| Followers | 686 |

| Posts | 142276 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Monday, June 13, 2022 12:34:35 PM

By: P. Radomski | June 13, 2022

In the Extra Gold & Silver Trading Alert that I sent over the weekend, I explained why Friday’s upswing was most likely unsustainable. We didn’t have to wait long for the market to agree with me.

In today’s pre-market trading, gold, silver, and stocks are down substantially, while the USD Index is up. Let’s take a closer look.

Gold declined 1% so far today and while it didn’t erase the entire Friday’s rally, it declined most of it and – most importantly – it already invalidated Friday’s attempt to break above the 38.2% Fibonacci retracement.

In the case of the silver market, Friday’s rally is barely visible. The reversal appeared notable, but silver is already back down in today’s pre-market trading, so it seems that even the short-term trend remains down.

At the time of writing these words, the stock market (the S&P 500 futures) is already trading at new 2022 lows. Silver and mining stocks (especially junior miners) are closely linked to the performance of stocks in the short term, so it seems that when gold finally declines, silver and miners will be affected and decline even more. That’s very much in tune with my previous expectations.

On May 21, 2022 (based on May 20 close), I wrote the following:

If history rhymes – as it usually tends to – we’re likely to see higher stock market values in the next 1-3 days. That’s likely to support higher junior mining stock prices.

Also, let’s not forget about the forest while looking at the trees. Yesterday’s intraday low in the S&P 500 was 3810.32, which was just about 5 index points below my initial target for this short-term decline at the 38.2% Fibonacci retracement based on the entire 2020 – 2022 rally.

This means that the odds of a short-term rally in stocks have greatly increased.

That was the bottom, and we have indeed seen a short-term corrective upswing since then. However, this correction appears to be over – stocks have just moved to new lows. Given that they already corrected after first approaching the 38.2% Fibonacci retracement based on the 2020 – 2022 rally – they can now break through this level without looking back. This would be particularly bearish for silver and mining stocks (especially junior mining stocks).

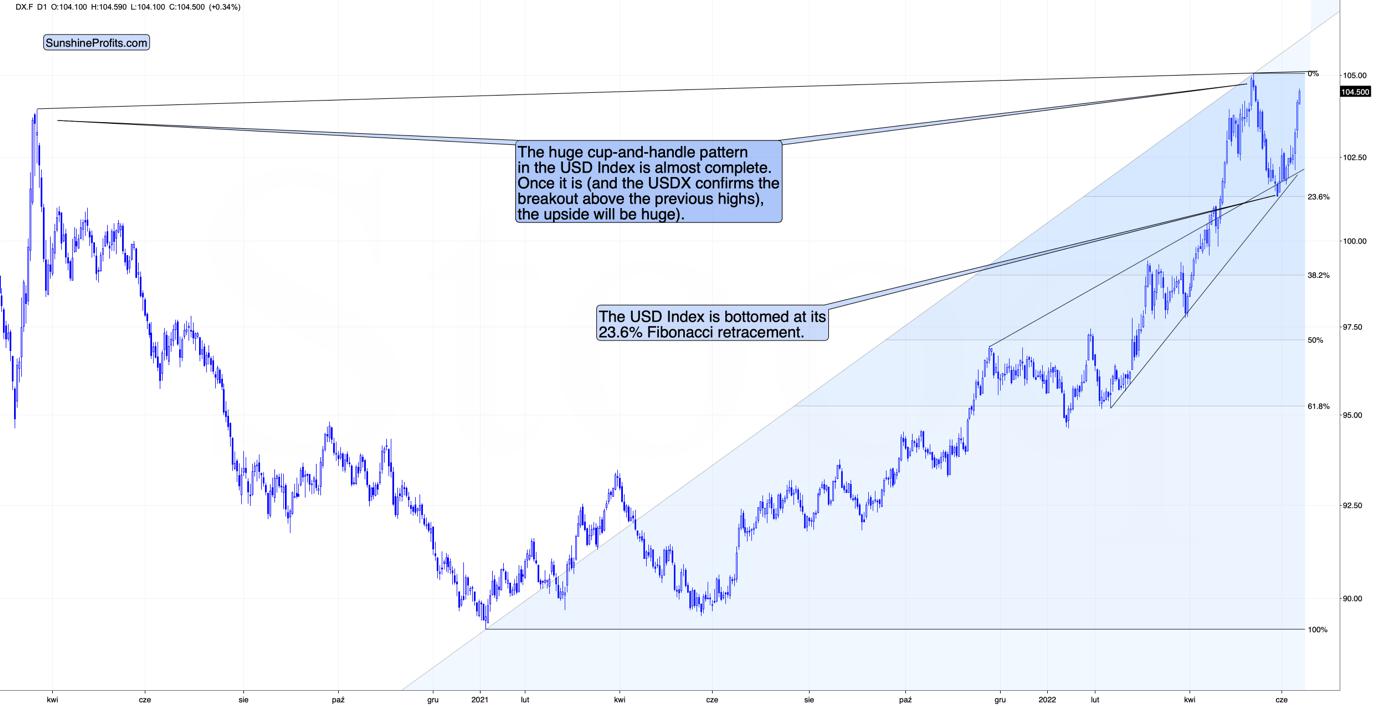

On top of that, we see a soaring USD Index, which is about to move to (and likely above) its previous highs.

The key detail about the following rally is that it will mean the completion of a broad cup-and-handle pattern. This means that after the breakout, the USD Index would be likely to continue rallying in the medium run, and yes, this means that the following rally could be huge. This is in perfect tune with what I’ve been expecting to see for many months – including the beginning of 2021, when almost everyone was bearish on the U.S. currency.

What about junior miners?

On Friday, they rallied in a quite emotional manner, just as gold did. Unlike gold, however, they didn’t move to new short-term highs. They just corrected to their previous highs, and even though Friday’s rally was much bigger than what we saw in early April, these rallies ended at similar levels – close to previous highs. I marked it with red, dashed lines.

Friday’s rally changes nothing with regard to the medium-term trends, and the overnight price changes that I discussed above support the theory in which junior miners head much lower in the following weeks (and probably days).

On a side note, do you know what appears to be a currency but doesn’t pay any interest, and doesn’t have thousands of years of history to back up its use? Cryptos. Do you know what just broke to new lows? Also cryptos, and as the interest rates on fiat currencies continue to increase, the pressure to sell cryptos will also increase. Please keep in mind that I called the top in bitcoin when it moved to $50k – it was not 100% precise, but given that it’s currently worth less than half of that, it seems that it was a quite good exit point.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent GDX News

- YieldMax GDXY Name Change • GlobeNewswire Inc. • 01/25/2024 04:22:00 PM

- Surging S&P 500 Breadth • ValueWalk • 07/19/2023 03:16:37 PM

- S&P 500 Corrects In Breadth • ValueWalk • 07/18/2023 03:08:49 PM

- If The USDX Fell So Much, Why Didn’t Gold Truly Soar? • ValueWalk • 07/17/2023 05:16:20 PM

- USD’s Decline That’s… Bearish For Gold?! • ValueWalk • 07/12/2023 02:38:08 PM

- S&P 500 Late Day Reversal Worry • ValueWalk • 07/10/2023 03:17:34 PM

- Massive Gaming Celebrates Global Launch of House of Blackjack with USDC Earning Race • ValueWalk • 07/10/2023 02:44:17 PM

- Breathers In Mining Stocks Are Not Real Rallies • ValueWalk • 07/06/2023 05:20:55 PM

- S&P 500 Character Changes • ValueWalk • 07/06/2023 03:10:06 PM

- S&P 500 – As Bullish As It Gets • ValueWalk • 07/03/2023 04:01:21 PM

- The Great Gold Migration: How Asia Is Dominating The Global Gold Landscape • ValueWalk • 06/30/2023 05:07:35 PM

- S&P 500 Dip Buying And Tame PCE • ValueWalk • 06/30/2023 03:34:13 PM

- The Bullish Reversal In Gold Is Coming • ValueWalk • 06/29/2023 04:00:44 PM

- Insufficient S&P 500 Rotations • ValueWalk • 06/27/2023 02:41:42 PM

FEATURED POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM

ECGI Holdings Targets $9.7 Billion Equestrian Apparel Market with Allon Brand Launch • ECGI • Jun 25, 2024 8:36 AM

Avant Technologies Addresses Progress on AI Supercomputer-Driven Data Centers • AVAI • Jun 25, 2024 8:00 AM

Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • GRLF • Jun 24, 2024 8:30 AM