Sunday, March 31, 2024 4:21:36 AM

It means that the litigation ends instantly.

As an attorney, Hamish Hume knows there is years of litigation ahead.

There would only be 7 Securities Law violations pending, if we add the CRT operations as a scam for the extortion of money in order to increase their capital needs for the hedge funds and investment banks lying in wait (MS, BLK, etc), besides the main claim of a breach of the statutory Credit Enhancement clause (Charter Act).

With a voluntary payment by the DOJ to settle this violations, estimated in a 0.25% IRR on a JPS par value during 15 years ($1.94 in a $50 par value JPS and Cs), no one can start fresh litigation. If one of the celebrity-attorneys stuck to Fanniegate, wants to start litigation, I guess that, because it has nothing to do with a contract or "implied contract", but outright felonies by a Federal Agency acting as conservator and by the UST, it wouldn't affect the enterprises and we would follow the multi-year litigation closely for the good old days!

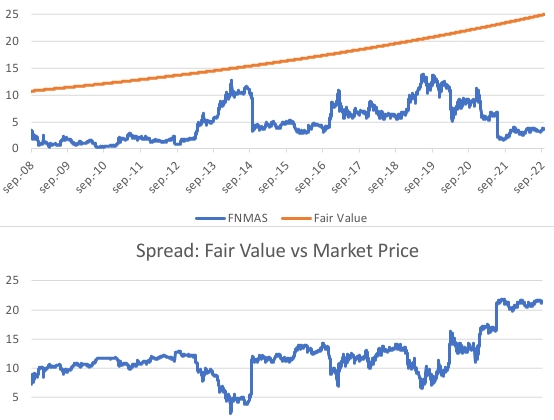

The penalty was assessed with a 0.5% rate (the same rate as the Net Interest Yield -NIY- or spread over Treasuries, that it's been estimated the Treasury earned in the bailout of FnF as per the Charter Act dynamics as a last resort. Section Purposes. It was a 0.299% spread with the FHLBanks in 1989. GAO report. This spread was used to assess the cumulative dividend rate on the 5- and 6-year investments in SPS, FnF respectively (watch Freddie Mac in my signature image below), at a weighted-average 1.8%. Too bad that later the amount of dividend that FnF owe to UST, is netted out with the interests that the UST owes to FnF on the $152B due) on the true damage (spread market price vs fair value, equal to half a JPS par value. Exactly $12 in $FNMAS through the 3Q2022. Estimated $12.5 through today. $FNMAS is used as a template for the rest, as the most liquid series of JPS in FnF), because the Separate Account prevented the stocks from trading at their fair value all along.

A 6% annual discount rate to the estimated date Fannie Mae should have resumed the dividend payments (3Q2022 Earnings report), which marks the day the JPS's fair value fetches its par value.

Even the common shareholders waive their claim against the DOJ in the scenarios of "as is" and "takeover", not in a "Takings + resale", and in no event a claim against the peddlers of the government theft story in formal documents.

It's also pending the case against the Deferred Income accounting (Debt). If someone reaps the profits in one fell swoop with an Accounting Standard change, the Equity holders want a cut of that income because it has prevented FnF from becoming Adequately Capitalized sooner, specially Freddie Mac with a disproportionate Deferred Income.

Simply because it would be our best case scenarios, with the stocks trading at fair value under a brand new Privatized Housing Finance System (Charter revoked), not because there were no Securities Law violations (SPS LP increased for free and its offset, absent from the balance sheets; SPS LP "increased" instead of issued, in order to skip the December 2009 deadline on purchases by the UST; a separate account through a dividend, with Accumulated Deficit Retained Earnings accounts; Etc.)

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM