| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Wednesday, January 12, 2022 9:34:00 PM

By: Mish Schneider | January 12, 2022

Everyone knows inflation is on the rise and, with the latest year-over-year inflation numbers up 7%, investors are finally getting the picture that market growth has challenges ahead. Now they are searching for the next areas to trade given the market's unfolding dilemma, with rates looking to increase and a possible rangebound market. Having said that, interest has grown in precious metals, bringing the potential for a huge move this year if the momentum continues.

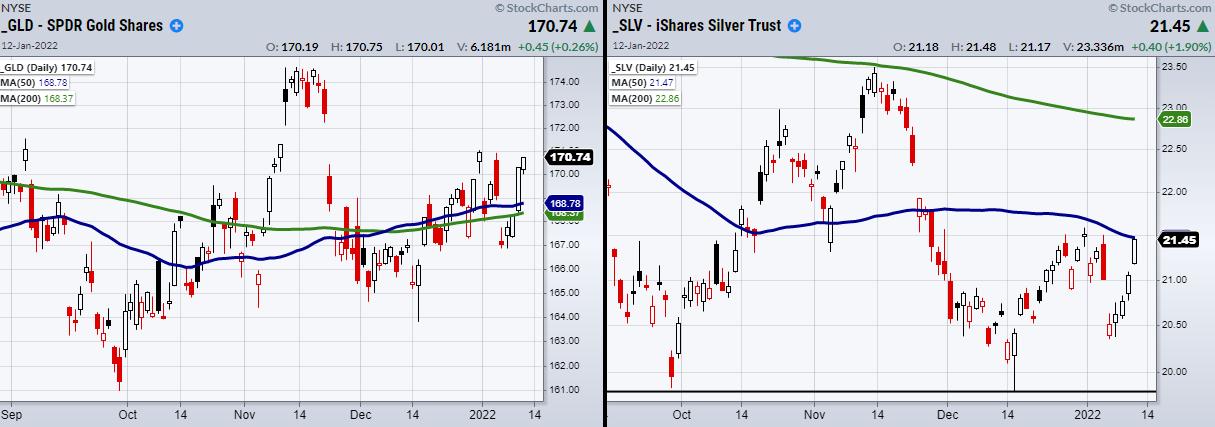

Looking at the chart of Silver (SLV), we can see sporadic price action going back through 2021. However, the most recent low at $19.80 shows a double bottom pattern. This can be viewed as the main support area SLV needs to hold going forward. With that said, SLV is now looking to clear its 50-day moving average at $21.47. While it has cleared above this major moving average in the past, the narrative for inflation has changed, which is why SLV is finding new buying interest.

Gold (GLD) has also gone through a period of sideways trading action and is now looking to hold over its 50- and 200-DMA. Even with interest rate hikes coming through the year, the Fed admitted that inflation was moving at a faster pace than they had originally expected. Therefore, if GLD and SLV can clear and continue to hold over the 50-DMA, this will show that precious metals need to be watched for trade entries.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent GLD News

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 09/09/2024 10:10:25 AM

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 08/20/2024 07:21:15 PM

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 08/20/2024 07:20:31 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/06/2024 06:55:39 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/29/2024 06:46:50 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 05/08/2024 06:11:30 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 02/08/2024 03:33:22 PM

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 01/19/2024 05:18:16 PM

- Crypto: RNDR, LINK, CHZ Emerge as Wednesday’s Top Performers, Ethereum Pilots Dencun Update, and More • IH Market News • 01/17/2024 04:51:44 PM

- Form 424I - • Edgar (US Regulatory) • 12/27/2023 04:04:08 PM

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 12/22/2023 09:02:08 PM

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 11/22/2023 07:49:08 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM