| Followers | 683 |

| Posts | 142174 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Saturday, May 18, 2024 12:24:53 PM

Consumers are becoming more discerning

By: Raymond James Financial | May 17, 2024

Key Takeaways

• Interest rates and inflation dent consumer confidence

• Consumers are becoming more discerning

• Household balance sheets remain healthy

As goes the consumer, so goes the U.S. economy. As Wall Street knows, the importance of the consumer cannot be overstated. That’s because consumer spending is the main engine of growth, representing ~70% of US economic activity – nearly 10% more of the economy than it did in the early 1980s. That is why there is so much focus on what the consumer will do next. Thus far, the consumer has been resilient – supported by a strong job market, excess pandemic savings and solid wage gains. However, some cracks have started to surface. Below we discuss a myriad of factors that are impacting the consumer, highlighting the more challenged areas in red, concerning, but not overly problematic areas in yellow, and positive areas in green, along with our view on where the consumer and the economy will go next.

• Consumer confidence is deteriorating | Consumer confidence has deteriorated for the third month in a row as rising interest rates and lingering inflation hit sentiment. The unexpected 10-point plunge in the latest University of Michigan’s consumer sentiment survey—its biggest monthly drop since August 2021 – confirms that optimism is waning. While spending has been resilient despite subdued confidence up to this point, any further weakness will likely cause consumers to pull back spending.

• Rising delinquencies pose a risk | Financially strapped consumers are starting to fall behind on their payments. In fact, a recent NY Fed article cited that nearly 1 in 5 borrowers are now “maxed out” on credit cards and the percentage of balances transitioning into serious delinquency (i.e., 90 days late) has climbed to the highest level since 2011. While this is typically a worrisome sign for an economy powered by consumer spending, the total outstanding debt at some stage of delinquency (~3.3%) is still quite low.

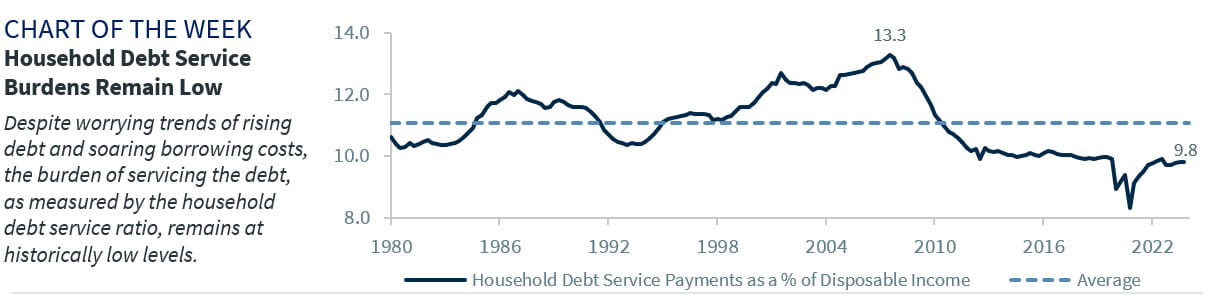

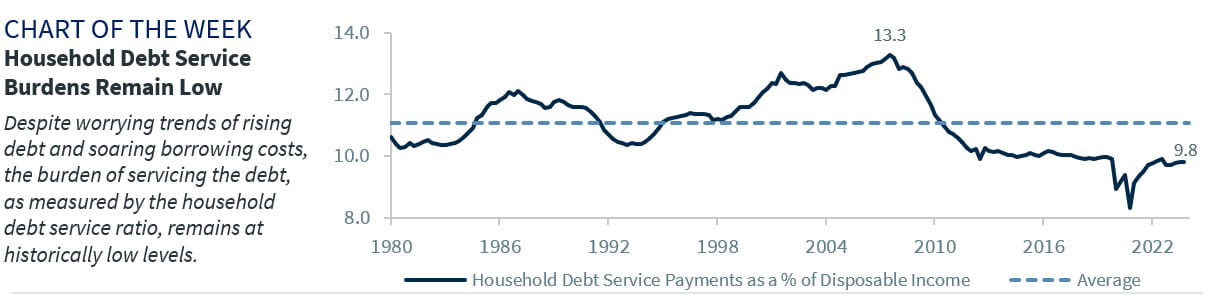

• Record levels of debt, but still manageable servicing costs | Household debt climbed to a record high of $17.7T in 1Q24. Soaring borrowing costs on everything from mortgage rates, credit cards and auto loans have raised concerns that debt servicing costs could explode. But while debt servicing costs have risen, they remain manageable. Case in point: the household debt servicing ratio, a measure of debt-servicing payments as a percentage of disposable income (9.8%) remains well below its long-term average of 11.1%. Key reasons why consumers have been less interest rate sensitive is that 60% do not hold any credit card debt, 75% of homeowners have a 4% or lower mortgage rate (well below the current ~7% rate) and 40% own their home outright.

• Consumers are becoming more cautious | While one of the key themes we heard through 1Q24 earnings season was that consumer spending, in aggregate, remains healthy, there were plenty of warnings that consumers (particularly those on the lower end of the income scale) are starting to pull back on spending. Not only was this confirmed in this week’s softer than expected retail sales report, but this was on full display in this quarter’s company earnings reports. For example, Amazon and Pepsi reported that consumers are beginning to trade down to cheaper options. And with restaurant activity declining for four consecutive months, select restaurants, such as McDonalds and Jack in the Box, have had to roll out more value offerings to lure back customers. This dynamic is expected to persist and should lead to a further moderation in spending in the months ahead.

• Consumer balance sheets are in good shape | Thanks to the surging stock market, rising home values and higher interest rates on savings accounts, household balance sheets are in good shape. In fact, at the end of 4Q23, household net worth (i.e., assets minus liabilities) climbed to a record $156.2T – that’s an increase of 8% from 2022 and a 33% increase since 2019. This wealth effect has been a powerful driver of consumer spending in recent years and a key factor behind the resilience of the economy. And with the S&P 500 hitting 23 new record highs this year, the upper-end consumer will likely benefit and continue to spend, cushioning any weakness from lower-end consumers. Remember, the top 20% of earners drive 40% of total spending.

• Rising real income should support spending | Real wage gains have been another positive trend supporting consumption and propelling the economy forward over the last year. The combination of strong labor markets and a powerful disinflationary trend have been key factors driving real incomes higher over the last 12 months. While there are some concerns this favorable trend may stall as the labor market cools and inflation remains sticky, we expect the trend to continue. In fact, we anticipate disinflation to resume and the labor market to ease but remain solid, with minimal job losses relative to past downturns.

Bottom line |Although pockets of concern have emerged, we are only expecting a modest pullback in consumer spending in the months ahead. The slowdown will most likely be driven by the lower-end consumer, who is more acutely feeling the pain of the Fed’s restrictive policy and lingering impacts from inflation. However, modest job growth, rising real wages and record net worth should keep upper-income consumers spending, cushioning any weakness from financially strapped consumers. This is a key reason why 2024 consensus estimates for growth have climbed from 1.2% at the start of the year to 2.2% today.

Read Full Story »»»

DiscoverGold

DiscoverGold

By: Raymond James Financial | May 17, 2024

Key Takeaways

• Interest rates and inflation dent consumer confidence

• Consumers are becoming more discerning

• Household balance sheets remain healthy

As goes the consumer, so goes the U.S. economy. As Wall Street knows, the importance of the consumer cannot be overstated. That’s because consumer spending is the main engine of growth, representing ~70% of US economic activity – nearly 10% more of the economy than it did in the early 1980s. That is why there is so much focus on what the consumer will do next. Thus far, the consumer has been resilient – supported by a strong job market, excess pandemic savings and solid wage gains. However, some cracks have started to surface. Below we discuss a myriad of factors that are impacting the consumer, highlighting the more challenged areas in red, concerning, but not overly problematic areas in yellow, and positive areas in green, along with our view on where the consumer and the economy will go next.

• Consumer confidence is deteriorating | Consumer confidence has deteriorated for the third month in a row as rising interest rates and lingering inflation hit sentiment. The unexpected 10-point plunge in the latest University of Michigan’s consumer sentiment survey—its biggest monthly drop since August 2021 – confirms that optimism is waning. While spending has been resilient despite subdued confidence up to this point, any further weakness will likely cause consumers to pull back spending.

• Rising delinquencies pose a risk | Financially strapped consumers are starting to fall behind on their payments. In fact, a recent NY Fed article cited that nearly 1 in 5 borrowers are now “maxed out” on credit cards and the percentage of balances transitioning into serious delinquency (i.e., 90 days late) has climbed to the highest level since 2011. While this is typically a worrisome sign for an economy powered by consumer spending, the total outstanding debt at some stage of delinquency (~3.3%) is still quite low.

• Record levels of debt, but still manageable servicing costs | Household debt climbed to a record high of $17.7T in 1Q24. Soaring borrowing costs on everything from mortgage rates, credit cards and auto loans have raised concerns that debt servicing costs could explode. But while debt servicing costs have risen, they remain manageable. Case in point: the household debt servicing ratio, a measure of debt-servicing payments as a percentage of disposable income (9.8%) remains well below its long-term average of 11.1%. Key reasons why consumers have been less interest rate sensitive is that 60% do not hold any credit card debt, 75% of homeowners have a 4% or lower mortgage rate (well below the current ~7% rate) and 40% own their home outright.

• Consumers are becoming more cautious | While one of the key themes we heard through 1Q24 earnings season was that consumer spending, in aggregate, remains healthy, there were plenty of warnings that consumers (particularly those on the lower end of the income scale) are starting to pull back on spending. Not only was this confirmed in this week’s softer than expected retail sales report, but this was on full display in this quarter’s company earnings reports. For example, Amazon and Pepsi reported that consumers are beginning to trade down to cheaper options. And with restaurant activity declining for four consecutive months, select restaurants, such as McDonalds and Jack in the Box, have had to roll out more value offerings to lure back customers. This dynamic is expected to persist and should lead to a further moderation in spending in the months ahead.

• Consumer balance sheets are in good shape | Thanks to the surging stock market, rising home values and higher interest rates on savings accounts, household balance sheets are in good shape. In fact, at the end of 4Q23, household net worth (i.e., assets minus liabilities) climbed to a record $156.2T – that’s an increase of 8% from 2022 and a 33% increase since 2019. This wealth effect has been a powerful driver of consumer spending in recent years and a key factor behind the resilience of the economy. And with the S&P 500 hitting 23 new record highs this year, the upper-end consumer will likely benefit and continue to spend, cushioning any weakness from lower-end consumers. Remember, the top 20% of earners drive 40% of total spending.

• Rising real income should support spending | Real wage gains have been another positive trend supporting consumption and propelling the economy forward over the last year. The combination of strong labor markets and a powerful disinflationary trend have been key factors driving real incomes higher over the last 12 months. While there are some concerns this favorable trend may stall as the labor market cools and inflation remains sticky, we expect the trend to continue. In fact, we anticipate disinflation to resume and the labor market to ease but remain solid, with minimal job losses relative to past downturns.

Bottom line |Although pockets of concern have emerged, we are only expecting a modest pullback in consumer spending in the months ahead. The slowdown will most likely be driven by the lower-end consumer, who is more acutely feeling the pain of the Fed’s restrictive policy and lingering impacts from inflation. However, modest job growth, rising real wages and record net worth should keep upper-income consumers spending, cushioning any weakness from financially strapped consumers. This is a key reason why 2024 consensus estimates for growth have climbed from 1.2% at the start of the year to 2.2% today.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.