Wednesday, September 28, 2011 4:54:21 PM

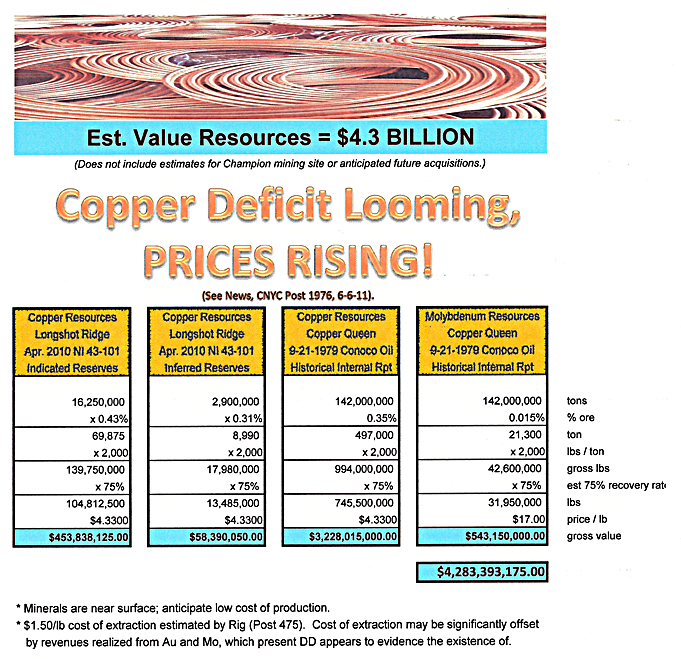

CNYC summary – 9-28-11 (avg. $.225)

TSX – CNC

OTC:BB – CNYC

Canyon Copper Corp (CNYC.OB)

1199 West Pender St., Suite 408

Vancouver, BC V6E 2R1

Phone: 604.331.9326 / 888.331.9326

Fax: 604.684.9365

URL: www.canyoncc.com

Email: info@canyoncc.com

IR: Robert Meister, Phone: 1.888.331.9326 x-231 / 1.604.331.9326 x-231 / info@cayoncc.com

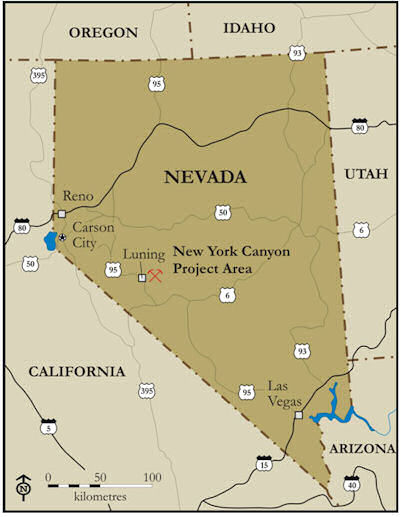

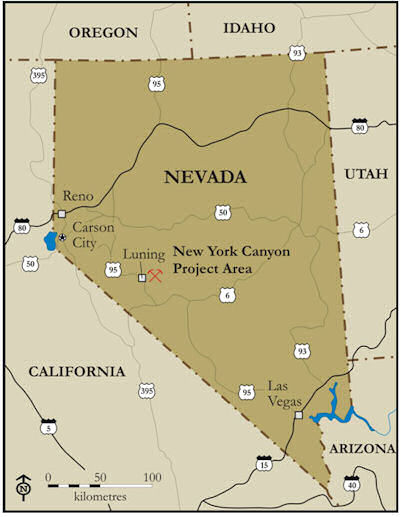

A resource exploration company with a well-advanced copper (both Oxide and Sulphide) and Molybdenum project. The Property lies within the famous Walker Lane Structural Belt of western Nevada, in Mineral County, Nevada, near the town of Luning. Canyon Copper holds a 100% interest in over 1,300 plus mineral claims (21 patented claims and 1,332 unpatented claims) representing approximately 27,000 acres.]

Immediate Corporate Objectives:

-- Develop a bulk tonnage Copper and Molybendum property in a 5km x 3 km mineralized belt.

-- Aggressive drill program to expand current NI 43-101 resource.

-- Acquisition of neighboring properties with significant resources.

-- Aim to establish a 2 billion lb. copper / molybdenum/gold resource and become a near-term producer.

MARKET CAP ~ $20,436,240 ($.33)

SHARE STRUCTURE (8-3-11):

Authorized Shares = 74,785,143

Outstanding Shares = 69,396,934

Held by Insiders = ~ 85%

Options Outstanding = 3,548,434 $0.27

Float = 15,800,000

AWAITING:

1. Marketing campaign targeting brokerage houses in Canada.

2. 3-5 drill units on site.

3. Hiring of new geologist for site management.

4. Property reassessment of core samples for value.

Revise Longshot Ridge resource estimate incorporating re-assayed values of 2006 drill & systematic road cut samples.

5. Apply for permit to dril on & around Longshot Ridge & adjacent copper oxide targets.

5. Apply for permits to drill Copper Queen & Champion target areas.

5. Assess potentials of copper oxide systems similar to the Longshot Ridge at the nearby Power Line & Buffington mine workings.

5. Initiate further work on metallurgical testing & environmental base line studies for Longshot Ridge deposit.

5. Pre-feasibility study.

6. Feasibility study.

7. Production (not restricted by season changes).

8. US uplisting to AMEX.

9. Acquisition of neighboring properties w/ significant resources around existing site in near future.

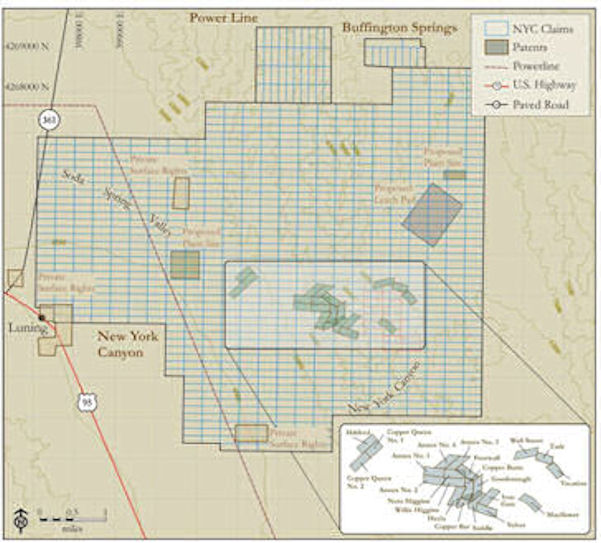

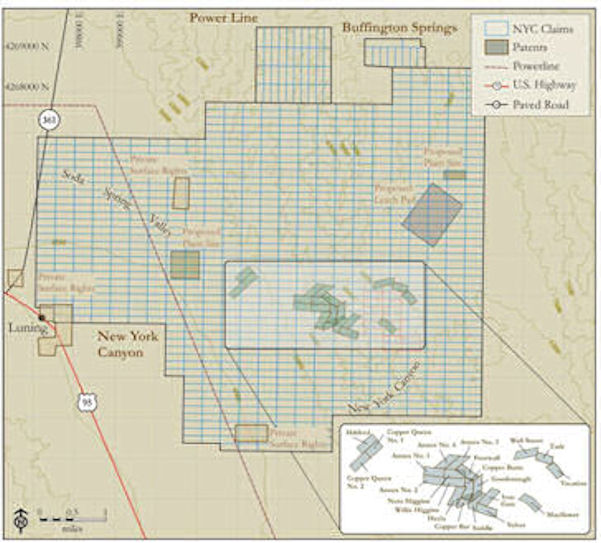

____Location of CNYC Project Area in Nevada____________Map of CNYC Claims: 1,353 mineral claims, 27,000+ acres

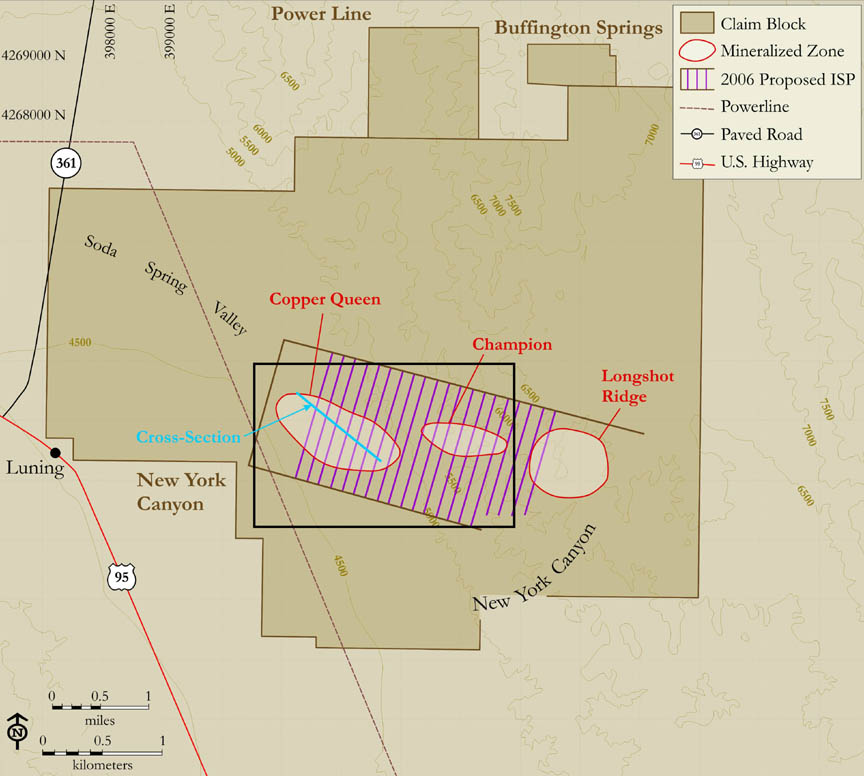

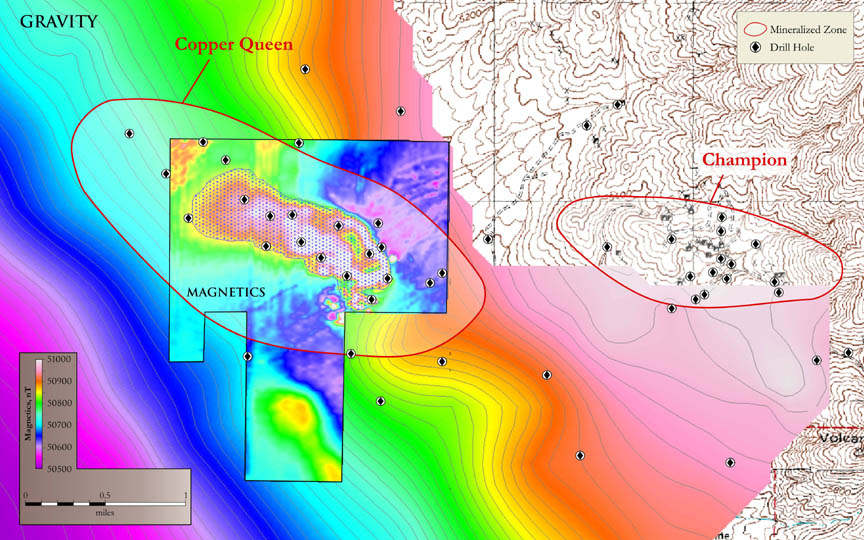

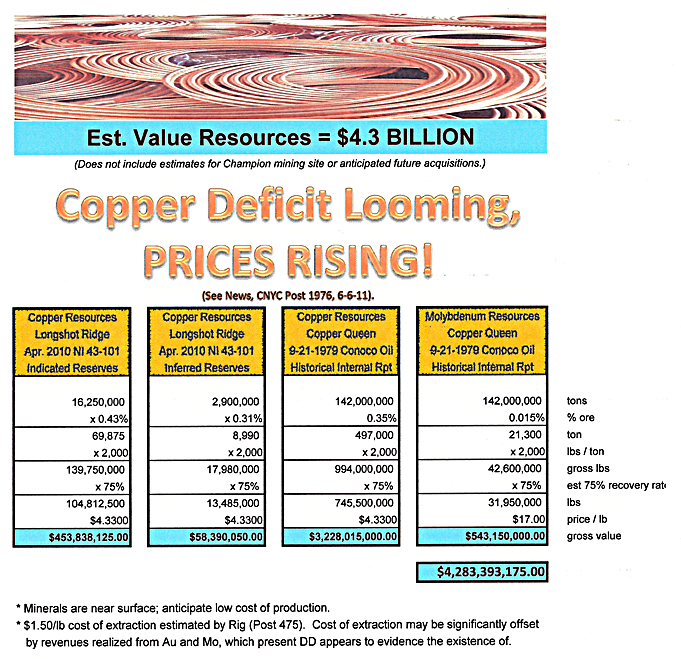

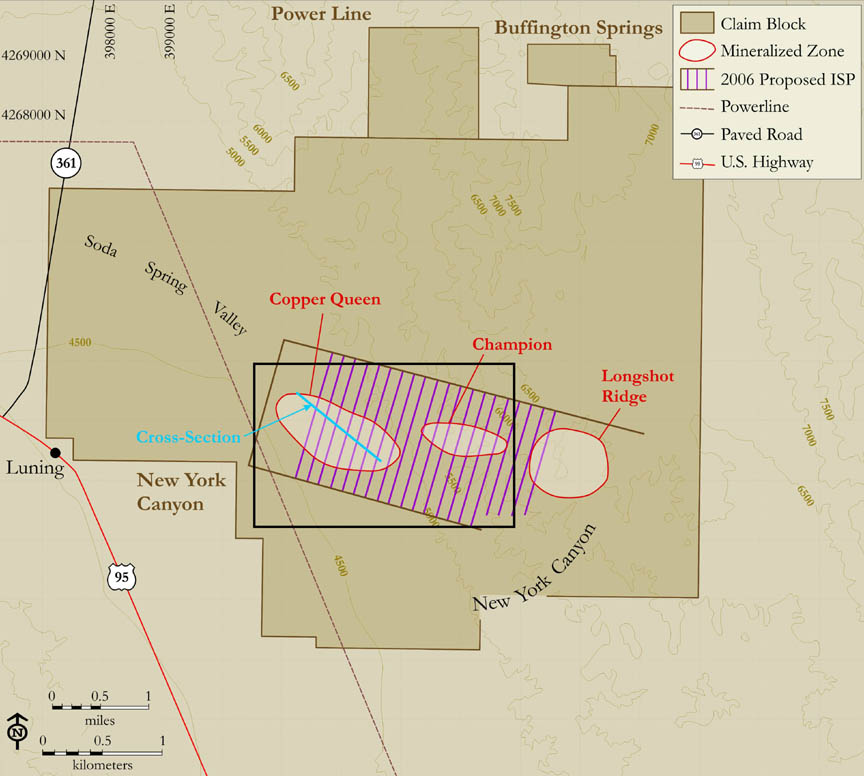

Identification 3 Primary Mining Zones: 1,353 mineral claims, 27,000+ acres

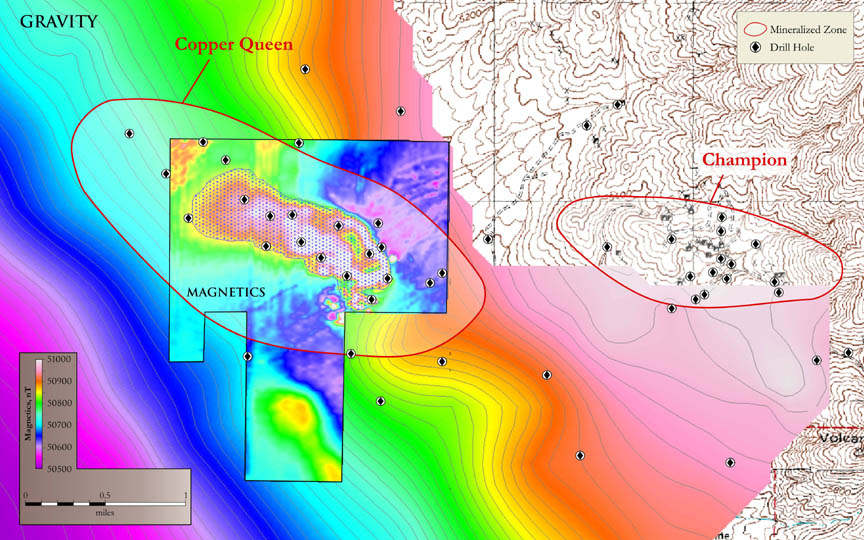

1. COPPER QUEEN – on the west.

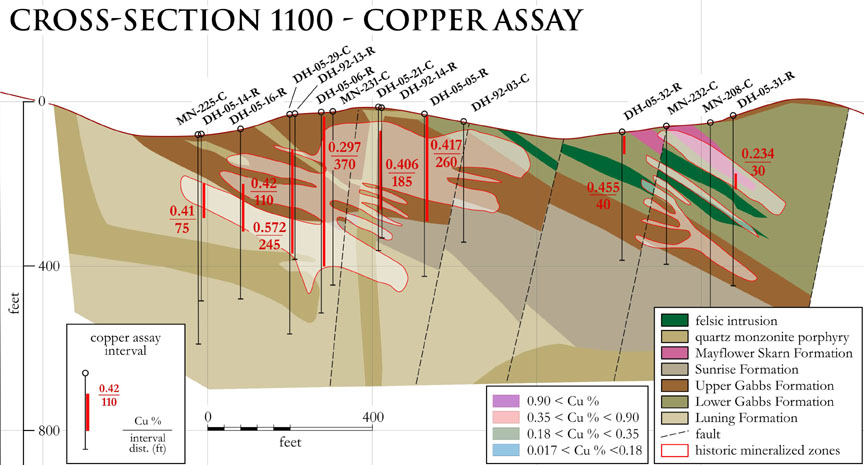

Has no exposed mineralization at surface, but contains Cu sulfide skarn at depth and an incompletely confirmed Cu-molybdenum sulphide porphyry system at greater depth.

2. CHAMPION – in the center.

Numerous widespread exposures of copper skarn mineralization, both in surface outcrop and abundant old mine workings.

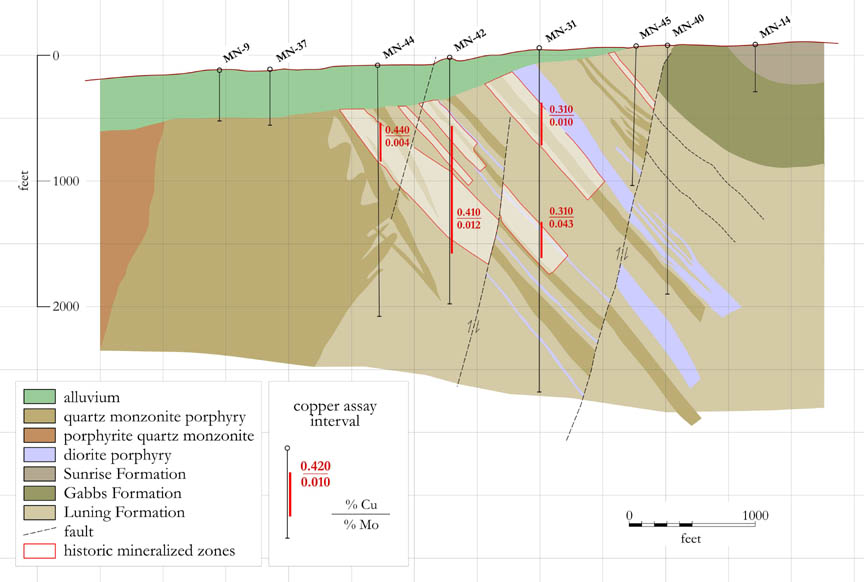

Picture of Copper Queen and Champion Mineralized Zones

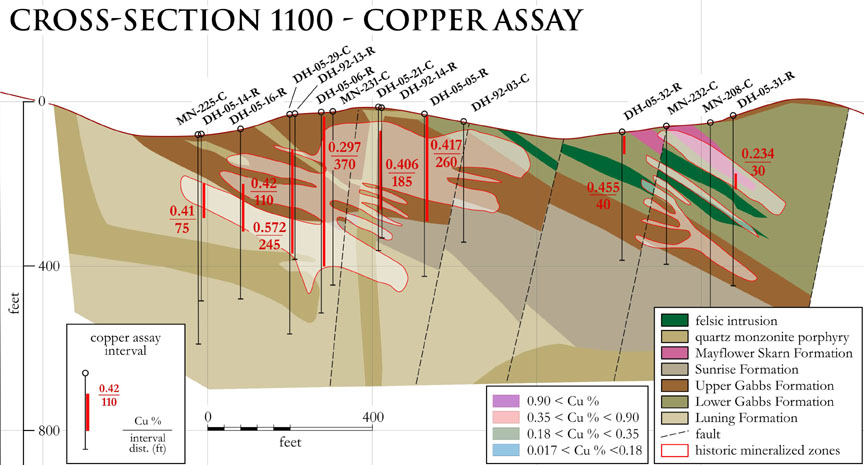

3. LONGSHOT RIDGE – on the east.

Numerous widespread exposures of copper skarn mineralization, both in surface outcrop and abundant old mine workings.

Majority of recent exploration efforts have been focused on extensive oxide Cu skarn mineralization at this location.

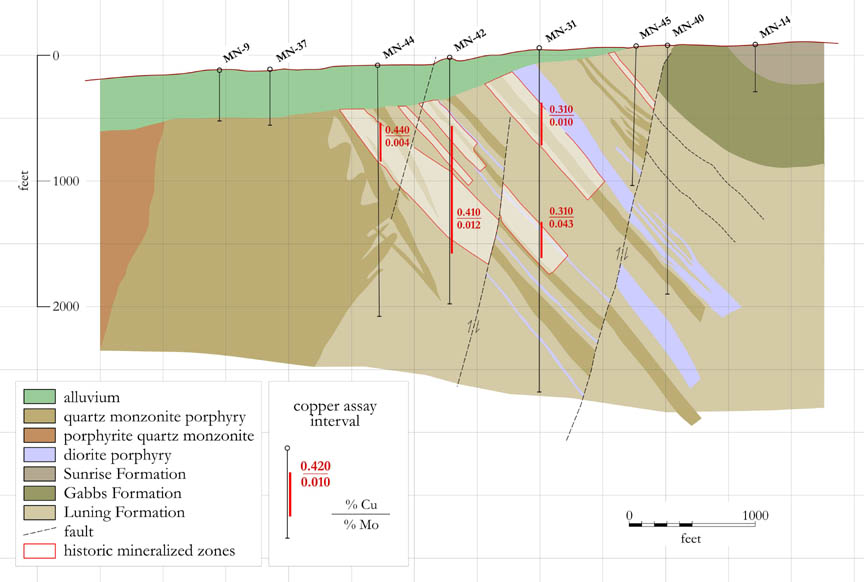

Formation: The Cu mineralization and associated alternation here at Longshot are projects of an extensive Cu-rich skarn system formed in carbonaceous sediments of the Luning, Gabbs and Sunrise Formations. Small amounts of Cu occur also in stockwork veinlets in felsic porphyry intrusive sills and dikes. The Cu mineralization consists almost entirely of secondary copper minerals, principally malachite, axurite, chrysocalla, and copper wad, in order of abundance. Additionally, some Cu-rich limonite (goethite) has been reported.

Deposit centralization: About 90% of the Longshot mineralization is within the 2 upper units of the Gabbs Formation. Drilling reveals that the strongest, thickest, and most continuous mineralization occurs in a NE-trending zone, 200’ W x 1300’ L, which is crossed by 2 NW-trending structurally-controlled high-grade zones, each about 100’ W and from 400-700’ L.

3-D Video of Cu Occurrence at Longshot Ridge – IMPRESSIVE -- http://www.canyoncc.com/s/NYCLongshot.asp?ReportID=439242

2004 Drilling Results, Longshot Ridge

-- Completed 2 diamond drill holes on Longshot: Drill hole 04-01 intersected 193’ of 0.547% Cu (from 20’ – 213’) including 50’ of 0.827% Cu (from 80’ – 130’). This hole ended in strong Cu mineralization.

-- Drill hole 04-03 was a vertical hole drilled to a depth of 43’. While drilling the hole, it was recognized that previousl drill holes in the vicinity had encountered significant mineralization at the contact of the overlying oxidized Gabbs Formation and the underlying Luning Formation, and this hole was extended to test this target. This drill hole (04-03) intersected 370’ of 0.314% Cu (from 25’ – 395’) including 140’ of 0.549% Cu (25’ – 1.65’.) and 35’ of 0.709% Cu (70’ – 105’).

Picture of Longshot Ridge drilling hole 04-03 and Copper Oxide Cores

Picture of Longshot Ridge

Site Picture

Site Picture – Core Drilling

PRINCIPALS:

Anthony R. Harvey, CEO, COB

Member of Advisory Board, Audit Committee and Disclosure Committee

Benjamin Ainsworth, President, Secretary, Director

Member of Disclosure Committee

Kurt Bordian, CFO, Treasurer

Member of Disclosure Committee

James Yates, Director

Over 25 years experience in mineral exploration and has served as director and officer of several public mining companies, such as ESO Uranium (TSX-V: ESO), and Nevada Geothermal power, Inc. (TSD-V: NGP).

Bryan Wilson, Director

Over 18 years varied career in fields of mining exploration and dvpmt, and 12 years in fin’l svcs.

Chris Broili, Project Mgr., NY Canyon Exploration project

Member of Disclosure Committee

HISTORICAL:

9-28-11 – 10K

-- CNYC has funding for proposed exploration program and continued operations ($1,090,000) for next 12 months, which includes 2011 – 2012 unpatented claim maintenance fees and monthly payments on patented claims, re-assay 2006 Longshot Ridge drill pulps, metallurgical sampling + testing, environmental base line study work, geological mapping.

-- Anticipates continuing to rely on sale of common & loans to continue funding business operations, incl. dilution, for Phase II.

9-12-11 – Listed by Stock Catalysts

7-15-11 – Canyon Copper completes Brokered Private Placement + Final Tranche of Non-brokered Private Placement.

Also made available on Canadian News Wire.

-- Brokered PP – issued 2,164,071 units @ CDN $.035 = $757,425.

-- Non-brokered PP – issued 857,142 units @ CDN $.035 = $300,000.

-- Warrants 1,510,606 @ CDN $0.50.

-- Brokered Warrants exercise restriction on transfer 11-14-11; to 1-13-13.

-- Non-brokered Warrants exercise restriction on transfer to 11-9-11; to 1-8-13.

-- May accelerate expiry date of warrants if CNYC’s shs close at price = $0.50 for 10 consecutive days providing 30 days notice of acceleration.

-- MGI Securities commission CDN $45,445; issued non-transfer options to purchase aggregate of 129,844 units @ CDN $0.35 per unit to selling group members.

7-11-11 -- Form 4

On 7-8-11, ARH Mgmt, Ltd. (CEO Anthony R. Harvey company) acquired 857,142 common @ $0.36 = $308,571.12.

Warrants (right to buy) 428,571 common @ $0.52

5-26-11 – Statement of Changes in Beneficial Ownership of Securities

5-17-11 – 8K – Milton Datsopolous resigns as member of Board of Directors

No disagreement with company.

5-16-11 – 8K – Unregistered Sale of Equity Securities, Fin’ls., + Exhibits

Reports non-brokered foreign Private Placement of May 11, 2011.

5-14-11 – Financials – March 31, 2011

5-12-11 – News – Canyon Copper Completes First Tranche of Non-Brokered Private Placement

5-11-11 – Non-Brokered Private Placement (rpt’d. in May 16, 2011 8K)

1. Issued 3,206,602 units @ $0.35 CDN per Unit = $1,112,310.70 CDN.

2. Each unit consists of 1 sh common stock (“Share”) and ½ share non-transferable purchase Warrant (“Warrant”).

3. Each whole Warrant entitles the holder to purchase an add’l Share of the Corporation at a price of $0.50 CDN / Share until November 10, 2012.

4. Company may accelerate expiry date, the accelerated expiry date w/b 30 days after the Company sends out notice of acceleration.

5. Company did not engage in a distribution of this offering in the US.

6. Share issuance represents the first tranche of the Company’s previously announced non-brokered foreign PP offering. Proceeds of offering w/b used to fund the Company’s exploration program on the New York Canyon Project, as well as for gen’l working capital and corporate purposes.

7. Also issued 142,857 units @ $.035 CDN per Unit for total proceeds of $50,000 CDN to a director of the Company.

5-10-11 – 10Q – March 31, 3011

4-6-11 – 8K – Conditional Approval to List as Tier 1 Mining Issuer

4-4-11 – News – CNYC Announces Conditional Approval to List on TSX Venture Exchange

3-4-11 – Telecon – Rigatoni interpretation of telecom w/ CEO, Anthony Harvey

-- He was hired to come in + clean up company; he fired all previously involved; company did a reverse to clean out bad management.

-- He has 50 years in mining business.

-- He has put 19 mines into production.

-- He has put 3 oil and gas projects into production.

-- He has worked on projects in 15 countries.

-- Just based on 43-101 report, they have a big property with huge potential.

-- Conoco did the original drilling and he bought all the data.

-- He said they increased the acreage and now think, hypothetically, they have 1.5 billion lbs of Cu and that would have been proven out with additional drilling to become accurate.

-- He knows institutions who own stock, and they won’t be selling for a long time, in his opinion.

-- Expecting listing at any time in Canada, rated Tier 1 upon application. No guarantees.

-- Potential future financing done for small amount, maybe 2.5 mil. Much higher than current stock price (IMO).

2-12-11 – Financials – Q4 2011

2-9-11 – 10Q – Q4 2011

1-31-11 – 8K – Regulation FD Disclosure, Fin’l Stmts + Exhibits

1-27-11 – News – Canyon Copper Announces Private Placement + Sponsorship Engagement Letter w/ MGI Securities, Inc.

1-27-11 – News – CNYC Announces Brokered Private Placement Offering of Units

http://biz.yahoo.com/e/110131/cnyc.ob8-k.html

1-21-11 – 8K, Entry into MDA, Regulation FD Disclosure, Fin’ls.

http://biz.yahoo.com/e/110121/cnyc.ob8-k.html

1-19-11 – News – CNYC Announces Private Placement Offering of Units

http://finance.yahoo.com/news/Canyon-Copper-Corp-Announces-iw-300850032.html?

11-29-10 – 8K, Entry into MDA, Amendments to Articles

http://biz.yahoo.com/e/101129/cnyc.ob8-k.html

11-24-10 – News – CNYC Announces Effectiveness of 79-for-100 Reserve Stock Split

http://finance.yahoo.com/news/Canyon-Copper-Announces-iw-1342808054.html?x=0&.v=1

11-15-10 – News – CNYC Corporate Overview

http://finance.yahoo.com/news/Canyon-Copper-Announces-iw-1342808054.html?x=0&.v=1

11-1-10 – 10Q

http://biz.yahoo.com/e/101101/cnycd.ob10-q.html

10-28-10 – News – CNYC Announces Approval for 79-for-100 Reverse Stock Split

Reverse split done in order for its capital structure to conform to capital structure requirements of TSC Venture Exchange, decreasing authorized capital of common stock from 166,666,666 shs (par $.00001/sh) to 131,666,666 shs ($.000001/sh), and issued and O/S common stock reduced from 78,39066,666 shs ($.000001/sh), and issued and O/S common stock reduced from 78,39,307 shs to 6,928,343 shs.

http://biz.yahoo.com/e/101101/cnycd.ob10-q.html

10-13-10 – 8K, Entry into MDA, Fin’l Stmts + Exhibits

http://biz.yahoo.com/e/101101/cnycd.ob10-q.html

9-28-10 – 10K, Annual Report

http://biz.yahoo.com/e/100928/cnyc.ob10-k.html

8-25-10 – 8K, ? of CPA, Fin’ls + Exhibits

http://biz.yahoo.com/e/100825/cnyc.ob8-k.html

5-31-10 – News – CNYC Announces NI 43-101 Indicated + Inferred Resources on Longshot Ridge Copper Skarn Deposit at New York Canyon Project

http://biz.yahoo.com/e/100825/cnyc.ob8-k.html

4-6-10 – NI 43-101 Technical Report on New York Canyon Project, Nevada

http://sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo=00027554&fileName=/csfsprod/data107/filings/01576633/00000001/v%3A%5CCanyonCopper%5CSEDAR%5C0003217_tech_May6_2010%5Cfiled%5CCanyonCopper_TechReportmay6.pdf

CAVEAT: The entirety of the above was compiled by and contains opinions of this user, and is not to be relied upon. Do your own due diligence.

TSX – CNC

OTC:BB – CNYC

Canyon Copper Corp (CNYC.OB)

1199 West Pender St., Suite 408

Vancouver, BC V6E 2R1

Phone: 604.331.9326 / 888.331.9326

Fax: 604.684.9365

URL: www.canyoncc.com

Email: info@canyoncc.com

IR: Robert Meister, Phone: 1.888.331.9326 x-231 / 1.604.331.9326 x-231 / info@cayoncc.com

A resource exploration company with a well-advanced copper (both Oxide and Sulphide) and Molybdenum project. The Property lies within the famous Walker Lane Structural Belt of western Nevada, in Mineral County, Nevada, near the town of Luning. Canyon Copper holds a 100% interest in over 1,300 plus mineral claims (21 patented claims and 1,332 unpatented claims) representing approximately 27,000 acres.]

Immediate Corporate Objectives:

-- Develop a bulk tonnage Copper and Molybendum property in a 5km x 3 km mineralized belt.

-- Aggressive drill program to expand current NI 43-101 resource.

-- Acquisition of neighboring properties with significant resources.

-- Aim to establish a 2 billion lb. copper / molybdenum/gold resource and become a near-term producer.

MARKET CAP ~ $20,436,240 ($.33)

SHARE STRUCTURE (8-3-11):

Authorized Shares = 74,785,143

Outstanding Shares = 69,396,934

Held by Insiders = ~ 85%

Options Outstanding = 3,548,434 $0.27

Float = 15,800,000

AWAITING:

1. Marketing campaign targeting brokerage houses in Canada.

2. 3-5 drill units on site.

3. Hiring of new geologist for site management.

4. Property reassessment of core samples for value.

Revise Longshot Ridge resource estimate incorporating re-assayed values of 2006 drill & systematic road cut samples.

5. Apply for permit to dril on & around Longshot Ridge & adjacent copper oxide targets.

5. Apply for permits to drill Copper Queen & Champion target areas.

5. Assess potentials of copper oxide systems similar to the Longshot Ridge at the nearby Power Line & Buffington mine workings.

5. Initiate further work on metallurgical testing & environmental base line studies for Longshot Ridge deposit.

5. Pre-feasibility study.

6. Feasibility study.

7. Production (not restricted by season changes).

8. US uplisting to AMEX.

9. Acquisition of neighboring properties w/ significant resources around existing site in near future.

____Location of CNYC Project Area in Nevada____________Map of CNYC Claims: 1,353 mineral claims, 27,000+ acres

Identification 3 Primary Mining Zones: 1,353 mineral claims, 27,000+ acres

1. COPPER QUEEN – on the west.

Has no exposed mineralization at surface, but contains Cu sulfide skarn at depth and an incompletely confirmed Cu-molybdenum sulphide porphyry system at greater depth.

2. CHAMPION – in the center.

Numerous widespread exposures of copper skarn mineralization, both in surface outcrop and abundant old mine workings.

Picture of Copper Queen and Champion Mineralized Zones

3. LONGSHOT RIDGE – on the east.

Numerous widespread exposures of copper skarn mineralization, both in surface outcrop and abundant old mine workings.

Majority of recent exploration efforts have been focused on extensive oxide Cu skarn mineralization at this location.

Formation: The Cu mineralization and associated alternation here at Longshot are projects of an extensive Cu-rich skarn system formed in carbonaceous sediments of the Luning, Gabbs and Sunrise Formations. Small amounts of Cu occur also in stockwork veinlets in felsic porphyry intrusive sills and dikes. The Cu mineralization consists almost entirely of secondary copper minerals, principally malachite, axurite, chrysocalla, and copper wad, in order of abundance. Additionally, some Cu-rich limonite (goethite) has been reported.

Deposit centralization: About 90% of the Longshot mineralization is within the 2 upper units of the Gabbs Formation. Drilling reveals that the strongest, thickest, and most continuous mineralization occurs in a NE-trending zone, 200’ W x 1300’ L, which is crossed by 2 NW-trending structurally-controlled high-grade zones, each about 100’ W and from 400-700’ L.

3-D Video of Cu Occurrence at Longshot Ridge – IMPRESSIVE -- http://www.canyoncc.com/s/NYCLongshot.asp?ReportID=439242

2004 Drilling Results, Longshot Ridge

-- Completed 2 diamond drill holes on Longshot: Drill hole 04-01 intersected 193’ of 0.547% Cu (from 20’ – 213’) including 50’ of 0.827% Cu (from 80’ – 130’). This hole ended in strong Cu mineralization.

-- Drill hole 04-03 was a vertical hole drilled to a depth of 43’. While drilling the hole, it was recognized that previousl drill holes in the vicinity had encountered significant mineralization at the contact of the overlying oxidized Gabbs Formation and the underlying Luning Formation, and this hole was extended to test this target. This drill hole (04-03) intersected 370’ of 0.314% Cu (from 25’ – 395’) including 140’ of 0.549% Cu (25’ – 1.65’.) and 35’ of 0.709% Cu (70’ – 105’).

Picture of Longshot Ridge drilling hole 04-03 and Copper Oxide Cores

Picture of Longshot Ridge

Site Picture

Site Picture – Core Drilling

PRINCIPALS:

Anthony R. Harvey, CEO, COB

Member of Advisory Board, Audit Committee and Disclosure Committee

Benjamin Ainsworth, President, Secretary, Director

Member of Disclosure Committee

Kurt Bordian, CFO, Treasurer

Member of Disclosure Committee

James Yates, Director

Over 25 years experience in mineral exploration and has served as director and officer of several public mining companies, such as ESO Uranium (TSX-V: ESO), and Nevada Geothermal power, Inc. (TSD-V: NGP).

Bryan Wilson, Director

Over 18 years varied career in fields of mining exploration and dvpmt, and 12 years in fin’l svcs.

Chris Broili, Project Mgr., NY Canyon Exploration project

Member of Disclosure Committee

HISTORICAL:

9-28-11 – 10K

-- CNYC has funding for proposed exploration program and continued operations ($1,090,000) for next 12 months, which includes 2011 – 2012 unpatented claim maintenance fees and monthly payments on patented claims, re-assay 2006 Longshot Ridge drill pulps, metallurgical sampling + testing, environmental base line study work, geological mapping.

-- Anticipates continuing to rely on sale of common & loans to continue funding business operations, incl. dilution, for Phase II.

9-12-11 – Listed by Stock Catalysts

7-15-11 – Canyon Copper completes Brokered Private Placement + Final Tranche of Non-brokered Private Placement.

Also made available on Canadian News Wire.

-- Brokered PP – issued 2,164,071 units @ CDN $.035 = $757,425.

-- Non-brokered PP – issued 857,142 units @ CDN $.035 = $300,000.

-- Warrants 1,510,606 @ CDN $0.50.

-- Brokered Warrants exercise restriction on transfer 11-14-11; to 1-13-13.

-- Non-brokered Warrants exercise restriction on transfer to 11-9-11; to 1-8-13.

-- May accelerate expiry date of warrants if CNYC’s shs close at price = $0.50 for 10 consecutive days providing 30 days notice of acceleration.

-- MGI Securities commission CDN $45,445; issued non-transfer options to purchase aggregate of 129,844 units @ CDN $0.35 per unit to selling group members.

7-11-11 -- Form 4

On 7-8-11, ARH Mgmt, Ltd. (CEO Anthony R. Harvey company) acquired 857,142 common @ $0.36 = $308,571.12.

Warrants (right to buy) 428,571 common @ $0.52

5-26-11 – Statement of Changes in Beneficial Ownership of Securities

5-17-11 – 8K – Milton Datsopolous resigns as member of Board of Directors

No disagreement with company.

5-16-11 – 8K – Unregistered Sale of Equity Securities, Fin’ls., + Exhibits

Reports non-brokered foreign Private Placement of May 11, 2011.

5-14-11 – Financials – March 31, 2011

5-12-11 – News – Canyon Copper Completes First Tranche of Non-Brokered Private Placement

5-11-11 – Non-Brokered Private Placement (rpt’d. in May 16, 2011 8K)

1. Issued 3,206,602 units @ $0.35 CDN per Unit = $1,112,310.70 CDN.

2. Each unit consists of 1 sh common stock (“Share”) and ½ share non-transferable purchase Warrant (“Warrant”).

3. Each whole Warrant entitles the holder to purchase an add’l Share of the Corporation at a price of $0.50 CDN / Share until November 10, 2012.

4. Company may accelerate expiry date, the accelerated expiry date w/b 30 days after the Company sends out notice of acceleration.

5. Company did not engage in a distribution of this offering in the US.

6. Share issuance represents the first tranche of the Company’s previously announced non-brokered foreign PP offering. Proceeds of offering w/b used to fund the Company’s exploration program on the New York Canyon Project, as well as for gen’l working capital and corporate purposes.

7. Also issued 142,857 units @ $.035 CDN per Unit for total proceeds of $50,000 CDN to a director of the Company.

5-10-11 – 10Q – March 31, 3011

4-6-11 – 8K – Conditional Approval to List as Tier 1 Mining Issuer

4-4-11 – News – CNYC Announces Conditional Approval to List on TSX Venture Exchange

3-4-11 – Telecon – Rigatoni interpretation of telecom w/ CEO, Anthony Harvey

-- He was hired to come in + clean up company; he fired all previously involved; company did a reverse to clean out bad management.

-- He has 50 years in mining business.

-- He has put 19 mines into production.

-- He has put 3 oil and gas projects into production.

-- He has worked on projects in 15 countries.

-- Just based on 43-101 report, they have a big property with huge potential.

-- Conoco did the original drilling and he bought all the data.

-- He said they increased the acreage and now think, hypothetically, they have 1.5 billion lbs of Cu and that would have been proven out with additional drilling to become accurate.

-- He knows institutions who own stock, and they won’t be selling for a long time, in his opinion.

-- Expecting listing at any time in Canada, rated Tier 1 upon application. No guarantees.

-- Potential future financing done for small amount, maybe 2.5 mil. Much higher than current stock price (IMO).

2-12-11 – Financials – Q4 2011

2-9-11 – 10Q – Q4 2011

1-31-11 – 8K – Regulation FD Disclosure, Fin’l Stmts + Exhibits

1-27-11 – News – Canyon Copper Announces Private Placement + Sponsorship Engagement Letter w/ MGI Securities, Inc.

1-27-11 – News – CNYC Announces Brokered Private Placement Offering of Units

http://biz.yahoo.com/e/110131/cnyc.ob8-k.html

1-21-11 – 8K, Entry into MDA, Regulation FD Disclosure, Fin’ls.

http://biz.yahoo.com/e/110121/cnyc.ob8-k.html

1-19-11 – News – CNYC Announces Private Placement Offering of Units

http://finance.yahoo.com/news/Canyon-Copper-Corp-Announces-iw-300850032.html?

11-29-10 – 8K, Entry into MDA, Amendments to Articles

http://biz.yahoo.com/e/101129/cnyc.ob8-k.html

11-24-10 – News – CNYC Announces Effectiveness of 79-for-100 Reserve Stock Split

http://finance.yahoo.com/news/Canyon-Copper-Announces-iw-1342808054.html?x=0&.v=1

11-15-10 – News – CNYC Corporate Overview

http://finance.yahoo.com/news/Canyon-Copper-Announces-iw-1342808054.html?x=0&.v=1

11-1-10 – 10Q

http://biz.yahoo.com/e/101101/cnycd.ob10-q.html

10-28-10 – News – CNYC Announces Approval for 79-for-100 Reverse Stock Split

Reverse split done in order for its capital structure to conform to capital structure requirements of TSC Venture Exchange, decreasing authorized capital of common stock from 166,666,666 shs (par $.00001/sh) to 131,666,666 shs ($.000001/sh), and issued and O/S common stock reduced from 78,39066,666 shs ($.000001/sh), and issued and O/S common stock reduced from 78,39,307 shs to 6,928,343 shs.

http://biz.yahoo.com/e/101101/cnycd.ob10-q.html

10-13-10 – 8K, Entry into MDA, Fin’l Stmts + Exhibits

http://biz.yahoo.com/e/101101/cnycd.ob10-q.html

9-28-10 – 10K, Annual Report

http://biz.yahoo.com/e/100928/cnyc.ob10-k.html

8-25-10 – 8K, ? of CPA, Fin’ls + Exhibits

http://biz.yahoo.com/e/100825/cnyc.ob8-k.html

5-31-10 – News – CNYC Announces NI 43-101 Indicated + Inferred Resources on Longshot Ridge Copper Skarn Deposit at New York Canyon Project

http://biz.yahoo.com/e/100825/cnyc.ob8-k.html

4-6-10 – NI 43-101 Technical Report on New York Canyon Project, Nevada

http://sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo=00027554&fileName=/csfsprod/data107/filings/01576633/00000001/v%3A%5CCanyonCopper%5CSEDAR%5C0003217_tech_May6_2010%5Cfiled%5CCanyonCopper_TechReportmay6.pdf

CAVEAT: The entirety of the above was compiled by and contains opinions of this user, and is not to be relied upon. Do your own due diligence.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.