Monday, April 01, 2024 2:53:35 AM

(*) "5- and 6-year investments in SPS" in Freddie Mac and Fannie Mae, respectively, not the maturity because the SPS LP was "increased" in different quarters and also it's been considered the partial repayments through the exception to the statutory Restriction on Capital Distributions (U.S.Code §4614(e)), with the assessments sent to Treasury, under the guise of dividend payments (unavailable earnings for distribution as dividend, out of Accumulated Deficit Retained Earnings accounts -Balance Sheets-).

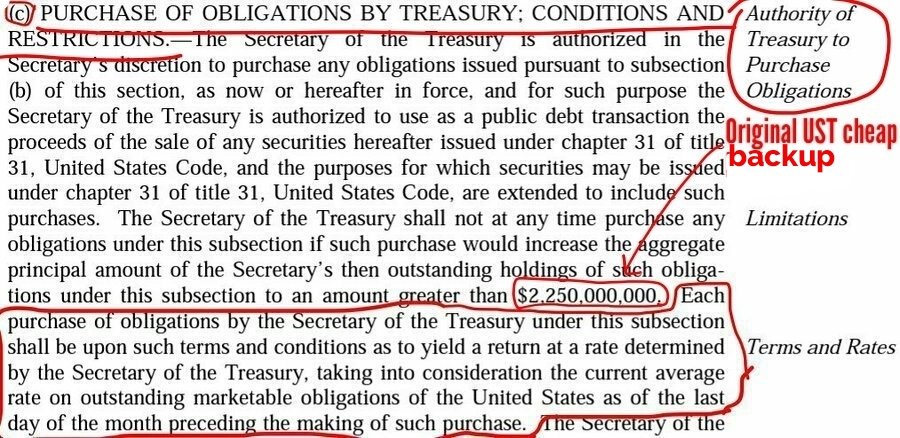

This is why it's mentioned a "weighted average" cumulative dividend rate (1.8%), "taking into consideration the Treasury yields as of the end of the month preceding the purchase", as per the original UST backup in the Charter Act, de facto updated with the SPSPA, which emerged in light of the authority of UST in the homonymous second UST backup inserted by HERA in the Charter Act by the ambitious Calabria/Pelosi for a Separate Account plan and the massive plan of deception attached.

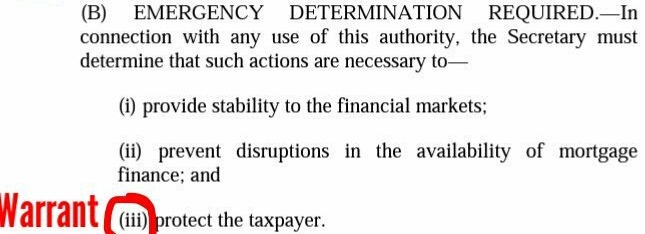

The SPS complied with the authority of UST (i) and (ii):

The original rate on "any" (subsection (c)) "redeemable obligation" (subsection (b)), including the SPS (the preferred stocks are obligations in respect of Capital Stock and redeemable at the option of the issuer), is the one that prevails, primarily because it's permanent, whereas the other was temporary (deadline December 31, 2009).

Let alone because it's part of the Charter Act dynamics:

-As a last resort and in exchange for their Public Mission (section Purposes)

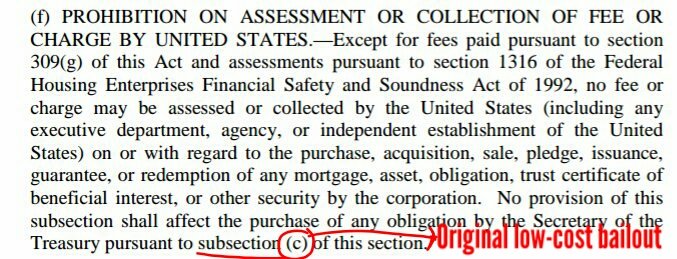

-The United States can't use FnF as piggy banks to make profits using their assets and securities, other than the rate similar to Treasuries mentioned before.

The litigants still don't understand that FnF are not ordinary businesses, but congressionally chartered-private corporations.

The law professor Nielson, Supreme Court-appointed amicus representing the FHFA in the Collins case, spotted the original UST backup of the enterprises right away. The hedge funds and investment banks forgot to pay him off too.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM