Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Excellent!

Thanks Doc. Thanks to everybody else for gathering all the necessary documents.

Here is a link to another James Hicks interview that features Clifton Roberts:

Clifton Roberts Talks The Premise of P4 and the AI Focused Whitepaper Between #Intel and #Enzolytics

LOL.... Chandra just blocked me from AdnexusBiotech on Twitter/X. Well, that's not much of an inconvenience. ![]()

A little deeper search at that same basic location:

https://community.intel.com/t5/Blogs/Intel/Policy-Intel/Empathetic-AI-Unlocks-New-Opportunities-for-Healthcare/post/1333312?wapkw=enzolytics

Apparently, the Intel and Samsung Partnerships were linked from the start, and it also indicates that Samsung brought ENZC/Chandra to Intel, telling him what else he needed to complete is AI model-process.

Had to read over 3 separate related releases to connect the dots.

GLTA

A quick check and I also couldn't find the white paper, although I did find this:

https://community.intel.com/t5/Blogs/Intel/Policy-Intel/Empathetic-AI-Unlocks-New-Opportunities-for-Healthcare/post/1333312?wapkw=enzolytics

The links it contains that are supposed to link to the white paper do not link to the white paper.

Here’s a link to the interview with Hicks:

Hicks Chandra Interview - Enzolytics 2022 FOCUS. UPDATES. EXPECTATIONS. NEXT STEPS

Also, regarding Intel, the white paper with Enzolytics is no longer on their website (or at least I couldn't find it). This is a link directly from Adnexus website mentioning collaboration on the joint paper with Intel:

4. Collaboration with biotechnology companies and veterinary institutions in early drug discovery and development programs, increasing safety, efficacy, and probability of success. A joint paper published with Intel Corporation provides more details regarding this collaboration.

https://www.intel.com/content/www/us/en/healthcare-it/healthcare-overview.html

Clifton Roberts serves as the Global Director for business acceleration, governments, markets and trade at Intel corporation

Nikhil Deshpande is director of security, high performance computing and graph analytics at intel corporation

Link to youtube video of interview:

The Use of Artificial Intelligence for Social Good (James Hicks Intel Chandra interview)

I know Clifton did at least one interview with James about Enzolytics, but there may be more than one.

No, that's a great idea. I don't have that name, never heard the Hicks interview. Very much worth an effort if anyone knows this info. Samsung contacts would be good too.

Has anyone reached out to the Intel employee that appeared in one of the James Hicks interviews with Chandra? I don't remember his name, but he may have information to offer (or he may not). Worst case is that it is a waste of a few minutes touching base with him, and he has nothing to offer.

Yeah, they'll be rigged for silent running until the LOI for Adnexus closes or busts, and/or if the SEC case or ours completes in court or settles out of court.

Until then, probably crickets, less a few rosy proses from Chandra about the state of current medicine and med-tech.

GLTA

Just FYI, the names in our lawsuit will be extending to anyone or any party looking to take those IP's and ownership to market.

GLTA

AND IN ADDITION to what SS just said, the Class-Action lawsuit going up for this legal matter will be at: ENZC Class Action

This site won't be live for another two weeks, but at the end of that time, all ENZC defrauded shareholders that had shares up to and until 4/30/2024, can qualify for this Class Action matter.

AGAIN, this site won't be live for another two weeks. If you use that URL prior to that, you'll get nothing for a while. We had to delay by 1 week to get legal notices and rules built into the new website, assuring participants privacy, security and private access to their uploaded files there.

Holders of past SAFE documents regarding Bioclinetics and Enzolytics are also covered.

There are no guarantees of a litigation victory, but attorneys advise us, at this time, our case is strong.

If you do sign up to participate in this Class Action Matter against CCC and ENZC, your information will be held privately and securely until the case information is heard at a court hearing with a date TBD.

GLTA

To those collecting evidence for a potential class action lawsuit, it wouldn't hurt to contact James Hicks to see if he has anything to offer. I don't believe he was involved in any of the wrongdoing that went on in ENZC. At the very least the interviews he did with ENZC representatives should be saved. When a representative from the company (Chandra) enthusiastically claims that they are days to weeks away from audits and uplisting, that may have led some investors to purchase shares. They did eventually finish the audits that were required, but since then their auditor's credibility has come into question. Did they ever intend to actually uplist?

Yeah, I'll try. This came out in early May, if memory serves, and it even included a map of the main HQ campus of Samsung Technologies near Seoul, South Korea. They even marked where the MABS-Tech office was on the campus. (Which I suspect is/was a complimentary small office location for being a Samsung partner, in this case, a supplier of the mABS for reproduction on a mass scale.) The video Joe Cotropia has supplied in the post, looked like it could have been the 'Bioclinetics Lab' at the Texas A&M building they were using again for dual purpose advertising.

It was definitely not the same lab as the Enzolytics lab at A&M that was up on the second floor, but it did look like the Bioclinetics lab they used to have on the 1st floor of the Preclinical Trials Research Center.

I'll see if I can go pull that up again. Think it went down with the MABS-Tech website, that I don't think is active for the time being.

GLTA

I hear you , if I was Hicks I would call him out , but we all know the Doctor or Charles will not make any statements now.

IMO, Hicks was not in on it or did not know what he was being fed was not true. When Hicks spoke of the NDA that Gaurav told him about, their relationship was terminated. Can we confirm there was an NDA today? NO.

You can maybe message Hicks, but he's been mum on the subject, even offering Chandra to do additional interviews but Chandra has ignored those requests for the most part.

I haven't seen anything related to Samsung posted , by chance have you reached out to Hicks to see what he thinks about all this. Alot of info was talked about in thoses interviews which could help show what they were stating and who they said were involved with ENZC. He to may have been mislead or was in on it, either wayn he and others have egg on their face GLTA

If Adnexus launches ,I will be calling the SEC direct that day for answers!!!!!! If you have any questions pm me .

In lack of confirmation of all the details you just covered, I'd have to say, Yes, I agree on all points. I think Chandra wants to get an assumption of full separation of responsibilities to anything ENZC related right now. He wants any online-cyberverse investor not thinking about ENZC when Adnexus launches, in whatever form that will be. He doesn't give any regard to folks remembering contradicting statements and PR's which he's been in on, or the sole author of, himself.

This is why my opinion of CBDW changing to ADNX still looks like their safest public offering move. While Lambrecht 'might' make CBDW profitable, his company design and marketplace is full of holes, IMHO. That someone wants to stake Adnexus through CBDW tells a lot. CBDW needs a new target acquisition candidate to make both businesses thrive under one stock banner.

And best yet, if he's telling the truth, (Chandra) he still owns a large stake in ENZC shares too, full severability never executed. CCC still owns every original share he said, and that's about 40-45% in preferred voting shares of that company.

Maybe they just sold those shares off in a panic to get that severed, I just don't know. CCC has so many contradictions out there, I believe any qualified attorney will make them look like fools stuttering in a court of law, if we ever get there with them.

clock's ticking....

We'd have to go look up those old postings and track down a contact.

Docs,

Chandra told you this, referring to funds used to pay for the company's labs and R&D (I assume)? How about CC?

Chandra first said investors paid for it, and that CC paid the last two months of operations to the tune of almost $400K of personal money.

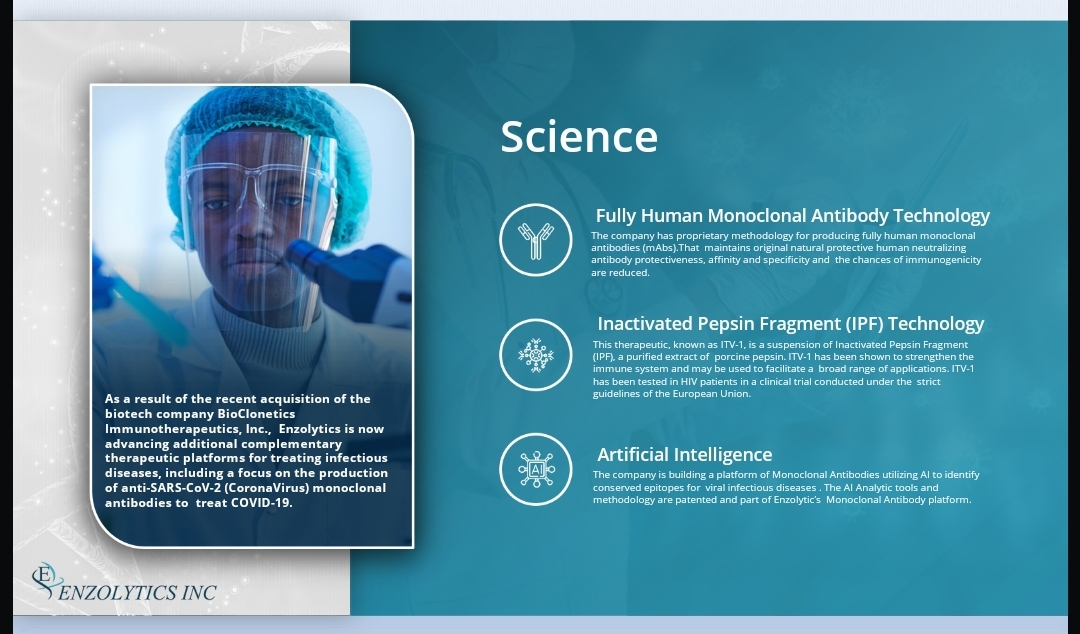

More recently, Chandra has said that all stock investor money all went to pumping Harry's ITV-1 product, nothing of investor funds went into their Clone3/7 or AI products.

I wonder if Samsung campus office would tell us if the statement is true.

It was posted and PR'ed, when the MABS-Tech shell was created by CC when the CCC group left ENZC. It was to hold and protect, maybe even go public someday with the Clone3 and 7 products. Right now, their direction is on with Adnexus Biotech, but the Samsung campus office was published in both a PR and a website posting with a video of Joe Cotropia working in a lab. You might have seen that.

We know. We think Chandra's trying to dissipate heat with the SEC clobbering his old company and partners right now. (trying to distance himself from his past...)

He may have large funding personally, but something else is going on, for certain.

GLTY and stay tuned.

"More recently, Chandra has said that all stock investor money all went to pumping Harry's ITV-1 product, nothing of investor funds went into their Clone3/7 or AI products."

For those of us who bought BioClonetics SAFEs in 2017 (3 years before the merger with ENZC), our money was definitely used on Clone 3.

The question is, where did the $20M come from???…And is the first time I hear they have an office at the Samsung campus in South Korea; Where was this posted or PRed?

No one knows who paid what. Harry was quoted as saying donors and investors paid it. Chandra first said investors paid for it, and that CC paid the last two months of operations to the tune of almost $400K of personal money.

More recently, Chandra has said that all stock investor money all went to pumping Harry's ITV-1 product, nothing of investor funds went into their Clone3/7 or AI products. Chandra does have financial resources, but I don't buy that crap about 0% of stockholder investments went elsewhere all of the time. The labs alone cut into large scale funding as it was, and there were other debts of operations too.

So, Chandra now contradicts himself on how Clone3 and Clone7 and his AI with Intel-Virus Mapping was all done without any ENZC shareholder investment. He's changed his mind, or he was lying in earlier years. If he has all of this money as he claims, somewhere in the neighborhood of $20 million, why hasn't he had at least a couple of volunteer trial successes with the CCC team?

Might have nothing as you say, but he might have a lot more, spending in other areas first. Their office at the Samsung campus in S. Korea isn't free either. May not be in actual use yet, but it's there.

A lot of fraud penalties easily applied to them, at super-high risk, if they have nothing. Why does a well-off guy bother if he does not have the goods?

I'm following the money, you go ahead and follow your anger. My anger is dealt with honestly and in different ways. You should see some of my vocabulary choices on 'X' these days.

1) What research or scientific findings came out of those two years plus at Texas A&M? Clone 3/7 really? Let's not discuss the basic AI information on their new website that can be found on many AI related websites... I don't find this credible, but maybe you do and that's where we can disagree

2) Who paid for those labs?

I don't see anybody going to jail, if anything they will pay a fine and move on with their lives. I think that's a risk Gaurav is willing to take again.. He doesn't even like in the states.... so like I said maybe you don't but you give them a LOT of credit that's undeserved.

For one who tosses speculation about, you should know, but don't, that's sad. I directed you once to the published data on Clone3/7, admittedly, it's not as much as I hoped for, and most of it is now part of the Adnexus Biotech webpages at Chandra's new site.

My speculation is speculation, but it's based on a lot more facts and common sense than what you toss around for insults.

We're all pissed at CCC's lack of professional, well, most anything, but the odds are against what you're claiming, as always.

If their LOI does not close and get funded, you're probably right. If they do get funded, for a 3rd or 4th time in this Bioclinetics journey on the 3-4 main IP's, your chances of being right are less than about 5% and that's being generous. Flim-Flam men of the early 1900's knew when to close up shop, move far away, and start a new con; that is not what is happening here. For whoever's right, it's an entirely different kind of operation.

If you're still holding ENZC shares, just for one piece of undeniable fact, you'd better damn well hope others are right and you're dead wrong.

GLTA

That's pure speculation and not fact.. "I believe" well we saw everything you "believed" with ENZC.

if YOU have facts, we'd like to see them. You can call me whatever name in the book, that doesn't change anything to me I'm not backing down until CCC (especially Gaurav Chandra) is held accountable for their part in the scam.

Welcome buddy, URL coming next week, website activation week after that.

Common Sense eludes this one. Elon Musk won't waste a dime if the tech isn't real, and he's far better off than the CCC group combined. Donors don't invest millions unless they've seen something tangibly passing the grade too. And no one fake-works a pair of labs like that. They'd take the money and run.

They did not. And with an SEC investigation crushing down on their old company and former partners, they'd not risk the same operation elsewhere with the same IPs to go to jail for extending such a 'scam'.

That's the best-case scenario for not brainless-mindless-factless bashing.

CCC's business acumen and strategy have been laughable for the pedigrees they collectively hold, but I believe they have the goods. It's certainly possible with those clowns, if they've learned nothing from the far and more recent past, they blow it and their IP's never make to market, or if Chandra is dangling the truth out there, they may be closer than previously thought to get into trials and licensing agreements.

One may disagree but try not to do it so stupidly. If you have facts, present them. You have none, and you ignore some of the Clone3/7 data that has been published.

GLTA

I hope @docsetc can explain this to the board based on his recent comments: "You don't spend over $600K keeping two labs in operations at Texas A&M's top facility for two years plus, if you have nothing and you're scam artists. "

WHY NOT?

1) What research or scientific findings came out of those two years plus at Texas A&M?

2) Who paid for those labs?

People keep saying we can't prove his science isn't real, but they also can't prove with 100% confidence IT IS real. