| Followers | 679 |

| Posts | 141159 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Saturday, February 20, 2021 11:06:02 PM

By: Financial Times | February 19, 2021

Silver is known as the devil’s metal because of its volatility – a characteristic that many retail investors judged at its cost earlier this month.

As investors crowded into the metal following comments on Reddit’s online forum WallStreetBets, the price of silver climbed 15% in the last week of January to reach its highest level in eight years at $ 30 an ounce.

The demand was so high that almost $ 1 billion was invested in money-backed exchange-traded funds in a single day. Silver coin and bullion retailers from Dallas to Singapore were out of stock.

A new army of retail investors believed they could drive up the price of silver by mimicking similar tactics being deployed against US game retailer GameStop.

For weeks starting in January, a Reddit member called TheHappyHawaiian had posted arguments that the money was ripe for retail investing. “I am convinced [we] can cause a brief squeeze of large-scale money if we actually go there, ”it read.

The articles suggested buying options on the iShares Silver exchange-traded fund, which is physically backed by money held in vaults. The ETF would then have to buy more silver, pushing up the price and squeezing the banks that had bet on falling silver prices.

In total, the word “money” was mentioned 4,571 times between January 28 and February 3 on a WallStreetBets forum, according to an FT study.

“WORLD’S GREATEST SHORT PRESSURE,” announced by one message, turned out to be anything but. Within a week of hitting $ 30, prices had lost all of their gains.

For retail investors, the workings of the market and its history have opposed them.

On the one hand, the silver market is considerably larger than that of a single stock, with an average of $ 29 billion traded daily across multiple locations in New York, Shanghai, and between banks in London.

The daily price of silver is determined by the major investment banks such as HSBC and JPMorgan in the London-based over-the-counter market. In addition to this, speculators, such as hedge funds, also trade on the New York futures market managed by the CME Group and on the Shanghai Futures Exchange.

The posts on Reddit’s WSB forum drew the conclusion that because some of these institutions bet against money in the futures market, they must be short. Few mentioned the possibility that the same institutions are just as likely to have corresponding long positions in the physical metal.

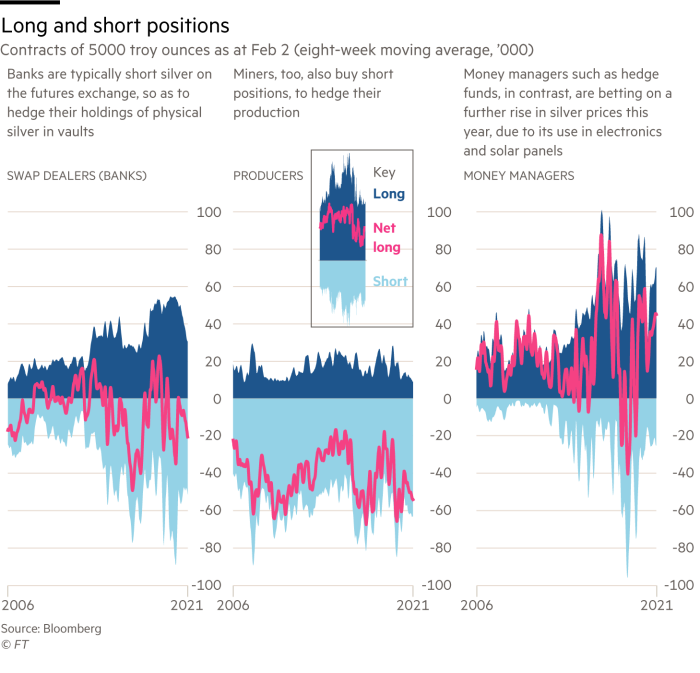

The big bullion banks are traditionally cash-strapped, but that’s to cover their holdings of silver metal in vaults. On the other hand, mining companies tend to buy short positions to reduce their exposure to fluctuations in the prices of metal production.

But overall, CME data on the positions of speculators such as hedge funds indicates that overall, investors are actually long on the money.

Ross Norman, a seasoned precious metals trader, estimated that retail traders collectively lost around $ 250 million in the decline in the price of silver.

“It is the delusional that leads the gullible,” he said. “They were led by a false premise, a story that doesn’t hold water – it’s a children’s crusade. And they enrich the guys they post against.

This has been the delusional leading the gullible. They were led by a false premise, a story that doesn’t hold water – it’s a children’s crusade

The attempt by retail traders to corner the silver market was reminiscent of a similar effort by oil barons William Herbert Hunt and Nelson Bunker Hunt who in 1979-80 bought billions of dollars in metal.

The Hunt brothers held nearly a third of the world’s silver supply through silver futures and pushed the price up more than 700% in three weeks. Most of it was purchased with borrowed money. They were later sanctioned for market manipulation and filed for bankruptcy after the price of silver collapsed in an event dubbed ‘Silver Thursday’.

As a result of the brothers’ attempt, the Comex futures exchange limited the amount of money that could be purchased using leverage. The owner of the exchange, CME, did the exact same thing this month, increasing margins by 18% on silver futures contracts from $ 14,000 to $ 16,500 per contract.

Even in the face of losses, the silver supporters are not discouraged. “We’ve created a new generation of #silver stackers,” wrote Jim Lewis, self-proclaimed retired trader and money bugger. “It’s a huge victory and we will repeat it.”

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM

Moon Equity Holdings, Corp. Announces Acquisition of Wikolo, Inc. • MONI • May 7, 2024 9:48 AM