Monday, January 24, 2022 8:03:18 AM

Oil Producer $AGYP is ready for a SHORT SQUEEZE! While oil is soaring above $85 per barrel the $AGYP oil pumps are working and producing!

$AGYP is a newly producing OTC OIL company trading well below a dollar that has great potential to attract the masses as reports of more new wells located at $AGYP lease sites begin producing more oil. We now have proof based on press and the Texas Railroad website that $AGYP successfully began SELLING THEIR OIL in Q4 of 2021. While other OTC oil companies try and drum up support by bragging about vast resources supposedly in the ground on their lease site, $AGYP is actually pumping OIL ABOVE THE GROUND and then SELLING IT.

But the best part is not that $AGYP is producing oil. The best part is that there is a SHORT the size of TEXAS deeply entrenched in the stock. $AGYP truly could be the the absolute perfect storm for a massive multi-week and multi-bagger gainer once the bulls force the short here to cover! Consider some of these powerful indicators and data that demonstrate OTC is being shorted daily.

The OBV and accum/dist lines tell a compelling story. $AGYP Longs know that $AGYP share structure has been rock solid and stable over the past year. When accum/dist and OBV goes up on a stock with a stable float and the price per share doesn't move significantly higher along with those indicators...the answer is the STOCK IS BEING SHORTED.

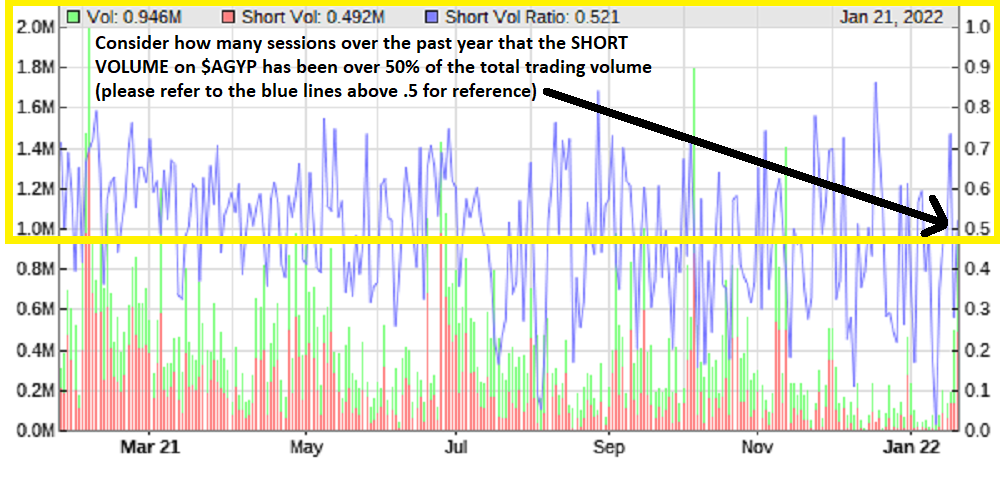

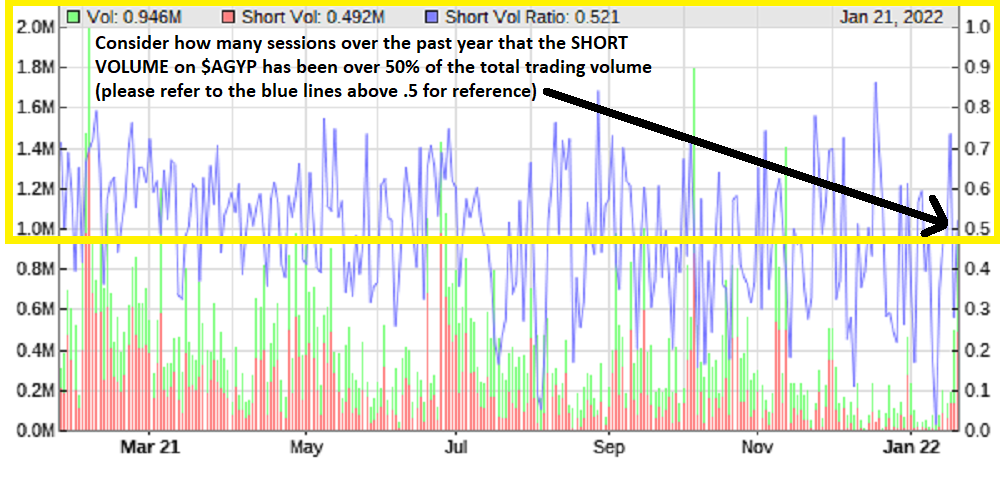

Personally I've never seen any stock under such consistent shortselling pressure for so many months. It is my personal opinion that over the past 10 months of trading there seems to have been anywhere from TEN to TWENTY MILLION shares sold SHORT into the market. These are NOT REAL SHARES and NEED TO BE COVERED. Need more convnicing? Look at this RegSho data compiled by shortvolume.com and charted for a quick visual:

FROM: https://shortvolume.com/?t=agyp

The average daily short volume over the past year of trading sessions in $AGYP is just over 50% short volume PER DAY! This means the short is accounting for over HALF THE DAILY VOLUME on a regular basis! Not only that but it's almost always the days where there's significant TOTAL volume that the short volume is well above 50%.

Look at another site that compiles RegSho short data https://otcshortreport.com/company/AGYP. Have you ever seen daily short volume reach the 60%, 70% and even 80% daily percent levels? That is criminally high shorting! Bulls can force this short to cover in a way that blows up his account. He's dug in deep like a tick, but the technicals on $AGYP show smart traders it is a pressure cooker ready to squeeze the shorts! I can easily see $AGYP going to $2+ on a squeeze! When it does squeeze it won't be a one day event. It'll be a full on raging bull party for weeks and weeks.

The shortseller in $AGYP primarily uses PUMA and/or CFGN to do his dirty work but also has placed unusual sized blocks of stock through other MMs in order to make Level 2 look thicker and less bullish. It's a dirty dirty game that several offshore brokers are willing to participate in, unfortunately. Sometimes, they get nabbed like broker BTIG did while they were logging short trades as either LONG or SHORT EXEMPT: https://www.sec.gov/litigation/litreleases/2021/lr25092.htm

The problem facing shorts on $AGYP now is that $AGYP is a proven oil producer. $AGYP did what they said they would do and now they are doing more of it. All while oil is reaching new 7 year highs. As I perform more due diligence for $AGYP this morning the oil market is showing crude oil at prices above $85 per barrel!

$100 Oil is coming and the smart money is writing about it daily now!

Oil prices will surge to $100 this year, Goldman Sachs warns https://www.msn.com/en-us/money/markets/oil-prices-will-surge-to-24100-this-year-goldman-sachs-warns/ar-AASTCSk

Why Biden Can’t Put A Cap On Oil Prices https://finance.yahoo.com/news/why-biden-t-put-cap-220000485.html

OPEC’s Shrinking Capacity Could Send Oil Above $100 https://oilprice.com/Energy/Oil-Prices/OPECs-Shrinking-Capacity-Could-Send-Oil-Above-100.html

The Last Three $AGYP Press Releases show strong business development within this blazing hot industry sector:

Allied Energy Corporation Reviews 2021 Oil Leases Progress to Production and Provides 2022 Outlook https://finance.yahoo.com/news/allied-energy-corporation-reviews-2021-133000251.html

Allied Energy Corporation Outlines Current Activities at the Prometheus Lease https://finance.yahoo.com/news/allied-energy-corporation-outlines-current-133000236.html

Allied Energy Corporation Provides Updates on the Gilmer Lease Projects https://finance.yahoo.com/news/allied-energy-corporation-provides-updates-143000558.html

Consider the following quote from $AGYP CEO and think about where he's going to take this company in 2022

$AGYP is definitely in the right sector at the right time! Imagine if oil goes back to the $100 range as some experts predict it does under the Biden administration.

MANY CONVINCED $AGYP BULLS have already realized that there is a short in $AGYP and have been quietly accumulating the past few weeks awaiting the inevitable squeeze. They are keeping the pressure on the short daily and are waiting for just the right time to unleash the bullish kraken and incite a MOASS! I think this ticker will see dollars in 2022. There are many AGYP market bulls. There are entire rooms dedicated to shortsqueezing $AGYP.

Watch the chart for a continued bullish UPTREND and a near-term RUN above summer highs (.83). The short will crack as $AGYP pumps more oil and energy investors discover this ticker. $AGYP Closed solidly above the 50 day on strong volume Friday. Now bulls need to take $AGYP above the 200 day moving average which is right around .35. Once broken the 200 day will become NEW SUPPORT.

$AGYP is a newly producing OTC OIL company trading well below a dollar that has great potential to attract the masses as reports of more new wells located at $AGYP lease sites begin producing more oil. We now have proof based on press and the Texas Railroad website that $AGYP successfully began SELLING THEIR OIL in Q4 of 2021. While other OTC oil companies try and drum up support by bragging about vast resources supposedly in the ground on their lease site, $AGYP is actually pumping OIL ABOVE THE GROUND and then SELLING IT.

But the best part is not that $AGYP is producing oil. The best part is that there is a SHORT the size of TEXAS deeply entrenched in the stock. $AGYP truly could be the the absolute perfect storm for a massive multi-week and multi-bagger gainer once the bulls force the short here to cover! Consider some of these powerful indicators and data that demonstrate OTC is being shorted daily.

The OBV and accum/dist lines tell a compelling story. $AGYP Longs know that $AGYP share structure has been rock solid and stable over the past year. When accum/dist and OBV goes up on a stock with a stable float and the price per share doesn't move significantly higher along with those indicators...the answer is the STOCK IS BEING SHORTED.

Personally I've never seen any stock under such consistent shortselling pressure for so many months. It is my personal opinion that over the past 10 months of trading there seems to have been anywhere from TEN to TWENTY MILLION shares sold SHORT into the market. These are NOT REAL SHARES and NEED TO BE COVERED. Need more convnicing? Look at this RegSho data compiled by shortvolume.com and charted for a quick visual:

FROM: https://shortvolume.com/?t=agyp

The average daily short volume over the past year of trading sessions in $AGYP is just over 50% short volume PER DAY! This means the short is accounting for over HALF THE DAILY VOLUME on a regular basis! Not only that but it's almost always the days where there's significant TOTAL volume that the short volume is well above 50%.

Look at another site that compiles RegSho short data https://otcshortreport.com/company/AGYP. Have you ever seen daily short volume reach the 60%, 70% and even 80% daily percent levels? That is criminally high shorting! Bulls can force this short to cover in a way that blows up his account. He's dug in deep like a tick, but the technicals on $AGYP show smart traders it is a pressure cooker ready to squeeze the shorts! I can easily see $AGYP going to $2+ on a squeeze! When it does squeeze it won't be a one day event. It'll be a full on raging bull party for weeks and weeks.

The shortseller in $AGYP primarily uses PUMA and/or CFGN to do his dirty work but also has placed unusual sized blocks of stock through other MMs in order to make Level 2 look thicker and less bullish. It's a dirty dirty game that several offshore brokers are willing to participate in, unfortunately. Sometimes, they get nabbed like broker BTIG did while they were logging short trades as either LONG or SHORT EXEMPT: https://www.sec.gov/litigation/litreleases/2021/lr25092.htm

The problem facing shorts on $AGYP now is that $AGYP is a proven oil producer. $AGYP did what they said they would do and now they are doing more of it. All while oil is reaching new 7 year highs. As I perform more due diligence for $AGYP this morning the oil market is showing crude oil at prices above $85 per barrel!

$100 Oil is coming and the smart money is writing about it daily now!

Oil prices will surge to $100 this year, Goldman Sachs warns https://www.msn.com/en-us/money/markets/oil-prices-will-surge-to-24100-this-year-goldman-sachs-warns/ar-AASTCSk

Why Biden Can’t Put A Cap On Oil Prices https://finance.yahoo.com/news/why-biden-t-put-cap-220000485.html

OPEC’s Shrinking Capacity Could Send Oil Above $100 https://oilprice.com/Energy/Oil-Prices/OPECs-Shrinking-Capacity-Could-Send-Oil-Above-100.html

The Last Three $AGYP Press Releases show strong business development within this blazing hot industry sector:

Allied Energy Corporation Reviews 2021 Oil Leases Progress to Production and Provides 2022 Outlook https://finance.yahoo.com/news/allied-energy-corporation-reviews-2021-133000251.html

Allied Energy Corporation Outlines Current Activities at the Prometheus Lease https://finance.yahoo.com/news/allied-energy-corporation-outlines-current-133000236.html

Allied Energy Corporation Provides Updates on the Gilmer Lease Projects https://finance.yahoo.com/news/allied-energy-corporation-provides-updates-143000558.html

Consider the following quote from $AGYP CEO and think about where he's going to take this company in 2022

$AGYP is definitely in the right sector at the right time! Imagine if oil goes back to the $100 range as some experts predict it does under the Biden administration.

MANY CONVINCED $AGYP BULLS have already realized that there is a short in $AGYP and have been quietly accumulating the past few weeks awaiting the inevitable squeeze. They are keeping the pressure on the short daily and are waiting for just the right time to unleash the bullish kraken and incite a MOASS! I think this ticker will see dollars in 2022. There are many AGYP market bulls. There are entire rooms dedicated to shortsqueezing $AGYP.

Watch the chart for a continued bullish UPTREND and a near-term RUN above summer highs (.83). The short will crack as $AGYP pumps more oil and energy investors discover this ticker. $AGYP Closed solidly above the 50 day on strong volume Friday. Now bulls need to take $AGYP above the 200 day moving average which is right around .35. Once broken the 200 day will become NEW SUPPORT.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.