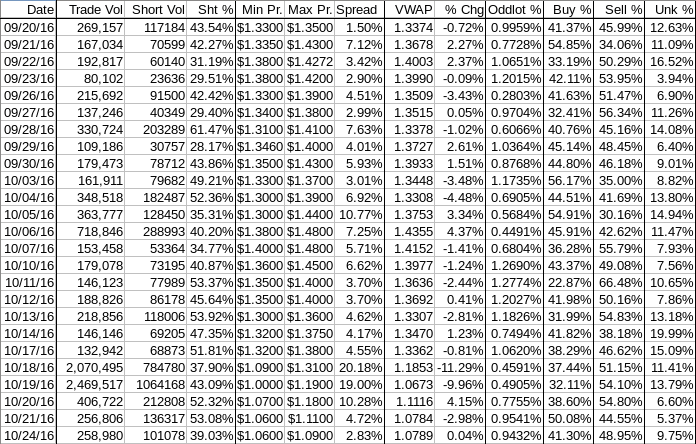

Buy:sell, daily shorts & pps 10/24 2016 EOD

All in continued consolidation with mild weakness for now but the first signs that the sag may end have appeared. A couple more days, probably, before we'll know if that develops.

There were no pre-market trades.

B/a at 9:20 was 5K:66 $1.06/15 (asks next 3K $1.19), 9:28 1K:100 $1.06/20.

09:30-10:01 opened the day with a 3,811 unknown for $1.09. Then came 9:32's b/a of ~1.3K:2.2K $1.08/9, 9:34's 1.1K $1.0800/33, 9:37's 13.1K $1.09 (~12K)/->$1.08, 9:39's b/a 2K:3.2K $1.07/9, 9:41's 3.1K $1.07/$1.0816, 9:42's 100 $1.0703, 9:44's 1.4K $1.07/$1.0720, 9:46's 200 $1.07, 9:48's b/a 2.8L:5.5K $1.08/9, and 9:49's 3K $1.0800/99 (2.5K).

Then began low-volume $1.07/8. B/a at 9:58 was 2.5K:4.1K $1.07/8. The period ended on 10:01's 4.8K $1.07.

10:02-10:12, after one no-trades minutes, began medium-volume $1.06/7 on 10:03's 6.7K $1.06/7. B/a at 10:03 was 7.4K:1.6K $1.06/7, 10:08 2.3K:3 $1.06/7 (that qty 3 asks backed by 3.8K $1.09). The period ended on 10:12's 103 $1.07.

10:13-11:12 returned to the higher range to begin very low/no-volume $1.07/8 (most $1.07) on 10:13's 1.9K $1.0700/50. B/a at 10:25 was 2.5K:8.7K $1.07/8. 100-share bid pecking began at 10:27. B/a at 10:34 was 8.1K:8.8K $1.07/8, 12.9K:10.5K $1.07/8, 11:03 12.8K:9.3K $1.07/8, 11:09 14.1K:7.8K $1.07/8. The period ended on 11:12's 900 $1.08.

11:13-11:35 began extremely low/no-volume $1.08/9 on 11:13's ~51.K $1.08->$1.0750->$1.08->$1.0850->$1.0898. B/a at 11:19 was 7.1K:7.8K $1.08/9. Volume was interrupted by 11:28's 5K $1.09->$1.08 (100) and 11:31-:33's 20.8K $1.0800/11. B/a at 11:33 was 400:7.8K $1.08/9. The period ended on 11:35's 100 $1.08.

11:36-12:01 did a drop to the prior level on 11:36's 14K (incl 10K $1.08 blk) $1.08->$1.07 and began a declining-volume $1.07/8 that became very low/no-volume at 11:41. B/a at 11:38 was 9.8K:2.8K $1.07/8, 11:57 9.8K:1.9K $1.07/8. The period ended on 12:01's 3.1K $1.08.

12:02-12:25 moved up to the prior range on 12:02's 300 $1.08/9 and began very low/no-volume $1.08/9. B/a at 12:07 was 1.7K:5.4K $1.08/9. The period ended on 12:25's 33.3K (incl 27.5K $1.08 blk) $1.0800/10.

12:26-15:11 dropped back to the prior range on 12:26's 800 $1.0700/50 and began very low/no-volume $1.07/8. B/a at 12:45 was 9K:5.2K $1.07/8, 12:52 9.6K:5.1K $1.07/8, 13:07 9.8K:1.8K $1.07/8, 13:20 11.1K:5.8K $1.07/8, 13:34 9.1K:5.2K $1.07/8, 13:48 9.3K:5.1K $1.07/8, 14:18 15.5K:3.8K $1.07/8, 14:48 15.4K:4.4K $1.07/8, 15:04 11.2K:4.1K $1.07/8, 15:12 12.4K:600 $1.07/8. The period ended on 15:11's 1K $1.08.

15:12-15:56 moved up to the prior range on 15:12's 600 $1.08/9 and began very low/no-volume 1.08/9. B/a at 15:13 was 12.2K:7.9K $1.07/9. Price was interrupted by 15:23's 850 $1.0710(550)->$1.08->$1.09. B/a at 15:30 was 2.4K:9.2K $1.08/9, 15:58 12.7K:400 $1.07/8. The period ended on 15:56's 7/5K $1.09->$1.850->$1.09->$1.08.

15:57-16:00, after one-no-trades minute, did 15:58's 10.525K $1.08->$1.07->$1.08, 15:59's 4.9K $1.08->$1.07->$1.08->$1.09->$1.08 and ended the period and day on 16:00's 467 sell for $1.08.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 7 larger trades (>=5K & 3 4K+) totaling 61,803, 23.86% of day's volume, with a $1.0811 VWAP. In light of the day's volume the count is not bad and the percentage is right in the normal range for short-term consolidation. Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

10:01 36177 $1.0700 $1.0900 $39,150.72 $1.0822 13.97% 53.98% Incl 09:37 $1.0900 4,967 6,100

10:12 17797 $1.0600 $1.0717 $19,022.09 $1.0688 6.87% 54.10% Incl 10:03 $1.0700 5,000

11:12 17073 $1.0700 $1.0800 $18,365.32 $1.0757 6.59% 53.89%

11:35 33045 $1.0750 $1.0900 $35,764.57 $1.0823 12.76% 44.13% Incl 11:31 $1.0800 4,100 $1.0811 4,100

11:36 $1.0800 10,000

12:01 26460 $1.0700 $1.0800 $28,551.41 $1.0790 10.22% 41.67%

12:25 34726 $1.0800 $1.0900 $37,511.85 $1.0802 13.41% 33.37% Incl 12:25 $1.0800 27,536

15:11 61965 $1.0700 $1.0800 $66,727.46 $1.0769 23.93% 40.38%

15:56 13650 $1.0710 $1.0900 $14,837.25 $1.0870 5.27% 42.11%

16:00 15667 $1.0700 $1.0900 $16,875.48 $1.0771 6.05% 41.22%

The first three periods, about a quarter of day's volume, tried to make a move up but that was quashed by the subsequent buy percentages which insisted on going towards the normal ending value range that we see associated with marginal weakness. I think it's just more of the post-three-day window short-term consolidation while the market awaits a catalyst and/or makes up its mind what to do.

On the traditional TA front, movements were: __Open_ ___Low_ __High_ _Close_ Volume_

Today 0.93% 0.00% -1.80% -1.82% 0.85%

Prior -8.47% -0.93% -5.93% 0.92% -36.86%

Just what we would expect during short-term consolidation. The only negative is the slightly higher volume on a slightly lower close. This however is in line with what we saw the intra-day buy percentages do.

On my minimal chart, there's really nothing of note. We are going sideways with a mild weakening bias, the experimental 13-period Bollinger limits are still diverging and the mid-point is weakening. I guess I could look at the volume and suspect we might have bottomed out here, seemingly supported by the low being flat today, but it's really too soon to make that determination.

On my one-year chart the 10, 20, 50 and 200-day SMAs continue descending and the 50-day is only $0.0027 above the 200-day. A "Death Cross" is no imminent. All the SMAs should continue to drop barring a substantial near-term rise.

The oscillators I watch, yesterday mixed with RSI, momentum, Williams %R, full stochastic, and accumulation/distribution improved marginally, today "unmixed" with all weakening, all still below neutral, and MFI (untrusted by me), RSI and Williams %R all oversold.

The experimental 13-period Bollinger limits, $0.9890 and $1.5433 ($1.0287 and $1.5483 yesterday), still diverging with a falling mid-point, no have a lower limit that becomes a concern since our history is to not stop at the mid-point. Let's hope price range start walking up towards the mid-point.

All in, nothing positive other than low volume on weakening. This is not a strong enough suggestion, by itself, to suggest that our consolidation will abandon it weakening bias.

Percentages for daily short sales and buys moved in the same direction, normal, and the short percentage dropped in near-the mid-point of my desired range (needs re-check) while the buy percentage gave up yesterday's near-positive reading and went back to the normal "doldrums" level. This suggests no upward strength while the short percentage suggests reduced downward pressure.

The spread dropped right into where we would expect as consolidation is well established and we star the period prior to moving out of consolidation one way or the other. Another day or two before we see it? Can't say.

The VWAP's last twenty-four readings, after two days steady at 14 negatives and 10 positives, improved to 13 and 11 respectively. Change since 09/20 is -$0.2585, -19.33%, and the averages of the rolling 24-day period seen in the last few days (latest first) are now -0.8187%, -0.8505%, -0.8923%, -1.0866%, -0.6859%, -0.2351%, -0.6179%, -0.8203%, -0.6925%, and -0.9581%.

Notice four consecutive improvements in those averages. This suggests the downward momentum started by the dilution announcement is definitely fading.

All, the short percentage suggesting downward pressure is abating conflicts with the buy percentage suggesting continued "sagging" lower. The tie-breaker seems to be the spread and the VWAP average changes. The latter two are neutral to mildly positive when combined with the volume as low as it's at. One last positive is the intra-day attempt to get buy percentage up early.

Bill