Friday, August 17, 2012 3:12:19 PM

CEO Steven King’s 29 min. Presentation – Wedbush/NYC 8-15-2012

Aug15, 2012 - Wedbush Life Sciences Mgt. Access Conf., NYC

8-15-2012 WEBCAST Replay: http://ir.peregrineinc.com/events.cfm

REPLAY direct link: http://wsw.com/webcast/wedbush21/pphm

Complete Webcast Schedule: http://wsw.com/webcast/wedbush21

Slides & Excerpts from CEO Steven King’s 8-15-12 Presentation at Wedbush/NYC:

INTRO by Wedbush host, 8-15-12: “Thank you all for coming to the last session this morning. We’re very pleased to have Steven King from Peregrine Pharmaceuticals with us today – not a company that’s under coverage at Wedbush, but certainly one of focus of a lot of investors. I think there’s some great anticipation for an update for Bavituximab here in the latter part of this year with their Lung Cancer study, and I hope you’ll find their story as interesting as we do here at Wedbush.”

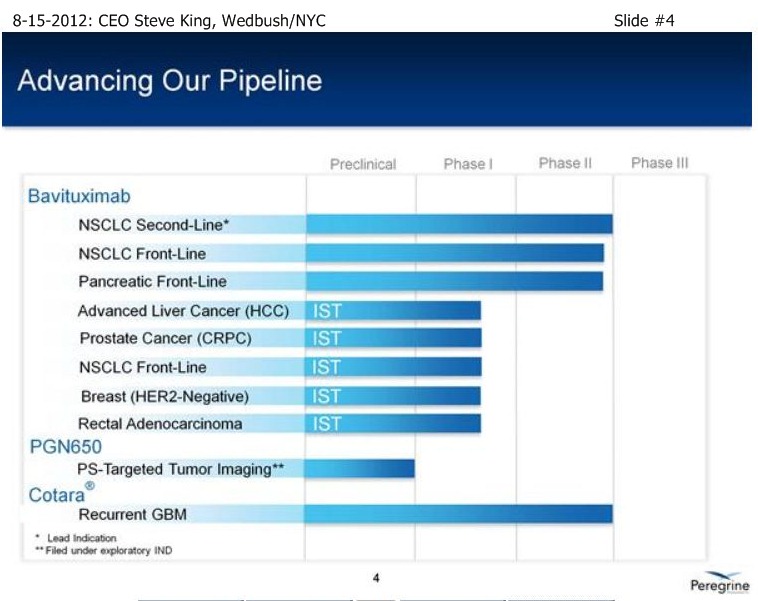

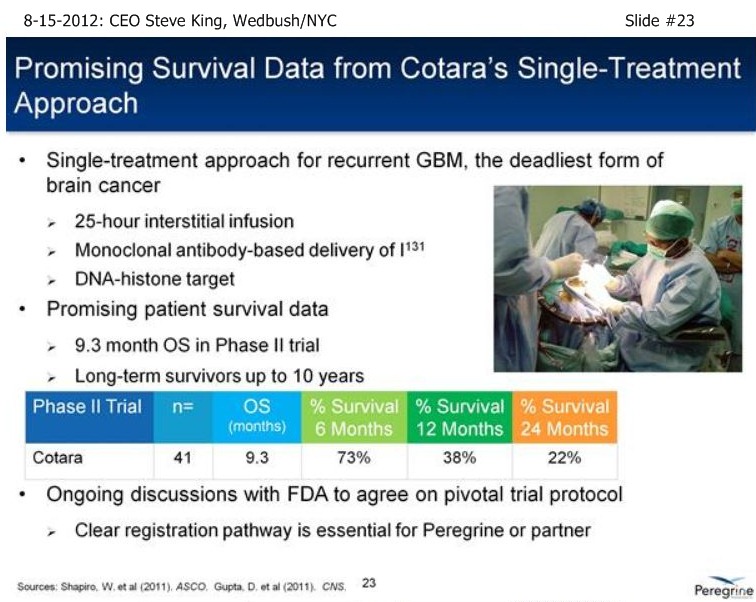

SK/S3: “We have 2 Phase3-ready pgms, the most recent to move into that area is Bavituximab, with some exceptional proof-of-concept data in 2nd-Line NSCLC, to go along with our Cotara/GBM pgm. Both of these are currently un-partnered, and we believe there are significant opportunities to go forward for partnering activities for both of these compounds. . . In addition, we operate a growing commercial mfg. business, Avid Bioservices. Avid had ~$15mm rev’s in the last FY, and we’re projecting at least $15mm in revs for the curr. FY. In addition, we currently have ~$30mm backlog in future business, so really a growing business, based on the success of our clients, in which we’re expecting a number of new product launches coming out of the facility over the coming year. But, importantly about Avid, is our own ability our products – that allows us to be as aggressive as we have been on the clinical front, but also as we look fwd to potentially 2 Phase III pgms, it also gives us the ability to mfg. those Ph.III products and to think about eventual commercial launches out of our own facility.”

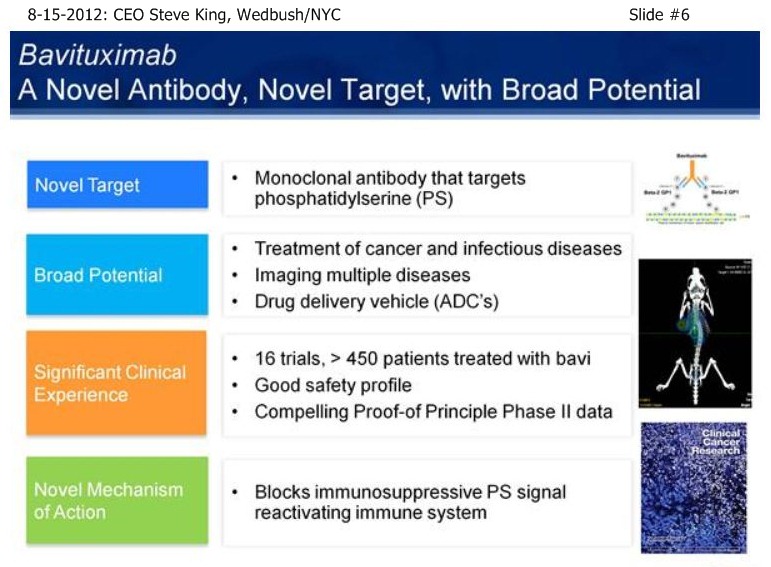

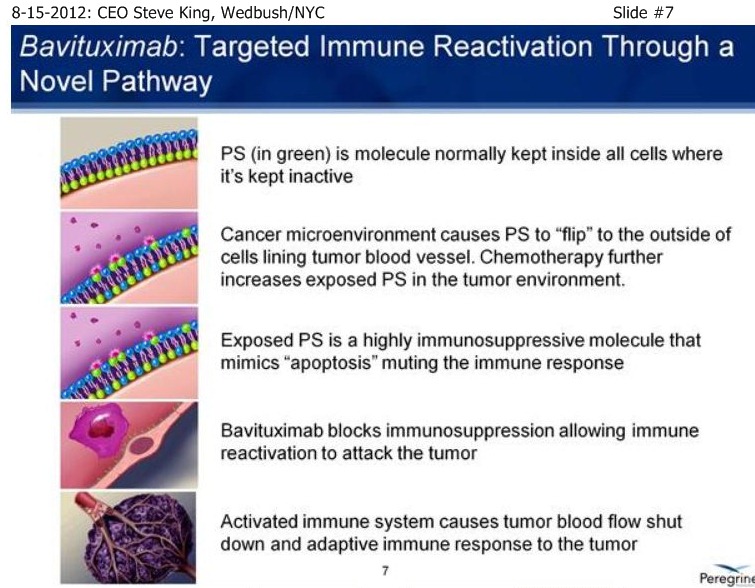

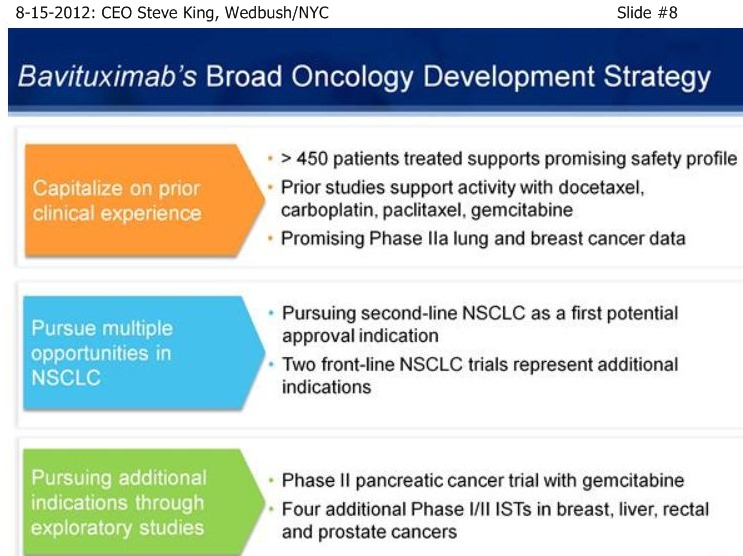

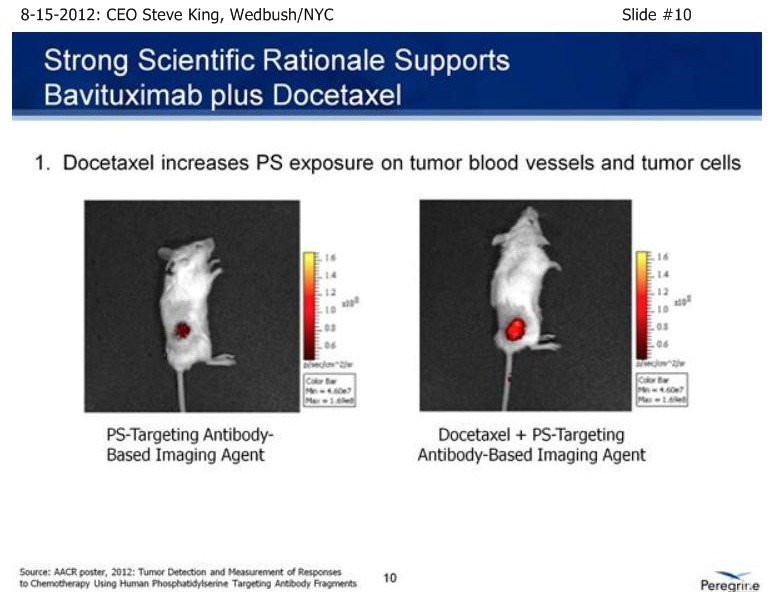

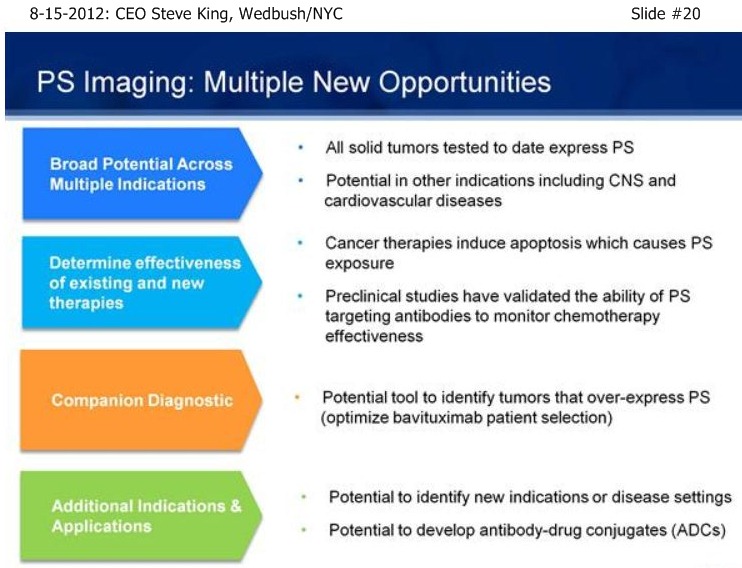

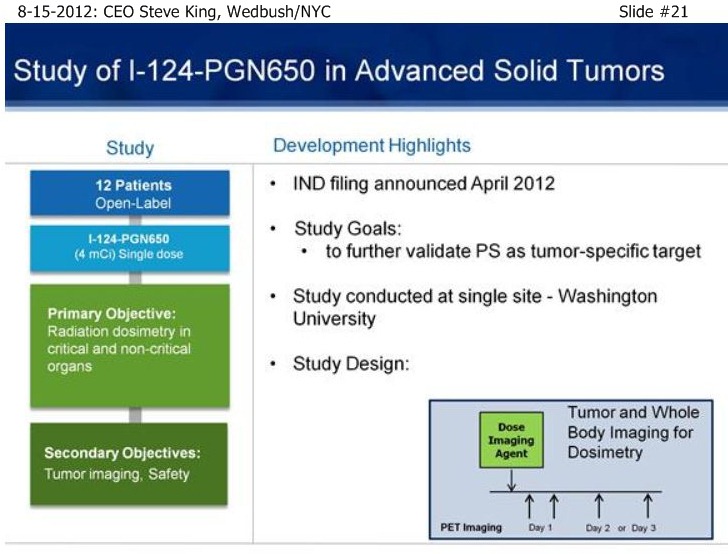

SK/S7: “A very novel MOA - it turns out that PS is not simply a marker of disease, but is actually involved in controlling the immune response to disease. By blocking that immunosuppressive signal, we actually allow the immune system to turn on and fight the disease. The concept is, Phosphatidylserine (PS) itself is a normal component of cellular membranes, present in every cell of the body, only very-tightly regulated to internal side of the cell. So, essentially, if you inject PS-finding agents, such as is done in our Imaging pgm, the agents simply float around and eventually clear the body if there’s no sign of disease. What our scientists discovered, is that as cancer develops, you get a very unique environment, you have poor blood flow, reactive oxygen species, hypoxia – as a result of all these insults, the mechanisms that keep PS inside of cells become disrupted, and the PS becomes exposed on the outside of the cell. It turns out that this exposed PS in the tumor microenvironment is very important in controlling the immune response. The only normal time which you have PS exposure is when cells undergo normal programmed cell death, or apoptosis. So, as cells die, you see the same phenomenon of PS becoming expressed or exposed on the outside of the cell. What happens then is, as the immune system is undergoing its daily routine of removing dead & dying cells, those macrophages & dendritic cells, whose responsibility it is to remove the cells, interact with the dead & dying cells, and actually have a PS-receptor on their surface. As the exposed PS binds to the receptor on the immune cells, it actually sends specific signals to down-regulate the immune response, because when you’re removing dead & dying cells you don’t need a robust immune response, obviously. It turns out that cancer, as well as a number of other diseases, have taken advantage of this fact, and by simply causing PS-exposure during the tumor microenvironment, you now do not get an adequate immune-response to the disease, allowing the tumors to outgrow the poor immune-response that’s being given. Bavituximab is injected, it goes to the site of the disease, so it accumulates on the PS inside the tumor environment, blocks the PS that’s exposed in that environment, and now those immune cells - you can actually detect a significant change in there phenotypes, as they go from a non-inflammatory to a pro-inflammatory state and really begin the fight the disease. And over time, you see development of a full adaptive immune response. As at fully adaptive immune response happens, you then have this full immune response, which includes ADCC, mediated by the antibody itself, normal cell-killing, mediated by the antibody, as well as activation and down-stream effects of the immune response.”

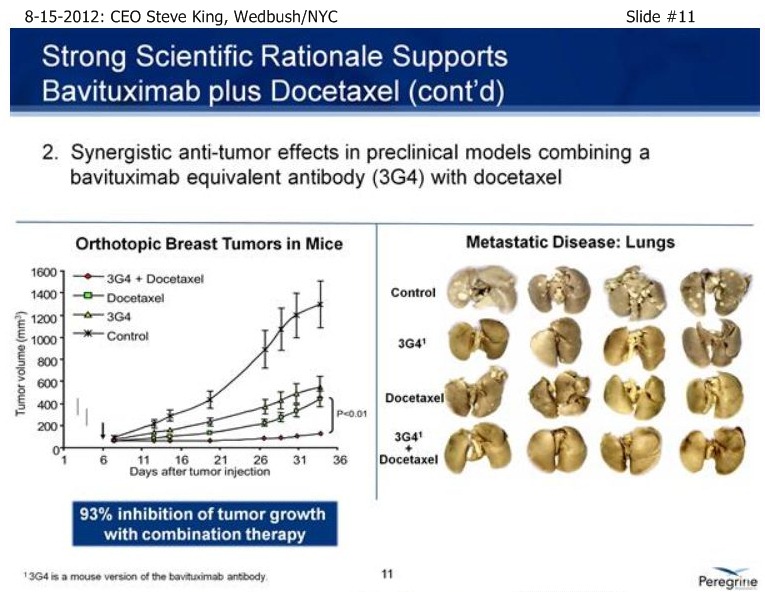

SK/S11: “[From pre-clinical models], we had a great rational going into the [NSCLC] clinical study. We knew that Docetaxel up-regulates the PS-marker itself… If you take a look at the treatment of solid tumors or metastatic disease, what you see normally is very robust tumor growth. You see Bavituximab and the chemo drug Docetaxel both inhibit tumor growth very significantly. But, when you combine the 2, you see almost a complete stoppage of tumor growth. And, in fact, if you look at metastatic disease, again in the treatment with the combination, you see can almost completely arrest the metastatic spread of the disease.”

SK/S12: “In addition to the pre-clin. modeling, we’ve also had some good clinical data supporting NSCLC in combo w/Docetaxel. In some single-arm Ph2A studies, which were really meant as signal-seeking studies as well as safety-generating studies, we studied Bavi+CP in NSCLC, as well as Bavi+Doce in Met. Breast Cancer. What we saw across the board were promising results, whether it was TRR’s, PFS, and OS. In particular, in the Docetaxel (MBC) study, we saw very nice results, including what was really a remarkable MOS from that study.”

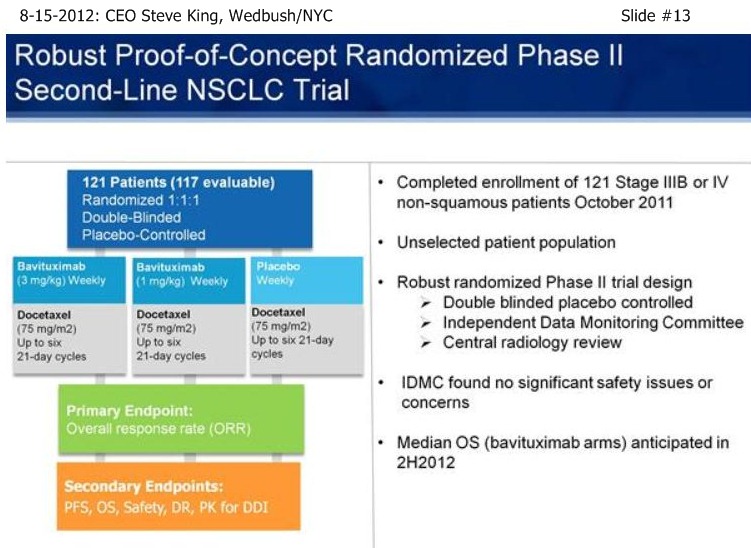

SK/S13: “With that (single-arm, signal-seeking) data on hand, we began discussions with the FDA. About that time we brought on board our Head/Regulatory, Rob Garnick, who was prior with Genentech and oversaw, from a regulatory standpoint, the development of most most of the major antibodies that are on the market [17 approvals, incl. Rituxan, Herceptin, Avastin, Lucentis]. And, thru those discussions, we came up with what we think is a very robust trial design, meant to truly be a proof-of-principle for the targeting platform and the continued studies… [Re: 2nd-Line NSCLC trial design] - a trial design to remove all biasness from the trial and to be able to get a clear results from the study… (re: 1mg vs. 3mg Bavi]: “we believe that even at the trough between dosing at 1mg/kg, you would still be saturating the target, so we do expect both arms to be active vs. the placebo arm. While this study was designed with ORR as the primary endpoint, really the key here is PFS and OS data, and in particular OS data because in all likelihood OS will be the primary endpoint going into any Phase III study. One more point on this slide, this is also a great opportunity to really take a look at the safety profile of the drug, in which the safety events are being looked at without knowing what the patients are receiving. Importantly, the IDMC found no differences between either of the Bavi arms and the placebo arm, so we’re not adding to the toxicity seen with the chemo itself.”

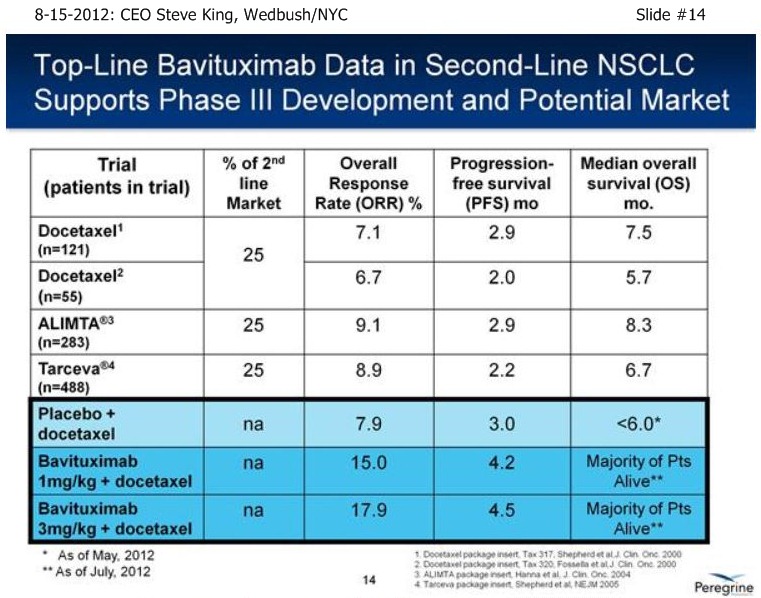

SK/S14: “As of a (2nd-Line NSCLC) data cut at the end of April, we were able to analyze the data – the IDMC recommended, based on the maturity of the ORR’s, to unblind the study in the middle of May, and we reported results on 5-21-12 [ http://tinyurl.com/73aeyxj ]. A few things have really stood out about this study, the 1st being that the CTL-arm really behaved itself wonderfully, right in alignment with prior results with Docetaxel alone from an historical perspective, with 8% TRR, 3 mos PFS, and less than 6 mos. MOS – the ctl-arm is right where we expected going into the designing of the study. The other thing that has stood out is the fact that both of the Bavi arms are actually right in alignment with each other, with approx. a doubling of TRR’s, 40-50% increase in PFS, and again, both of those data points were mature at the time of unblinding. What is most exciting about the results is the fact that when we unblinded, we had already well-surpassed the MOS point for the control arm at less than 6 mos., and again, that was as of the end of April. As we’re sitting here today, we have still not reached the # of events for MOS in either of the Bavituximab arms – and, in fact, we still have patients that are on treatments. So, clearly we’re seeing a very nice separation with regards to survival between the ctl-arm and both Bavi arms, which continue to perform very equally.”

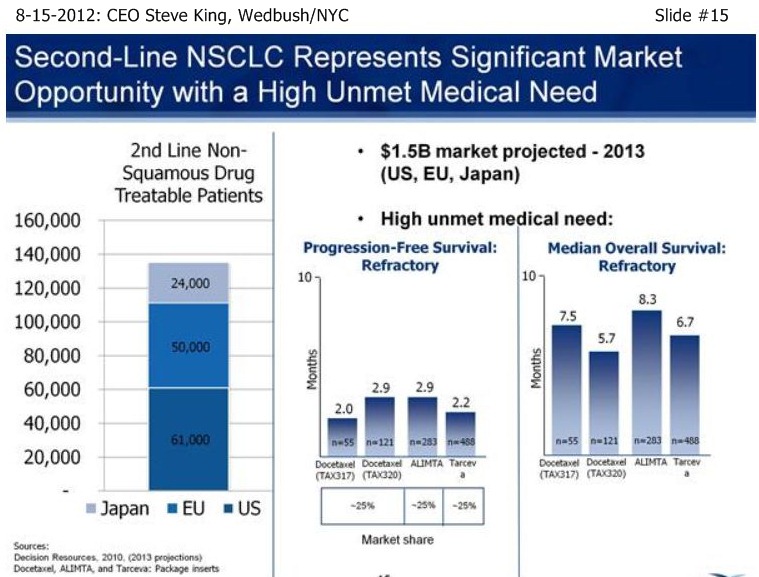

SK/S15: “We view 2nd-Liine NSCLC as a significant market opportunity…This is a disease in which there is a very high unmet medical need, with < 3mos PFS, and MOS of only 5-8 mos. historically.”

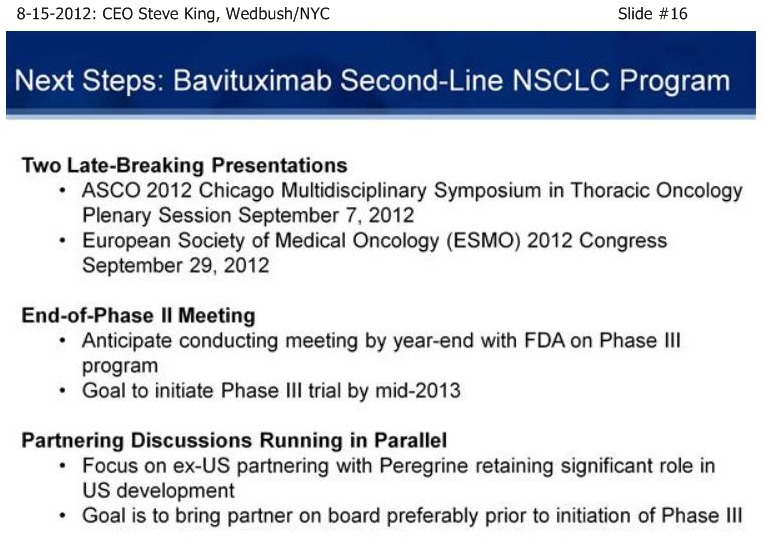

SK/S16: “With this (2nd-Line NSCLC) data in hand, we now have a number of events to look forward to… We have 2 Late-Breaking presentations coming up… Our goal in the Sept. 7th Chicago data presentation is to be able to talk a little bit more about the (2nd-Line NSCLC) MOS and where we’re at evaluating that in both Bavi arms. Even though we haven’t reached MOS, and certainly may not have reached it by then, we still will be able to talk a little bit more about where we’re at in that process. We’ll also be able to talk more about how the statistics in the trial are trending, and how we put those kinds of events together into our thinking about a Phase III trial design. Our goal is to get the data out there, but we’re already beginning our EOP2 meeting preparations. We’re working actively on a Ph.3 trial design; our goal is to have the EOP2 meeting before the end of the year, which will put us on track for initiating a Ph.3 trial by the middle of 2013.

While we’re moving our own preps. for the EOP2 meeting forward, we’re also parallel-tracking partnering discussions. We really have a focus on ex-US partnering – our goal is to be able to maintain as much U.S. rights as we can as part of a deal structure, to bring in the capital not just to run a Ph.3 study, but also to continue to study the broad-nature of the technology platform itself. So, our goal is to bring in a partner, hopefully in conjunction with the EOP2 meeting – that’s really the one opportunity to affect the discussion with the agency, and also to, at the end of the day, to have a trial design we feel will be not just effective in the U.S., but also on a global basis - certainly we would anticipate that trial being run in the U.S. and in Europe, and probably some other territories as well. I think we’re track - the discussions are moving forward very nicely, but really we’re controlling what we can control, which is to start thinking about the EOP2 meeting and pushing towards that event ourselves.”

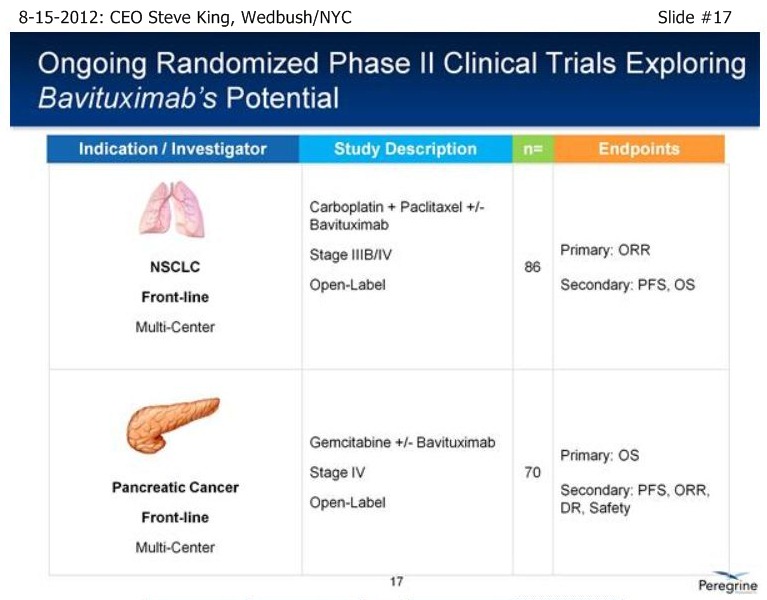

SK/S17: “In addition to our lead pgm in NSCLC, we have a # of other important events coming up over the next 6 mos. or so… [re: Front-Line NSCLC randomized trial], we expect OS data to mature probably toward the end of this year or potentially at the beg. of next year – these are time-to events, but certainly in that sort of timeframe…”

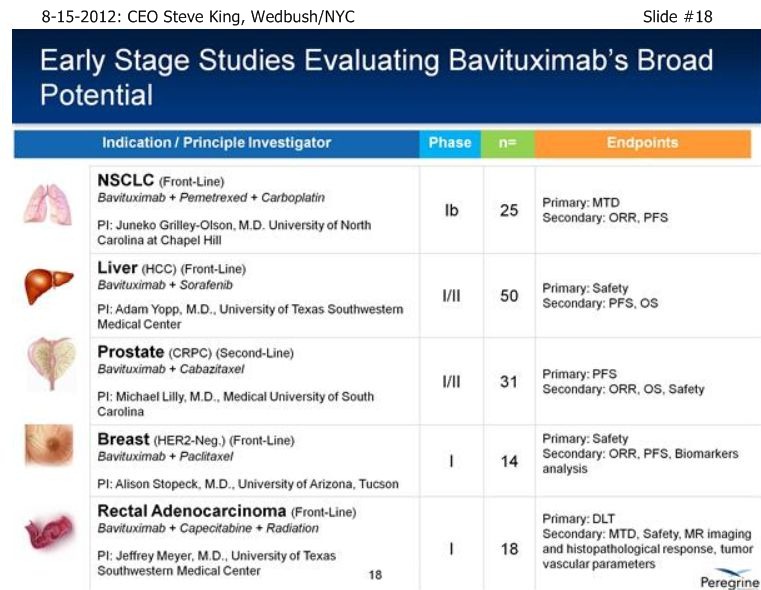

SK/S18: “…we have a # of other studies that are ongoing to really further explore the broad-potential of the platform. . . Bavi+Sorafenib in Liver Cancer, which can be a very important indication as we start to think about the future as we partner the drug [ see http://tinyurl.com/8cuxjdn ], and certainly Liver Cancer is a major market opportunity throughout Asia. . . And, a very exciting new study is Bavi+Radiation – in pre-clinical models, radiation is a very potent inducer of PS, and so we think it could be a really great partner for combination.”

SK/S25/AVID: “…This is our successful revenue-generating CMO… We currently have a backlog of $30mm in revenue, which extends over the next couple of FY’s. Importantly, this is an integrated business in which we are also mfg. our own product, preparing for Phase III, in fact we’re ready for Phase III, and then we’re starting to think about what the production would look like for the eventual commercialization of Bavi as well as Cotara. We do expect a # of new product launches coming out of the facility, so from a regulatory standpoint, we operate this facility at a very high level.”

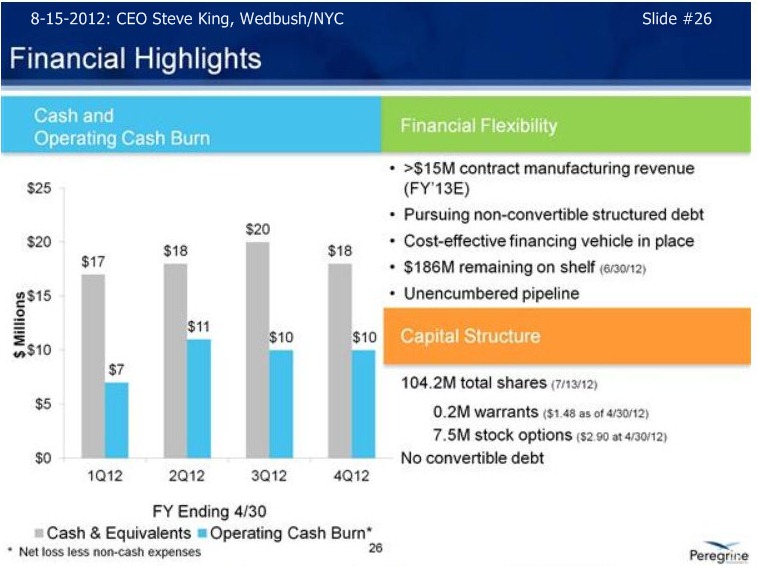

SK/S26/FINANCIALS: “We reported fin. results in July (fy/e 4-30-12) – at that time we ha ~$18mm in cash at 4-30-12. In addition to that, we have received $7mm+ in reservation fees from our 3rd-party clients as they are tying up our capacity going fwd. If you look at it historically over time, we basically have raised the amt. of capital we needed to get to these inflection points, and now that achieving the inflection points, obviously we have some great opportunities going forward. We’ve laid out our strategy for financing the company; we’ve not been raising money thru the capital markets in any way. We’re not currently planning on going out for, nor have we been actively involved in any other fund-raising activities. Right now, our stated goal is to pursue a debt-arrangement – with an asset like Avid Bioservices, we can get very preferential rates on raising debt-type funding right now, which we feel is the least-dilutive for the company. In fact, our stated goal is to raise $20-30mm thru a debt facility between now and out next earnings call on Sept. 10th. With that capital in the bank, we’ll then will have a 1yr+ runway. We believe that will get us thru the partnering discussions, and then with a partner on board, then certainly we expect that’ll bring in the capital needed to move the company forward for what should hopefully be several years time period. So, that’s our goal – we have a nice, clean cap structure, minimal # of warrants, stock options – there’s no convertible debt on the books, so we think we’re in good shape as we continue to move the company forward into those successful partnering discussions.”

SK/S27: “we have a number of key value-drivers coming up. The 2nd-Line NSCLC study is obviously continuing to be the focus, as we have what we believe to be a clear pathway to move that program forward. MOS data, again this is a time-to event and we haven’t reached it yet, but at some point in all likelihood we will. We have the upcoming oral presentation at the ASCO Chicago Symposium (9-7-12), as well as at ESMO (9-29-12/Vienna), which gives us a great opportunity to talk about the clinical data and to describe to people why we’re so excited about the potential of this trial, and why, not just ourselves, but key opinion leaders that are active in the pgm, as well as potential partners, believe this is a clear path into Phase III and to move the pgm forward. In addition, again, we’re planning for an EOP2 meeting before the end of the year. Our goal would be to have a partner on board for that meeting, but in any case, we are moving towards that meeting ourselves, and do plan on having the meeting with or without a partner…”

Q&A:

Q1: ”re: 2nd-Line NSCLC trial, what is the minimum MOS figure that we could see?”

SK: “The data cut at the end of April already showed that we had clearly reached MOS in the ctl-arm. As we sit here now today, several months later, we still haven’t reached that min. # of events for either of the Bavi arms to be there (MOS). It’s not quite as simple as a 1-to-1, ie, 1 month doesn’t mean it’s 1 month addl. in OS, but what we can say is, it [2nd-Line NSCLC MOS] is going to be a very positive result, it’s just a matter now of magnitude. Importantly, because we often get this question, potential partners do not need to reach MOS to make a decision on partnering. We do not need to reach MOS in the Bavi arms at this point to plan what the pivotal trial will potentially look like. At this point, we have data, and I think we’ll be able to make it clearer when we present the full package on Sept. 7th in Chicago. Basically, the longer, the better, obviously – it’s not just great for the program, it’s great for the patients, because, again, we do have patients that are out and still even on treatments as we speak.”

Q2: ”How many partners are you talking to presently?”

SK: “We said in our last qtly CC (7-16-12 http://tinyurl.com/cs7spbz ) was that just from May until that time in July, we’d had over 15 face-to-face meetings with potential partners. We’ve had meetings since that time period, very active due-diligence – I kinda joke that DD has now become a full-time job, and we all get to do our day jobs at night. But, very active discussions; I think they’re all progressing very nicely, and there continues to be a lot of enthusiasm for the data and the program.”

*end*

= = = = = = = = = = = = = = = = = = = = = = = = = = = = =

F. Phase IIb Bavi+Doce vs. 2nd-Line NSCLC (randomized, double-blinded, placebo-controlled, n=120, 'registrational')

Protocol: http://clinicaltrials.gov/ct2/show/NCT01138163 (24 U.S. + 15 India + 2 RepGA + 7 RussianFED + 5 Ukraine = 53 as of 8-12-11)

...Also listed in: India's CTRI registry ctri.in#2191 (12 sites a/o 3-20-11)

6-2011 WJCO article lists 2ndLine NSCLC hist. results (Doce/Tarceva/Pemetrexed) http://tinyurl.com/7jdtpto

. . . . .see pg.266, 2ndLine comparator results: ORR=6.7-9.1%, PFS=2.2-6.0mo, MOS=5.7-8.3mo

…8-15-12 CEO Steve King, Wedbush/NYC ( http://tinyurl.com/8mhrtld )

……”As we’re sitting here today, we have still not reached the # of events for MOS in either of the Bavituximab arms – and, in fact, we still have patients that are on treatments.” Q&A: “it’s going to be a very positive MOS result, it’s just a matter now of magnitude.”

…7-16-12 QTLY. CONF. CALL - COMMENTS ON 2ND-LINE NSCLC PROGRAM... ( http://tinyurl.com/cs7spbz )

……Steve King 7-16-12: "The strength of this data (esp. MOS trends) in this large area of high unmet medical need has also sparked a surge in partnering discussions that has included over 15 in-person partnering meetings since that time with major players in oncology, with all discussions ongoing and addl. parties showing interest. Our goal for the program is to position ourselves, along with a potential partner, to initiate Ph3 by mid-2013, which means an EOP2 meeting by yr-end'12. It would be ideal to have a partner on board to participate in the EOP2 meeting, and we have communicated this to interested parties and they agree."

……Rob Garnick 7-16-12: "We've been working very hard and very actively on the next steps in our Bavi 2nd-Line NSCLC pgm, given the favorable data that we've seen. As you can imagine, with data like this, there are many things that we need to consider. One consideration is that, should the data continue to trend the way it is, particularly in survival, this opens a door for potential discussions around a pathway for Accelerated Approval. At this point, all options are being considered, with Peregrine working towards the most efficient path forward from a regulatory standpoint." Q&A: "…all in all, I think the data is extremely compelling and I think it makes a really good case. Certainly, I think, I've seen a lot of Ph2 & Ph3 data, and this is as compelling Ph2 data as I've ever seen. So, I'm very comfortable proposing a meeting with the FDA for Q4'12."

…7-12-12 CEO Steve King, JMP-Conf/NYC ( http://tinyurl.com/csdclwb )

……Steve King 7-12-12: "Re: 2nd-Line/NSCLC trial, the most thrilling thing is the fact that, even though we'd reached MOS for the ctl-arm(Doce) at end of Apr'12 of LESS THAN 6MOS, the majority of patients are still alive (today) in both Bavi arms, and we expect that to continue for some period of time still. Ph3 planning is underway already; our goal is to start this Ph3 by mid'13, meaning an EOP2 meeting with the FDA in Q4'12; our goal is to bring a partner on board, ideally in time for that EOP2 meeting, certainly before the beg. of the Ph3 trial."

…5-21-12: TopLine data n=117 for Bavi/3mg+Doce arm: ORR=17.9%/PFS=4.5mos (vs. CTL 7.9%/3mos) http://tinyurl.com/73aeyxj

......Importantly, MOS for CTL-arm "< 6 mos", but not yet reached in both Bavi arms.

...10-6-11: Enrollment complete. http://tinyurl.com/3m9re39

...7-14-11/CC: Enrollment was taking longer than expected; have amended protocol; expanding to ~45 sites, expect enroll. comp. "early in Q4/2011", data unblinding 1H'12. http://tinyurl.com/6k6y2as

…3-17-10/Roth, CEO S.King: "We refer to this trial as a Registrational Phase II Study, because we believe that if we have results anywhere near approaching what we saw in the earlier [India] study, it could be a conduit for Accelerated Approval."

...6-4-10: Ph.2b randomized reg. trial Open for enrollment: http://tinyurl.com/25v22qk

……"up to 120 refractory patients at ~30 clinical sites; goal: fully-enroll by mid'11, topline data by y/e'11."

= = = = = = = = = = = = = =

• 7-16-12: Peregrine's Ambitious Goal for Bavi: Accelerated Approval after Phase II: http://tinyurl.com/c39428b

• 6-2012: FTM's charts of MOS Data from CtlArms(chemo) of Comp.Trials for 1NSCLC 2NSCLC PANCRE trials http://tinyurl.com/757plm7

• 6-2011 WJCO article summarizes The War on NSCLC (1st- & 2nd-Line) - lots of trial summaries: http://tinyurl.com/7jdtpto

• 7-2-11: Early comp. of Bavi/n=49/Ph2 vs. Avastin/n=434/E4599 in Frontline NSCLC: http://tinyurl.com/6k5uuf7

• 11-25-11: Comp. of Bavi+Chemo vs. Avastin & Chemo-Only in 3 completed Ph.2 single-arm trials (ABC/2 & NSCLC): http://tinyurl.com/79b3jcj

• 6-15-12: Table of All 16 BAVI Cancer & Viral Trials (~606 treated, ~687 targeted): http://tinyurl.com/6spf8fd

Recent CDMO News

- Avid Bioservices to Participate in Craig-Hallum Bioprocessing Conference • GlobeNewswire Inc. • 09/12/2024 08:05:27 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 09/09/2024 08:43:56 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 09/09/2024 08:19:30 PM

- Avid Bioservices Reports Financial Results for First Quarter Ended July 31, 2024 • GlobeNewswire Inc. • 09/09/2024 08:05:31 PM

- U.S. Futures Rise Amid Inflation Report Anticipation; Oil Prices Climb on Hurricane Threat and Supply Concerns • IH Market News • 09/09/2024 10:09:14 AM

- Avid Bioservices to Report Financial Results for First Quarter of Fiscal Year 2025 After Market Close on September 9, 2024 • GlobeNewswire Inc. • 09/03/2024 08:05:20 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/29/2024 08:30:10 PM

- Form ARS - Annual Report to Security Holders • Edgar (US Regulatory) • 08/28/2024 08:34:04 PM

- Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material • Edgar (US Regulatory) • 08/28/2024 08:32:18 PM

- Form DEF 14A - Other definitive proxy statements • Edgar (US Regulatory) • 08/28/2024 08:30:28 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/16/2024 11:50:20 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/16/2024 11:48:19 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/15/2024 08:40:04 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/12/2024 08:30:04 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/11/2024 09:02:39 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/11/2024 09:02:27 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/11/2024 09:01:22 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/11/2024 09:01:05 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/11/2024 09:00:54 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/11/2024 09:00:45 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 07/11/2024 12:23:26 AM

- Avid Bioservices Reports Financial Results for Fourth Quarter and Fiscal Year Ended April 30, 2024 • GlobeNewswire Inc. • 07/02/2024 08:05:04 PM

- Avid Bioservices to Report Financial Results for Quarter and Fiscal Year Ended April 30, 2024, After Market Close on July 2, 2024 • GlobeNewswire Inc. • 07/01/2024 11:00:21 AM

- Avid Bioservices Earns Committed Badge from EcoVadis for Sustainability Performance • GlobeNewswire Inc. • 05/23/2024 12:05:46 PM

- Avid Bioservices to Participate at Upcoming Investor Conferences • GlobeNewswire Inc. • 05/07/2024 08:05:11 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM