| Followers | 839 |

| Posts | 120661 |

| Boards Moderated | 13 |

| Alias Born | 09/05/2002 |

Monday, February 20, 2012 8:17:43 PM

PepsiCo Announces ‘Strategic Investments’ to Drive Growth

[This PR was issued on 2/9/12 concurrently with PEP’s 4Q111 earnings report, and it didn’t go over especially well with investors—the share price is down about 6% since then. PEP is cutting 8,700 jobs, 3% of its worldwide workforce, and is guiding for a down year in EPS: -5% YoY excluding the effects of currency and -8% YoY including currency (due to an expected stronger US Dollar relative to the average in 2011). 2012 guidance for non-GAAP “core” EPS (excluding currency and a boatload of other items) is $4.40, while the implicit non-GAAP EPS including currency is about $4.05. Thus, at the current share price, the 2012 P/E based on the above metrics are about 14x and 15x, respectively. On a cursory inspection, this does not seem like a bargain, especially given the array of items that have been excluded from the definition of core EPS.

Still, PEP strikes me as a stock where most—if not all—of the bad news is already out. Commodity inflation for the commodities relevant to PEP have probably peaked, according to the company, and management expects core EPS growth growth (excluding acquisitions and currency) in the high single digits starting in 2013. Cash flow from operations remains strong and, to placate shareholders during what will be a down year in EPS, PEP committed to repurchase $3B of stock in 2012 and to raise the dividend 4% in June (the 40th consecutive year with a dividend hike). At the new annualized dividend rate of $2.15, the dividend yield at the current share price is 3.4%, so PEP could be considered as a sort of bond proxy.

Moreover—and most important, IMO—PEP *is* a fine play on The Global Demographic Tailwind, as evidenced by the discussion in #msg-72112619. Thus, while the kneejerk response of my investors to a company such as PEP that has underperformed the market in recent years is to dump, I’m inclined to stay the course and even add to my smallish position. If anyone here thinks this is a bad idea, please speak up!

PEP 4Q11 CC slides are at: http://www.pepsico.com/Download/PEP_Q411_Webdeck-FINAL.pdf .]

http://www.pepsico.com/Download/PEP_Q411_Webdeck-FINAL.pdf

›NEW YORK, Feb. 9, 2012 /PRNewswire/ --

• Plans to increase advertising and marketing support behind its global brands by $500-$600 million in 2012, with particular focus on North America; going forward, it expects to maintain or increase that rate of support as a percentage of revenues

• Multi-year productivity program expected to generate $1.5 billion of incremental cost savings by 2014 through optimization of operating practices and organization structure, including a reduction in force of about 8,700 employees, about 3 percent of global workforce

• Company targets high-single-digit core constant currency* EPS growth for 2013 and beyond after a transition year in 2012, in which it expects core constant currency EPS to decrease by 5%

• Announces plan to increase returns to shareholders in the form of higher dividends and share repurchases in 2012

PepsiCo (NYSE: PEP) announced today a series of strategic investment and productivity initiatives to deliver top-tier, sustainable long-term growth for its shareholders. These decisions are based on a comprehensive review by the Company's management of its portfolio, brands, costs, organization and capital structure. As a result of its review, the Company reaffirmed its commitment to an integrated food and beverage portfolio through a one-company platform. [I.e. PEP does not plan to split its snacks and beverage businesses as investment bankers have been clamoring for them to do.]

"In a volatile global environment over the past five years, PepsiCo has delivered double-digit compound annual growth in core net revenue, 8% compound annual growth in core EPS, and returned about $30 billion to shareholders in the form of dividends and share repurchases," said PepsiCo Chairman and CEO Indra Nooyi. "Our goal is to continue on that earnings trajectory over the next 5 to 10 years, fully recognizing that we need to make changes in how we operate to address the challenges we identified in the review process. 2012 will be a transition year, in which we will be taking the appropriate steps to build a stronger, more successful company going forward."

James Schiro, PepsiCo's presiding director, said: "The Board of Directors has been engaged throughout the review process. We are fully aligned with and supportive of management with respect to both the strategic direction of the Company and also the initiatives being announced today."

Key Initiatives

The Company reaffirmed the underlying strength of its integrated food and beverage portfolio -- and concluded that PepsiCo offers the most compelling value to shareholders as one company.

Beginning in 2012, PepsiCo is undertaking a number of key actions to further strengthen the Company and enhance shareholder value. The Company said it plans to:

• Significantly increase investments in its iconic brands and in bringing innovation to market. Advertising and marketing spending will increase by $500-$600 million in 2012, the majority in North America. Going forward, it expects to maintain or increase that rate of support as a percentage of revenues. To drive efficiencies, it will reduce the number of agency partners and also take steps to leverage the global scale of its top brand platforms. The brand investments are expected to drive top-line growth and enable greater price realization;

• Implement a three-year productivity program that is expected to generate over $500 million in incremental cost savings in 2012, further incremental reductions in the cost base of about $500 million in 2013, and an additional $500 million in 2014. The productivity savings will span every aspect of the business: leveraging new technologies and processes across operations, go-to-market and information systems; heightened focus on best practice sharing across the globe; consolidating manufacturing, warehouse and sales facilities; and implementing simplified organization structures, with wider spans of control and fewer layers of management. This effort includes headcount reductions of about 8,700 employees across 30 countries, about 3% of the Company's global workforce. The productivity programs will enhance the Company's cost-competitiveness as well as provide a source of funding for future brand-building and innovation initiatives.

• Improve its net return on invested capital by at least 50 basis points annually beginning in 2013 through increased focus on capital spending and working capital management. As an example, in 2012 we will be reducing capital expenditures by 10% versus 2011. The emphasis is on systematically improving the efficiency of the existing asset base; and

• Enhance returns to shareholders in 2012 through both a 4% increase in its annual dividend beginning with the June 2012 dividend payment, and also the execution of a share repurchase program this year of at least $3 billion.

2012: A Transition Year, with Accelerated Productivity, Stepped-Up Brand Investment, and High Commodity Costs

"As we implement our strategic priorities in 2012, we've had to make some tough decisions," said Chief Financial Officer Hugh Johnston. "As a result, 2012 will be a year of transition, one in which we will make the right investments to position PepsiCo properly to achieve long-term high-single-digit core constant currency EPS growth."

For 2012, the Company is targeting mid-single-digit core constant currency net revenue growth, in-line with its long-term target. It expects a decline in core constant currency EPS of approximately 5 percent from its fiscal 2011 core EPS of $4.40, reflecting a combination of strategic and macroeconomic factors, primarily:

• Marketplace Investments: In 2012, the Company will step-up its strategic brand investments by $500-$600 million, particularly in North American beverages and food -- the benefits from which will be increasingly seen in the second half of 2012 and into 2013. Further, the Company anticipates a larger increase in consumer-facing spending through marketing efficiency initiatives. Additionally, incremental investments in routes and display racks will total about $100 million in 2012.

• Commodities: The Company anticipates a second consecutive year of global commodity cost inflation that is well above historic levels. In a different economic climate the Company would likely offset these additional costs through increased pricing. However, it does not anticipate that it can pass through all of the higher commodity costs to its consumers in 2012 given the continuing challenges that consumers are facing, particularly in the developed economies.

• Pension/Interest/Taxes: Additionally, the Company expects higher pension costs as a result of a lower discount rate, higher net interest expense as it increases indebtedness and also terms-out debt in a low interest rate environment, and a core tax rate of approximately 27%, about 50 basis points higher than in 2011.

• Productivity: Partially offsetting these additional costs, major productivity initiatives are expected to result in about a $500 million incremental reduction in operating expenses in 2012.

Based on the current forex market consensus, foreign exchange translation would have a three percentage point unfavorable impact on the Company's full-year core EPS growth in 2012 [i.e. non-GAAP EPS *including* currency is expected to decline 8% YoY.]

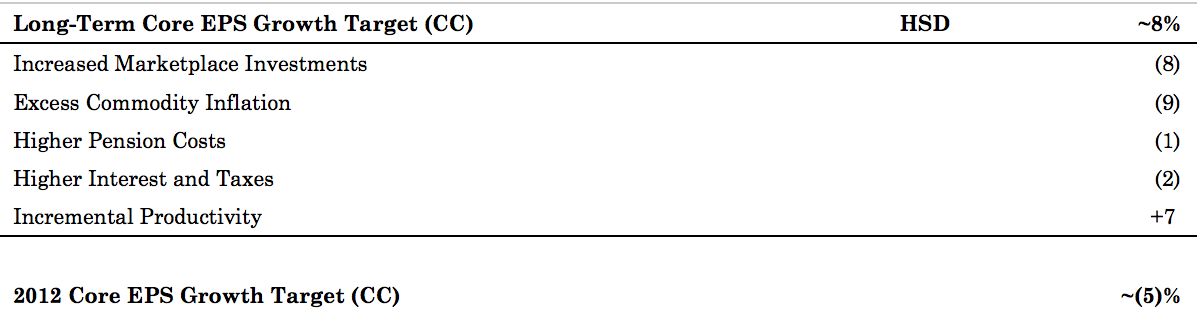

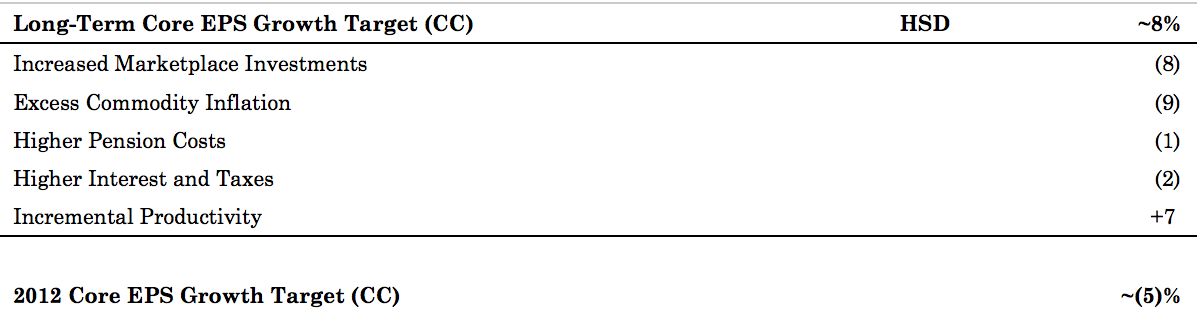

The following table presents the key elements explaining the difference between the Company's long-term core constant currency EPS growth target and its 2012 core constant currency EPS growth target:

On a reported basis, the Company's results will reflect charges from its three-year productivity program, primarily severance costs associated with workforce reductions. In the fourth quarter of 2011, the Company incurred pre-tax non-core restructuring charges of $383 million, and it anticipates additional charges of approximately $425 million in 2012 and another $100 million from 2013 through 2015.

The Company is targeting about $8 billion in cash flow from operating activities and more than $6 billion in management operating cash flow (excluding certain items) in 2012, which will include the favorable impacts of a 10% reduction in capital expenditures and incremental working capital efficiency. The Company also expects to make a pre-tax discretionary pension and retiree medical contribution of $1 billion in 2012. [This is necessitated by the lower discount rate on pension liabilities stemming from continued low interest rates.]

Dividend Increase/Higher Share Repurchases

Reflecting the Company's commitment to return capital to shareholders and confidence in its long-term growth targets, PepsiCo today announced that it will raise the annualized common stock dividend, effective with the dividend payable in June 2012, by 4 percent to $2.15 per share, the 40th consecutive year of dividend growth. The Company anticipates increasing share repurchases in 2012 by at least $3 billion, which will be financed by operating cash flow and additional debt.

Long-Term Financial Targets

PepsiCo provided its long-term target of mid-single-digit constant currency net revenue growth. It also announced that it is targeting long-term core constant currency operating profit growth of 6-7%, and long-term high-single-digit core constant currency EPS growth after a transition year in 2012 [i.e. starting from the lower 2012 base], driven by positive returns from executing its strategic initiatives.‹

[This PR was issued on 2/9/12 concurrently with PEP’s 4Q111 earnings report, and it didn’t go over especially well with investors—the share price is down about 6% since then. PEP is cutting 8,700 jobs, 3% of its worldwide workforce, and is guiding for a down year in EPS: -5% YoY excluding the effects of currency and -8% YoY including currency (due to an expected stronger US Dollar relative to the average in 2011). 2012 guidance for non-GAAP “core” EPS (excluding currency and a boatload of other items) is $4.40, while the implicit non-GAAP EPS including currency is about $4.05. Thus, at the current share price, the 2012 P/E based on the above metrics are about 14x and 15x, respectively. On a cursory inspection, this does not seem like a bargain, especially given the array of items that have been excluded from the definition of core EPS.

Still, PEP strikes me as a stock where most—if not all—of the bad news is already out. Commodity inflation for the commodities relevant to PEP have probably peaked, according to the company, and management expects core EPS growth growth (excluding acquisitions and currency) in the high single digits starting in 2013. Cash flow from operations remains strong and, to placate shareholders during what will be a down year in EPS, PEP committed to repurchase $3B of stock in 2012 and to raise the dividend 4% in June (the 40th consecutive year with a dividend hike). At the new annualized dividend rate of $2.15, the dividend yield at the current share price is 3.4%, so PEP could be considered as a sort of bond proxy.

Moreover—and most important, IMO—PEP *is* a fine play on The Global Demographic Tailwind, as evidenced by the discussion in #msg-72112619. Thus, while the kneejerk response of my investors to a company such as PEP that has underperformed the market in recent years is to dump, I’m inclined to stay the course and even add to my smallish position. If anyone here thinks this is a bad idea, please speak up!

PEP 4Q11 CC slides are at: http://www.pepsico.com/Download/PEP_Q411_Webdeck-FINAL.pdf .]

http://www.pepsico.com/Download/PEP_Q411_Webdeck-FINAL.pdf

›NEW YORK, Feb. 9, 2012 /PRNewswire/ --

• Plans to increase advertising and marketing support behind its global brands by $500-$600 million in 2012, with particular focus on North America; going forward, it expects to maintain or increase that rate of support as a percentage of revenues

• Multi-year productivity program expected to generate $1.5 billion of incremental cost savings by 2014 through optimization of operating practices and organization structure, including a reduction in force of about 8,700 employees, about 3 percent of global workforce

• Company targets high-single-digit core constant currency* EPS growth for 2013 and beyond after a transition year in 2012, in which it expects core constant currency EPS to decrease by 5%

• Announces plan to increase returns to shareholders in the form of higher dividends and share repurchases in 2012

PepsiCo (NYSE: PEP) announced today a series of strategic investment and productivity initiatives to deliver top-tier, sustainable long-term growth for its shareholders. These decisions are based on a comprehensive review by the Company's management of its portfolio, brands, costs, organization and capital structure. As a result of its review, the Company reaffirmed its commitment to an integrated food and beverage portfolio through a one-company platform. [I.e. PEP does not plan to split its snacks and beverage businesses as investment bankers have been clamoring for them to do.]

"In a volatile global environment over the past five years, PepsiCo has delivered double-digit compound annual growth in core net revenue, 8% compound annual growth in core EPS, and returned about $30 billion to shareholders in the form of dividends and share repurchases," said PepsiCo Chairman and CEO Indra Nooyi. "Our goal is to continue on that earnings trajectory over the next 5 to 10 years, fully recognizing that we need to make changes in how we operate to address the challenges we identified in the review process. 2012 will be a transition year, in which we will be taking the appropriate steps to build a stronger, more successful company going forward."

James Schiro, PepsiCo's presiding director, said: "The Board of Directors has been engaged throughout the review process. We are fully aligned with and supportive of management with respect to both the strategic direction of the Company and also the initiatives being announced today."

Key Initiatives

The Company reaffirmed the underlying strength of its integrated food and beverage portfolio -- and concluded that PepsiCo offers the most compelling value to shareholders as one company.

Beginning in 2012, PepsiCo is undertaking a number of key actions to further strengthen the Company and enhance shareholder value. The Company said it plans to:

• Significantly increase investments in its iconic brands and in bringing innovation to market. Advertising and marketing spending will increase by $500-$600 million in 2012, the majority in North America. Going forward, it expects to maintain or increase that rate of support as a percentage of revenues. To drive efficiencies, it will reduce the number of agency partners and also take steps to leverage the global scale of its top brand platforms. The brand investments are expected to drive top-line growth and enable greater price realization;

• Implement a three-year productivity program that is expected to generate over $500 million in incremental cost savings in 2012, further incremental reductions in the cost base of about $500 million in 2013, and an additional $500 million in 2014. The productivity savings will span every aspect of the business: leveraging new technologies and processes across operations, go-to-market and information systems; heightened focus on best practice sharing across the globe; consolidating manufacturing, warehouse and sales facilities; and implementing simplified organization structures, with wider spans of control and fewer layers of management. This effort includes headcount reductions of about 8,700 employees across 30 countries, about 3% of the Company's global workforce. The productivity programs will enhance the Company's cost-competitiveness as well as provide a source of funding for future brand-building and innovation initiatives.

• Improve its net return on invested capital by at least 50 basis points annually beginning in 2013 through increased focus on capital spending and working capital management. As an example, in 2012 we will be reducing capital expenditures by 10% versus 2011. The emphasis is on systematically improving the efficiency of the existing asset base; and

• Enhance returns to shareholders in 2012 through both a 4% increase in its annual dividend beginning with the June 2012 dividend payment, and also the execution of a share repurchase program this year of at least $3 billion.

2012: A Transition Year, with Accelerated Productivity, Stepped-Up Brand Investment, and High Commodity Costs

"As we implement our strategic priorities in 2012, we've had to make some tough decisions," said Chief Financial Officer Hugh Johnston. "As a result, 2012 will be a year of transition, one in which we will make the right investments to position PepsiCo properly to achieve long-term high-single-digit core constant currency EPS growth."

For 2012, the Company is targeting mid-single-digit core constant currency net revenue growth, in-line with its long-term target. It expects a decline in core constant currency EPS of approximately 5 percent from its fiscal 2011 core EPS of $4.40, reflecting a combination of strategic and macroeconomic factors, primarily:

• Marketplace Investments: In 2012, the Company will step-up its strategic brand investments by $500-$600 million, particularly in North American beverages and food -- the benefits from which will be increasingly seen in the second half of 2012 and into 2013. Further, the Company anticipates a larger increase in consumer-facing spending through marketing efficiency initiatives. Additionally, incremental investments in routes and display racks will total about $100 million in 2012.

• Commodities: The Company anticipates a second consecutive year of global commodity cost inflation that is well above historic levels. In a different economic climate the Company would likely offset these additional costs through increased pricing. However, it does not anticipate that it can pass through all of the higher commodity costs to its consumers in 2012 given the continuing challenges that consumers are facing, particularly in the developed economies.

• Pension/Interest/Taxes: Additionally, the Company expects higher pension costs as a result of a lower discount rate, higher net interest expense as it increases indebtedness and also terms-out debt in a low interest rate environment, and a core tax rate of approximately 27%, about 50 basis points higher than in 2011.

• Productivity: Partially offsetting these additional costs, major productivity initiatives are expected to result in about a $500 million incremental reduction in operating expenses in 2012.

Based on the current forex market consensus, foreign exchange translation would have a three percentage point unfavorable impact on the Company's full-year core EPS growth in 2012 [i.e. non-GAAP EPS *including* currency is expected to decline 8% YoY.]

The following table presents the key elements explaining the difference between the Company's long-term core constant currency EPS growth target and its 2012 core constant currency EPS growth target:

On a reported basis, the Company's results will reflect charges from its three-year productivity program, primarily severance costs associated with workforce reductions. In the fourth quarter of 2011, the Company incurred pre-tax non-core restructuring charges of $383 million, and it anticipates additional charges of approximately $425 million in 2012 and another $100 million from 2013 through 2015.

The Company is targeting about $8 billion in cash flow from operating activities and more than $6 billion in management operating cash flow (excluding certain items) in 2012, which will include the favorable impacts of a 10% reduction in capital expenditures and incremental working capital efficiency. The Company also expects to make a pre-tax discretionary pension and retiree medical contribution of $1 billion in 2012. [This is necessitated by the lower discount rate on pension liabilities stemming from continued low interest rates.]

Dividend Increase/Higher Share Repurchases

Reflecting the Company's commitment to return capital to shareholders and confidence in its long-term growth targets, PepsiCo today announced that it will raise the annualized common stock dividend, effective with the dividend payable in June 2012, by 4 percent to $2.15 per share, the 40th consecutive year of dividend growth. The Company anticipates increasing share repurchases in 2012 by at least $3 billion, which will be financed by operating cash flow and additional debt.

Long-Term Financial Targets

PepsiCo provided its long-term target of mid-single-digit constant currency net revenue growth. It also announced that it is targeting long-term core constant currency operating profit growth of 6-7%, and long-term high-single-digit core constant currency EPS growth after a transition year in 2012 [i.e. starting from the lower 2012 base], driven by positive returns from executing its strategic initiatives.‹

“The efficient-market hypothesis may be

the foremost piece of B.S. ever promulgated

in any area of human knowledge!”

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.