| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Sunday, July 03, 2022 9:48:11 AM

By: Jordan Roy-Byrne | July 3, 2022

Gold stocks have broken down technically, but they are extremely oversold.

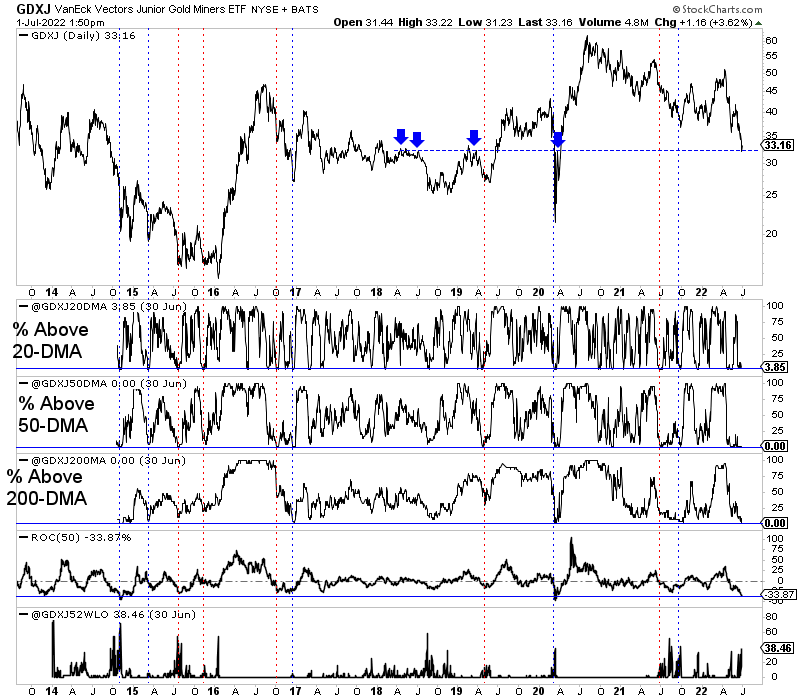

Let’s start with GDXJ, which is rebounding today after testing support at $32.

The chart below plots GDXJ along with four breadth indicators, including new 52-week lows and a 50-day rate of change. The blue lines mark where the percentage of GDXJ stocks above all the moving averages is similar, and the red lines mark where the percentage of GDXJ stocks above only the 20-day and 50-day moving averages are identical.

GDXJ is arguably the most oversold or the second most oversold (Covid crash) in the last six years. When the market is this oversold, it typically enjoys, at worst, a decent rebound.

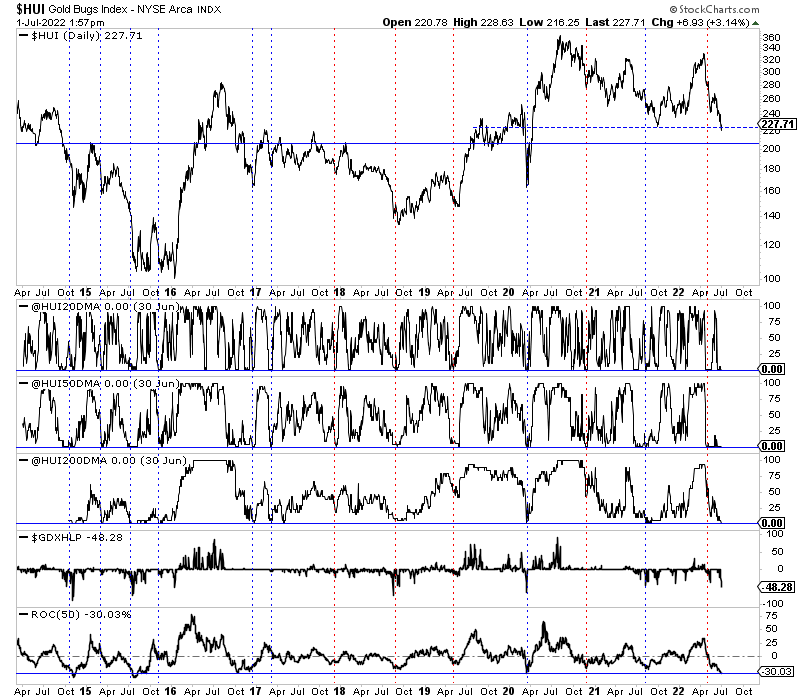

Meanwhile, the HUI Gold Bugs Index looks similar. It traded as low as 216 Friday, which is less than 5% from strong support.

No HUI stocks are trading above the 20-day, 50-day, and 200-day moving averages, and yesterday 48% of GDX stocks (all HUI stocks are in GDX) made a new 52-week low. In the last six years, the only time new 52-week lows spiked that high were at the 2018 and 2020 (Covid crash) bottoms.

The macro is also lining up in Gold’s favor as the 2-year yield plunged to as low as 2.72% this morning, inflation expectations have rolled over, and the Atlanta Fed model shows we are in a recession. The market is now aggressively pricing in rate cuts in 2023.

Later this month, the Fed will likely take rates up to 2.50% to 2.75%. Should the 2-year yield and inflation expectations continue to fall, this will certainly be the Fed’s final rate hike. It makes sense that precious metals would bottom right before the last rate hike.

Now is the time to be a buyer of weakness.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent GDX News

- YieldMax GDXY Name Change • GlobeNewswire Inc. • 01/25/2024 04:22:00 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM