Thursday, June 18, 2009 2:41:39 PM

The full 120 page reserve report is on the Company website at http://www.hollomanenergy.com It takes about 15 minutes to download all three sections. The important pages are the actual Probabilistic Tables on pages 46,52,58,64,88,94,100,105,111 and 117. Each of these tables takes one of the ten prospects and breaks it down into various parameters with the most important being Recoverable Reserves.

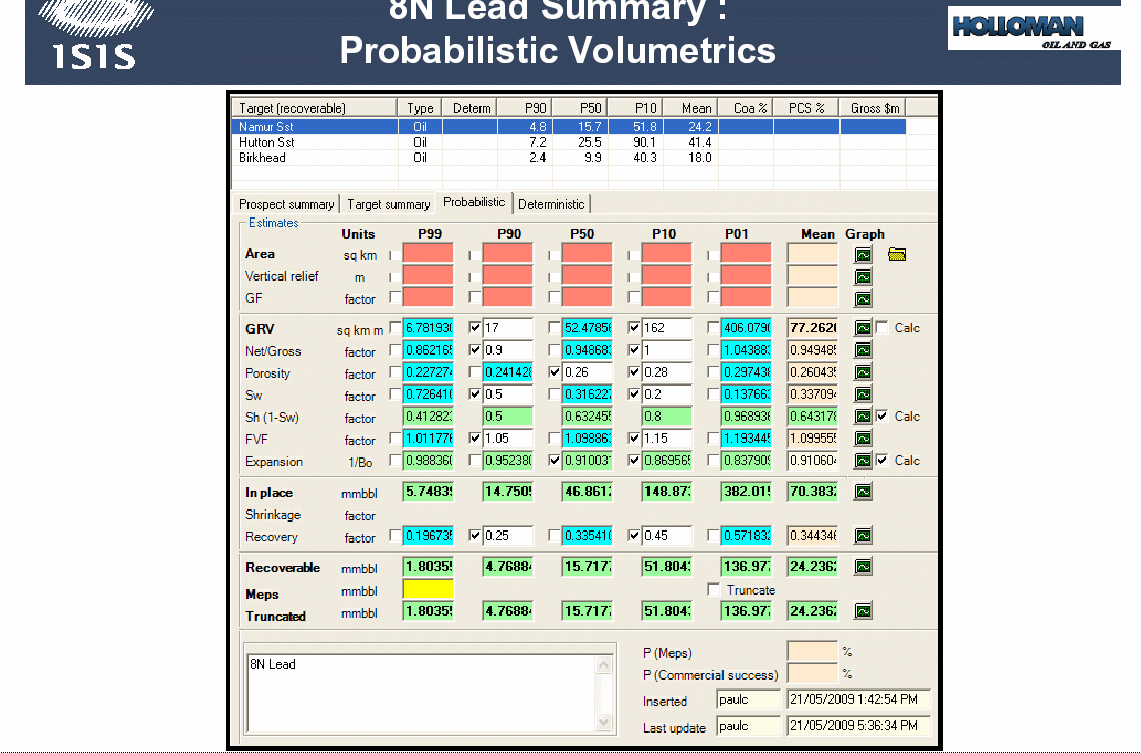

I have made an image of just one of the tables, (8N on PEL112 pg.111).

This is how to read the important points.

In Row labeled Recoverable you see six headers with a P preceding a number. The P is for Probability. The number is the Percentage of Probability. The Higher the "P number" the more conservative the Reserve Estimate.

So the first column, P99 means a 99% probability that this location will have 1.8035 million barrels of recoverable reserves. Or in other words, with the stock at .30 it has a market cap of just over $30 million, that one location alone with 1.8 million barrels, at a lifetime average of $50 a barrel would be worth $90 million.

The next column is P90, or what HENC reported today in its PR. P90 is the norm for Proven Probabilistic reserve reporting and will be required to be reported WITH A DOLLAR VALUE beginning January 1, 2010 as per a new SEC reporting guideline for oil and gas reporting. SEC 17 CFR Parts 210, 211 et al. Modernization of Oil and Gas Reporting; Final Rule http://www.sec.gov/rules/final/2009/33-8995fr.pdf (BTW under the new Rule, Companies will also be allowed to report dollar values for their Probable and Possible Reserves for the first time).

In this second column the P90 means a 90% probability recoverable for this one prospect is 4.78 million barrels. (Do the math-Over $230 million for just this one prospect at $50 a barrel) I shutter to think how big the dollar value will be on this years 10k.

The third column is P50 (a fifty-fifty chance of being accurate) and according to the above referenced link considered Probable reserves. This column shows 15.7 million barrels recoverable or or around $800 million at $50 a barrel.

The fourth column shows P10 (10% chance) Possible reserves of 52 million barrels.

Fifth column shows P1 or one chance in a hundred that there could be as much as 137 million barrels on this one section alone.

Sixth column shows the "Mean" number or 24.3 million barrels.

Remember, the above is just one of the ten locations covered in this report.

I tallied up the 10 P90 and 10 P50. The total of the ten locations P90 is 25.3 million barrels ($1,265,000,000 at average $50 a barrel) and the total P50 is 82.78 million barrels. ($4,139,000,000 at average $50 a barrel.)

Pretty interesting Risk/Reward for a "Penny Stock"

This is exactly why I have always loved the Oil and Gas Business. It is one of the only industries that a small company can become big overnight by just being lucky in picking the right acreage before the area gets hot.

BTW, One thing that does confuse me about the PR is that the Company Call P90 as being "Probable". According to the Society of Petroleum Engineers Committee report 2005, Page 4, P90 should be classified as Proven, not Probable.

• Most classifications recognize three deterministic scenarios with decreasing technical certainty: a low estimate, best estimate and high estimate. While probabilistic assessments are not commonly applied, it is generally accepted that the equivalent estimates on a cumulative probability distribution would be greater than or equal to P90, P50 and P10 respectively. For discovered and commercial volume estimates, the discrete (incremental) volumes within these bounds are generally referred to as proved, probable and possible reserves... http://www.spe.org/spe-site/spe/spe/industry/reserves/OGR_Mapping_Final_Report.pdf

Recent HENC News

- Form 8-K - Current report • Edgar (US Regulatory) • 12/05/2023 11:04:16 AM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/16/2023 11:02:27 AM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 11/14/2023 08:06:44 PM

Last Shot Hydration Drink Announced as Official Sponsor of Red River Athletic Conference • EQLB • Jun 20, 2024 2:38 PM

ATWEC Announces Major Acquisition and Lays Out Strategic Growth Plans • ATWT • Jun 20, 2024 7:09 AM

North Bay Resources Announces Composite Assays of 0.53 and 0.44 Troy Ounces per Ton Gold in Trenches B + C at Fran Gold, British Columbia • NBRI • Jun 18, 2024 9:18 AM

VAYK Assembling New Management Team for $64 Billion Domestic Market • VAYK • Jun 18, 2024 9:00 AM

Fifty 1 Labs, Inc Announces Acquisition of Drago Knives, LLC • CAFI • Jun 18, 2024 8:45 AM

Hydromer Announces Attainment of ISO 13485 Certification • HYDI • Jun 17, 2024 9:22 AM