Saturday, February 04, 2023 8:24:56 PM

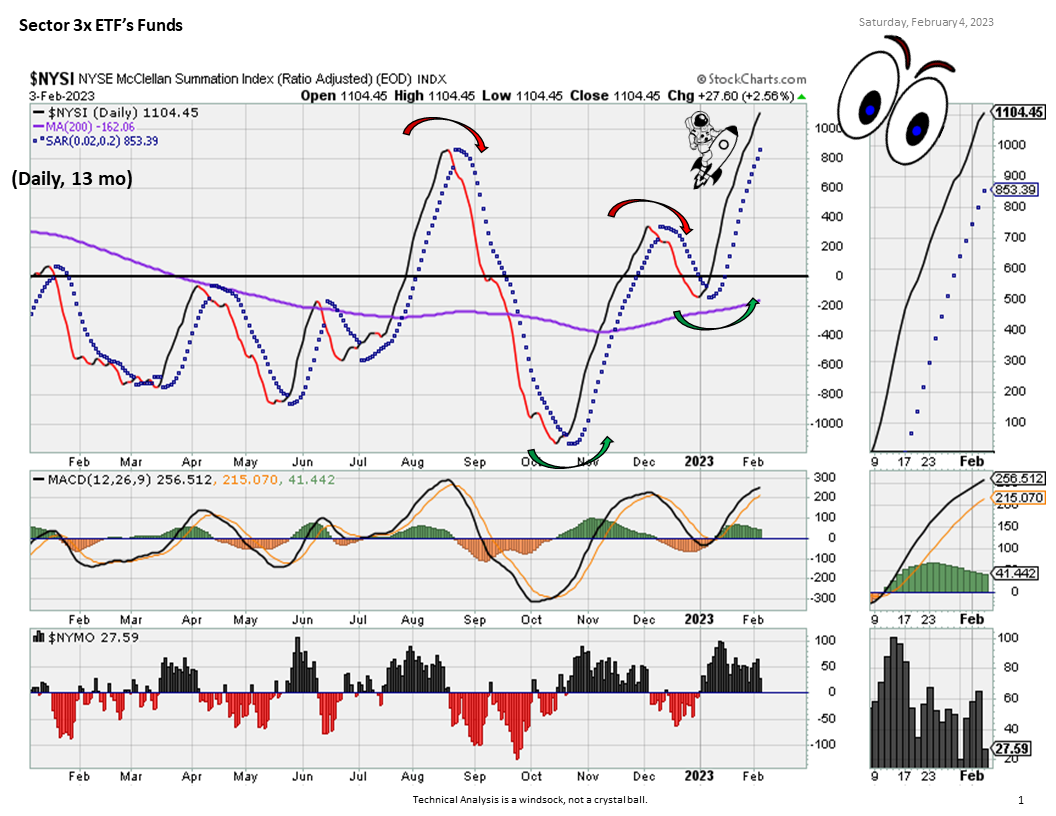

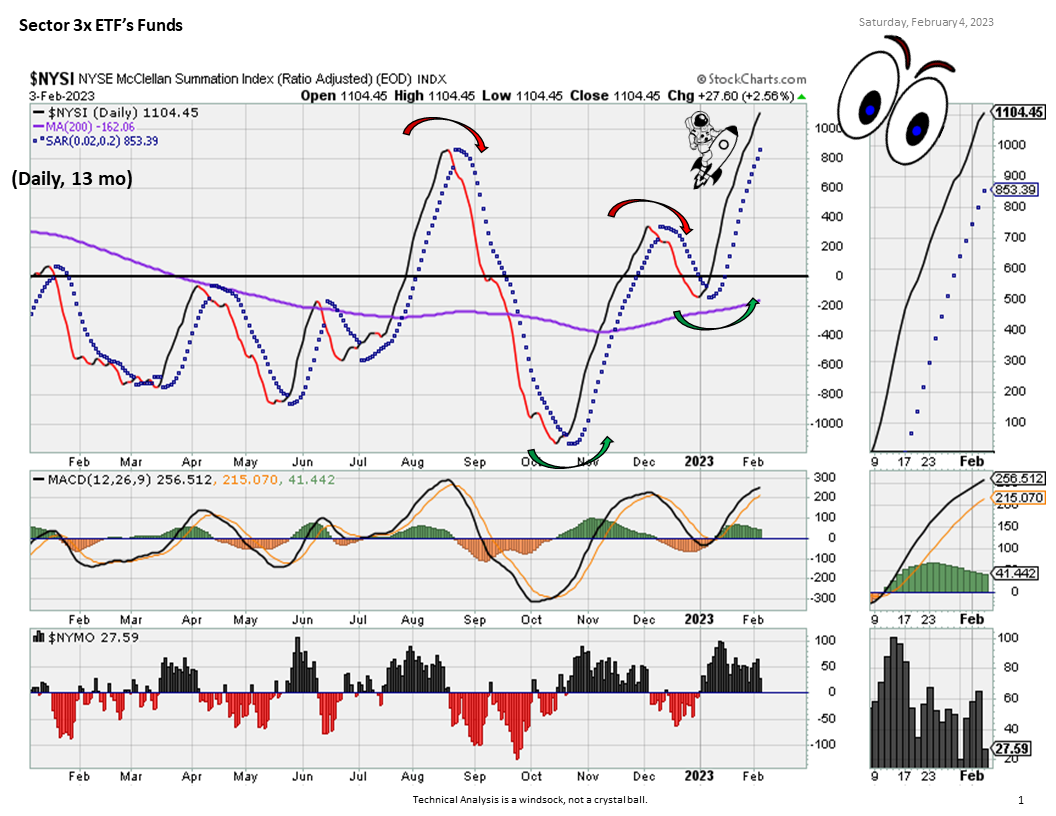

This is my favorite overall market barometer. The trend line will turn from black to red a day or two before the PSar flips. Black to red is a heads-up, start paying attention. PSar flipping is confirmation the market trend is changing/has changed.

https://stockcharts.com/h-sc/ui?s=%24NYSI&p=D&yr=1&mn=1&dy=1&id=p80047377357

Zerohedge posted this article yesterday. I saw it today.

https://www.zerohedge.com/markets/hedge-fund-capitulation-yesterdays-short-squeeze-was-biggest-8-years-surpassing-even-jan

FYI, if you insert

archive.is/

between https:// and www, you can sneak behind most news organizations' paywalls.

Here is the article - https://archive.is/4kk2B

,,,and the associated reference article mentioned - https://archive.is/lsmGf

The author's premise is the market has entered a 'blow-off' top phase. The conclusion of a 'blow-off top is usually down hard.

In case the above links don't work, below are the contents of the two articles. GLTY

1 of 2

"Hedge Fund Capitulation": Yesterday's Short Squeeze Was The Biggest In 8 Years, Surpassing Even Jan 2021

Tyler Durden's Photo

BY TYLER DURDEN

FRIDAY, FEB 03, 2023 - 06:22 PM

Over the weekend, we warned readers that the January squeeze was only the beginning, and the pain for bears was only going to accelerate, and sure enough, yesterday's post-Fed/post-ECB/post-BOE blowout showed just how brutal a "capitulatory" short squeeze can be.

Here are the details of yesterday's "Hedge Fund Capitulation" courtesy of Goldman's Prime Brokerage:

On the back of the sharp market rally yesterday led by High Retail Sentiment (GSCBHRSB), High Beta 12M Losers (GSCBLMOM), and Most Short (GSCBMSAL) stocks, the Prime book saw a sharp increase in de-grossing activity, driven by short covers and long sales (1.6 to 1 ratio).

What does that mean in notional terms?

As Goldman's Vincent Lin explains, yesterday's de-risking, or de-grossing - short covers and long sales combined - was the largest since Jan '21 and ranks in the 99.9th percentile vs. the past 10 years. US and European equities made up ~64% and 35% of the notional de-grossing, respectively. That's right: hedge funds were so beared up going into the FOMC, the result was bloodbath as margin calls collided with stop losses and everything was sold with the bathwater.

What about just short covering?

Again, in notional terms, Goldman's Prime desk calculates that yesterday's short covering was the largest since Nov '15 (exceeding even Jan '21 during the meme frenzy) and ranks in the 99.8th percentile vs. the past 10 years. US and European equities made up ~61% and 38% of the notional short covering, respectively.

And as we reported yesterday (and will have more to say later), in a hilarious twist, it was once again the retail investors who frontran (and maybe precipitated, thank you extremely illiquid market) this panicked short covering by institutions, something we last saw at the start of 2021.

So, if the Jan 2021 analogue is indeed the right one, watch out above as retail investors are once again becoming the dominant price setter in a market where only technicals and positioning mater, and the momentum - at least for now - is clearly up and to the right.

More in the full note available to pro subs.

2 of 2

Today Was The Largest Option Volume Session Of All Time

Tyler Durden's Photo

BY TYLER DURDEN

FRIDAY, FEB 03, 2023 - 03:10 AM

Earlier today, during the market's furious meltup, we took a quick look at the volumes in the 0DTE (0-days to expiration) option universe and what we found left us speechless (but not tweetless):

0DTE lordy

— zerohedge (@zerohedge) February 2, 2023

We had to wait until the close to learn what happened. As GS reports, a record 68 million contracts traded over the course of the session, consisting of 40 million calls (also a record) vs 28 million puts.

Goldman strategists break the action down and note that mega cap tech upside was the main driver: some 2.7mm TSLA calls (1.6mm avg) trader, as well as 1.8mm AMZN calls (600k avg), 1.4mm META calls (225k avg), 1.3mm AAPL calls (600k avg) and so on.

As Goldman's Brian Garrett notes, "the market continues to show strong demand for right tail in-spite (or because?) of this rally": and indeed, SPX 1 month upside trades 14v (8th percentile); NDX 1 month upside trades 21v (13th percentile) and RTY 1 month upside trades 18v (20th percentile).

Meanwhile, picking up on what we observed over the weekend, namely the biggest surge in retail buying in almost a year (as measured by Goldman)...

... overnight JPMorgan also concludes that seemingly undaunted by losses of more than 50% in some favorite retail stocks last year, individual traders are storming back to stocks like Carvana and crypto-related products as the market staged a rebound that added almost $2 trillion to equity values in January alone.

With professional investors staying on the sidelines, paralyzed by the market's seemingly incomprehensible moves, the basement dwelling trader's foray is boosting retail’s market presence, and as Bloomberg reports, citing the latest JPM Retail Radar report (available to pro subs), retail participation increased significantly in the new year and accounted for 23% of the market’s total volume in late January, above the previous high of 22% reached during the 2021 meme mania.

Some details from the report:

Retail traders net bought $1.4B this past week, in line with last 12M average. ETFs made up the bulk of the imbalance, accounting for +$1.3B in ETFs. Inflows into S&P 500 and NASDAQ 100 ETFs were -0.8 standard deviations below average. In comparison, EM equities (EEM +1.8z), gold (+1.6z), and credit ETFs (LQD + 1.5z, HYG +1.2z) saw strong demand. +$133MM of single stocks were net bought this past week. Continuing a similar pattern from previous weeks, TSLA was the most sold stock (-$485MM) while AMZN (+$167MM) and AAPL (+$124MM) were the most bought.

Unsurprisingly, the largest increase in activity came from small-cap stocks

“They are encouraged by the recent rebound in small-cap meme stocks and cryptoassets which crashed last year,” JPM strategist Peng Cheng told Bloomberg in an interview. “Trading volume is overall lower and that also may have exaggerated retail market share.”

Powell “simply provided a green light for the speculation to continue,” said Michael O’Rourke, chief market strategist at Jonestrading. But that may sow seeds for trouble down the road, he added. “Just because the Chairman of the Federal Reserve has blessed a speculative frenzy, it does not mean it will help the deteriorating fundamentals companies are facing.”

However, it's not just retail investors. As Vanda Research notes in its VandaTrack weekly, intraday flows suggest that institutional investors may finally be joining retail traders in the latest rebound. The below chart captures intraday retail activity over the past three days.

First, Monday saw retail traders buy US-listed securities at the highest clip YTD (US$ +1.8bn net inflow). As per usual, this group bought aggressively at the open but also supported markets at the close as stocks dipped.

Retail activity on Tuesday and Wednesday was notably different, however. On Tuesday, retail crowds locked in some profits at the end of the day as markets rallied (sensible behavior ahead of the FOMC). On Wednesday, buying was strong throughout the day, especially during the FOMC statement and Powell's press conference. Although flows slowed down as markets took off, it seems that retail investors kept buying.

What's interesting is the stark contrast between retail flows and the S&P500 at the end of the day, suggesting that institutional investors drove the market higher. These dynamics reinforce Vanda's belief that this rally may be more sustainable than expected and that discretionary managers are (at last) increasing their equity exposure.

https://stockcharts.com/h-sc/ui?s=%24NYSI&p=D&yr=1&mn=1&dy=1&id=p80047377357

Zerohedge posted this article yesterday. I saw it today.

https://www.zerohedge.com/markets/hedge-fund-capitulation-yesterdays-short-squeeze-was-biggest-8-years-surpassing-even-jan

FYI, if you insert

archive.is/

between https:// and www, you can sneak behind most news organizations' paywalls.

Here is the article - https://archive.is/4kk2B

,,,and the associated reference article mentioned - https://archive.is/lsmGf

The author's premise is the market has entered a 'blow-off' top phase. The conclusion of a 'blow-off top is usually down hard.

In case the above links don't work, below are the contents of the two articles. GLTY

1 of 2

"Hedge Fund Capitulation": Yesterday's Short Squeeze Was The Biggest In 8 Years, Surpassing Even Jan 2021

Tyler Durden's Photo

BY TYLER DURDEN

FRIDAY, FEB 03, 2023 - 06:22 PM

Over the weekend, we warned readers that the January squeeze was only the beginning, and the pain for bears was only going to accelerate, and sure enough, yesterday's post-Fed/post-ECB/post-BOE blowout showed just how brutal a "capitulatory" short squeeze can be.

Here are the details of yesterday's "Hedge Fund Capitulation" courtesy of Goldman's Prime Brokerage:

On the back of the sharp market rally yesterday led by High Retail Sentiment (GSCBHRSB), High Beta 12M Losers (GSCBLMOM), and Most Short (GSCBMSAL) stocks, the Prime book saw a sharp increase in de-grossing activity, driven by short covers and long sales (1.6 to 1 ratio).

What does that mean in notional terms?

As Goldman's Vincent Lin explains, yesterday's de-risking, or de-grossing - short covers and long sales combined - was the largest since Jan '21 and ranks in the 99.9th percentile vs. the past 10 years. US and European equities made up ~64% and 35% of the notional de-grossing, respectively. That's right: hedge funds were so beared up going into the FOMC, the result was bloodbath as margin calls collided with stop losses and everything was sold with the bathwater.

What about just short covering?

Again, in notional terms, Goldman's Prime desk calculates that yesterday's short covering was the largest since Nov '15 (exceeding even Jan '21 during the meme frenzy) and ranks in the 99.8th percentile vs. the past 10 years. US and European equities made up ~61% and 38% of the notional short covering, respectively.

And as we reported yesterday (and will have more to say later), in a hilarious twist, it was once again the retail investors who frontran (and maybe precipitated, thank you extremely illiquid market) this panicked short covering by institutions, something we last saw at the start of 2021.

So, if the Jan 2021 analogue is indeed the right one, watch out above as retail investors are once again becoming the dominant price setter in a market where only technicals and positioning mater, and the momentum - at least for now - is clearly up and to the right.

More in the full note available to pro subs.

2 of 2

Today Was The Largest Option Volume Session Of All Time

Tyler Durden's Photo

BY TYLER DURDEN

FRIDAY, FEB 03, 2023 - 03:10 AM

Earlier today, during the market's furious meltup, we took a quick look at the volumes in the 0DTE (0-days to expiration) option universe and what we found left us speechless (but not tweetless):

0DTE lordy

— zerohedge (@zerohedge) February 2, 2023

We had to wait until the close to learn what happened. As GS reports, a record 68 million contracts traded over the course of the session, consisting of 40 million calls (also a record) vs 28 million puts.

Goldman strategists break the action down and note that mega cap tech upside was the main driver: some 2.7mm TSLA calls (1.6mm avg) trader, as well as 1.8mm AMZN calls (600k avg), 1.4mm META calls (225k avg), 1.3mm AAPL calls (600k avg) and so on.

As Goldman's Brian Garrett notes, "the market continues to show strong demand for right tail in-spite (or because?) of this rally": and indeed, SPX 1 month upside trades 14v (8th percentile); NDX 1 month upside trades 21v (13th percentile) and RTY 1 month upside trades 18v (20th percentile).

Meanwhile, picking up on what we observed over the weekend, namely the biggest surge in retail buying in almost a year (as measured by Goldman)...

... overnight JPMorgan also concludes that seemingly undaunted by losses of more than 50% in some favorite retail stocks last year, individual traders are storming back to stocks like Carvana and crypto-related products as the market staged a rebound that added almost $2 trillion to equity values in January alone.

With professional investors staying on the sidelines, paralyzed by the market's seemingly incomprehensible moves, the basement dwelling trader's foray is boosting retail’s market presence, and as Bloomberg reports, citing the latest JPM Retail Radar report (available to pro subs), retail participation increased significantly in the new year and accounted for 23% of the market’s total volume in late January, above the previous high of 22% reached during the 2021 meme mania.

Some details from the report:

Retail traders net bought $1.4B this past week, in line with last 12M average. ETFs made up the bulk of the imbalance, accounting for +$1.3B in ETFs. Inflows into S&P 500 and NASDAQ 100 ETFs were -0.8 standard deviations below average. In comparison, EM equities (EEM +1.8z), gold (+1.6z), and credit ETFs (LQD + 1.5z, HYG +1.2z) saw strong demand. +$133MM of single stocks were net bought this past week. Continuing a similar pattern from previous weeks, TSLA was the most sold stock (-$485MM) while AMZN (+$167MM) and AAPL (+$124MM) were the most bought.

Unsurprisingly, the largest increase in activity came from small-cap stocks

“They are encouraged by the recent rebound in small-cap meme stocks and cryptoassets which crashed last year,” JPM strategist Peng Cheng told Bloomberg in an interview. “Trading volume is overall lower and that also may have exaggerated retail market share.”

Powell “simply provided a green light for the speculation to continue,” said Michael O’Rourke, chief market strategist at Jonestrading. But that may sow seeds for trouble down the road, he added. “Just because the Chairman of the Federal Reserve has blessed a speculative frenzy, it does not mean it will help the deteriorating fundamentals companies are facing.”

However, it's not just retail investors. As Vanda Research notes in its VandaTrack weekly, intraday flows suggest that institutional investors may finally be joining retail traders in the latest rebound. The below chart captures intraday retail activity over the past three days.

First, Monday saw retail traders buy US-listed securities at the highest clip YTD (US$ +1.8bn net inflow). As per usual, this group bought aggressively at the open but also supported markets at the close as stocks dipped.

Retail activity on Tuesday and Wednesday was notably different, however. On Tuesday, retail crowds locked in some profits at the end of the day as markets rallied (sensible behavior ahead of the FOMC). On Wednesday, buying was strong throughout the day, especially during the FOMC statement and Powell's press conference. Although flows slowed down as markets took off, it seems that retail investors kept buying.

What's interesting is the stark contrast between retail flows and the S&P500 at the end of the day, suggesting that institutional investors drove the market higher. These dynamics reinforce Vanda's belief that this rally may be more sustainable than expected and that discretionary managers are (at last) increasing their equity exposure.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.