08:36 China Grows More Picky About Debt-- New York Times

The New York Times reports leaders in both Washington and Beijing have been fretting openly about the mutual dependence — some would say codependence — created by China's vast holdings of United States bonds. China is growing more picky about which American debt it is willing to finance, and is changing laws to make it easier for Chinese companies to invest abroad the billions of dollars they take in each year by exporting to America. For its part, the United States is becoming relatively less dependent on Chinese financing. China has actually bought Treasury bonds at an accelerating pace over the last year. But the borrowing needs of the United States government have grown even faster. So China represents a rapidly shrinking share of overall purchases of Treasury securities. Financial statistics released by both countries in recent days show that China paradoxically stepped up its lending to the American government over the winter even as it virtually stopped putting fresh money into dollars. This combination is possible because China has been exchanging one dollar-denominated asset for another — selling the debt of government-sponsored enterprises like Fannie Mae and Freddie Mac in a hurry to buy Treasuries. While this has been clear for months, new data shows that China is also trading long-term Treasuries for short-term notes. China does not appear to be dumping euros or yen to buy Treasuries. China now earns more than $50 billion a year in interest from the United States. Since November, China has been buying more Treasury bills, with a maturity of a year or less, than Treasuries with longer maturities. This gives China the option of cashing out its positions in a hurry, by not rolling over its investments into new Treasury bills as they come due should inflation in the United States start rising and make Treasury securities less attractive. The government has been buying a wider range of assets and encouraging the private sector to invest more money overseas. Iron ore has been piling up on Chinese docks, government stockpiles of crude oil and grain are being expanded and stockpiles are being started for products like gasoline, diesel and sugar. After six years of silence, China unexpectedly disclosed last month that it had been gradually buying gold from domestic producers. A person in periodic contact with China's central bank, who insisted on anonymity to preserve his access, said that a Chinese central banker complained to him last year that "we have so much money and there's so little gold, we can't buy much without driving up the price."

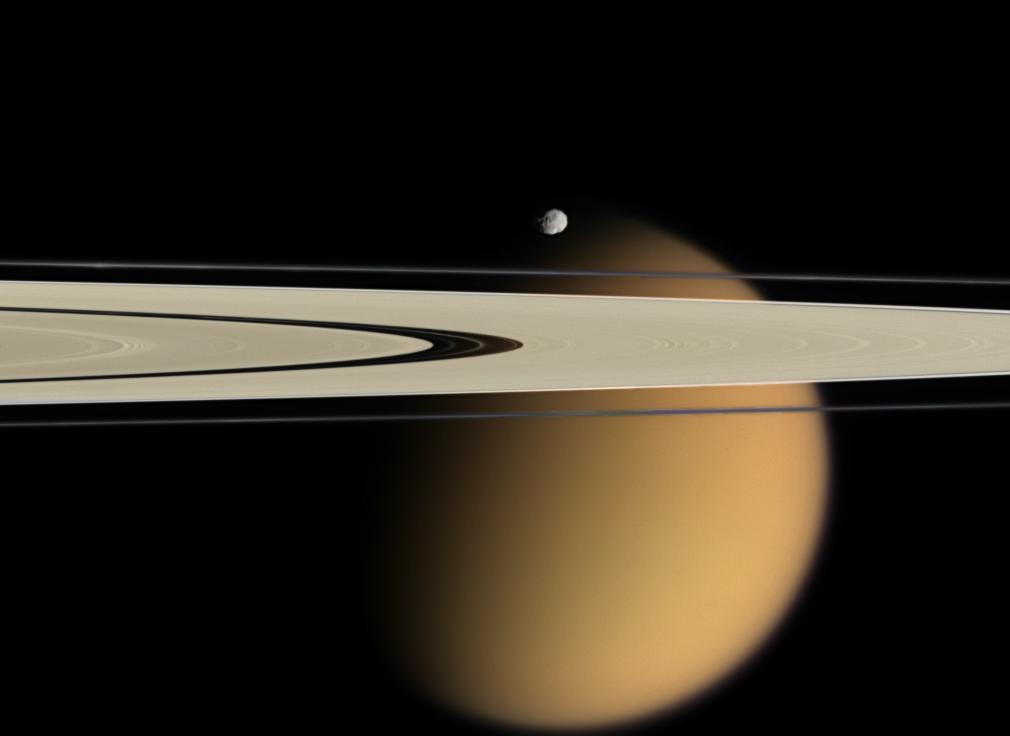

Titan Beyond the Rings of Saturn