Monday, December 25, 2023 4:13:42 AM

Spot on! I posted yesterday that the plaintiff Bryndon Fisher might be preparing a third appeal illegally, when he saw that his "innovative stance" about a Derivative claim on behalf of Fannie Mae that he is peddling all the time (on Twitter and Ihub as well. Also borrowing Guido from Pagliara, to praise him and echo his stance), was already taken by other plaintiff of the related cases, in a question presented in the Supreme Court.

Fisher lost his opportunity to file an appeal in the Supreme Court on time, maybe because his questions were already filed by other plaintiffs in related cases. So, he thought that he had lost yet again another opportunity to be in the spotlight and pretend to be a "Fanniegate hero", like our other enemy Glen Bradford that calls himself that.

This is the question presented by one of the Fairholme plaintiffs, Andrew T. Barrett, who separately asserted derivative claims on behalf of Fannie Mae and Freddie Mac alleging Takings:

The plotters just seek court news that harm our economic interests, for stock price manipulation.

Therefore, a Takings case has already been denied by the Supreme Court, that, obviously, took into consideration the prior ruling by Justice Alito, along with judge Willett (5th Cir.), both on the Collins case, making clear that the conservator must "rehabilitate FnF", adding the wording that enables a Separate Account plan for the extortion of their resources.

So, do not insist. There has been no Takings. This is a Conservatorship. The powers and rights must be returned once the conservator fulfills its mission. This is not a Receivership.

Anyway, there is no innovation (the CRT and bitcoin are called innovation too. A telltale sign of fraud). These rogue attorneys still don't understand that a Derivative claim and a Direct claim are the same claim when an Equity holder challenges directly the profits, holders of each share class accordingly.

Other theme is challenging something related to the business activity.

This is because the shareholders have a legal claim on the full amount of profits of the company they own, after the payment of dividends to the Preferred Stocks, and regardless that those profits are later retained by the company (Retained Earnings account) or distributed to them as dividend.

The reason why a common stock trades at a determined price each day, discounting those future profits (EPS). A common stock is not an unbacked crypto (without fundamentals and a fraud) or, as the prior SEC chairman with Trump: "the tokenization of the common stocks", that trade for no reason.

The preferred stocks are subject to the specifications of their contract, that allow the management to not declare dividends (for the recapitalization of the enterprises. It's not done just on a whim), which is very harmful for a fixed-income security.

Everything is discounted by each share class.

Bill Ackman sells smoke (bitcoin a technology like the internet and the telephone or tokens are commodities), implying that the common stocks are "options" in his Pershing letters, and later portraying himself as an expert options trader. No, the common stocks and JPSs discount everything I've just said accordingly, beginning with FnF posting $0 EPS due to the gifted SPS, the Warrant, frivolous lawsuits, Financial Statement fraud with gifted SPS absent from the balance sheets, etc.

So, a case of stock price manipulation for which we request 3 rounds of Punitive Damages. Against the peddlers of the government theft story in formal documents, included.

The NWS dividend is a Common Equity Sweep.

The SPS LP increased for free is a Common Equity Sweep too (through the offset: reduction of Retained Earnings account), that we call NWS 2.0.

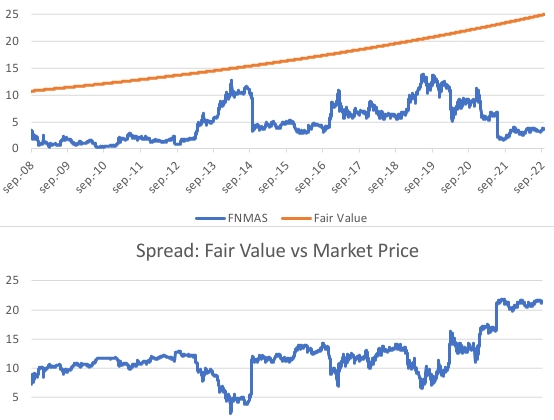

This is why Fanniegate, is all about Common Equity held in escrow in order to uphold the law, depriving the stocks of trading at their fair value all along.

The Common Equity is necessary to build up, to a minumum required in the FHEFSSA, as amended by FHFA regulation (Capital Rule), for the resumption of dividends to Cs and JPSs.

Common Equity, the sum of:

-Common Stock par value

-Additional Paid-In Capital account

-Retained Earnings account

-AOCI

The CET1 required, is the Common Equity with some regulatory adjustments (a limit in the Deferred Assets that can be recorded as Retained Earnings, etc)

The conservator mistook that it doesn't have to consider the interests of the Equity holders, for deliberately harm them with stock price manipulation and other 7 Securities Law breaches.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM