| Followers | 686 |

| Posts | 142475 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Wednesday, May 03, 2023 3:08:30 PM

By: Tim Ord | May 3, 2023

SPX Monitoring Purposes: Long SPX on 2/6/23 at 4110.98.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Neutral.

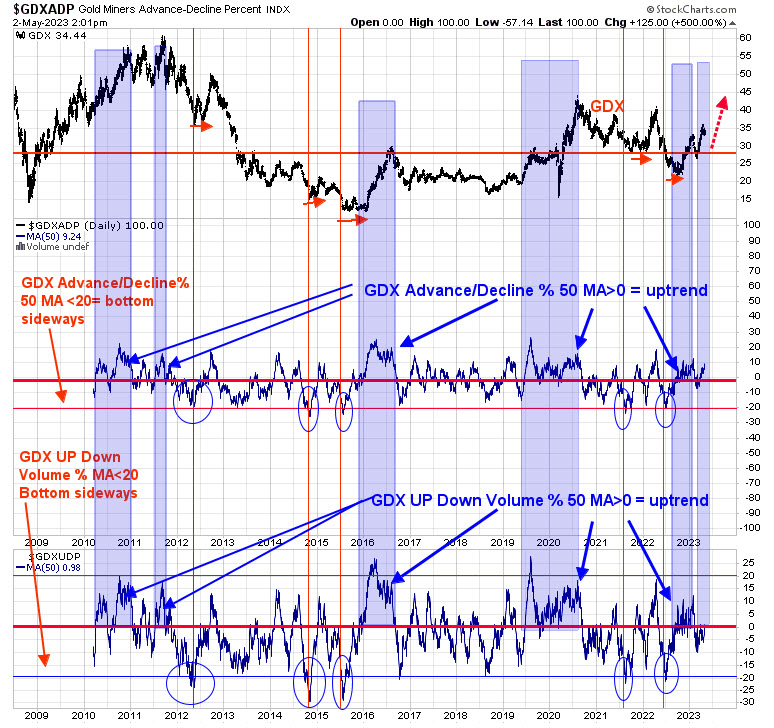

Yesterday, we said, "The bottom window is the 50-day average of the Up-Down Volume percent for GDX, and the next window higher is the 50-day average of the Advance/Decline percent for GDX. We found that the 50-day average of the Up Down Volume percent identify up rend in GDX when this indicator is above 0 and stays above 0. We noted these times with the light blue-shaded area. It helps to confirm the uptrend when the 50-day average of the Up Down Volume percent is also above 0, but the 50-day average of the Advance/Decline appears to carry the load better. Both indicators closed above 0 back in late August of last year, and the 50-day average of the Advance/Decline has held above 0 in general since that time and remains above it, currently suggesting the GDX rally has further to go." Added to above is that 50-day average of Up Down Volume Percent (bottom window) closed above 0 today at +.98, suggesting the short-term consolidation may be ending and an impulse wave up is beginning.

Tim Ord,

Editor

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent GDX News

- YieldMax GDXY Name Change • GlobeNewswire Inc. • 01/25/2024 04:22:00 PM

- Surging S&P 500 Breadth • ValueWalk • 07/19/2023 03:16:37 PM

- S&P 500 Corrects In Breadth • ValueWalk • 07/18/2023 03:08:49 PM

- If The USDX Fell So Much, Why Didn’t Gold Truly Soar? • ValueWalk • 07/17/2023 05:16:20 PM

- USD’s Decline That’s… Bearish For Gold?! • ValueWalk • 07/12/2023 02:38:08 PM

- S&P 500 Late Day Reversal Worry • ValueWalk • 07/10/2023 03:17:34 PM

- Massive Gaming Celebrates Global Launch of House of Blackjack with USDC Earning Race • ValueWalk • 07/10/2023 02:44:17 PM

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM