| Followers | 130 |

| Posts | 5096 |

| Boards Moderated | 6 |

| Alias Born | 04/12/2010 |

Thursday, March 08, 2012 12:15:53 AM

Perspectives On A Printing Press Pause

It would appear, given the actions and rhetoric of the last week or so, that global central bank printing presses have been switched to 'pause' mode and allowed to cool as implicit inflation 'energy' rears its economic-growth-dragging head around the world (as the bears told us earlier). Whether this leads to a slow grind higher or a tactical correction is the question Morgan Stanley considers in a recent note and their answer is that bullish sentiment, 'under-appreciated' risks, and 'tranquil' markets justify a cautious asset allocation. The focus has switched much more to growth, likely why we have not seen a greater deterioration post-printing yet, but this leaves the market much more sensitive to data surprises(as the backstop of QE has been removed for now). Simply put, we tend to agree with MS' view (given our previous discussions of the volatility surface) that as event and growth risks linger, and with valuations no longer cheap in most cases, expectations of a continued grind higher without a tactical correction are overly confident.

Morgan Stanley: A Liquidity Lull

After watching last week’s events unfold, it seems that the central bank printing presses could cool off for awhile. ... The apparent success that the LTRO has had in reducing tail risks, at least in the near term, means that further ECB liquidity injections don’t appear likely any time soon. If this doesn’t come as a surprise to most investors, perhaps Chairman Bernanke’s testimony before Congress did. The market interpreted his acknowledgement that recent employment data has gotten better as a signal that QE3 is now less likely. The ripple effect of no QE by both the Fed and ECB could mean less easing in other regions.

The prospect of less monetary easing puts an even greater focus on growth. Our view has been that growth, not QE, was the primary driver of risk assets over the past few years, and the modest market reaction to the diminished prospects of more QE supports that. That direct relationship between growth and the markets should only be stronger if more QE is on hold. But growth also matters indirectly because it drives Fed action. Given the bullish sentiment of most investors, the market could continue to grind higher on a “heads we win, tails you lose” mentality regarding growth: the market rises with good data, but it also rises with bad data because the Fed (and ECB) will open up the liquidity spigot as needed. Nothing like having your cake and eating it too!

Alas, this sanguine view isn’t supported by the growth data sending a strong risk-on signal. Indeed, US data continues to be mixed, with labor market improvement offset by weakness in personal spending and income. Most confusing is that we had a sizable drop in our US 1Q GDP tracking estimate from 2.2% in late January down to 1% today, at the same time that Chairman Bernanke acknowledged the stronger data.

Now with the price of oil rising on Middle East tensions, and gasoline prices potentially reaching demand-destructive levels during the summer driving season, the risks to growth can’t be downplayed.

Grinding Higher or Tactical Correction?

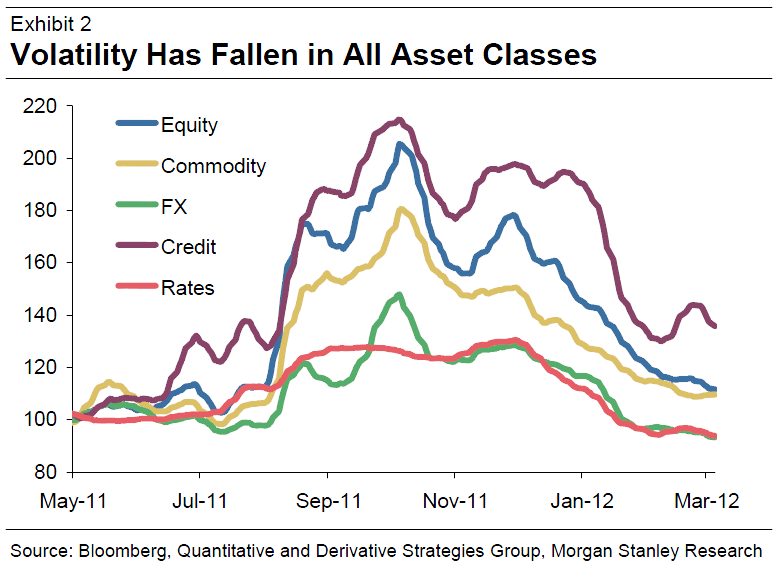

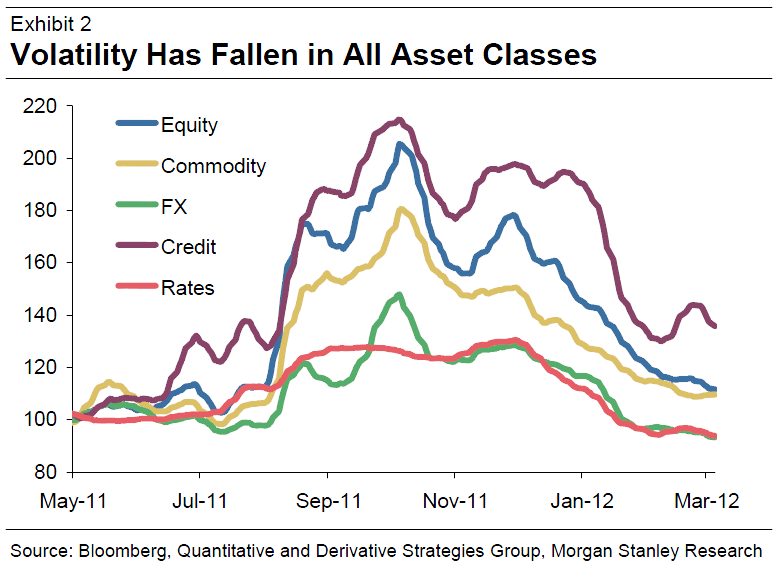

The economic data is providing a bounty for investors and strategists alike: there is something for everyone to justify their view. Bulls can point to the improving labour market conditions, while bears can emphasize weak income growth, persistently high leverage, or looming fiscal tightening. Thus, there is ammunition to argue both that markets can continue to grind higher and that a tactical correction is likely. Putting aside these subjective economic assessments, the price action also provides context for assessing the potential near term market outcomes. For starters, volatility for all asset classes has fallen significantly over the past few months, returning to the lows prior to last summer’s sell-off, with credit being the exception (Exhibit 2).

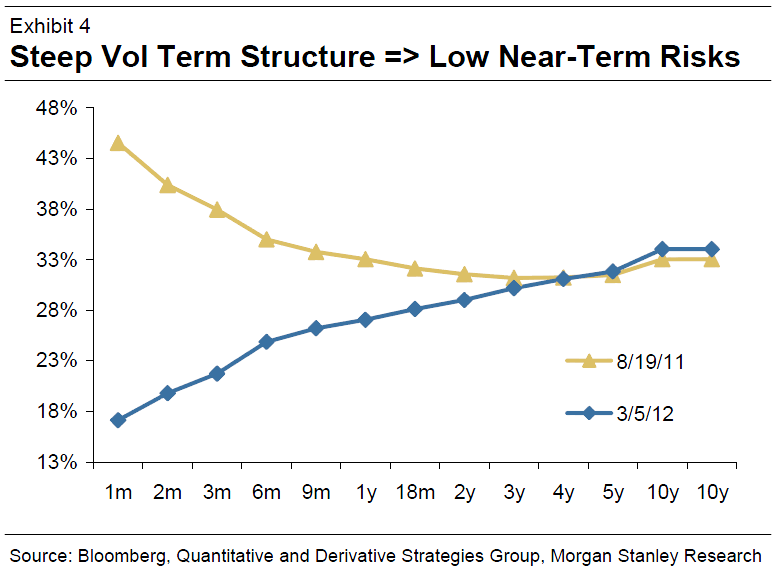

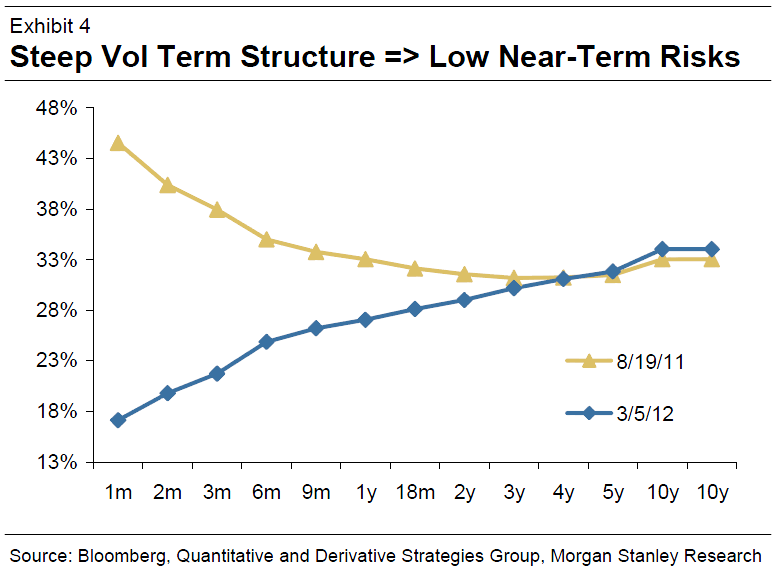

Focusing specifically on equities, three aspects of volatility tell the story of current investor thinking. First, realized volatility has fallen to exceptionally low levels. This reflects the slow steady grind higher, as well as the Fed effectively crushing volatility. However, since this is also occurring at low volumes, it suggests caution and complacency to some degree. Second, the implied volatility term structure is once again steep (its normal condition), which is a complete reversal from last August (Exhibit 4).

Back then, the risks appeared to be front-loaded after the US credit rating downgrade, and on fears of a double dip recession and sovereign stress in Europe. The current low short term vol speaks to the fact that investors are fairly calm about the near term. However, the third aspect of volatility, the steep skew, implies that both tails are relatively fat, with investors willing to pay for downside and upside protection.

Putting this all together, it suggests a market in which investors are fairly comfortable with the view that risk assets can continue to grind higher in the near term, but they’re also fearful of the other shoe dropping, whether on growth, Europe, or something else. And the interest in both tails is consistent with different interpretations of the growth data.

The combination of bullish sentiment, underappreciated risks, and “tranquil” markets justifies a cautious asset allocation, in our view. The low volatility suggests a complacency that isn’t warranted given the risks, specifically, on growth because of higher oil prices and in Europe after the LTRO and Greece bailout. On the latter, it’s not obvious if a firewall exists around the rest of the periphery (or how it could work). Without a proper firewall, Portugal is next in line for a potential debt restructuring, and the rise in its sovereign CDS spread in the wake of the Greece agreement is a disconcerting sign. In addition, the move by Spain to relax its deficit reduction is also a red flag.

With these risks lingering, and valuations no longer overly cheap, we are clearly cautious on the markets, even though we admittedly fret about continued grind higher without a tactical correction. Nonetheless, we maintain our view that investors should continue to take risk down on the margin and implement tail hedges.

It would appear, given the actions and rhetoric of the last week or so, that global central bank printing presses have been switched to 'pause' mode and allowed to cool as implicit inflation 'energy' rears its economic-growth-dragging head around the world (as the bears told us earlier). Whether this leads to a slow grind higher or a tactical correction is the question Morgan Stanley considers in a recent note and their answer is that bullish sentiment, 'under-appreciated' risks, and 'tranquil' markets justify a cautious asset allocation. The focus has switched much more to growth, likely why we have not seen a greater deterioration post-printing yet, but this leaves the market much more sensitive to data surprises(as the backstop of QE has been removed for now). Simply put, we tend to agree with MS' view (given our previous discussions of the volatility surface) that as event and growth risks linger, and with valuations no longer cheap in most cases, expectations of a continued grind higher without a tactical correction are overly confident.

Morgan Stanley: A Liquidity Lull

After watching last week’s events unfold, it seems that the central bank printing presses could cool off for awhile. ... The apparent success that the LTRO has had in reducing tail risks, at least in the near term, means that further ECB liquidity injections don’t appear likely any time soon. If this doesn’t come as a surprise to most investors, perhaps Chairman Bernanke’s testimony before Congress did. The market interpreted his acknowledgement that recent employment data has gotten better as a signal that QE3 is now less likely. The ripple effect of no QE by both the Fed and ECB could mean less easing in other regions.

The prospect of less monetary easing puts an even greater focus on growth. Our view has been that growth, not QE, was the primary driver of risk assets over the past few years, and the modest market reaction to the diminished prospects of more QE supports that. That direct relationship between growth and the markets should only be stronger if more QE is on hold. But growth also matters indirectly because it drives Fed action. Given the bullish sentiment of most investors, the market could continue to grind higher on a “heads we win, tails you lose” mentality regarding growth: the market rises with good data, but it also rises with bad data because the Fed (and ECB) will open up the liquidity spigot as needed. Nothing like having your cake and eating it too!

Alas, this sanguine view isn’t supported by the growth data sending a strong risk-on signal. Indeed, US data continues to be mixed, with labor market improvement offset by weakness in personal spending and income. Most confusing is that we had a sizable drop in our US 1Q GDP tracking estimate from 2.2% in late January down to 1% today, at the same time that Chairman Bernanke acknowledged the stronger data.

Now with the price of oil rising on Middle East tensions, and gasoline prices potentially reaching demand-destructive levels during the summer driving season, the risks to growth can’t be downplayed.

Grinding Higher or Tactical Correction?

The economic data is providing a bounty for investors and strategists alike: there is something for everyone to justify their view. Bulls can point to the improving labour market conditions, while bears can emphasize weak income growth, persistently high leverage, or looming fiscal tightening. Thus, there is ammunition to argue both that markets can continue to grind higher and that a tactical correction is likely. Putting aside these subjective economic assessments, the price action also provides context for assessing the potential near term market outcomes. For starters, volatility for all asset classes has fallen significantly over the past few months, returning to the lows prior to last summer’s sell-off, with credit being the exception (Exhibit 2).

Focusing specifically on equities, three aspects of volatility tell the story of current investor thinking. First, realized volatility has fallen to exceptionally low levels. This reflects the slow steady grind higher, as well as the Fed effectively crushing volatility. However, since this is also occurring at low volumes, it suggests caution and complacency to some degree. Second, the implied volatility term structure is once again steep (its normal condition), which is a complete reversal from last August (Exhibit 4).

Back then, the risks appeared to be front-loaded after the US credit rating downgrade, and on fears of a double dip recession and sovereign stress in Europe. The current low short term vol speaks to the fact that investors are fairly calm about the near term. However, the third aspect of volatility, the steep skew, implies that both tails are relatively fat, with investors willing to pay for downside and upside protection.

Putting this all together, it suggests a market in which investors are fairly comfortable with the view that risk assets can continue to grind higher in the near term, but they’re also fearful of the other shoe dropping, whether on growth, Europe, or something else. And the interest in both tails is consistent with different interpretations of the growth data.

The combination of bullish sentiment, underappreciated risks, and “tranquil” markets justifies a cautious asset allocation, in our view. The low volatility suggests a complacency that isn’t warranted given the risks, specifically, on growth because of higher oil prices and in Europe after the LTRO and Greece bailout. On the latter, it’s not obvious if a firewall exists around the rest of the periphery (or how it could work). Without a proper firewall, Portugal is next in line for a potential debt restructuring, and the rise in its sovereign CDS spread in the wake of the Greece agreement is a disconcerting sign. In addition, the move by Spain to relax its deficit reduction is also a red flag.

With these risks lingering, and valuations no longer overly cheap, we are clearly cautious on the markets, even though we admittedly fret about continued grind higher without a tactical correction. Nonetheless, we maintain our view that investors should continue to take risk down on the margin and implement tail hedges.

http://investorshub.advfn.com/boards/board.aspx?board_id=18186

I am not a professional and my opinions are just that, opinions.

Please do not buy based on my

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.