Friday, April 19, 2024 3:59:53 AM

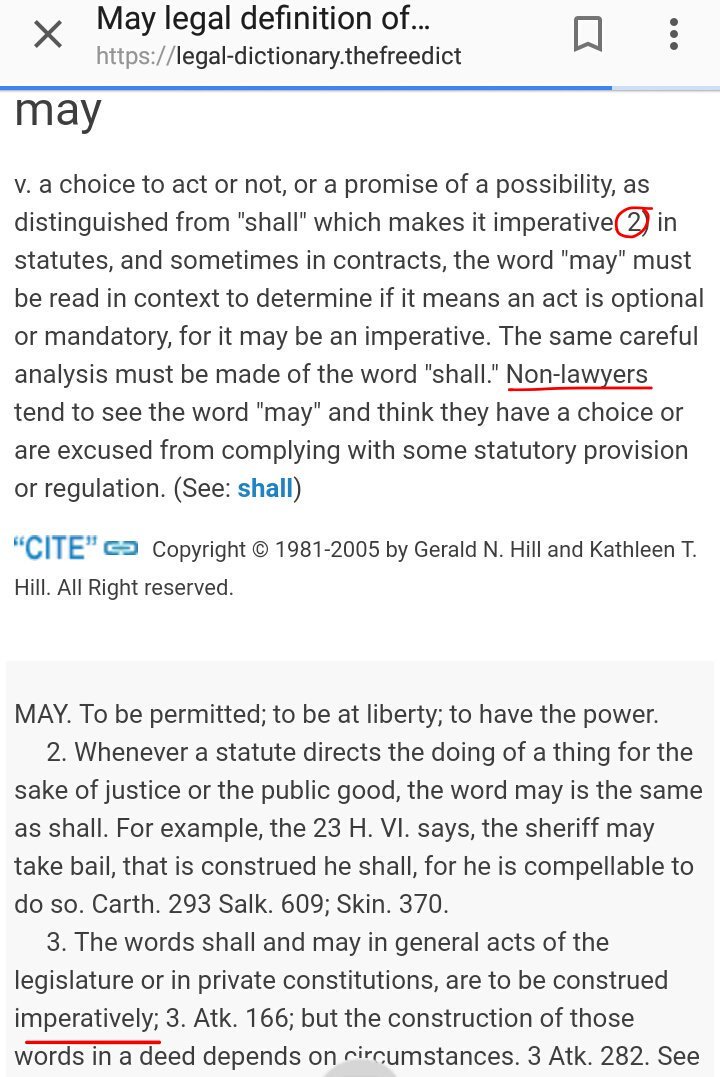

This word is very important because the FHFA's Wall Street law firm, bases all the defense on this word, stating that it's "permissive, rather than mandatory".

It's clear that it means to have permission to do something. An authority. A power.

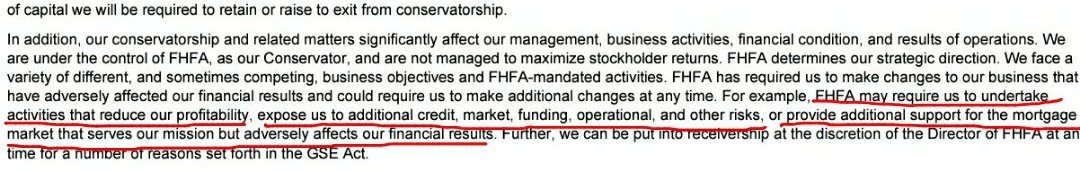

But it doesn't mean that it can be excused from complying. That is, it's imperative once the capital has been generated, in order to (may) put FnF in a sound and solvent condition (FHFA-C's Power). That is, to restore regulatory capital levels, and since day one.

$426B of core capital is held in escrow, including the $125B corresponding to the offset attached to the $125B SPS LP increased for free (another capital distribution restricted)

"May" in the FHFA-C's Power is also interrelated to the FHFA-C's Incidental Power, about activities in the best interests of the FHFA, and it can be used this comment by Freddie Mac as explanatory note. It can be included the expenses to build the CSP, etc.

All the legal proceedings have been built around this, and it has ended up with the fiction of implied contract (the dividend was impeccably suspended, as per the Restriction on Capital Distributions) and false damages (one-day share price drop) in the Lamberth court, which, by the way, the motion for JMOL was fraudulently filed as a backdoor appeal, to show strength, and the real appeal will be filed when due, because it wasn't related to the evidence argued during the trial and a jury issue, required in a motion for JMOL, but this private sector law firm brought up again the issue of whether a claim travels with the shares. Judge Lamberth already said that it's correct, but now, it comes the appeal many years later, so it's reduced to those that can demonstrate that they held stocks on the day of the 3rd amendment. Basically, only Berkowitz and other plaintiffs get damages with money taken from FnF (back dividends), another capital distribution restricted by the way.

Judge Lamberth knew that the FHFA couldn't file 55 pages in a motion for JMOL Rule 50 (b), if the one Rule 50 (a) was an oral motion. This is why he didn't respond to the question whether it can file 55 pages and let the FHFA file a shadow appeal.

Evidence that everything has been rigged by the parties and the judge, since day one. Create expectations is always their modus operandi to act freely and draw more people into their cause, but seeking a different outcome.

The FHFA Directors and their Wall Street law firm will receive always the same response:

NO!

$1TRILLION SUIT LOOMS@FHFA says "may" is permissive rather than obligatory https://t.co/1RroDt7vgr

— Conservatives against Trump (@CarlosVignote) June 4, 2017

NO! https://t.co/G8pNhEgzIs#Fanniegate

FEATURED Mawson Finland Provides Update on Exploration Activities at Rajapalot • Aug 21, 2024 9:06 AM

Unitronix Announces Strategic Entry into Cryptocurrency Space • UTRX • Aug 21, 2024 10:00 AM

Avant Technologies to Implement Robust Cybersecurity Measures for AI-Driven Healthcare Solutions • AVAI • Aug 21, 2024 8:00 AM

HealthLynked Corp. Announces Second Quarter and First Half 2024 Results: Continued Cost Reductions Set the Stage for Strategic Shift to App-Based Technology Services • HLYK • Aug 16, 2024 8:00 AM

PickleJar Announces Official Name Change and New Ticker Symbol • NREG • Aug 15, 2024 2:23 PM

VAYK's Q2 Profit Added to Accumulated Net Profit of Over $2.2 Million In 18 Months • VAYK • Aug 15, 2024 9:07 AM