Sunday, July 15, 2012 12:25:43 PM

July12 2012: JMP Securities 7th Annual Healthcare Conf., NYC

http://www.jmpg.com/jmpsecurities/about/conferences

CEO Steven King’s 26 min. Presentation – JMP/NYC 7-12-2012

7-12-2012 WEBCAST Replay: http://ir.peregrineinc.com/events.cfm

Direct: http://wsw.com/webcast/jmp18/pphm

Note: Interesting Q&A session begins at 23:10 – totally about the ongoing 2nd-Line NSCLC trial (MOS in both Bavi arms still not reached as of 7-12-12 and “and we expect that to continue for some period of time still”) – see Q&A transcript inserted after Slide16.

Selected Slides & Excerpts from CEO Steven King’s 7-12-12 Presentation at JMP/NYC:

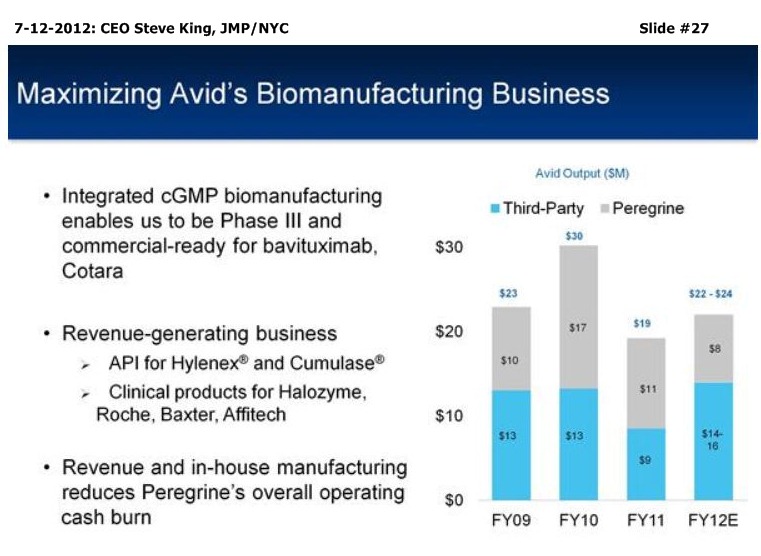

SK/S3: “We currently have 2 pgms which we believe are ready for Phase III advancement. That’s based on recent, exceptional bavituximab proof-of-concept data in 2nd-Line NSCLC, as well as earlier data for overall survival in recurrent GBM for our Cotara pgm, and we’re currently in discussions with the FDA about a Ph3 trial design for that pgm. Both of these are largely un-partnered, so we think that being ready for Ph3 is going to give us some significant partnering opportunities over the coming year, as we make those preparations to move these pgms forward. . . We operate Avid Bioservices as a growing commercial mfg. business, For this FY, we’ve been projecting $14-16mm in revenues. And, again we, do see some upside potential for the Avid business, as our clients are more & more successful in moving their programs further towards commercialization, so we do expect several new product launches coming over the coming year, really pointing to a growing (Avid) business…”

SK/S11: “…not only does that (Bavi+Doce) work against the primary solid tumor as shown in the left-hand panel, but also, if you look in the right-hand panel, you’ll see really a significant decrease in the number of metastatic lesions, and of course that’s the main problem with cancer patients is the metastatic disease - that’s often what leads the patients to succumb to the disease itself.”

SK/S12: “…but really what has stood out has been the Overall Survival data from that (Bavi+Doce/MBC) study, in which we saw a 20.7 MOS in those patients, almost double what you’d expect in that patient population. Again, adding to the rationale that if you can kick in the immune system to fight the disease, you’re going to have longer-term survivors. In the bottom panel, what you see is the waterfall plot of tumor responses in individual patients, and you can see that we had quite a number of complete resolution of those target lesions, but most patients overall did see some clinical benefit in the shrinkage of their tumors with this combination, so, again, it’s a highly active combination (Bavi+Doce) to pursue.”

SK S13/14/15/16 (2nd-Line NSCLC Trial): “That led to us working with the FDA on a Phase II clinical trial design (in 2nd-Line NSCLC). This was a very robust trial design, really meant to be part of a registration package. We worked with the FDA on this, and it has a lot the same bells & whistles you would find normally in Phase III clinical dev., in a slightly smaller study, of course. So, a very robust design: double-blinded, placebo-ctl’d, IDMC (Indep. Data Monitoring Committee), central radiology review - really meant to be a robust proof-of-principle study to show if the drug has activity or not. The trial itself is 121 pts, randomized into 3 arms, high-dose Bavi, low-dose Bavi, or placebo + Docetaxel. The rationale there was that at 3mg/kg of Bavi, we know we’re oversaturating the target. Based on pre-clin. modeling and our earlier PK data from our clinical trials, we also felt that at 1mg we’d still be over the saturating serum concentration levels between doses, so we wanted to look at that in a Ph2 setting and establish some more dosing info. I think importantly out of this study, the IDMC found no significant safety issues or concerns when the trial was unblinded. Basically, this is the best way to look at safety of a drug, as in a case where the physicians & the patients don’t know what they’re receiving, and you can really get a clean look at the safety profile of the drug itself. So, that led us to the unblinding of the data; we reported this on 5-21-2012, just a few weeks ago. In the bottom panel (S14), you see the results from our study. In placebo+Doce, we couldn’t have been more happy at the unblinding than we were with the fact that the ctl-arm really behaved itself, it came out almost exactly what you would expect – you could have almost taken these numbers out of the package insert for Docetaxel itself, with about an 8% tumor resp. rate, 3mos. median PFS, and less than 6 mos. MOS. What has stood out on the data analysis is the fact that both Bavi arms are really pretty equal in their activity, with almost a doubling of tumor resp. rates, which is good, but really the key clinical points going forward are going to be in PFS & Overall Survival, because one of those two is most likely going to be the primary endpoint in the Phase III trial design. In that case, we saw a 40-50% improvement in PFS in the 2 arms of the study. And, probably the most thrilling thing is the fact that, even though we had reached the MOS by the cutoff point at the end of April of less than 6mos. for the ctl-arm, the majority of patients are still alive in both arms of the Bavi-containing treatment regimen. So, that’s (MOS) is an ongoing time-to event obviously, but at this point we’re extremely comfortable with the fact that the data is going to be positive, and at this point it’s just a matter of how positive that that data is going to be. You can kind of get a feeling, if you look at the table here, of how this stacks up with other drugs that are currently used in 2nd-Line NSCLC, in which generally you’re seeing a less than 10% tumor resp. rate, PFS of 2-3mos., and MOS certainly less than 9mos, and down as low as 5.5mos – clearly room for improvement. We feel our #’s are stacking up very well against those other therapies; in fact, ALIMTA has now moved more into the front-line setting, so again there’s really a need for more treatment options as we go forward. We see this as a significant opportunity from a dev. standpoint; there are ~140,000 patients/year in 2nd-Line NSCLC that are drug-treatable. We’re spending about $1.5B in treating those patients in the U.S., Europe, and Japan, and with the results I just talked about, again, with low resp. rates, poor PFS, and poor MOS. As we met with our advisors, there’s been a real emphasis in moving this pgm toward Phase III. Based on the strength of the data, the 60% improvement in median PFS, and also this trend towards significant improvement in Overall Survival, which is the most-likely endpoint for a Phase III study. Phase III planning is underway already, with the efforts to finalize the Phase III trial design – it’s likely to look very much like the current Phase IIB study, which we think gives us a very high probability of success in Phase III. Our goal is to start this Phase III by mid-2013, which means we should be having the End-of-Phase2 (EOP2) meeting by the end of 2012 to set the stage for that goal. So, as we’re continuing our Phase III planning, we’re also parallel tracking partnering discussions; the data here has led to a surge in interest in partnering for the pgm. Our goal is to bring a partner on board, ideally in time for that EOP2 meeting, certainly before the beginning of the Phase III trial. And that, based on the level of discussions, is something that we’re maintaining as our goal, to be able to move the program to that end, and be in position to start the Phase III in 2012.”

At 23:12, JMP analyst Charles Duncan interrupted SK’s talk due to time (after PS-Imaging Slide #22), and requested they move to a Q&A session. Since all questions were about 2nd-Line NSCLC trial, I’m inserting the Q&A session after Slide #16:

Q&A:

Charles Duncan: ”The 2nd-Line NSCLC data is pretty provocative. Can you 1st of all help us understand the type of patients – where they primarily Stage4 or Stage3 patients?”

SK: “They were Stage IIIB/IV patients. The majority were Stage IV; I believe a little over 90% of the patients in each of the arms were Stage IV.”

Charles Duncan: ”So they were pretty advanced?”

SK: “Yes.”

Charles Duncan: ”And, as you said, for that patient population, they behaved as you might have anticipated, about 6 mos. Overall Survival. You said that at the end of April, the majority of the Bavi patients were still alive – is that still the case?”

SK: “Yes it is. Obviously, it’s a constant monitoring of progress, as we get addl. data, we’ll continue to monitor that very closely, but at this point [7-12-2012], still the majority of patients in both Bavituximab arms are alive and we expect that to continue for some period of time still.”

Charles Duncan: ”Excellent. And, in terms of disclosure plans around MOS for the experiment arms, would you press release when hit the MOS on those arms?”

SK: “Yes, we would definitely give an update, probably thru a press release, at the time in which we felt we’ve achieved those critical endpoints. In addition, we’re looking for some early fall conferences in which will have some opportunity maybe to at least give an update at that point in time of the status at that particular point. At this point, the data is trending very positively, and, of course, every week & every month that it goes further, we think the data really just gets that more dynamic. One important point there is that we don’t have to wait for the data to fully mature necessarily to start to think about the Phase III trial design, because we do have the ability to look at it on an ongoing basis. So, the power of the study, as the data comes in, we become more & more sure on how we can design that study.”

Charles Duncan: ”And that argues for a potential EOP2 later in the year as you suggested. Could it be earlier in Q4?”

SK: “Practically speaking, when you set up an FDA meeting, it’s a 60-day look-fwd in setting up the meeting, and so trying to do it much before October might be a bit tricky, but certainly during Q4 we anticipate that meeting taking place.”

Charles Duncan: ”Excellent. Well, unfortunately, we’re out of time. If there are any more questions, pls. take it out into the hall and we’ll continue. Thank you.”

S18: “…Liver Cancer – of our IST’s, this is perhaps the most interesting, to me anyway. It’s bavi in combo with Sorafenib. This is one of the ways in which we can differentiate our drug with some of the other vascular-acting drugs, such as the Anti-VEGF therapies [ex: Avastin]. In the case of Liver Cancer with Sorafenib, the Anti-VEGF drugs have combined-toxicities with Sorafenib, which limits the ability to use those. In our study, we’ve been thru the Ph.1 portion of the study, had a good safety profile, and we’ve now moved to the Ph.2 portion of that study. We seeing some very interesting things in that study, and it gives us the opportunity to do, as well, is to start to look at some of the mechanistic parts of the story, in which we’re going to be collecting tumor biopsies, pre-treatment & post-treatment, and looking at signs of immune-activation, again, tying in with what we’ve seen in pre-clinical studies.

At 23:12, JMP analyst Charles Duncan interrupted SK’s talk due to time (after PS-Imaging Slide #22), and requested they move to a Q&A session. Since all questions were about 2nd-Line NSCLC trial, I’m inserting the Q&A session after Slide #16 – see above.

*end*

= = = = = = = = = = = = = =

JMP Securities/Charles Duncan - init. 8-30-2011 OutPerf/PT=$5, CURR: OutPerf$5 http://www.jmpg.com

Universe: http://www.jmpg.com/wp-content/files_flutter//2012/05/JMP-Research-Universe1.pdf

Recent CDMO News

- Avid Bioservices Reports Financial Results for Third Quarter Ended January 31, 2024 • GlobeNewswire Inc. • 04/24/2024 09:25:33 PM

- Avid Bioservices Announces Receipt of Deficiency Notice from Nasdaq Regarding Late Form 10-Q • GlobeNewswire Inc. • 03/20/2024 11:00:10 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/07/2024 11:30:11 AM

- Avid Bioservices Announces Pricing of Private Placement of Convertible Notes • GlobeNewswire Inc. • 03/07/2024 04:58:48 AM

- Avid Bioservices Announces Proposed Private Placement of Convertible Notes • GlobeNewswire Inc. • 03/06/2024 09:32:07 PM

- Avid Bioservices Announces Certain Preliminary Financial Results for Third Quarter Ended January 31, 2024 • GlobeNewswire Inc. • 03/06/2024 09:31:28 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/06/2024 09:30:18 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 01/26/2024 09:57:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 12:34:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:39:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:38:30 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:37:38 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:36:27 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:35:47 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/11/2024 12:56:02 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 01/08/2024 09:32:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:56:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:55:07 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:53:58 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:51:57 AM

- Form SC 13G - Statement of acquisition of beneficial ownership by individuals • Edgar (US Regulatory) • 12/19/2023 09:05:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:34:08 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:33:03 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:32:11 AM

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM