| Followers | 683 |

| Posts | 142196 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Sunday, February 18, 2024 1:25:12 PM

The equity market endures, regardless of who is in office

By: Raymond James Financial | February 16, 2024

Key Takeaways

• Perception versus reality remains a challenge for Biden

• Fed policymakers are not influenced by politics

• The equity market endures regardless of who is in office

Ready for the long holiday weekend? The origins of Presidents Day can be traced back to the early 1800s when the nation gathered to celebrate one of the most important figures in American history, George Washington. While Washington’s birthday is now commonly referred to as Presidents Day, there was never a proclamation to officially change the name of this federal holiday. Today, the nation celebrates all presidents, past and present - regardless of how revered they are/were by the nation. And speaking about revered presidents, over 70% of voters would prefer there not be a 2020 redux in 2024 - which is surprising as a rematch appears to be in the offing. While we are still in the early stages leading up to the 2024 election, here’s what we are keeping an eye on:

• Will the economy’s resilience last? | The state of the economy is among the top issues for voters heading to the polls. And contrary to what many perceive, this economy is one for the record books. Looking back through history, there has not been another period where GDP growth was above 3% for two consecutive quarters, the unemployment rate was below 4.0% and inflation, as measured on a six-month annualized basis, was running at the Federal Reserve (Fed)’s 2.0% target. The stock market is also up over 20% in the last year. Truly impressive! The problem for Biden: voters are not feeling it. In fact, a recent poll from RealClear Politics states that over 65% of the country believes the economy is on the ‘wrong’ track, with 50% of voters believing the economy is in a recession - or worse. Voter perception versus reality is a challenge Biden will need to overcome - especially if economic growth actually slows in the months ahead. History shows that if a recession unfolds in the two years leading up to the election, the incumbent does not get reelected and vice versa. The good news for the economy: it doesn’t matter which party wins the presidency; the economy, overall, has historically performed similarly regardless of the party in power.

• The fed during election years | This year is a pivotal year for the Fed as it contemplates when to cut interest rates (we’re still penciling in June). Which begs the question: will the Fed’s decisions be influenced by the political calendar? Absolutely not. However, this does not prevent politicians from using the Fed as a political pawn in the upcoming year. Fed rate cuts so close to an election that stimulate the economy will be applauded by Democrats as Republicans question the timing while, conversely, Democrats will fret over few or no rate cuts as Republicans highlight economic weakness. Fortunately, the Fed is an independent entity where policymakers routinely ignore politics when making their rate decisions. In fact, their historical record shows just that. The Fed has either hiked or cut rates 85% of the time in election years dating back to 1972. And more applicable to the scenario that is unfolding this year, the Fed has cut rates 62% of the time in election years. Therefore, it does not matter if it is an election year or not, the Fed’s reaction function is based on its dual mandate - inflation stability and full employment.

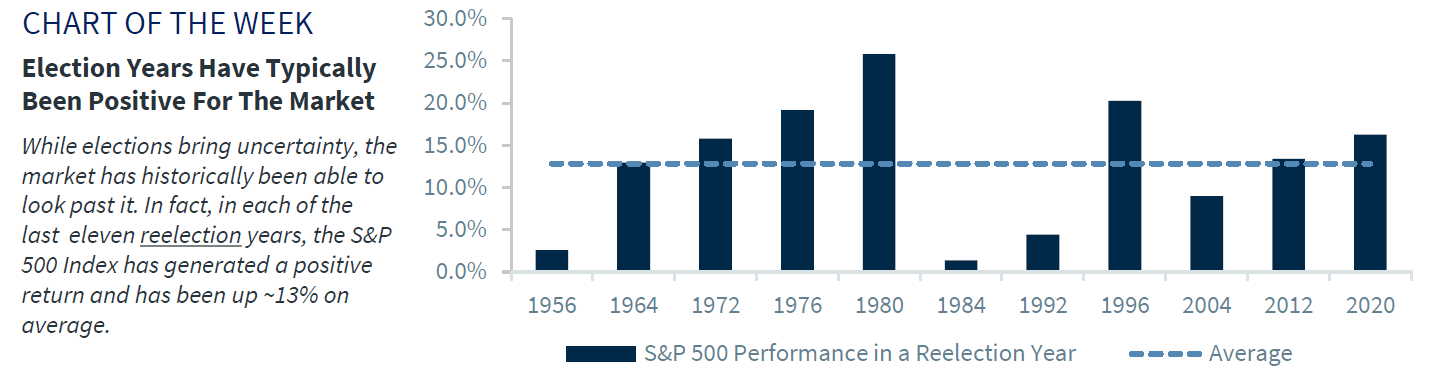

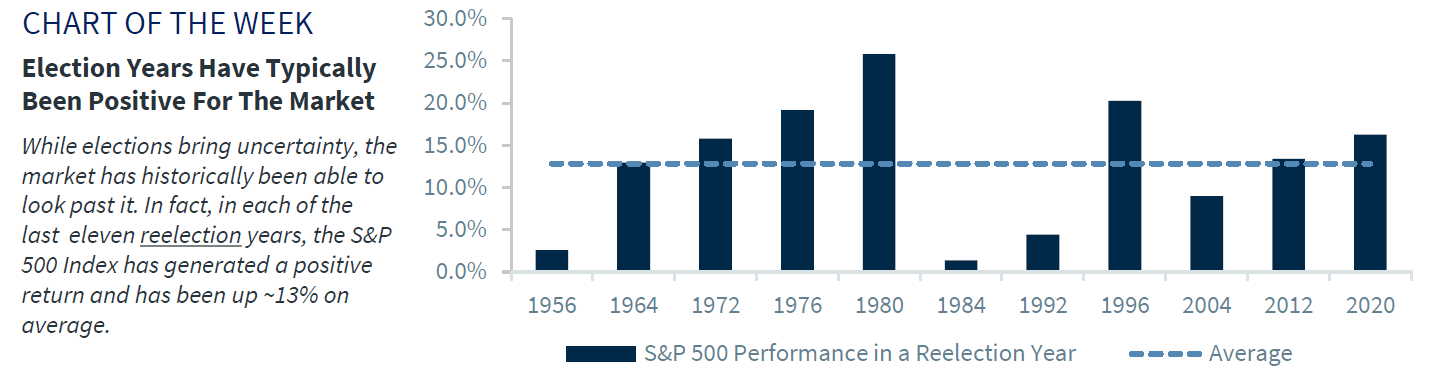

• Election year impact on the equity market | An election year - particularly a reelection year - has been positive for the equity market. In fact, the S&P 500 was up ~13%, on average, and was positive in each of the last 11 reelection years. But while the market, on average, has been positive, election years bring increased volatility. During election years, the market experiences a max drawdown of ~15% (vs. 13% in a normal year) and four 5% pullbacks (vs. three) on average dating back to 1980. This year, we are already seeing election-related impacts starting to play out in some pockets of the market. For example, while the S&P 500 is up ~5% year-to-date, EV/solar names (Trump may roll back portions of the IRA/CHIPs acts), Mexico (the USMCA is up for review in 2026) and China (Trump’s call for 60% tariffs on Chinese imports) are in negative territory. Similarly, there has been some underperformance of oil and gas companies after Biden announced a temporary pause on LNG projects. Going forward, pay close attention to S&P 500 performance in the three months leading up to the election, as the equity market has a track record of predicting who wins the election - correctly calling 20 of the last 24 elections. Historically, if the market’s performance is positive three months leading into the election, the incumbent party wins. On the contrary, if it is down, the incumbent loses.

• Bottom line | History suggests that investors should not re-position their portfolios simply based on the fact it is an election year. While election years bring uncertainty, in the long term, fundamentals, such as economic and earnings growth, monetary policy, interest rates and inflation, have a more meaningful impact on future returns than which party is in power in Washington. Examining the markets since 1937, the S&P 500 has experienced 21 negative years - 11 coming under a Republican president and 10 occurring under a Democrat president. Similarly, when looking at GDP growth, 7 negative years have occurred under both a Republican and Democrat president. The point is, the market and the economy have historically gone up regardless of which party is in power, so we would suggest not making knee-jerk decisions based off the winner of the election.

Read Full Story »»»

DiscoverGold

DiscoverGold

By: Raymond James Financial | February 16, 2024

Key Takeaways

• Perception versus reality remains a challenge for Biden

• Fed policymakers are not influenced by politics

• The equity market endures regardless of who is in office

Ready for the long holiday weekend? The origins of Presidents Day can be traced back to the early 1800s when the nation gathered to celebrate one of the most important figures in American history, George Washington. While Washington’s birthday is now commonly referred to as Presidents Day, there was never a proclamation to officially change the name of this federal holiday. Today, the nation celebrates all presidents, past and present - regardless of how revered they are/were by the nation. And speaking about revered presidents, over 70% of voters would prefer there not be a 2020 redux in 2024 - which is surprising as a rematch appears to be in the offing. While we are still in the early stages leading up to the 2024 election, here’s what we are keeping an eye on:

• Will the economy’s resilience last? | The state of the economy is among the top issues for voters heading to the polls. And contrary to what many perceive, this economy is one for the record books. Looking back through history, there has not been another period where GDP growth was above 3% for two consecutive quarters, the unemployment rate was below 4.0% and inflation, as measured on a six-month annualized basis, was running at the Federal Reserve (Fed)’s 2.0% target. The stock market is also up over 20% in the last year. Truly impressive! The problem for Biden: voters are not feeling it. In fact, a recent poll from RealClear Politics states that over 65% of the country believes the economy is on the ‘wrong’ track, with 50% of voters believing the economy is in a recession - or worse. Voter perception versus reality is a challenge Biden will need to overcome - especially if economic growth actually slows in the months ahead. History shows that if a recession unfolds in the two years leading up to the election, the incumbent does not get reelected and vice versa. The good news for the economy: it doesn’t matter which party wins the presidency; the economy, overall, has historically performed similarly regardless of the party in power.

• The fed during election years | This year is a pivotal year for the Fed as it contemplates when to cut interest rates (we’re still penciling in June). Which begs the question: will the Fed’s decisions be influenced by the political calendar? Absolutely not. However, this does not prevent politicians from using the Fed as a political pawn in the upcoming year. Fed rate cuts so close to an election that stimulate the economy will be applauded by Democrats as Republicans question the timing while, conversely, Democrats will fret over few or no rate cuts as Republicans highlight economic weakness. Fortunately, the Fed is an independent entity where policymakers routinely ignore politics when making their rate decisions. In fact, their historical record shows just that. The Fed has either hiked or cut rates 85% of the time in election years dating back to 1972. And more applicable to the scenario that is unfolding this year, the Fed has cut rates 62% of the time in election years. Therefore, it does not matter if it is an election year or not, the Fed’s reaction function is based on its dual mandate - inflation stability and full employment.

• Election year impact on the equity market | An election year - particularly a reelection year - has been positive for the equity market. In fact, the S&P 500 was up ~13%, on average, and was positive in each of the last 11 reelection years. But while the market, on average, has been positive, election years bring increased volatility. During election years, the market experiences a max drawdown of ~15% (vs. 13% in a normal year) and four 5% pullbacks (vs. three) on average dating back to 1980. This year, we are already seeing election-related impacts starting to play out in some pockets of the market. For example, while the S&P 500 is up ~5% year-to-date, EV/solar names (Trump may roll back portions of the IRA/CHIPs acts), Mexico (the USMCA is up for review in 2026) and China (Trump’s call for 60% tariffs on Chinese imports) are in negative territory. Similarly, there has been some underperformance of oil and gas companies after Biden announced a temporary pause on LNG projects. Going forward, pay close attention to S&P 500 performance in the three months leading up to the election, as the equity market has a track record of predicting who wins the election - correctly calling 20 of the last 24 elections. Historically, if the market’s performance is positive three months leading into the election, the incumbent party wins. On the contrary, if it is down, the incumbent loses.

• Bottom line | History suggests that investors should not re-position their portfolios simply based on the fact it is an election year. While election years bring uncertainty, in the long term, fundamentals, such as economic and earnings growth, monetary policy, interest rates and inflation, have a more meaningful impact on future returns than which party is in power in Washington. Examining the markets since 1937, the S&P 500 has experienced 21 negative years - 11 coming under a Republican president and 10 occurring under a Democrat president. Similarly, when looking at GDP growth, 7 negative years have occurred under both a Republican and Democrat president. The point is, the market and the economy have historically gone up regardless of which party is in power, so we would suggest not making knee-jerk decisions based off the winner of the election.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.