Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

BYD continues to pull away from the pack

https://insideevs.com/news/734623/byd-seagull-best-selling-china/?utm_source=Klaviyo&utm_medium=campaign&_kx=12wFdFU2yACIHXNEiG-QsKItdCqYwsrNEcSsJJoyaXI.VCGm8F

Refer to my recent post RE Calif grid #29545

What is your basis for assuming the power source is 60% renewables and 40% NG?

EV charging price check in SF area - just amazed at the pricing and implied gross margins. Low cost charging can be had via PowerFlex at ~20 cents/kw typically at public facilities like school parking lots on weekends. However, more typical regular hour charging being priced at ~40-60 cents/kw at shopping areas and people are using them (1 empty charger out of 20 at 3:30PM at 56 cents/kw) for convenience while shopping. For reference, I topped off 15kw for $6.45 for 27 miles of range the other day at public school. The equivalent gasoline cost for those added miles would have been ~$4. The cost of that EV charge (assuming 60% renewables and 40% NG) including transmission ~ $1. There is no way for H2 to ever be adopted or for O&G downstream to compete with those current margins.

From the same PR:

The partnership will initially seek to unlock $30 billion of private equity capital over time from investors, asset owners, and corporates, which in turn will mobilize up to $100 billion in total investment potential when including debt financing.

WY touts forests as climate-change mitigation_vehicle:

https://finance.yahoo.com/news/weyerhaeuser-nature-conservancy-announce-joint-203000748.html

CAT—Apropos_to_a_prior_discussion_about recharging electric-powered mining equipment:

https://finance.yahoo.com/news/caterpillar-introduces-groundbreaking-dynamic-energy-130500514.html

Stelco shareholders approve buyout by CLF:

https://finance.yahoo.com/news/cleveland-cliffs-announces-shareholder-approval-201500774.html

The Arrangement Resolution received support of 99.97% of the total votes cast for the Arrangement Resolution. The transaction is expected to close in the fourth quarter of 2024.

Trade "wars" always have a detrimental affect on global economic growth and often result in resource misallocation. If you believe the rhetoric emanating from the mouths of politicians in the EU and USA we are facing years of subpar global growth and bouts of persistent inflation. Politicians pandering to constituents are analogous to sand tossed into an ICE. LOL..........

Note.....The old saying; "when the US sneezes, the world catches a cold", might morph into; when China catches a cold the world catches the flu.

More multinational firms pulling back from China:

https://www.wsj.com/world/china/western-firms-that-flocked-to-china-are-now-pulling-back-ea2f3c27

Many global businesses are pushing China down on their list of investment destinations and consolidating operations in the country, citing slower growth and diminishing profits.

The gloomy investment trend was the focus of twin reports this week from the European Union Chamber of Commerce in China and the American Chamber of Commerce in Shanghai.

“The risk of doing business in China has gone up in the past few years and at the same time the market is slowing down,” said Eric Zheng, president of the U.S. group. A poll by the U.S. chamber found the percentage of respondents ranking China as their headquarters’ top investment destination fell to the lowest level since the annual survey began 25 years ago.

NKGN - PR about what was mentioned in HC Wainwright presentation regarding starting Ph 2 clinical trial and 3 month interim results for first 3 patients.

https://nkgenbiotech.com/nkgen-biotechs-positive-phase-1-clinical-data-in-moderate-alzheimers-disease-advances-troculeucel-into-phase-2-with-first-patient-dosed-in-phase-1-2a-trial/

If they have fuel cells that would make 2028 possible, then they could demonstrate those engines now. If they can’t/wont do that, then vaporware

AD therapy - using autologous NK cells. Intriguing results but I wonder how it can be commercially scaled up since it is autologous. Below is the replay from HC Wainwright conference from last Monday.

https://journey.ct.events/view/fe1b7363-0853-41ec-be6a-17e0e81f8ff2

H2 refueling stations are all but non-existent.

Sounds like a trial balloon. Haven't done any research but I assume fueling locations are minimal.

SEC fines Esmark/ex-CEO for_lying_wrt X buyout offer:

https://finance.yahoo.com/news/esmark-ex-ceo-settle-sec-181828171.html

Esmark Inc. and its former chief executive officer have settled charges brought on by the US Securities and Exchange Commission for publicly announcing an offer to buy United States Steel Corp. without having the financial means to back the bid.

… The steel distributor surprised the market in August 2023 by offering to buy US Steel for $7.8 billion in cash, one day after Cleveland-Cliffs Inc.’s $7.25 billion bid which was rejected by the target company.

Esmark’s then-CEO James P. Bouchard told Bloomberg News at the time that the company had available cash on hand to fund the offer. Bouchard also said in a television interview at the time that Esmark had $10 billion available in cash committed to the deal and wouldn’t put up any of Esmark’s assets as collateral, according to an SEC statement on Friday.

…The SEC finds that the statements Bouchard made “were false because Esmark did not have the $7.8 billion in cash required to complete the purchase of US Steel, and, therefore, Esmark and Bouchard did not have a reasonable belief that they would have the means to purchase the securities needed to complete the announced tender offer for US Steel,” according to the statement.

BMW, Toyota collaborate on hydrogen-powered vehicles:

https://www.wsj.com/business/autos/bmw-toyota-aim-to-make-hydrogen-powered-evs-mainstream-with-partnership-e93f47ac

The German carmaker said Thursday that it will release hydrogen-powered versions of one of its existing model lines in 2028 as part of its strategy—which Toyota shares—to broaden its reach with various fuel types. BMW and Toyota’s hydrogen cars will use powertrains, which contain the engine and transmission, developed in tandem by the companies, according to a joint statement.

CLF is ready to acquire Mon Valley assets that X might abandon if Nippon’s buyout of X is blocked by the US government, according to a PR today:

https://finance.yahoo.com/news/cleveland-cliffs-commends-president-biden-204600079.html

Any such acquisitions would presumably be at fire-sale prices.

I agree. Whenever I use GT I'm impressed with how quickly and accurately it completes the task.

SHEL—Environmental activists put North Sea project at risk:

https://finance.yahoo.com/news/stopping-north-sea-drilling-risks-134337235.html

It's mildly interesting to take the link that semi_infinite provided, which is to a Korean news report, and compare the results of Google translate to the AI translation that you get if you click on the English button on the website itself. I can't speak to which is more accurate but the Google translate is certainly better English and reads more naturally.

ABT’s Lingo CGM now shipping in US:

https://finance.yahoo.com/news/abbotts-lingo-continuous-glucose-monitor-130000534.html

Abbott…today announced U.S. availability of Lingo, the company's first continuous glucose monitoring system available without a prescription. The Lingo system includes a biosensor and a mobile app designed for consumers who want to improve their overall health and wellness. Lingo is based on Abbott's world-leading FreeStyle Libre continuous glucose monitoring technology, now used by more than 6 million people with diabetes globally.

…Abbott's consumer biowearable, Lingo, is available for consumers 18 years and older not on insulin. Lingo tracks glucose in real-time and provides personal insights and coaching to help people build healthy habits, retrain their metabolism and improve their overall well-being.

JNJ increases talc settlement offer from $8B—>$9B:

https://finance.yahoo.com/news/johnson-johnson-wins-over-longtime-201240773.html

MSFT/PLTR/GOOG in that order at Samsung for online customer service AI. They ran a in-house 3 way shoot out for customer assistance AI platform under "Rubicon Project".. If results hold up after initial release, it will be introduced globally next spring.

https://www.etnews.com/20240902000267

Definitely but I would rate the shift of MSFT AI R&D as being more significant than whatever IBM was doing in China.

https://www.cnbc.com/2024/05/16/microsoft-offers-relocation-to-hundreds-of-china-based-ai-staff-.html

Maybe Nippon is reacting to the story in yesterday’s NYT:

https://www.nytimes.com/2024/08/26/business/nippon-steel-us-steel.html

Nippon Steel Looks to Woo US Union With Extra $1.3 Billion

Additional investments pledged for Mon Valley, Gary operations

Plants are among the legacy shops operated by US Steel

Bloomberg

Nippon Steel Corp. plans to invest an additional $1.3 billion at plants operated by United States Steel Corp. as the Japanese company steps up efforts to secure union support for a takeover bid that’s been opposed by both President Joe Biden and Donald Trump.

Nippon Steel plans to make the investments at the Mon Valley Works and Gary Works, as part of its pending $14.1 billion acquisition of US Steel, it said Wednesday in a statement.

Mon Valley, a flagship plant where founder Andrew Carnegie built his first mill in the 1870s, and Gary are among the legacy US Steel operations that use traditional blast-furnace production of steel from iron ore. Those types of facilities are typically unionized, and increasing spending to extend their lifelines is part of a bid by Nippon Steel to garner support from the United Steelworkers union, which has so far opposed the corporate tie-up.

https://www.bloomberg.com/news/articles/2024-08-28/nippon-steel-plans-additional-1-3-billion-spending-at-us-steel?srnd=homepage-americas&sref=XLA0GJqR

That didn't last long, LOL.

CLF—(+6% this week)—benefiting from Canada’s new 25% tariff on steel imports (and EVs) from China:

https://www.nytimes.com/2024/08/26/business/canada-ev-tariffs-china.html

We all remember the busting of the internet bubble at the turn of the century?

Many charts looked like CSCO>>>

https://finance.yahoo.com/quote/CSCO/

Look at some comparable max charts now in assorted industries today

https://finance.yahoo.com/quote/COST/

https://finance.yahoo.com/quote/WMT/

https://finance.yahoo.com/quote/AAPL/

https://finance.yahoo.com/quote/AMZN/

Yes, fallacy of small sampling, but surely, I can find more.

Food for fear?

Does IBM qualify?

IBM closes R&D center in China:

https://finance.yahoo.com/news/ibm-shut-china-r-d-074741070.html

See #msg-172191068 for related info.

Saw a TV ad for Hummer this past week. Line up the Hummer in the road adjacent to the parking space, all 4 wheels can be turned at once to quickly glide you into the parking space. The ad did not show whether removal of rear seats would convert the vehicle to a truck, tho’ that would be logical. We have no use for any vehicle that big; we will stay with our 2020 Audi-S4.

Understood. Thanks.

I own a mini-van so we can toss loads of stuff in the back without packing carefully if we go on a long trip.

Storage space is useful.

I didn’t mean you specifically, Biowatch ![]() I guess I assumed the fine journalists at Axios were surveying truck owners to help them recognize they are spending $ on a vehicle they feel is bloated and unnecessary.

I guess I assumed the fine journalists at Axios were surveying truck owners to help them recognize they are spending $ on a vehicle they feel is bloated and unnecessary.

I don’t want to be told by someone else what I “need”.

If you follow QS they discuss production issues. Mass producing solid state batteries is a continuing problem. I suppose they'll eventually find a better process, but in the interim traditional LFP batteries improve. BYD's Blade 2.0 is supposed to be have significant energy storage increase in a smaller footprint. See Tesla for issues with producing new battery designs; they're still struggling 2 years after introducing their large format battery.

That is a real game changer if it is workable in standard charging staions.

Samsung Just Showed a 600-Mile Solid-State EV Battery, Charges in 9 Minutes

https://www.rideapart.com/news/728316/samsung-ss-ev-battery-coming-soon/

Then, of course, there’s the issue of cost. At present, it costs way more to manufacture solid-state EV batteries than Lithium-ion and LFP batteries found in current EVs—around three or four times, to be specific. Perhaps that’s why Toyota plans on introducing solid-state batteries on its Lexus vehicles first, where profit margins are much higher.

Our Gov at it's best......

And they didn’t mince words. “It’s just atrocious,” said Glen Capelo, a managing director at Mischler Financial Group. “There’s a big problem,” said Claudia Sahm, chief economist at New Century Advisors. “It’s crazy,” said Andrew Brenner, head of international fixed income at NatAlliance Securities.

The problems began when the Bureau of Labor Statistics failed to release a key revision to jobs data at 10 a.m. New York time as had been expected.

That error was compounded when BLS officials then began to provide the data — which showed that job growth estimates will be marked down significantly — to analysts who called up the agency.

So for a few excruciating minutes, a handful of firms, including BNP Paribas and Mizuho Financial Group, had the data while everyone else was left in the dark as markets shot higher and lower. Rumors flew, with some regurgitating the correct number and others spreading incorrect figures. The BLS finally released the data on its website a little after 10:30 a.m., when it showed that the number of jobs created in the year through March was likely to be revised down by 818,000, the most since 2009.

I have a 12 year old pickup that no longer “looks cool”. (The one I owned before that was 25 years old when I took it to the scrap yard.)I put stuff in the back and haul it around 3 or 4 days per week. Having less indoor cab space is sometimes an inconvenience for me, however I can’t be without one pickup in our household. I don’t want to be told by someone else what I “need”.

The evolution of Ford 150 trucks over the years:

Do you have any idea how much harder it is to have to pass a bloated car on a narrow street? It’s not as if most of these truck owners need a pickup truck for anything other than look cool, at least not in suburbia or downtown.

https://www.kansascity.com/opinion/editorials/article271697427.html

Axios looked at yearly surveys of F-150 owners from 2012 to 2021 and determined that 87% of them use the trucks frequently for shopping and errands, 70% for pleasure driving, and 52% for commuting. Only 28% do personal hauling frequently, and 63% reported they “rarely or never” use the pickups for towing.

Timing...Ford changes EV plans, will delay pickup truck, axe three-row SUV

https://finance.yahoo.com/news/ford-plans-low-cost-ev-120607969.html

2027??? By 2027 BYD will be the clear NEV leader. So 1st up is a mid-sized pickup. OK....where's the entry level sedan or small SUV? The dominant ICE majors are playing tic-tact-toe while BYD is playing 3 dimensional chess, it's not even close. Toss in BYD's leading edge battery tech and it's really game over.

Meanwhile, the only potential domestic competitor is pitching robotaxis, robots and AI which leads me to believe they've given up on being the dominant NEV player.

Everyone loves to hate the Chinese battery manufacturers and leading NEV manufacturers, but you have to tip your hat to their seeing the future and building an insurmountable lead.

https://foreignpolicy.com/2024/03/07/china-ev-byd-cars-auto-industry-price-war/

Assuming consumers will pay a premium for "economy" EV's, we'll see if the US industry ever produces a model. I have my doubts. Low cost EV's are crucial for broad adoption. BYD has low cost EV's today, one reason they will dominate many global markets,

The rebuttal by F's CEO is quite persuasive, IMO.

Great article....and the reason US car manufacturers will never design and sell sub 30k EV's. Also the reason why BYD will dominate the global markets outside the EU and USA. BYD has every market segment covered.

Why No One Wants To Sell You A $25,000 EV

https://insideevs.com/news/730788/why-evs-arent-cheap/?utm_source=Klaviyo&utm_medium=campaign&_kx=12wFdFU2yACIHXNEiG-QsKItdCqYwsrNEcSsJJoyaXI.VCGm8F

One of the auto industry’s dirtiest secrets is that at scale, it doesn’t cost that much more to make a bigger, more expensive than a smaller and cheaper one

SA continues to make new highs for 2024. Hard to imagine they won't be able to ink a JV for KSM. No doubt the share appreciation is anticipation of a JV.

Just have to wary of the nut jobs that want to pipe or store H2 in existing gas infrastructure in your neighborhood.

https://www.bloomberg.com/news/videos/2024-08-12/the-dirty-secret-behind-the-green-hydrogen-push

|

Followers

|

201

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

29597

|

|

Created

|

05/14/09

|

Type

|

Free

|

| Moderator DewDiligence | |||

| Assistants semi_infinite | |||

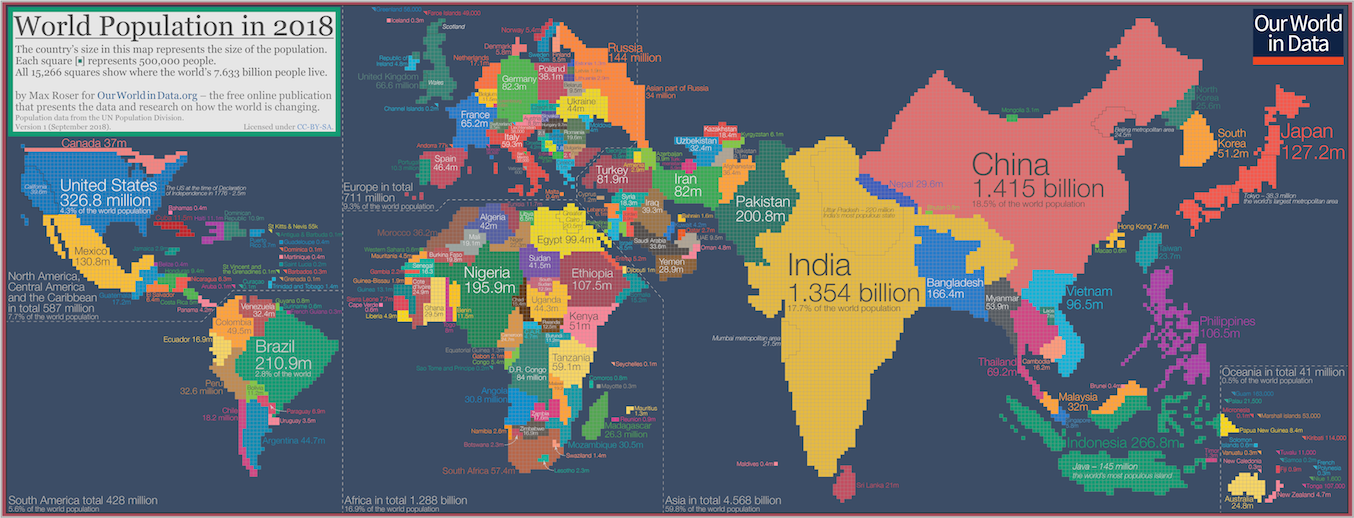

In many nations, a middle class is emerging for the first time in history.

Companies who satisfy the demands of these consumers in a sustainable manner should have bright prospects.

The Rising Influence of Rising Affluence is a forum for investment ideas based on this premise.

|

Posts Today

|

0

|

|

Posts (Total)

|

29597

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |