Monday, April 15, 2024 12:18:08 AM

He talks about misinformation, when he is accused of going to the Supreme Court as amicus to lie, writing a dozen times that the SPS are non-repayable securities.

Not only it isn't written anywhere, but also it's precisely the repayment of SPS the only capital distribution authorized when FnF are undercapitalized, as exception to the Restriction on Capital Distributions by law, U.S. Code §4614(e).

What FnF have done through the assessments sent to UST under the guise of dividend payments (10% and NWS dividends. Phases 1 and 2). No actual dividend was ever paid, as there were no earnings available for distribution as dividend with Accumulated Deficit Retained Earnings accounts, and a capital distribution restricted.

This is authorized in the FHFA-C's Incidental Power: "Any action authorized by this section,...."

Then, the FHFA added the recapitalization in a separate account (CFR 1237.12) in the July 20, 2011 Final Rule, as another exception to the same statutory restriction ("It supplements and shall not replace or affect it", that is, a follow-on plan), when it foresaw that, with the coming NWS dividend (fastest speed to that end), the SPS would be fully repaid fast. End of 2013 in Freddie Mac (signature image below) and end of 2014 in Fannie Mae.

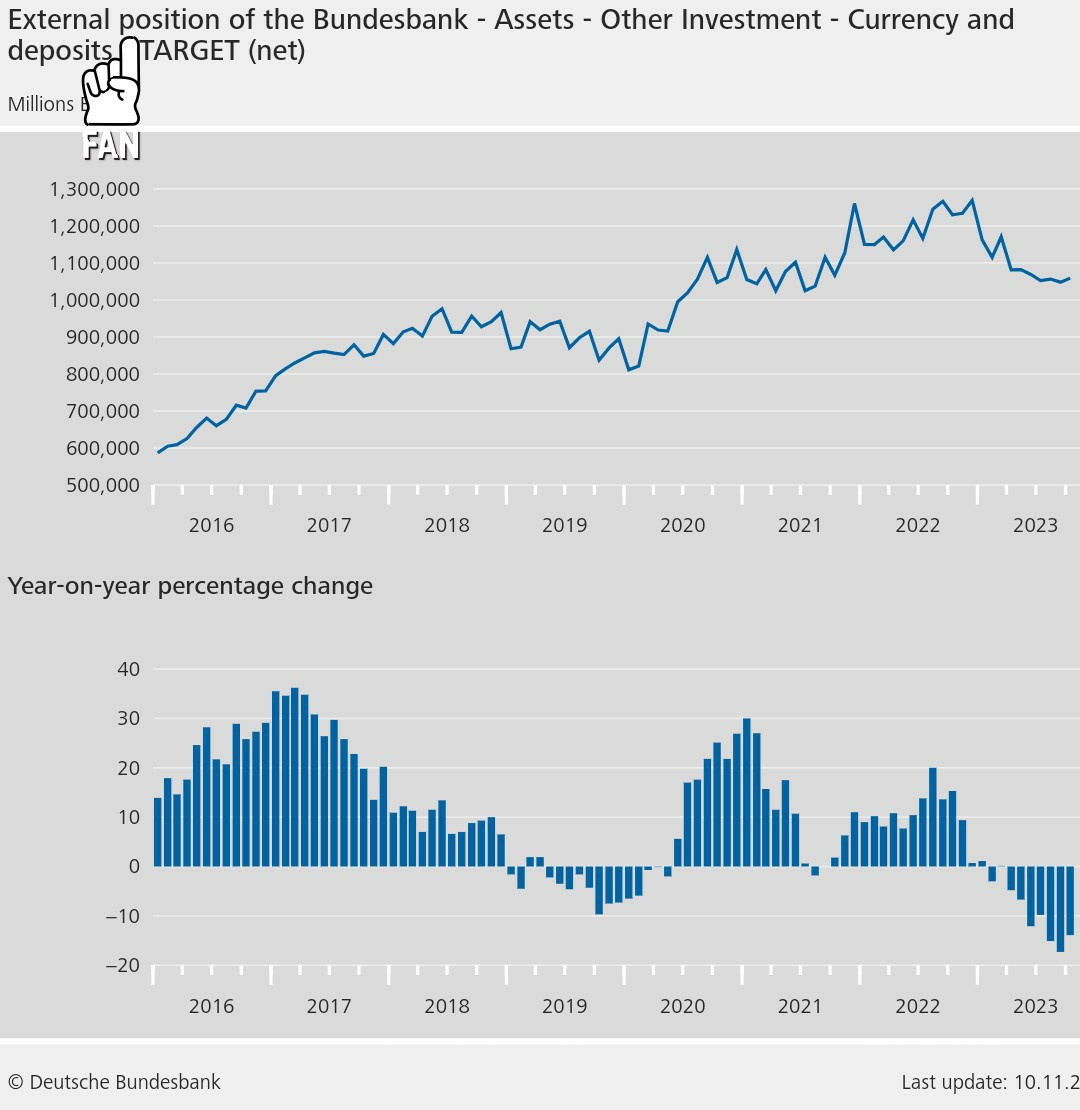

These assessments in the form of capital distributions, are currently in the 3rd phase with the SPS LP increased for free (another capital distribution, like the dividends) and its corresponding offset with reduction of Retained Earnings account (core capital). Thus, in reality, this reduction of core capital is common equity held in escrow, which would uphold the FHFA-C's Rehabilitation power (recapitalization) as well, pending unwinding this operation, because, in this world, the rehabilitation is on the Balance Sheet. Ain't no External Position, Bundesbank-style. That's fraud.

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM