Wednesday, September 15, 2021 3:44:01 PM

Gold prices could double from here -

https://www.livewiremarkets.com/wires/gold-prices-could-double-from-here

There are few advantages to getting older. But one undeniable plus is the perspective it provides. This is particularly important for investors because while market history does not repeat itself it certainly rhymes.

The surge in the gold price this year has been notable, but it is far from unprecedented. Between 2008 and 2011, gold doubled as investors weighed up a sluggish recovery from the financial crisis and the then unfamiliar sight of central banks hosing the markets with cash. The stagflation fears which that combination generated came to nothing, however, and gold soon lost its lustre.

Having doubled over the past five years again, the rise and fall of gold a decade ago provides one template for what might happen next. But it is possibly not the best guide to what could unfold. For those with a longer-term perspective, the key year to understanding where gold goes from here is 1979.

Looking back over the world’s post-war history, that was the pivotal year on so many fronts and it is no coincidence that it was the last time that the gold price went into the stratosphere.

Before we go back to my O-level year, however, it’s worth looking at the short-term reasons why gold is rising. They are important, even if they only tell part of the story.

The first reason for gold’s rise is the recent weakness in the dollar as investors focus on the prospect of lower growth in the US. A lower dollar is good news for the gold price because it reduces the cost of the metal to buyers around the world, who need fewer pounds, yen or euros to buy the same weight of bullion.

The knock-on impact of the economic fragility that is undermining the dollar is lower interest rates and bond yields. These, too, support the gold price because they reduce the opportunity cost of holding a non-income-generating asset like gold. When you can earn a decent income from relatively safe financial assets like bonds or even a deposit account, gold is less attractive. If the alternatives are also yield-free, then gold looks a lot more interesting.

And it is not just the absolute level of alternative income streams that matters. If the perception increases that inflation is back on the radar, then the real, price-adjusted value of a bond’s coupon, is reduced yet further. It might, as now, even turn negative, making gold’s zero return look positively generous. Now, clearly, inflation is not a problem today, but the measures employed by governments and central banks to support economies through the pandemic are a step into the unknown.

Inflation could well be a big problem tomorrow.

These factors explain the performance of gold to date. They probably do not provide a reason for it to continue rising. Indeed, for that to happen we would need to see a move further into negative territory for real bond yields. And that would require either higher inflation or lower growth or both. It is possible, but so too is a repeat of the 2011 scenario in which inflation fails to show up and growth bounces back. That would be a recipe for a sharp retrenchment in the gold price from here.

To make the case for a materially higher gold price from today’s elevated level, you need to go back to that critical year, 1979. And while it isn’t necessary to go fully down the ‘guns and tinned goods in the backwoods of Idaho’ path, you do need to entertain the idea that the events of 2016 to 2020, Brexit to Trump to Covid-19, actually change everything.

Between December 1978 and January 1980, the price of gold more than quadrupled from under $200 an ounce to over $800. This is the equivalent of a rise from the $1,200 an ounce at which gold traded last September to around $5,000. Agonising about whether you have missed the gold and silver boat at today’s record high of just over $2,000 will seem ludicrous if we get a re-run of 1979’s flight to safety.

It is not too hard to see why investors were so unsettled in 1979. The election of Margaret Thatcher in Britain and the appointment of Paul Volcker as chairman of the Federal Reserve that year marked a sea-change in the post-war consensus about how to manage the global economy. The modest rise in the Dow on the day that Volcker arrived at the Fed was greeted by one prescient commentator at the time as ‘like throwing a party to celebrate the arrival of your executioner’. Actually, he turned out to be a kind of saviour, but that is another story.

And 1979 was not just a transatlantic or macro-economic turning point. Kim Ghattas’s magnificent history of the Saudi-Iranian rivalry that has shaped the modern world, Black Wave, points to 1979 as being the watershed year, with the Iranian revolution, the siege of the Holy Mosque in Mecca by Saudi zealots and the Soviet invasion of Afghanistan sowing the seeds of 40 years and counting of misery in the Middle East. 1979 laid the foundations for today’s geo-politics.

Is 2020 the new 1979? It is, of course, a different situation but the scale of change unleashed by the emergence of a new economic cold war between the US and China, the rise over the past four years of anti-globalist populism all over the world, and the complete re-shaping of how we lead our lives and pay for the new social contract in the wake of the Covid-19 pandemic mark this year as its rival in significance.

I do not know whether gold halves or doubles from here, but I suspect it will be one or the other. And given the higher probability I would assign to the latter, I am happy to have a small proportion of a well-diversified portfolio sheltered in this traditional port in the storm.

*References made to dollars are US dollars unless otherwise stated.

Keep up to date with our latest markets insights

Get our Livewire posts delivered straight to your inbox by clicking 'follow' below.

$Pierre Lassonde: 1:1 Dow to Gold Ratio - $25,000 Gold Coming

22,126 views - May 31, 2021

https://youtu.be/XyroIjmQi_I

$John Paulson on Why Gold Goes Parabolic

8,156 views Aug 30, 2021

https://www.youtube.com/watch?v=U7cYaoONWv0

$Mining Newsflash with Gran Colombia Gold and MAG Silver

Aug 19, 2021

Swiss Resource Capital AG

20.9K subscribers

https://www.youtube.com/watch?v=GGPcpvJNCek&t=3s

$Gran Colombia Announces Second Quarter and First Half 2021 Results

August 12, 2021

https://grancolombiagold.com/news-and-investors/press-releases/press-releases-details/2021/Gran-Colombia-Announces-Second-Quarter-and-First-Half-2021-Results/default.aspx

TORONTO, Aug. 12, 2021 (GLOBE NEWSWIRE) --

$Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) announced today

the release of its unaudited interim condensed consolidated financial

statements and accompanying management’s discussion and analysis (MD&A)

for the three and six months ended June 30, 2021.

All financial figures contained herein are expressed in U.S. dollars

(“USD”) unless otherwise noted.

Second Quarter and First Half 2021 Highlights

Gran Colombia has completed a major step forward in its strategy to grow through diversification, completing the acquisition on June 4, 2021 of all the shares of Gold X Mining Corp (“Gold X”) it did not already own and then closing a $300 million offering on August 9, 2021 of 6.875% Senior Unsecured Notes due 2026 (the “2026 Notes”) to fund the development of the Toroparu Project in Guyana, to prepay the remaining $18.0 million balance of its Gold Notes and for general corporate purposes. The Company is nearing completion of an updated preliminary economic assessment (“PEA”) for the Toroparu Project incorporating the recently announced high-grade results from the 2020-2021 drilling program undertaken by Gold X.

The Company added a 27% equity interest in Denarius Silver Corp. (“Denarius”) to its portfolio in the first half of 2021, giving it exposure to the Lomero-Poyatos polymetallic deposit located in Spain, in close proximity to the Matsa JV project in the Iberian Pyrite Belt, and to the Guia Antigua and Zancudo Projects in Colombia.

In February 2021, Gran Colombia also successfully brought its spin out of the Marmato Mining Assets to a conclusion, one in which the Company has a continuing equity ownership of 44% in Aris Gold Corporation (“Aris”). The Marmato operating and financial results are only consolidated up to February 4, 2021 and thereafter the Company equity accounts for its investment in Aris.

Gran Colombia published its inaugural sustainability report in June 2021. The report reflects a focused effort on measuring and disclosing the Company’s Environmental, Social and Governance (“ESG”) priorities and performance moving forward. The Company remains committed to the health and safety of its employees, and through COMFAMA Colombia, was the first mining company in Antioquia to secure vaccines for employees and their families. Gran Colombia has purchased 8,000 vaccines (16,000 doses), created educational vaccine campaigns, and has administered over 5,000 first doses with second doses beginning mid-August.

Gran Colombia’s gold production from its Segovia Operations totaled 52,198 ounces in the second quarter of 2021 compared with 44,377 ounces in the second quarter of 2020. Total gold production from Segovia for the first half of 2021 amounted to 101,256 ounces compared with 94,723 ounces in the first half last year. In July 2021, Segovia’s gold production, which reflected the impact of a planned four-day maintenance shutdown at the plant, was 15,258 ounces. This brings the Company’s trailing 12-months total gold production from its Segovia Operations at the end of July 2021 to 201,688 ounces, up 3% over 2020. The Company remains on track with its annual production guidance of 200,000 to 220,000 ounces of gold from Segovia in 2021. Including Marmato production up to February 4, 2021, consolidated gold production for the first half of 2021 was 103,684 ounces compared with 104,475 ounces in the first half last year.

Consolidated revenue amounted to $96.4 million and $198.3 million in the second quarter and first half of 2021, respectively, up from $77.1 million and $178.1 million in the second quarter and first half, respectively, of 2020. The year-over-year increase in revenue largely reflects an increase in the Company’s realized gold price (1) which averaged $1,805 per ounce sold in the first half of 2021 compared with an average of $1,622 per ounce sold in the first half last year.

At the Segovia Operations, total cash costs(1) averaged $767 per ounce in the second quarter of 2021, compared with $654 per ounce in the second quarter of 2020, bringing the average for the first half of 2021 to $796 per ounce compared with $625 per ounce in the first half last year. The year-over-year increase in Segovia’s total cash cost per ounce in the second quarter and first half of 2021 reflects (i) an increase in contractor and artisanal mining payment rates (which had not changed since 2017) implemented in the third quarter of 2020 in response to the current gold market conditions, (ii) higher spot gold prices which increased production taxes on a per ounce basis and (iii) additional costs to maintain the necessary COVID-19 protocols required to protect the health and safety of Segovia’s workers and the local communities. Including Marmato, consolidated total cash costs were $816 per ounce in the first half of 2021 compared with $686 per ounce in the first half last year.

All-in sustaining costs (“AISC”) (1) per ounce sold for the Segovia Operations were $1,101 and $1,110 in the second quarter and first half, respectively, of 2021 compared with $965 and $890 in the second quarter and first half, respectively, of 2020. The year-over-year increase in Segovia’s AISC in 2021 reflects (i) the increased total cash costs as described above and (ii) an increase in mine development and other sustaining capital expenditures. Sustaining capital expenditures at Segovia amounted to $19.9 million in the first half of 2021, up from $13.0 million in the first half last year which reflected a slowdown in activity in the second quarter of 2020 during the early stages of the COVID-19 national quarantine in Colombia that delayed many of the Company’s initiatives until later in 2020. Including Marmato, consolidated AISC in the first half of 2021 was $1,133 per ounce compared with $954 per ounce in the first half last year.

Adjusted EBITDA (1) amounted to $48.0 million for the second quarter of 2021 compared with $37.6 million in the second quarter last year. This brings the total adjusted EBITDA for the first half of 2021 to $94.3 million, up from $88.0 million in the first half of 2020. The Company’s trailing 12-months adjusted EBITDA at the end of June 2021 stood at $194.1 million compared with $187.8 million in 2020.

Net cash provided by operating activities in the second quarter of 2021 was $12.8 million compared with $7.0 million in the second quarter last year. Operating cash flow in the second quarter each year typically bears the heaviest impact of income tax payments in Colombia which amounted to $49.3 million in the second quarter of 2021, up from $35.3 million in the second quarter last year. For the first half of 2021, net cash provided by operating activities amounted to $26.4 million compared with $38.9 million in the first half last year reflecting the increased level of income tax payments in 2021 and $8.8 million of change of control payments made by Aris related to the Aris Transaction.

Free Cash Flow (1) in the second quarter of 2021, which reflected the increased levels of sustaining capital expenditures and income tax payments this year, was negative $3.0 million compared with negative $3.8 million in the second quarter of 2020. Free Cash Flow for the first half of 2021 was negative $0.5 million compared with $14.1 million in the first half of 2020. The Company’s Free Cash Flow, adjusted to exclude Aris, in the first half of 2021 was $11.8 million compared with $20.1 million in the first half last year, reflecting an increased level of income tax payments and capital expenditures at Segovia in the first half of 2021 compared with the first half last year.

The Company’s balance sheet continued to reflect solid liquidity with total cash of $57.8 million and working capital of $59.3 million at the end of June 2021.

The Company returned a total of $7.6 million to shareholders in the first half of 2021 with payment of its monthly dividends totaling $4.4 million and the repurchase of 702,000 shares at a cost of $3.2 million.

Income from operations in the second quarter of 2021 was $39.6 million, up from $30.4 million in the second quarter last year largely on the strength of higher realized gold prices and higher production volume offset partially by the increase in Segovia’s total cash cost per ounce compared with the second quarter last year. Income from operations in the first half of 2021 amounted to $78.7 million compared with $71.3 million in the first half of 2020 despite including five fewer months of operating results from Marmato due to the loss of control of Aris at the beginning of February 2021. In the first half of 2021, the increase in realized gold prices together with lower G&A and share-based compensation expense more than mitigated the impact of Segovia’s higher cash costs per ounce on income from operations.

The Company reported net income of $29.8 million ($0.41 per share) in the second quarter of 2021 compared with a net loss of $18.6 million ($0.27 per share) in the second quarter of 2020, reflecting the $9.2 million improvement in income from operations as noted above and a gain on financial instruments of $1.5 million in the second quarter of 2021 compared with a loss on financial instruments of $35.4 million in the second quarter of 2020. For the first half of 2021, net income amounted to $148.1 million ($2.31 per share) compared with $5.7 million ($0.13 per share) in the first half last year. Net income in the first half of 2021 reflected the $7.4 million improvement in income from operations as noted above and also benefitted from the $56.9 million gain on loss of control of Aris, the $44.3 million gain on financial instruments (compared with a $18.9 million loss on financial instruments in the first half last year) and the $8.9 million gain on sale of the Zancudo Project. Net income in the first half of 2021 included Aris Transaction costs of $9.8 million while net income in the first half of 2020 included Bluenose RTO Transaction costs of $16.7 million.

Adjusted net income (1) for the second quarter of 2021 was $23.6 million ($0.33 per share) compared with $17.5 million ($0.29 per share) in the second quarter last year. For the first half of 2021, adjusted net income improved to $45.5 million ($0.69 per share) from $38.7 million ($0.66 per share) in the first half last year. The year-over-year improvement in adjusted net income in the second quarter and first half of 2021 largely reflects the factors noted above regarding income from operations partially offset by an increase in income tax expense.

The Company’s ongoing drilling program at Segovia continues to provide encouraging results as announced in press releases dated June 9, 2021 and July 12, 2021. Gran Colombia is carrying out 60,000 meters of drilling at Segovia in 2021 with 40,000 meters dedicated to the ongoing in-mine and near-mine drill program at its four operating mines and the other 20,000 meters is aimed at testing its highest priority brownfield targets on the 24 known veins in its mining title that it is not currently mining.

https://grancolombiagold.com/news-and-investors/press-releases/press-releases-details/2021/Gran-Colombia-Announces-Second-Quarter-and-First-Half-2021-Results/default.aspx

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=165446542

This news release contains "forward-looking information",----Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

For Further Information, Contact:

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

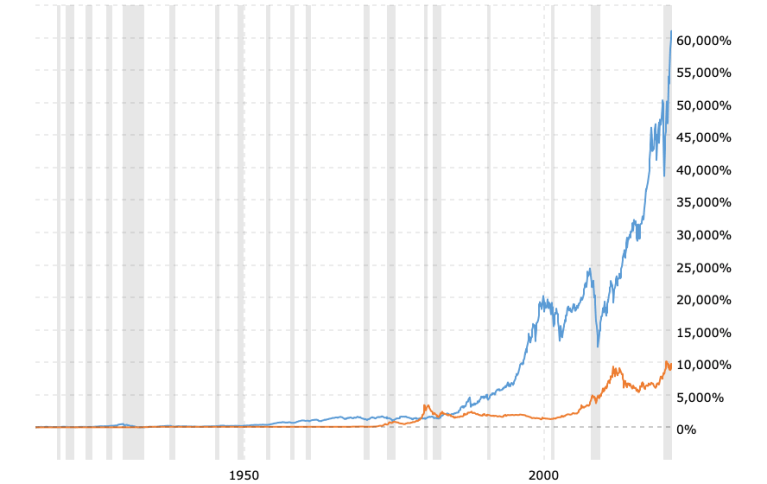

$Gold Price vs Stock Market – 100 Year Chart

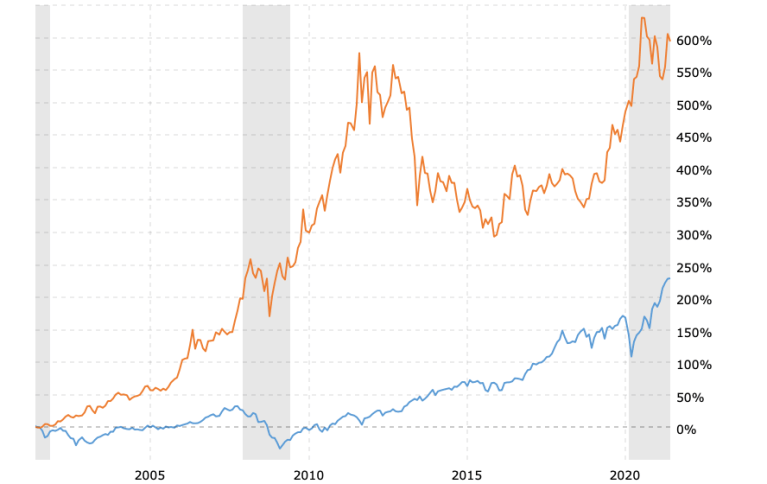

$Gold Price vs Stock Market – 20 Year Chart

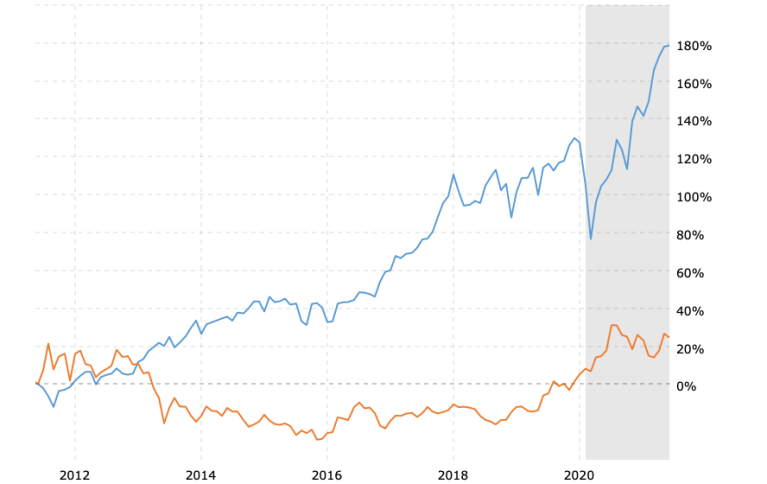

$Gold Price vs Stock Market – 10 Year Chart

$Pierre Lassonde: 1:1 Dow to Gold Ratio - $25,000 Gold Coming

22,126 views•May 31, 2021

https://youtu.be/XyroIjmQi_I

Palisades Gold Radio

70.2K subscribers

Tom welcomes mining legend Pierre Lassonde to the show. Pierre is the Co-

Founder of Franco Nevada and Formerly President of Newmont Mining.

https://www.youtube.com/watch?v=XyroIjmQi_I

$trunkmonk thanks; Aris Gold Announces 10,000 Metre Drill Program At Juby Project, Ontario, Canada

Aris Gold Corp this morning announced that it has begun

planning for a drill program on its Juby Project within

the Abitibi greenstone belt of Ontario.

The program is expected to consist of a total of 10,000 metres of

drilling.

https://thedeepdive.ca/aris-gold-announces-10000-metre-drill-program-at-juby-project/

Aris Gold Corp (TSX: ARIS) this morning announced that it has begun

planning for a drill program on its Juby Project within the Abitibi

greenstone belt of Ontario.

