| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, July 05, 2022 2:27:31 PM

By: P. Radomski | July 5, 2022

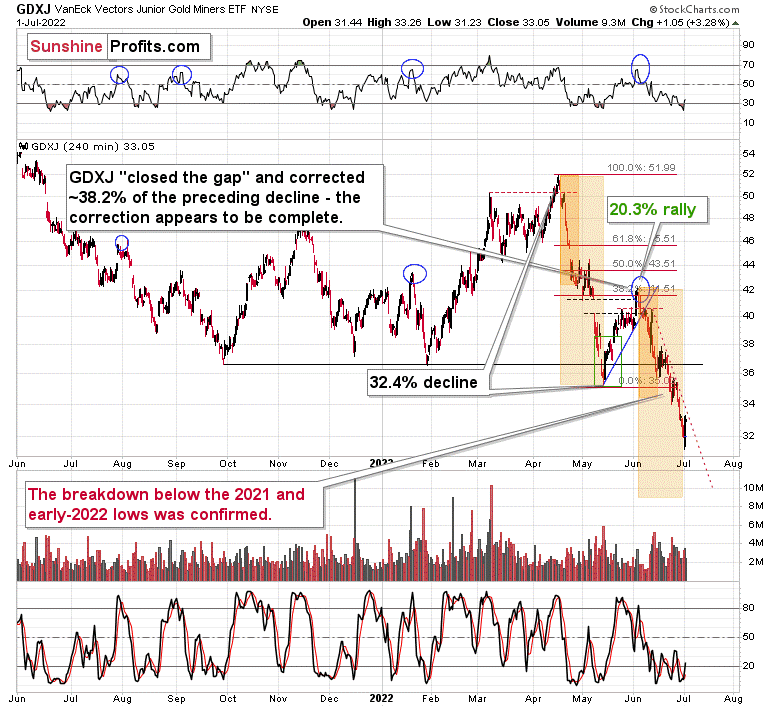

Mining stocks moved higher on Friday, and you might be wondering if this was anything more than a daily breather – so let’s start today’s analysis with the GDXJ ETF.

In short, so far, we haven’t seen a good indication that the rally is anything more than a normal daily rebound. Even the very sharp declining, red, dashed resistance line remains unbroken.

Consequently, the trend remains down.

Now, the bigger of the orange rectangles that you see on the above chart just ended, which means that, based on the time analogy to the April-May decline, we might see a bigger corrective upswing shortly. However, it’s not very likely that this is going to be the case. The reason is that this time the decline was visibly smaller than it was before, and thus the GDXJ is not as severely oversold.

Additionally, there are good reasons (like the situation in the USD Index) to think that the precious metals sector is about to move much lower instead of rallying. I covered many of them in Friday’s flagship Gold & Silver Trading Alert.

So, won’t there be any corrective upswing this time? Well, based on Friday’s 3% upswing, it’s obvious that we already saw one, and based on the following chart, it seems that even seeing an additional small upswing would be a part of a bigger bearish pattern.

The GDXJ is after a breakdown below the head and shoulders formation, which is a very bearish fact for the following weeks. However, on a very short-term basis, it’s important to remember that breakdowns below those formations tend to be followed by a corrective rally back (or almost back) to the previously broken neck level.

That’s exactly what we saw on Friday, and if we see a move even closer to the neck level, it won’t make the situation bullish – it’s all part of a big, bearish pattern with a downside target slightly below $24.

Moreover, please keep in mind that despite Friday’s small upswing, the GDXJ just closed the week at the lowest level since the first half of 2020.

Amazingly bearish, isn’t it? So much money has been printed in the last 2 years, and there’s a war in Europe, yet junior miners are trading at lower levels.

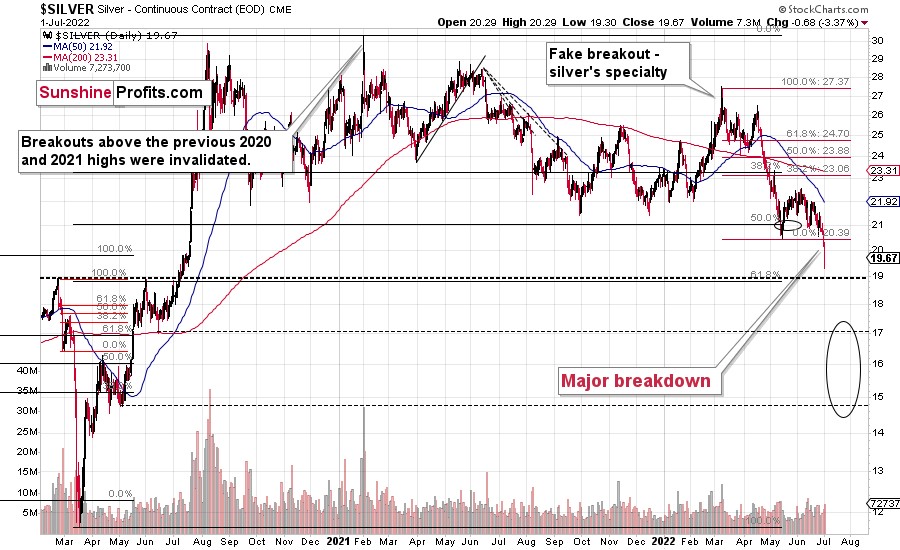

Speaking of weakness and major breakdowns, here’s what silver did recently.

The white metal corrected part of its decline, but it still ended $0.68 lower on Friday, which was the lowest daily and weekly close since mid-2020. This is profoundly bearish.

Remember when everyone and their brother thought that silver was about to soar to the moon in early 2021? When (with silver close to $30) I warned that while I agree that it’s eventually likely to do it, it’s very unlikely to happen without a bigger decline first?

While silver might correct this breakdown and move back to $20.5 or so, it’s quite likely that the breakdown will hold.

The real bearish fireworks are likely to start once gold breaks below its own head and shoulders pattern, though.

Gold touched the neck level based on the previous lows on Friday (July 1), but it didn’t break below it. Once it does, it’s likely to fall significantly. The target based on the formation is about $1,540. However, since we have a strong support area close to the 2021 lows, I think that seeing an interim bottom close to them is a likely outcome.

If only there was some kind of trigger that could push gold prices lower and make them complete the H&S formation.

Oh wait, there is one – a major one.

The USD Index is trading very close to the 105 level, and while it didn’t manage to break to new highs on Friday, its persistence is quite clear. It only has to confirm the breakout once for the bullish floodgates to be opened.

Given the rising real interest rates in the U.S. that are rising at a faster pace than the ones in the Eurozone, it seems that the USDX will continue to move to higher levels in the following weeks and months.

Therefore, it seems that the breakout and its confirmation are just a matter of time, and given that the corrective downswings after the attempts to break above the 105 level are getting smaller and smaller, it’s likely that we won’t have to wait too long for the USDX to show this material strength.

This, in turn, means that gold would be likely to break below its head and shoulders pattern, and junior miners would be likely to continue their massive slide after a brief correction. While I can’t promise any kind of performance, it seems that the profits on our short positions in junior miners are likely to increase even more.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is over, and the decline will now continue.

As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

1. rising real interest rates,

2. rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent GDX News

- YieldMax GDXY Name Change • GlobeNewswire Inc. • 01/25/2024 04:22:00 PM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM