Saturday, October 10, 2020 2:21:09 PM

I'll Alert you of stocks to Buy,

before the Run happens !

________________________________________________________________

ENZC Security Details

Share Structure

Market Value1...........$38,287,121 a/o Oct 09, 2020

Authorized Shares...3,000,000,000 a/o Sep 30, 2020

Outstanding Shares..2,438,670,097 a/o Sep 30, 2020

Restricted..............767,839,585 a/o Sep 30, 2020

Unrestricted..........1,670,830,512 a/o Sep 30, 2020

Held at DTC...........1,271,629,924 a/o Sep 30, 2020

Float.....................Not Available

Par Value 0.001

https://www.otcmarkets.com/stock/ENZC/security

________________________________________________________________

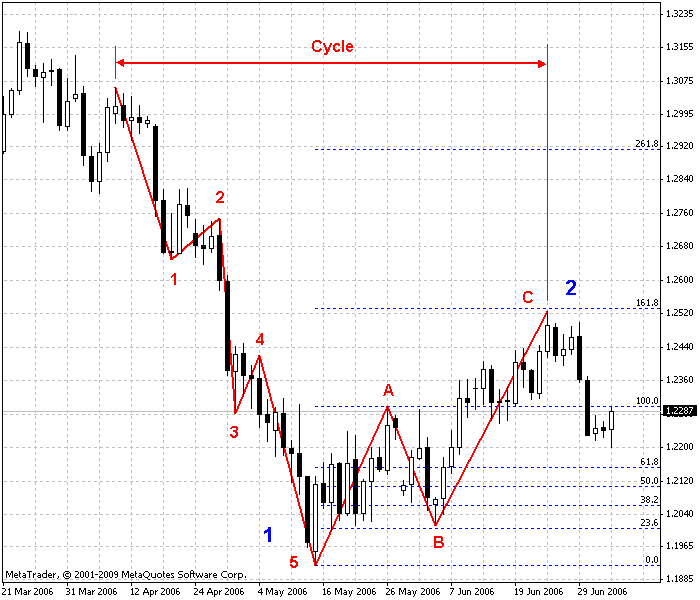

How Targets are Calculated

Fibonacci Numbers and Retrace Targets: Explained

________________________________________________________________

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

Fibonacci Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

_________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

Recent ENZC News

- Small Cap Recipient of Military Drone Technology • InvestorsHub NewsWire • 11/20/2023 01:14:45 PM

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM