy, and short percentage went below my desired range (needs re-check) while buy percentage returned to the low readings that suggest a near-term move up is unlikely.

The spread widened, thanks to a common open high and drop big through ~13:15 before going flattishwith extremely low/no-volume for most of the rest of the day. This leads to a near-term weakening outlook.

The VWAP's last twenty-four readings improved, for the fourth consecutive day, to 12 negatives and 12 positives from 13 and 11 respectively. Change since 10/31 is $0.0306, 3.39%, and the averages of the rolling 24-day period seen in the last few days (latest first) are now 0.1931%, 0.1218%, -0.4019, %-0.5046%, -0.7608%, -0.7208%, -0.6795%, -0.7820%, -0.5530%, and -0.9605%.

The continuing improvement of the rolling average change is quite a positive ... well, at least counter to a negative. It's definitely a trend now but we should expect some interruptions.

All in, the short and buy percentages and spread suggest near-term weakness within the consolidation pattern. The VWAP trends suggest longer-term improvement is under way but do not preclude near-term weakness.

Bill