Tuesday, November 01, 2022 3:44:26 PM

Getting shares early for solid-state battery companies has been extremely profitable for investors in the last few years with the emergence of electric vehicles (EV), energy storage for national power grids, and smaller solutions for single-family homes with solar.

Volt Carbon Technologies (TSXV: VCT / OTCQB: TORVF) is a multi-faceted company that offers patented solid-state battery and energy storage solutions with a share price that is extremely low at present because they are not greatly publicized or yet known to investors.

We've all said to ourselves at one time or another, "I wish I bought when the share price of company X was still under $3.00..." or something to that effect.

But we didn't buy shares at the early/low price because:

1. Didn't know about the opportunity

2. Didn't know about the opportunity

3. Didn't know about the opportunity

4. Looked at it briefly and dismissed the trade idea without doing any further research.

5. Didn't understand how they will service the marketplace with their solution(s)

It is clear that the solid-state battery and energy storage solution market is growing rapidly and investors need to act fast when opportunities arise.

Volt Carbon Technologies is not one to watch but one to buy while its share price is still the lowest in the market when compared to its cohorts. (See below)

Volt Carbon Technologies reported that:

“The solid electrolyte is based on a metal-organic framework (MOF) and has shown outstanding capabilities. Preliminary testing of early prototype samples has shown that the technology can challenge more established competitors such as QuantumScape Inc. (NYSE: $QS SP: $8.63), whose technology consists of a ceramic separator used in a lithium metal battery.”

Source: The Innovation Platform, June 2022, Pg. 83

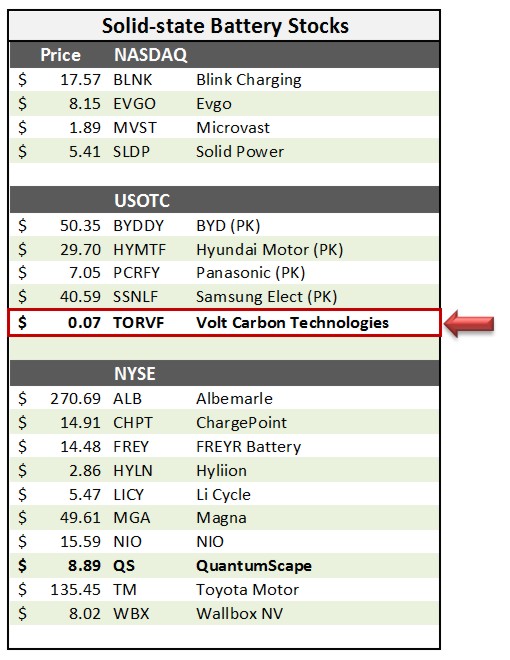

Below is a list of solid-state battery companies and their share price as of 3-OCT-2022.

Look at Volt Carbon's share price compared to all others on the list.

Volt Carbon Technologies will not stay below $3.00 for very much longer and can easily run past many on the list because of their share structure and low float.

For example, Volt Carbon with the market cap of QuantumScape would be approx. $23.16 per share.

QS is trading at $8.26 and a MC of $3.54B and has 433MM shares outstanding.

VCT is trading at $0.09 and a MC of $14.07M and has153MM shares outstanding.

Even just 10% of $23.16 is $2.32 PPS and VCT states that their battery tech is better than QS and has zero toxic debt.

I realize that there are many other factors to consider when comparing companies and that the above market cap comparison is a broad outlook, but the fact remains that Volt Carbon Technologies is manufacturing its patented solid-state batteries and is on track to being a major player in several markets.

If you are looking for your next trade idea or investment opportunity, then take a look at what Volt Carbon Technologies is doing. Link to additional DD >

Footnote:

I remember the day I was listening to National Public Radio (NPR) while driving across the Golden Gate Bridge and they stated that Netflix accounted for 25% of all internet bandwidth usage. My first thought was, "those guys are clogging up the web by hogging bandwidth."

That was an error on my part. I should have been buying as many shares as I could get while their price was so cheap because streaming was just beginning to catch on and ISPs were all upgrading their backhaul gear to carry the load we have today.

Disclosure:

I have a beneficial long position in the shares of TSXV: VCT, OTCQB: TORVF either through stock ownership, options, or other derivatives.

I wrote this post myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

GLTA

wm

" faber est suae quisque fortunae " The above is for informational purposes only, responsibility for all trading decisions lies solely with the reader.

VPR Brands (VPRB) Reports First Quarter 2024 Financial Results • VPRB • May 17, 2024 8:04 AM

ILUS Provides a First Quarter Filing Update • ILUS • May 16, 2024 11:26 AM

Cannabix Technologies and Omega Laboratories Inc. enter Strategic Partnership to Commercialize Marijuana Breathalyzer Technology • BLO • May 16, 2024 8:13 AM

Avant Technologies to Revolutionize Data Center Management with Proprietary AI Software Platform • AVAI • May 16, 2024 8:00 AM

HealthLynked Corp Announces First Quarter 2024 Results: Achieves 8% Revenue Growth Over Last Quarter • HLYK • May 16, 2024 8:00 AM

Integrated Ventures Files Q3/2024 With Mining Revenues Of $1,983,250 And Positive Earnings Of $0.05 Cents Per Share • INTV • May 15, 2024 10:30 AM