The program is expected to consist of a total of 10,000 metres of

drilling.

The initial drill program is set to begin in the third quarter of 2021,

with the program targeting an extension between the Big Dome and Golden

Lake deposits, while also testing known high grade mineralized zones.

Currently, the project contains a 10 kilometre long strike which

follows the Tyrrell Shear Zone.

Presently, the 14,000 acre Juby property contains a mineral resource

estimate of 773,000 ounces of indicated gold within 21.3 million tonnes

based on an open pit model.

A further 1,488,000 ounces of inferred resource is contain within the

model, within 47.1 million tonnes. The estimate is based on a 0.4 g/t

cut-off, and was established via 105,861 metres of drilling within 379

holes.

Active exploration has not occurred on the property since 2018.

Aris Gold last traded at $2.30 on the TSX.

$Gran Colombia Gold (TPRFF)(GCM:TSE) also owns approximately

44% of Aris Gold Corporation (TSX: ARIS), a Canadian mining company

currently advancing a major expansion and modernization of its

underground mining operations at its

Marmato Project in Colombia.

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

Recent GDX News

- YieldMax GDXY Name Change • GlobeNewswire Inc. • 01/25/2024 04:22:00 PM

- Surging S&P 500 Breadth • ValueWalk • 07/19/2023 03:16:37 PM

- S&P 500 Corrects In Breadth • ValueWalk • 07/18/2023 03:08:49 PM

- If The USDX Fell So Much, Why Didn’t Gold Truly Soar? • ValueWalk • 07/17/2023 05:16:20 PM

- USD’s Decline That’s… Bearish For Gold?! • ValueWalk • 07/12/2023 02:38:08 PM

- S&P 500 Late Day Reversal Worry • ValueWalk • 07/10/2023 03:17:34 PM

- Massive Gaming Celebrates Global Launch of House of Blackjack with USDC Earning Race • ValueWalk • 07/10/2023 02:44:17 PM

- Breathers In Mining Stocks Are Not Real Rallies • ValueWalk • 07/06/2023 05:20:55 PM

- S&P 500 Character Changes • ValueWalk • 07/06/2023 03:10:06 PM

- S&P 500 – As Bullish As It Gets • ValueWalk • 07/03/2023 04:01:21 PM

- The Great Gold Migration: How Asia Is Dominating The Global Gold Landscape • ValueWalk • 06/30/2023 05:07:35 PM

- S&P 500 Dip Buying And Tame PCE • ValueWalk • 06/30/2023 03:34:13 PM

- The Bullish Reversal In Gold Is Coming • ValueWalk • 06/29/2023 04:00:44 PM

- Insufficient S&P 500 Rotations • ValueWalk • 06/27/2023 02:41:42 PM

- Failing S&P 500 Rotations • ValueWalk • 06/23/2023 03:09:19 PM

- Countdown to S&P 500 Downleg • ValueWalk • 06/19/2023 01:49:20 PM

- Now THAT Was The Game-Changer For The Price Of Gold! • ValueWalk • 06/15/2023 04:40:35 PM

- S&P 500 Manages To Recover Initial Decline • ValueWalk • 06/15/2023 03:30:07 PM

- S&P 500 Manages To Recover From Tech-Driven Decline • ValueWalk • 06/15/2023 03:30:07 PM

- S&P 500 Withstands The Initial Selling – No Hike Tomorrow • ValueWalk • 06/13/2023 03:15:19 PM

- Roadmap For Mining Stocks – Courtesy Of The Stock Market • ValueWalk • 06/06/2023 03:17:49 PM

- Stocks To Still Extend S&P 500 Upswing • ValueWalk • 06/05/2023 03:31:02 PM

- AI, Stocks, And Gold Stocks – Connected After All • ValueWalk • 05/31/2023 03:29:15 PM

- Could Gold Miners Finally Stop Sliding?! • ValueWalk • 05/26/2023 08:42:37 PM

- S&P 500 Fine Selling Initiative • ValueWalk • 05/24/2023 03:06:00 PM

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM