Saturday, April 13, 2013 9:12:23 AM

Yeah, i know they registered 147M shares

lets look a little closer, especially at the related Filings:

On 20th Dec.2012 the Company filed a S1, which contains this legal Opinion Letter:

KI ¦ & ¦ HWANG, ¦ LLC

ATTORNEYS AND COUNSELORS AT LAW

1629 K Street NW

Suite 300

Washington, DC 20006

15800 Crabbs Branch Way

Suite 310

Rockville, Maryland 20855

E-Mail: jki@ki-hwang.com

Fax: 240.715.9116

John Ki, Esq. is duly licensed to practice law in Maryland and District of Columbia

December 20, 2012

SW China Imports, Inc.

15800 Crabbs Branch Way, Ste. 310

Rockville, MD 20855

Re:SW China Imports, Inc.

Registration Statement on Form S-1

147,500,000 Shares of Common Stock

Ladies and Gentlemen:

I have acted as special counsel to SW China Imports, Inc., a Nevada corporation ("SW China"), in connection with SW China's registration statement on Form S-1 ("Registration Statement"), filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended ("Securities Act"), of the offer and sale by the selling stockholders identified in the Registration Statement of up to 147,500,000 shares of SW China's common stock, par value $0.0001 per share (“Common Stock").

As the basis for the opinion hereinafter expressed, I have examined such statutes, including the Nevada Revised Statutes, as amended ("NRS"), regulations, corporate records, and documents, including the Certificate of Incorporation and Bylaws of SW China, certain resolutions of SW China’s Board of Directors pertaining to the issuance by SW China of the Common Stock, and other instruments and documents as I have deemed necessary or advisable for the purposes of this opinion.

In making our examination, I have assumed and have not verified (i) that all signatures on documents examined by us are genuine, (ii) the legal capacity of all natural persons, (iii) the authenticity of all documents submitted to us as originals, and (iv) the conformity to the original documents of all documents submitted to us as certified, conformed, or photostatic copies.

Based upon the foregoing, and subject to the limitations and assumptions set forth herein, and having due regard for such legal considerations as I deem relevant, I are of the opinion that the shares of the Common Stock are duly authorized, validly issued, fully paid and non-assessable.

I express no opinion on the laws of any jurisdiction other than the Federal Securities Laws and the NRS, including its applicable statutory provisions, the rules and regulations underlying those provisions and the applicable judicial and regulatory determinations.

Board of Directors

December 20, 2012

Page 2

I hereby consent to the use of this letter as an exhibit to the Registration Statement and to any and all references to our firm under the caption “Interests of Named Experts and Counsel” in the prospectus which is a part of the Registration Statement. In giving such consent I do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Securities and Exchange Commission. This opinion and consent may be incorporated by reference in a subsequent registration statement on Form S-1 filed pursuant to Rule 462(b) under the Act with respect to the Common Stock.

Very truly yours,

/s/ John Ki

John Ki

http://www.sec.gov/Archives/edgar/data/1516559/000151655912000021/ex51.htm

------------------------------------------------------

after that a few other Filings took place as you can see here:

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001516559&type=&dateb=&owner=include&count=40

------------------------------------------------------

2013-02-15 shows that this Correspondence was sent to the SEC:

February 19, 2013

VIA EDGAR CORRESPONDENCE

Division of Corporate Finance

Securities and Exchange Commission

Washington, DC 20549

ATTN:

Lisa Kohl, Staff Attorney

Mara L. Ransom, Assistant Director

Re:

Registration Statement on Form S-1

Filed December 20, 2012

File No. 333-185571

Dear Ms. Ransom and Kohl:

In accordance with Regulation C, Rule 461, we hereby request acceleration of the effective date of our registration statement on Form S-1, such that it be deemed effective on Tuesday, February 19, 2013, at 2:00pm (Eastern Time), or as soon as practicable thereafter.

On behalf of the Company, I hereby acknowledge that:

a) Should the Commission or the Staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing;

b)The action of the Commission or the Staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the Company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and

c)The Company may not assert Staff comments and the declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

The Company further understands that the Division of Enforcement has access to all information provided to the Staff of the Division of Corporation Finance in the Staff’s review of the Company’s filings or in response to the Staff’s comments on the Company’s filings.

Ms. Kohl and Ransom

February 15, 2013

Page 2

Please direct any questions or comments regarding the Registration Statement to Taurus Financial

Partners, LLC at (512) 772-1542.

Very truly yours,

On behalf of:

SW CHINA IMPORTS, INC.

/s/ Seon Won

Seon Won

President and Chief Executive Officer

SW China Imports, Inc.

http://www.sec.gov/Archives/edgar/data/1516559/000151655913000017/filename1.htm

----------------------------------------------------

So the CEO requested now to declare the S1 Filing from 20.Dec.2012 effective.

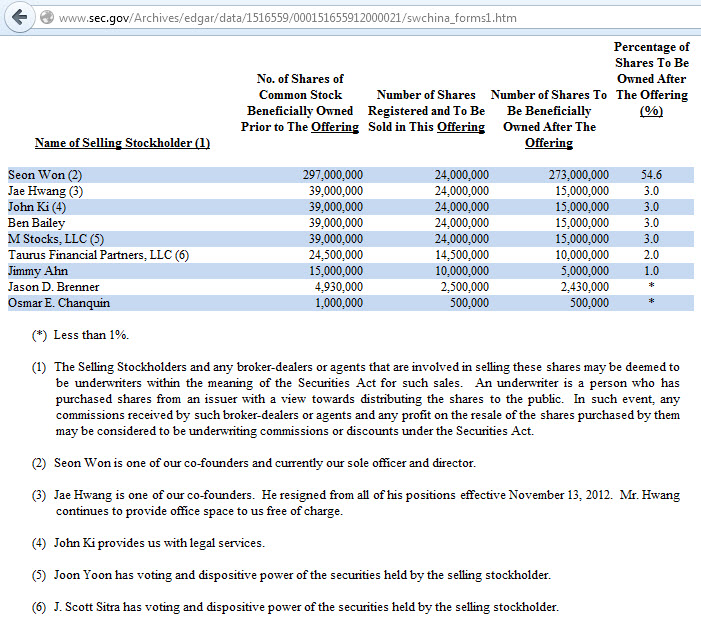

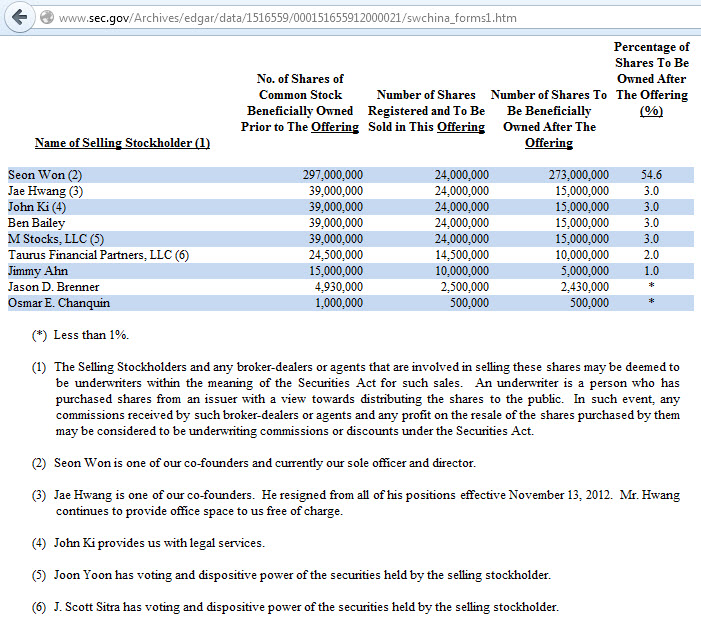

Let's see what the S1 Filing discovers about those 147,000,000 shares:

Future sales of our common stock may depress our stock price.

The market price for our common stock could decline as a result of sales of substantial amounts of our common stock into the public market, or as a result of the perception that such large scale sales could occur. We are registering for resale by the selling stockholders 147,500,000 shares of our common stock in this prospectus. As of the date of this prospectus, the shares being registered in this prospectus represent 29.5% of our total issued and outstanding shares. Any significant sales of these shares or anticipated sales could result in a decline in the market price of our common stock.

On February 1, 2012 we appointed VStock Transfer, LLC, located in Cedarhurst, New York, as the Company’s official transfer agent and registrar.

On February 22, 2012, we issued 1,000,000 shares of restricted common stock, $0.0001 par value, to Kyung Lee in exchange for $10,000, or $0.01 per share.

http://www.sec.gov/Archives/edgar/data/1516559/000151655912000021/0001516559-12-000021-index.htm

------------------------------------------------------

As shown in the S1 as well:

We are currently in the development stage and have nominal operations and minimal assets, which makes us a “shell company” as defined in Rule 12b-2 of the Exchange Act, as amended. Because we are considered a shell company our shares of common stock can only be resold through (i) registration under the Securities Act of 1933, as amended (“Securities Act”), (ii) Section 4(1) under the Securities Act, if available, for non-affiliates, or (iii) by meeting the conditions of Rule 144(i) under the Securities Act which requires a minimal holding period of 12 months following SW China Imports no longer being classified a shell company.

So now you'll have to go through the Filings again and look at who got shares when etc to verify how many shares really can be dumped into the Market.

Per the Promoters here and the PR they've sent on 08.Apr'12 it's ~40M shares.

lets look a little closer, especially at the related Filings:

On 20th Dec.2012 the Company filed a S1, which contains this legal Opinion Letter:

KI ¦ & ¦ HWANG, ¦ LLC

ATTORNEYS AND COUNSELORS AT LAW

1629 K Street NW

Suite 300

Washington, DC 20006

15800 Crabbs Branch Way

Suite 310

Rockville, Maryland 20855

E-Mail: jki@ki-hwang.com

Fax: 240.715.9116

John Ki, Esq. is duly licensed to practice law in Maryland and District of Columbia

December 20, 2012

SW China Imports, Inc.

15800 Crabbs Branch Way, Ste. 310

Rockville, MD 20855

Re:SW China Imports, Inc.

Registration Statement on Form S-1

147,500,000 Shares of Common Stock

Ladies and Gentlemen:

I have acted as special counsel to SW China Imports, Inc., a Nevada corporation ("SW China"), in connection with SW China's registration statement on Form S-1 ("Registration Statement"), filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended ("Securities Act"), of the offer and sale by the selling stockholders identified in the Registration Statement of up to 147,500,000 shares of SW China's common stock, par value $0.0001 per share (“Common Stock").

As the basis for the opinion hereinafter expressed, I have examined such statutes, including the Nevada Revised Statutes, as amended ("NRS"), regulations, corporate records, and documents, including the Certificate of Incorporation and Bylaws of SW China, certain resolutions of SW China’s Board of Directors pertaining to the issuance by SW China of the Common Stock, and other instruments and documents as I have deemed necessary or advisable for the purposes of this opinion.

In making our examination, I have assumed and have not verified (i) that all signatures on documents examined by us are genuine, (ii) the legal capacity of all natural persons, (iii) the authenticity of all documents submitted to us as originals, and (iv) the conformity to the original documents of all documents submitted to us as certified, conformed, or photostatic copies.

Based upon the foregoing, and subject to the limitations and assumptions set forth herein, and having due regard for such legal considerations as I deem relevant, I are of the opinion that the shares of the Common Stock are duly authorized, validly issued, fully paid and non-assessable.

I express no opinion on the laws of any jurisdiction other than the Federal Securities Laws and the NRS, including its applicable statutory provisions, the rules and regulations underlying those provisions and the applicable judicial and regulatory determinations.

Board of Directors

December 20, 2012

Page 2

I hereby consent to the use of this letter as an exhibit to the Registration Statement and to any and all references to our firm under the caption “Interests of Named Experts and Counsel” in the prospectus which is a part of the Registration Statement. In giving such consent I do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Securities and Exchange Commission. This opinion and consent may be incorporated by reference in a subsequent registration statement on Form S-1 filed pursuant to Rule 462(b) under the Act with respect to the Common Stock.

Very truly yours,

/s/ John Ki

John Ki

http://www.sec.gov/Archives/edgar/data/1516559/000151655912000021/ex51.htm

------------------------------------------------------

after that a few other Filings took place as you can see here:

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001516559&type=&dateb=&owner=include&count=40

------------------------------------------------------

2013-02-15 shows that this Correspondence was sent to the SEC:

February 19, 2013

VIA EDGAR CORRESPONDENCE

Division of Corporate Finance

Securities and Exchange Commission

Washington, DC 20549

ATTN:

Lisa Kohl, Staff Attorney

Mara L. Ransom, Assistant Director

Re:

Registration Statement on Form S-1

Filed December 20, 2012

File No. 333-185571

Dear Ms. Ransom and Kohl:

In accordance with Regulation C, Rule 461, we hereby request acceleration of the effective date of our registration statement on Form S-1, such that it be deemed effective on Tuesday, February 19, 2013, at 2:00pm (Eastern Time), or as soon as practicable thereafter.

On behalf of the Company, I hereby acknowledge that:

a) Should the Commission or the Staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing;

b)The action of the Commission or the Staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the Company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and

c)The Company may not assert Staff comments and the declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

The Company further understands that the Division of Enforcement has access to all information provided to the Staff of the Division of Corporation Finance in the Staff’s review of the Company’s filings or in response to the Staff’s comments on the Company’s filings.

Ms. Kohl and Ransom

February 15, 2013

Page 2

Please direct any questions or comments regarding the Registration Statement to Taurus Financial

Partners, LLC at (512) 772-1542.

Very truly yours,

On behalf of:

SW CHINA IMPORTS, INC.

/s/ Seon Won

Seon Won

President and Chief Executive Officer

SW China Imports, Inc.

http://www.sec.gov/Archives/edgar/data/1516559/000151655913000017/filename1.htm

----------------------------------------------------

So the CEO requested now to declare the S1 Filing from 20.Dec.2012 effective.

Let's see what the S1 Filing discovers about those 147,000,000 shares:

Future sales of our common stock may depress our stock price.

The market price for our common stock could decline as a result of sales of substantial amounts of our common stock into the public market, or as a result of the perception that such large scale sales could occur. We are registering for resale by the selling stockholders 147,500,000 shares of our common stock in this prospectus. As of the date of this prospectus, the shares being registered in this prospectus represent 29.5% of our total issued and outstanding shares. Any significant sales of these shares or anticipated sales could result in a decline in the market price of our common stock.

On February 1, 2012 we appointed VStock Transfer, LLC, located in Cedarhurst, New York, as the Company’s official transfer agent and registrar.

On February 22, 2012, we issued 1,000,000 shares of restricted common stock, $0.0001 par value, to Kyung Lee in exchange for $10,000, or $0.01 per share.

http://www.sec.gov/Archives/edgar/data/1516559/000151655912000021/0001516559-12-000021-index.htm

------------------------------------------------------

As shown in the S1 as well:

We are currently in the development stage and have nominal operations and minimal assets, which makes us a “shell company” as defined in Rule 12b-2 of the Exchange Act, as amended. Because we are considered a shell company our shares of common stock can only be resold through (i) registration under the Securities Act of 1933, as amended (“Securities Act”), (ii) Section 4(1) under the Securities Act, if available, for non-affiliates, or (iii) by meeting the conditions of Rule 144(i) under the Securities Act which requires a minimal holding period of 12 months following SW China Imports no longer being classified a shell company.

So now you'll have to go through the Filings again and look at who got shares when etc to verify how many shares really can be dumped into the Market.

Per the Promoters here and the PR they've sent on 08.Apr'12 it's ~40M shares.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.