Thursday, April 18, 2024 3:09:08 AM

1st. She refers to the FHFA-R's duty "ensure that FnF operate in a safe and sound manner", but she omits once again (like all other FHFA directors) what comes up next: "...including maintenance of adequate capital".

And "capital", in this world, means regulatory capital if everything is set forth in the FHEFSSA that establishes the capital ratios, definitions, etc. She can't make up "Capital Reserve" and badly assessed (Adjusted Capital Reserve = $0) with the Net Worth.

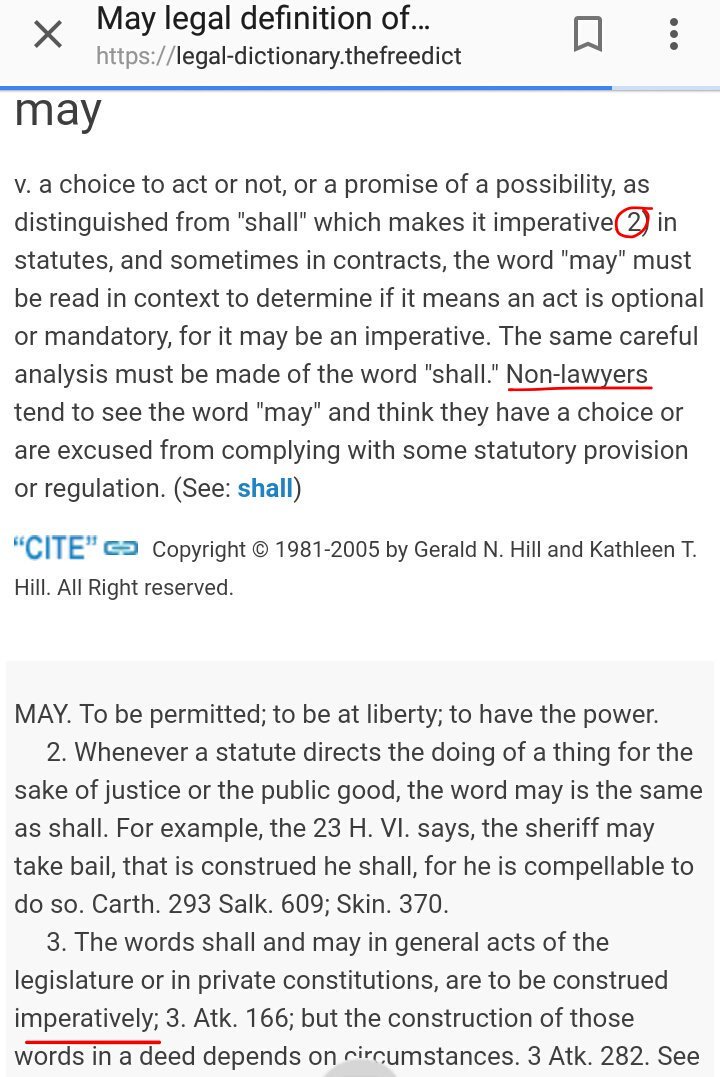

Also, she omits her role as director of the FHFA acting as conservator, with a Power of recapitalization, commonly known as "Rehab power": "May put FnF in a sound and solvent condition", when soundness is related to capital levels. And "may" is related to some leeway in activities that carry more risk or incur losses, taking into account that supposedly the American economy is still bleeding (Huh?). In no event "may" means that it's excused from complying once the capital has been generated, authorizing to syphon it off to the Treasury.

Legal dictionary:

2nd. She has omitted this time, the prior slogan: "FnF remain undercapitalized". She must have read my comments pointing out that that was a quote taken from the Restriction on Capital Distributions in the law, as a reason for the restriction. Now she says that their capital available is "well below the minimum capital requirement".

3rd. The same lie: "FnF retain earnings", like Bill Ackman and his clerk, Bradford, and recently the FNMA CEO, based on the Financial Statement fraud of FnF, when they are reluctant to post on the balance sheet the SPS LP increased for free since December 2017, because they carry an offset (reduction of Retained Earnings account) that wipes out the Retained Earnings just built.

It would show that their current $125B Net Worth has been built solely with $125B SPS LP increased for free, currently missing.

She has omitted this time the: "FnF continue to build capital" before "through retained earnings", a slogan repeated by the others mentioned, and now she just says: "FnF built $125B Net Worth", when that's not a metric for the soundness in a financial company.

It's time to appoint someone with the knowledge in capital adequacy matters, who doesn't play with the words all the time: "Dividend obligation", in order to pass it off as the security "obligation" in the RefCorp obligation (FHLBanks' 1989 bailout).

This way, she wants to turn the dividend payments on SPS into the interest payments on RefCorp obligations, and skip the Restriction on Capital Distributions (Dividends, today's SPS LP increased for free and the Lamberth rebate).

A Goldman Sachs alumni will always do Goldman Sachs things.

CBD Life Sciences Inc. (CBDL) Launches High-Demand Mushroom Gummy Line for Targeted Wellness Needs, Tapping into a Booming $20 Billion Market • CBDL • Oct 31, 2024 8:00 AM

Nerds On Site Announces Q1 Growth and New Initiatives for the Remainder of 2024 • NOSUF • Oct 31, 2024 7:01 AM

Innovation Beverage Group Receives Largest Shipment of its Top-Selling Bitters to Date in the U.S.-Ready to Meet Growing Demand from Expanding Distribution Network • IBG • Oct 30, 2024 12:22 PM

Element79 Gold Corp to Update Investors on the Emerging Growth Conference on October 31, 2024 • ELMGF • Oct 30, 2024 9:08 AM

CBD Life Sciences Inc. (CBDL) Announces Grand View Research Report Findings on High - Growth CBD Equine Market, Aiming to Drive Unprecedented Shareholder Value • CBDL • Oct 29, 2024 10:19 AM

Integrated Ventures Announces Partnership And Lease Agreement with Driptide Wellness - Leading Health and Wellness Provider. • INTV • Oct 29, 2024 8:45 AM