Wednesday, April 10, 2024 12:38:16 PM

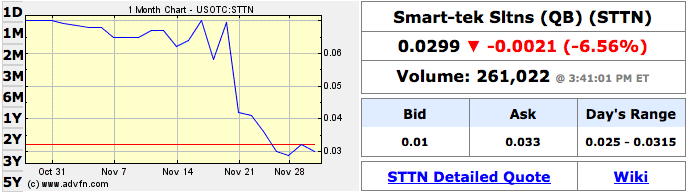

STTN some research inspired by the filing of the last 10Q on November 21, 2011

The stock started to plummet the day before the 10Q filing (maybe some insiders with advanced knowledge that the 10Q was going to be brutal decided they better start getting out early?)

-----

So what was in this 10Q?

Before we get to that a quick rundown on the events that have happened over the past few months:

-----

Starting shortly after the former Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer and founder of the company, Perry Law, tendered his resignation from his last remaining position of Director effective immediately on June 3, 2011 things have taken a very bad turn for the worse.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7985378

-----

On June 9, 2011, Brian Bonar signed a toxic financing agreement with La Jolla which included a $500,000 debenture agreement and the right for La Jolla to purchase up to $5,000,000 worth of stock at 80% below the market price. To date this agreement has not been executed.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7997447

On June 15, 2011, Brian Bonar issued himself 21,897,999 shares at no cost. According to the recently filed 10Q those shares were issued for $218,979 in compensation owed. On June 15, 2011, STTN closed at $.071/share making the actual value of those shares $1,554,757.93.

http://www.sec.gov/Archives/edgar/data/947011/000106299311002630/xslF345X03/form4a.xml

On June 17, 2011, Brian Bonar issued to his Director, Owen Naccarato, 3,000,000 shares at no cost for $225,000 in compensation owed.

http://www.sec.gov/Archives/edgar/data/947011/000106299311002672/xslF345X03/form4.xml

On July 29, 2011, Brian Bonar and Owen Naccarato met at the Rancho Bernardo Inn and used their 24,897,999 shares to elect themselves as the new Directors for the STTN shell.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8069037

On October 17, 2011, Brian Bonar brought his son, Colin Niven Bonar (aka C. Niven Bonar aka C N Bonar), into the picture by purchasing a group of companies which were all wholly owned subsidiaries of American Marine LLC, a company controlled by both Brian Bonar and C. Niven Bonar, for $50,000 and a $500,000 debt Note.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8194094

Solvis Medical Group consists of three revoked Nevada entities

Solvis Medical Inc and Solvis Medical Staffing Inc and Solvis Physical Therapy Inc all with Eric Gaer and Robert Dietrich listed as officers.

http://www.nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=No7ECnVOD%252fGsiNkCUFW2LQ%253d%253d&nt7=0

http://www.nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=yFODmvgQyKDOvEpFxWLg1Q%253d%253d&nt7=0

http://www.nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=HBaek7OBLYw8hhhlaykbmA%253d%253d&nt7=0

Former chairman of the Solvis Medical Group is Brian Bonar.

American Marine LLC is controlled by both Brian Bonar and C. Niven Bonar

http://www.corporationwiki.com/California/Escondido/american-marine-llc/47532519.aspx

Owen Naccarato (STTN Director) served as the legal counsel for the signed agreement between father and son.

C. Niven Bonar and Brian Bonar were previously linked with Dalrada Financial Corp (DFCO). Both C. Niven Bonar and Brian Bonar's daughter, Pauline Bonar, were initial shareholders in Dalrada Financial Corp back in 1999 while Brian Bonar was the CEO. Not so coincidentally Owen Naccarato was and still is the legal counsel for Bonar linked Delrada Financial Corp.

http://www.otcmarkets.com/stock/DFCO/company-info

The Bonar, Bonar, Naccarato connections don't end there.

The three can be linked to Allegiant Professional Business Services, Inc. (APRO)

Where daddy Bonar served as a Director and president, son Bonar served as the COO, and Naccarato once against served as legal counsel:

http://www.otcmarkets.com/stock/APRO/company-info

http://investing.businessweek.com/research/stocks/people/people.asp?ticker=APRO:US

APRO was (I used past tense because that company is basically dead now) a PEO company just like STTN is now.

APRO even uses the same address as STTN

11838 Bernardo Plaza Ct.

Suite 240

San Diego, CA 92128

Which is in shouting distance from American Marine LLC

11838 Bernardo Plaza Ct

Suite 210

San Diego, CA 92128

And is within walking distance from Dalada Financial Corp

11956 Bernardo Plaza Drive

#516

San Diego, CA 92128

John Capezzuto who works with Brian Bonar with APRO also worked with Brian Bonar with scam company Warning Management Services Inc. (WNMI) which was revoked by the SEC on May 22, 2009

http://www.sec.gov/litigation/admin/2009/34-59968.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64388493

Legal counsel for scam company WNMI was Owen Naccarato.

Are you beginning to wonder if Brian Bonar always uses Owen Naccarato for a reason?

Here is a list of companies for which Owen Naccarato currently provides legal services:

http://www.otcmarkets.com/service-provider/Naccarato-&-Associates?id=2062&b=n&filterOn=3

Allegiant Professional Business Services, Inc. (APRO)

Blackbird International Corporation Oakville Canada (BBRD)

--- This was added to the original post ---

Com-Guard.com, Inc. (CGUD)

Dalrada Financial Corp. (DFCO)

Diverse Media Group, Inc. (DVME)

DPOLLUTION International Inc. (RMGX)

eMamba International Corp. (EMBA)

Family Room Entertainment Corp. (FMYR)

Genco Corp. (GNCC)

Global Digital Solutions, Inc. (GDSI)

Icon Media Holdings, Inc. (ICNM)

ITonis, Inc. (ITNS)

Lexico Resources International, Inc. (LXXI)

Markray Corp. (RVBR)

Quad Energy Corp (CDID)

Ree International, Inc. (REEI)

Smart-Tek Solutions, Inc. (STTN)

South Shore Resources, Inc. (SSHO)

TapSlide, Inc. (TSLI)

Velocity Energy Inc. (VCYE)

This link draws some interesting past connections between Corey Ribotsky and many companies that used Owen Naccarato as legal counsel

http://www.offshorealert.com/WorkArea/threadeddisc/print_thread.aspx?id=60&g=posts&t=37726

---------------------

I got side tracked though back to the 10Q

Then on November 21, 2011, the STTN 10Q for the 3rd quarter came out and it was ugly.

Cash on September 30, 2011 - $270,048

Cash on June 30, 2011 - $882,069

STTN lost $612,021 in cash during the 3rd quarter

Accounts payable and accrued liabilities on September 30, 2011 - $8,384,307

Accounts payable and accrued liabilities on June 30, 2011 - $3,256,689

STTN added $5,127,619 in accounts payable and accrued liabilities during the 3rd quarter

The accounts payable and accrued liabilities for the 2nd quarter was only $82,477

$5,127,619 is $2,129,070 more than STTN had in accounts payable and accrued liabilities for its entire existence from 1995 - through the 2nd quarter of 2011.

Why the $5,127,619 in accounts payable and accrued liabilities all in just a 3 month period? Who is all that money owed to?

Gross profit on September 30, 2011 (for 3rd quarter) - negative $155,177

Gross profit on June 30, 2011 (for 2nd quarter) - $1,685,183

STTN went from a profitable business to a company with a failing business. The cost of revenue for the 3rd quarter of 2011 was higher than the revenues themselves. They would have been better off not doing business in the 3rd quarter.

Subtract away the operation costs/expenses and

Overall operating loss on September 30, 2011 (for 3rd quarter) - $2,963,852

Overall operating loss on June 30, 2011 (for 2nd quarter) - $599,161

STTN's operating losses increased by $2,364,691.

During the 1st quarter of 2011 (the period ending March 31, 2011), STTN didn't have an operation loss. They had an operating gain of $363,354 after subtracting away all the costs of operations from the revenues for the quarter. It is obvious the direction that STTN is headed, and it is not good.

A further break down of the Selling, general and administrative expenses helps partially explain why STTN is headed down the toilet.

Salaries & Related Expense

1st quarter - $311,430

2nd quarter - $582,969

3rd quarter - $553,404

Consulting

1st quarter - $220,366

2nd quarter - $158,823

3rd quarter - $353,624

Commissions

1st quarter - $177,223

2nd quarter - $269,583

3rd quarter - $633,742

Outside Services

1st quarter - $31,688

2nd quarter - $62,403

3rd quarter - $211,287

Overall Selling, General, and Administrative Expenses

1st quarter - $1,272,515

2nd quarter - $1,685,183

3rd quarter - $1,997,439

Since revenues dropped by 28% from the 2nd quarter to the 3rd quarter why did commissions increase by 235% during that same stretch?

----------------

The most disturbing parts of the recent STTN filings:

#1) Brian Bonar paying himself $1,554,757.93 in shares for a $218,979 balance that was owed to him then writing off the payment in the books as a $218,979 stock expense.

#2) Brian Bonar issuing himself and his son a $500,000 debt Note for a group of revoked business entities.

#3) The $5,127,619 in accounts payable accrued during the 3rd quarter alone. Who is all that money owed to?

#4) STTN went from a positive balance sheet at the end of the 1st quarter to a failing business whose revenues cost more than what they make.

#5) The past connections and histories of the main players involved in STTN.

Originally posted by nodummy -

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=69486867

replies follow

Slojab 12/01/11 9:44 AM

#18773 RE: nodummy #18772

I stopped by the board on 9/20 when I read they announced the Solvis Group deal only because I was familiar with Bonar from his ITEC days. I only told people how he operated back in those days with all his convoluted deals and how things always "appeared" to be going well. ITEC ceased to be.

Apparently, he didn't change his modus operandi.

jaxstraw 12/27/11 10:00 AM

#19878 RE: nodummy #18772

It appears the shell that just released quite a few filings and then filed a Certification and Notice of Termination of Registration -Form 15, LXES, has become a new addition to the mining exploration entities of late

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=70111867

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=70166228

Has some interesting associates that are handled by it's legal counsel according to OTC Markets, tickers which you are familiar with, RMGX and HZHI

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=58895175&txt2find=hzhi

I see that Arella's outfit spans out to

Horizon Health International (HZHI)

http://www.foreveryoung-lactoferrin.com/horizonhealth/corporateprofile.php

Dpollution International Inc. (RMGX)

http://www.dpollution.com/

http://serious-speculator.com/2011/01/05/dpollution-international-clearing-the-air-or-just-smoke-and-mirrors/

Bio-Solutions Corp.(BISU)

http://www.bio-solutionscorp.com/site/index/en/

http://www.marketwire.com/press-release/Bio-Solutions-Corp-Investors-Recap-OTC-Bulletin-Board-BISU-1142674.htm

shortstay

02/04/12 10:08 AM

#21773 RE: nodummy #18772

I GOT CAUGHT IN THAT SCAM.PARIS HILTON WAS SUPPOSE TO WEAR THEIR JEANS AND T SHIRTS (WARNING) WAS SUPPOSE TO BE THEIR LOGO.

I STILL HAVE A MILLION SHARES.I READ THEY TOOK THE ASSETS FROM WNMI AND PUT THEM IN ANOTHER CO HOW THAT COULD BE LEGAL I DON'T KNOW (IF THATS WHAT THEY DID)

dealerschool2006

03/21/12 12:53 PM

#23776 RE: nodummy #18772

Got in STTN because chart looks good, but getting out cause DD looks bad...TY...

BillEvans80 04/28/12 2:28 PM

#24927 RE: nodummy #18772

Some updates on Smart-Tek Services (STTN) CEO Brian Bonar.

Smart-Tek's Nevada SOS is in Default.

http://nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=DeEjvB9F7sltHS8EQyGpUw%253d%253d&nt7=0

Smart-Tek has been sued by a Factoring (financing) company in Florida. This Lawsuit has not been reported on an 8K nor has there ever been a notification that this financing was in place.

http://dockets.justia.com/docket/florida/flmdce/6:2011cv01579/263374/

Smart-tek filed an extension to file their 10K. With the extension the 10K was due April 14. The company is silent as to if and when it will be filed.

BillEvans80

05/14/12 7:18 PM

#25565 RE: nodummy #18772

STTN files 10K for period ending 12/31/12.

http://www.smart-tekservices.com/regulatory_filings.aspx

Here is my opinion.

Quote:

” ITEM 3. LEGAL PROCEEDINGS.

On February 24, 2012 the Company entered into a Joint Settlement Agreement with AmeriFactors relating to a lawsuit between the

two companies whereby Smart-tek would pay AmeriFactors the sum of $180,000”

This lawsuit was filed Sept 28, 2011. Smart-Tek had negative equity at the time of the filing. It is required that a company inform it’s shareholders of any material legal proceedings within thirty days. A $180,000 law suit is material to a company with negative equity.

Quote:

“Net Income (loss) from continuing operations for the year ending December 31, 2011 is $(8,123,553)”

“Related party transactions

During the year ended December 31, 2011, Smart-tek Communications Inc. (a wholly-owned subsidiary) paid $1,485,097 in management salaries to its President and Vice President which included commissions of $434,312 and benefits of $348,297.”

Eight million dollar loss yet two people were paid $1,485.097. I guess because they did such a good job?

Quote:

“During the year ended December 31, 2011, Smart-tek Automated Services Inc. (a wholly-owned subsidiary) paid consulting fees of $515,693 to a company controlled by an officer of the Company for Financial, HR and Legal Services”

More money in Bonar’s pocket?

Quote:

“Due From Allegiant Professional Services $ 2,132,027”

This is a non reporting public company (APRO) that is run by Brian Bonar. Is this collectable? The company went silent and hasn’t reported since Dec 2008.

Quote:

“Based on this evaluation, management has concluded that our internal control over financial reporting was not as effective as of December 31, 2011 due to the relatively small staff size of its financial group.”

Why again was 515k paid to a management company owned by a Corporate Officer”? I would think 515K would be enough to have controls on a company this size.

Quote:

“Accrued payroll taxes 11,958,012”

This is a disgrace. It is illegal to withhold payroll taxes and not remit them, yet Bonar found it acceptable to pay himself over a million dollars last year.

Operating loss:

Revenue $ 21,748,488

Cost of revenue 20,805,474

Gross profit 943,014

Selling, general and admin exp 6,953,960

Operating income (loss) (6,010,946)

If ratios remain the same the company would need to increase revenues about 750% just to break even operationally.

Quote:

“The Company regularly discounts selected trade accounts receivable from clients to a commercial factoring company. Under the terms of the factoring agreement, the factor remits the invoiced amounts to the Company less a portion for reserves. When paid in full, the factor remits the reserve amount less a portion for processing fees and interest. Accounts are factored with recourse as to credit losses.

The Company reflects a liability to the factoring company on its Balance Sheet for the uncollected amounts that remain uncollected until the factored invoices have been paid in full.”

This practice is unheard of in the PEO Industry. The margin is so low in the business that any profit would be eaten up by the factoring fee which are very expensive way to borrow money, and have a high likelihood of default as was probably the case with the company that is being paid out $180,000 It also probably accounts for why there were doubtful accounts written off. The PEO industry does not lend money to their clients.

BillEvans80 11/17/12 10:53 PM

#34784 RE: nodummy #18772

Nodummy,

An update on Brian Bonar CEO of STTN. A Federal Civil jury trial is set to begin next Monday on eight allegations made by an insurance provider (Arch Insurance Company) for APRO, a company Bonar was President and Chairman of and what appears to be a predecessor of STTN the company where he is currently CEO:

The Arch Insurance lawsuit is set to go to jury trial November 27 (a week from Monday). There are eight allegations in the lawsuit including violation of the RICO act by APRO and its executives. Here is a link to a PDF of the complaint:

http://www.leagle.com/xmlresult.aspx?xmldoc=In%20FDCO%2020121016C98.xml&docbase=CsLwAr3-2007-Curr

Poohbear357 11/18/12 8:59 AM

#34787 RE: nodummy #18772

Excellent DD! Hopefully other people will see this and save their money by not risking it on this company!

jaxstraw 11/25/12 8:58 AM

#35044 RE: nodummy #18772

Looks like Owen Naccarato has got himself a new pump venture..VIZS.

Here is a list of companies for which Owen Naccarato currently provides legal services:

http://www.otcmarkets.com/service-provider/Naccarato-&-Associates?id=2062&b=n&filterOn=3

Allegiant Professional Business Services, Inc. (APRO)

Com-Guard.com, Inc. (CGUD)

Dalrada Financial Corp. (DFCO)

Diverse Media Group, Inc. (DVME)

DPOLLUTION International Inc. (RMGX)

eMamba International Corp. (EMBA)

Family Room Entertainment Corp. (FMYR)

Genco Corp. (GNCC)

Global Digital Solutions, Inc. (GDSI)

Icon Media Holdings, Inc. (ICNM)

ITonis, Inc. (ITNS)

Lexico Resources International, Inc. (LXXI)

Markray Corp. (RVBR)

Quad Energy Corp (CDID)

Ree International, Inc. (REEI)

Smart-Tek Solutions, Inc. (STTN)

South Shore Resources, Inc. (SSHO)

TapSlide, Inc. (TSLI)

Velocity Energy Inc. (VCYE)

https://www.otciq.com/otciq/ajax/showFinancialReportById.pdf?id=94233

https://www.otciq.com/otciq/ajax/showFinancialReportById.pdf?id=94233

https://www.otciq.com/otciq/ajax/showFinancialReportById.pdf?id=94493

And it appears to be more of the same here on IHUB 'ala' HERC....

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81757773

batty boots 01/29/21 9:57 AM

#180883 RE: nodummy #18772

Thank you for the history lesson most of which are assumptions based on the information you perceive to be correct. I buy stock for future performance and no one can deny the steady growth of DFCO and the technologies that DFCO is rolling out mainly based on emissions and green energy trends all of which are receiving significant attention worldwide. As stated previously the CEO challenge is how to produce to meet demands, my guess is he will.

Recent DFCO News

- Form 8-K - Current report • Edgar (US Regulatory) • 02/26/2024 07:39:08 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/20/2024 01:18:05 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 02/14/2024 10:19:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/08/2024 11:25:14 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 02:51:49 AM

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 10/19/2023 07:57:47 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 10/12/2023 09:06:37 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 10/06/2023 12:01:32 PM

- Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405 • Edgar (US Regulatory) • 09/29/2023 11:53:53 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/22/2023 09:23:22 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 09/05/2023 06:45:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/08/2023 08:15:35 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/08/2023 08:13:57 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/13/2023 11:59:05 AM

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM

ECGI Holdings Targets $9.7 Billion Equestrian Apparel Market with Allon Brand Launch • ECGI • Jun 25, 2024 8:36 AM

Avant Technologies Addresses Progress on AI Supercomputer-Driven Data Centers • AVAI • Jun 25, 2024 8:00 AM

Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • GRLF • Jun 24, 2024 8:30 AM

Bemax Inc. Positions to Capitalize on Industry Growth with New Improved Quality of Mother's Touch® Disposable Diapers • BMXC • Jun 24, 2024 8:00 AM

Last Shot Hydration Drink Announced as Official Sponsor of Red River Athletic Conference • EQLB • Jun 20, 2024 2:38 PM