Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

We have to stay positive with this one and one of these days we will be popping champagne 🍾 🍾!

**Dalrada Financial Corporation (DFCO)** has been making significant strides towards its goal of uplisting to the Nasdaq exchange. The company has implemented various strategies to enhance its financial performance and meet the rigorous requirements for Nasdaq listing.

Here are some key developments:

* **Cost-cutting measures:** Dalrada has successfully reduced its general and administrative expenses by over $4 million, accelerating its path to profitability.

* **Strategic initiatives:** The company has focused on core businesses, implemented efficient systems, and streamlined its operations to improve overall efficiency.

* **Positive financial results:** Dalrada has reported strong financial performance, including revenue growth and progress towards profitability.

While the exact timeline for Nasdaq uplisting remains uncertain, the company's ongoing efforts and positive developments suggest that it is making progress towards achieving this milestone. Investors should stay updated on Dalrada's announcements for the latest information on its progress.

Something might be up with $DFCO. Go to https://t.co/JCmAF5MDpb and look up the company Dalrada. Up until very recently there were two entities under the DFCO umbrella, Dalrada Financial and Dalrada Home. Now there is only the latter. I asked Grok what are some possible reasons… pic.twitter.com/kCkMSKtPgx

— Professor Brainiac (@ChartDiligence) September 20, 2024

Thank you, hopefully with the feds cutting half point interest rates that will help out overall stock market and especially otc. Hopefully we blow away the report.

Due at the end of the month-

When is the report?

Monitor position? What the heck is that??

This stockmjist kept going down the news the company put out. Last week they got that 260k contract and the stock reacted like is some kind of joke...I'm confused..

Lets get this board going again - everyone should apply for a monitor position now that it's a clean slate ;) Let fill up the spots

Impatient investors selling lol - just before Q report - insanity!

$DFCO scooping up some super cheap shares - Thank you

Because they have no IP and no unique products.

Why isn't the stock moving despite all these good news??..

With the current DFCO volume ot is obvious that what is happening BONAR & Co getting the fly swatter treatment. There is no "manipulation" involved. Just an irritating insect being treated as such in the market.

Even the volume is small but is getting killed by mm manipulation..

DFCO Signals & Forecast

There are few to no technical positive signals at the moment. The Dalrada Financial Corporation stock holds sell signals from both short and long-term Moving Averages giving a more negative forecast for the stock. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average. On corrections up, there will be some resistance from the lines at $0.149 and $0.166. A break-up above any of these levels will issue buy signals. A sell signal was issued from a pivot top point on Monday, July 08, 2024, and so far it has fallen -28.43%. Further fall is indicated until a new bottom pivot has been found. Furthermore, there is currently a sell signal from the 3 month Moving Average Convergence Divergence (MACD). Dalrada Financial Corporation gained volume on the last day, but on falling prices. In technical terms, this is called divergence and may be an early warning. In some cases, increasing volume on falling prices may be considered positive, but that is mainly in typical "sell-offs". The very low volume increases the risk and reduces the other technical signals issued.

There an interview coming up that Bonatd said thr next 4 to 8 weeks will be could be a game changer.. Added some in the .13s and .14..

We're all still here- just waiting on some news or the 10K that will hopefully blast us out of this no man's land zone we're currently in. Not worried in the least here.

Dam, this board is dead. What happened to the all old timer? Sold out and left I guess...I'm accumulating more..

250 shares sold today --- BONAR & Buddies must be out to lunch...

Even paint has failed.

I expect earnings to be unimpressive - the space is very competitive and they have no patents or unique IP...

https://www.amazon.com/s?k=12000+btu+ductless&adgrpid=1343603779128348&hvadid=83975450779008

When is the earning report??

BONAR can't get it up....

.... there will be no "put up" because there are no fundamentals.

I really hope so because people are waiting for the results, is either put up or shut up..

.

There was no legitimate news,,, it was all P&D B.S.

I think remainder of the year is a big one here. If $dfco #s aren’t what they are saying in Q4 w/some of these heat pump deals/sales coming through they’re going to lose a lot of people I think. Personally I’m like man maybe I should put my allocation towards bitcoin…Yes Bonar said Q1 ‘25 is when #s should really show but if this thing is .15-.18 for another 5 months I don’t think that will sit will…

Especially since that would be no progress towards uplisting like they mentioned by EOY

Is there any hope left here? Seemed like the more news is out the more the stock dropped. They should no longer put out pr because doesn't do shizz for the stock and just wasting money promoting it..

JLPTNG - IMO this is just another BONAR alias.

There is no way in hell that BONAR will succeed with this pile of crap.

No coherent business plan and no valid IP....

... and you have to figure a 50 year history of BONAR pump and dumps into the equation.

LOL!!!

LOL!!! LOL!!!

LOL!!! LOL!!! LOL!!!

LOL!!! LOL!!! LOL!!! LOL!!!

There is no IP here, not unique products, the reality is that BONAR is just recycling the same old con in this recycled shell.

If they having these so many news and the stock go down instead up mainly because a lot of people got burned from .92 ath but a lot of us are lucky got in early around 2018 .01s and took profits but a lot of new comer got burned or under water are selling for taxes losses. 3 yrs ago with these news the stock would be trading $2 history don't always repeat. Starting in 2021 the stock moved on every news but now is go down on the news so might as well don't pr it because just wasting money. Sad but is the reality, those good old days are gone.. too many people got burned and no new money are coming in. This stock been down for 3 yrs now and the biggest bounce was last October from .17 .27 .46 topped out and never recovered, some blamed on the market correction myself too thought it was the market but the market since recovered from Convid an breaking ath and yet this stock is officially dead.. nailed shut in the coffin .. Still holding massive amount average. 06s but a lot of thinking

Because holding dead money for 3 yrs..

There are not enough trading but to dump it would cost it to go .05s area...Will hold until the end of the yr and see if the company really turned profits..

Well, that's a great question. I'd imagine investors will get better insight after earnings. In the meantime. I'm looking at the potential to increase my position size personally... Again, nothing negative in the news to change my thesis. Everyone has to make their own decision. I'd imagine at some level, the buyers will be stepping back in... or finding a new entry point for themselves. There are lots of OTC stocks out there so traders are looking for short flips... As long term investors swoop up the available shares.. eventually there will be a tipping point. Paytience is a virtue. :)

The more news the more the stock dropped.. Wtf.. Even yesterday and today the company is presenting their products at the L.A show and yet the stock go south..wtf is going on??

I didn't know about the pool systems! That will be a great product!

If you're a $PWDY, $DFCO, $GME or $SPZI shareholder (or really any ticker where you believe you see massive potential which the market refuses to currently price in), this message is for you. Heck this is as much a reminder for myself as it is for anyone else.

— Professor Brainiac (@ChartDiligence) August 26, 2024

I believe that… https://t.co/bb9TYFnutG

I'm expecting at least .21 .25 cents now but we don't seems to be going anywhere..

What's your honest expectation? this its not like, "a sad board." learn a long term timeframe. consider yourself lucky for a 5-10year game maybe.

Anyone who researches BONAR's track record and still "invests" needs to check into the local insane asylum.

Applied Technologies also has a distribution agreement with this company...

https://atiofny.com/products/endura-plus-boiler/

There is no patent pending with DFCO because they have no IP and they are selling Chinese imports.

Product logo

Fulton Endura+ Commercial Ultra-High Efficiency Condensing Boiler

Designed for variable primary flow systems, Fulton’s ENDURA Plus firetube condensing boilers represent a revolution in firetube condensing boiler technology.

Whereas conventional boiler designs transfer stresses directly onto the most critical components, Fulton’s patent-pending stress reliever completely eliminates these stresses and significantly increases boiler longevity.

ENDURA+ provides industry-leading performance without sacrificing durability.

Key Features

Thermal Stresses Virtually Eliminated

Durable Stainless Steel Firetube Heat Exchanger

Up to 15:1 Turndown; O2 Compensation

Compact Footprint – Fits Through a Standard Doorway (Up to 6MM BTU/hr)

Designed for Variable Primary Flow

The investor treating the news like is a fake because the stock go down instead of up.. Is crazy and I hope they came through big time on this coming earnings repot in September and I hope we have a big run prior to that..

BONAR is 100% B.S.

Prescriptive Growth Coming

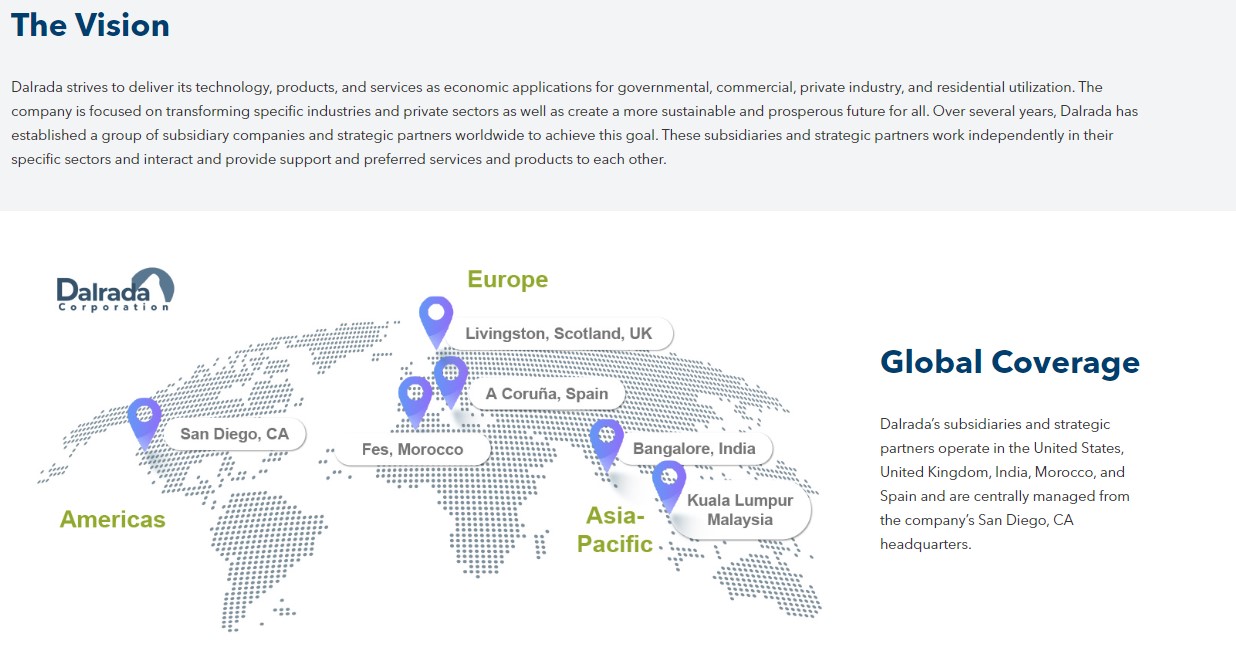

Since its founding in 1982, Dalrada has become a multi-national holding company that develops, manufactures, and sells products and services in the clean energy and health care and sectors. Its wholly owned subsidiary, Genific, is a provider of frontline health products and services, end-to-end prescription services plus patient advocacy and support.

That sector also looks promising, Bonar said.

“We’re going to be soon announcing something on the very topical weight loss programs where you get these shots… the ones that reduce your weight over a number of years,” Bonar said, similar to Ozempic. “That will push our pharmacy sales more.”

Dalrada Financial Corporation

FOUNDED: 1982

CEO: Brian Bonar

HEADQUARTERS: Escondido

BUSINESS: Climate technology and healthcare

REVENUE: $29.7 million (2023)

STOCK: DFCO (OTCQB)

EMPLOYEES: 100+

WEBSITE: dalrada.com

CONTACT: 858-326-2661 or DFCOinquiries@dalrada.com

NOTABLE: Founder and CEO Brian Bonar has a B.S. in technical engineering and master’s in mechanical engineering and has an honorary title of Lord Bonar of Wilcrick, Cardiff, Wales, U.K.

BONAR is all B.S.

There is no IP here, nothing unique to sell. He's just selling imported heat pumps and. The so called medical division is also worthless....

IMO....that was one of the better videos we have seen from DFCO...Once we break .2 and move these F-ing MMs out of the way...this is gonna ruuuuunn

Low volume... New buyers are watching for something... who knows what. Maybe the financials to back up the claims. That's what triggers the FOMO buying as new investors get in. People who have been in a while are maybe satisfied with their current position sizes? It's hard to say, but as a long time follower, the news only strengthens my thesis. It's hard to guess what motivates people. I hear your frustration with the stock price stagnation, but the reason I'm in is for the next several years and beyond of potential growth. Waiting can be stressful... I'm hoping for a report of good numbers!

|

Followers

|

64

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

26774

|

|

Created

|

05/09/04

|

Type

|

Free

|

| Moderators | |||

DFCO

https://dalrada.com/

Updated May 2021:

Dalrada Financial was a defunct organization up until January 2018 when out of the blue it began filing again with OTCMarkets.com (up to date). At this point the market got excited and repriced shares from the low .00s up to the .02 range (give or take a penny), where it sat for a solid year with a slow sprinkling of company updates periodically. Ever since that breakout event in January 2018 the stock has exploded to almost $0.50 a share, 14 year high, where it is currently basing for another leg up. Despite having little interest from traders since the initial explosive blip in early 2018, the stock has held its gains amazingly well. We've seen nearly 3 years of updates now as the company went from defunct to having multiple subsidiaries under it's umbrella, multiple acquisitions (very favorable terms for relatively small amounts of restricted common shares, mind you), filing with the SEC(!), and numerous fundamental catalysts on deck (see below press releases). $DFCO is grossly mispriced, but that will change in a hurry when the switch is flipped here. They recently reported a 3,181% Increase In Quarterly Financial Results! Check out what this sleeping giant is up to.

DALRADA FINANCIAL “DFCO”

Publicly-traded on the OTCQB under the symbol “DFCO”, Dalrada and its subsidiaries are positioned for stable long-term growth through intelligent market research, sound business acumen, and established operational infrastructure. The team is dedicated to scaling and accelerating business growth through exceptional financial planning, risk and business analysis, advanced technology platforms, branding, sales and marketing, human resources, legal, accounting, and administrative support.

Dalrada solves real-world problems by producing innovation-focused and technologically-centered solutions on a global level.

Delivering next-generation manufacturing and healthcare products and services that provide and propel growth, Dalrada is a team of industry experts and an organization built upon a strong foundation of financial capital.

OUR BUSINESSES (3 VERTICLES):

DALRADA PRECISION

Dalrada Precision provides alternative solutions to OEMs through design and manufacturing of component parts that are customized for any specific solution.

The company also produces heater/chiller units that provide simultaneous heating and cooling, without the need for combustion or the burning of fossil fuels, through its wholly-owned company, Likido.

www.dalradaprecision.com

www.likido.net

DALRADA TECHNOLOGY

Through its technology division, Prakat Solutions, the company brings over 10 years of expertise providing end to end product engineering services across various domains, including – Banking & Financial Services, Telecom, Retail, Healthcare, Manufacturing, Legal and IT Infrastructure.

DALRADA HEALTH PRODUCTS

Dalrada Health is in the business of solving health problems – globally. The company develops products and services that address the unmet needs of consumers due to accessibility, affordability, or availability. With operations in the U.S., Malaysia, and India, Dalrada Health is able to reach underserved markets through strong partnerships and the development of efficient supply chains.

www.glanhealth.com

The CDC has recommended caution with sanitizers and the product can be toxic if over used.

www.pacificstemcells.com

Pacific Stem Cells Web site lists no medical professional.

www.ihgcc.com

This company trains CNAs and is apparently not active at this time due to covid, 2 of 3 locations shut down.

NEWS/PRESS RELEASE HISTORY:

https://finance.yahoo.com/quote/DFCO/press-releases/

RECENT PRESS RELEASE HIGHLIGHTS:

Dalrada Financial Corporation Announces Up List To OTCQB Market

https://finance.yahoo.com/news/dalrada-financial-corporation-announces-list-130000244.html

Dalrada Reports 3,181% Increase In Quarterly Financial Results

https://finance.yahoo.com/news/dalrada-reports-3-181-increase-130000960.html

Dalrada Financial Corp Records First Sales of LikidoVOLT® Independent Power Generators With Hidden Villa Ranch

https://finance.yahoo.com/news/dalrada-financial-corp-records-first-120000713.html

Prakat and Dragonchain Partner to Create Clean Energy, Fintech, and Healthcare Blockchain Solutions

https://finance.yahoo.com/news/prakat-dragonchain-partner-create-clean-165500113.html

Dalrada Launches Development of Likido®HOME Water Heater Designed to Improve Energy Efficiency by 300% and Significantly Reduce Carbon Emissions

https://finance.yahoo.com/news/dalrada-launches-development-likido-home-133000775.html

Dalrada Financial Corporation Launches LikidoVOLT® Independent Power Generators With 90% Clean Energy Efficiency Range

https://finance.yahoo.com/news/dalrada-financial-corporation-launches-likidovolt-130000998.html

Dalrada Executes Contract For Likido North America Exclusive Manufacturing With Tongrun International

https://finance.yahoo.com/news/dalrada-executes-contract-likido-north-203000292.html

Dalrada Precision Acquires Green Energy License For 87% Energy Efficiency And Cost-Savings Advancing Subsidiary Abilities

https://finance.yahoo.com/news/dalrada-precision-acquires-green-energy-120000817.html

DFCO'S Likido Limited Awarded Clean Energy Grant By Innovate UK, Aligns With CLIMAGAL S.L. For Europe Climate Change Implementation

https://finance.yahoo.com/news/dfcos-likido-limited-awarded-clean-130000069.html

Dalrada Health Presents VIA Cervical Cancer Screening Study Findings at 17th World Congress for Cervical Pathology and Colposcopy

https://finance.yahoo.com/news/dalrada-health-presents-via-cervical-120000323.html

Dalrada Financial Corporation Aids COVID-19 Vaccination Administration With Healthcare Staff Of Newly Acquired International Healthcare Group (IHG)

https://finance.yahoo.com/news/dalrada-financial-corporation-aids-covid-130000621.html

https://www.facebook.com/dalrada

https://twitter.com/dalrada_DFCO

DFCO

https://dalrada.com/

09/06/2023 BONAR's Dalrada hasn't sold a single heat pump....

There are no spec sheets so you can't compare them to the long established companies they are competing with.

Crown Glory Holding seems to be a dummy shell...

See screen shot below at https://crowngloryholding.com/about-us/

Crown Glory Holding seems to be a dummy shell...

See screen shot above has been "fixed" with some mediocre text but https://crowngloryholding.com/about-us/ on September 6. They've added a couple paragraphs of blah blah blah

But the site is still dummied up... this is from today 10/20/23:

DALRADA NASDAQ BOUND!

Along with the recent organizational restructuring, our Board of Directors is taking the necessary steps to make Dalrada compliant with NASDAQ requirements. Once compliant, this will also allow the company to qualify for other national and global exchanges once we have satisfied all other listing requirements.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |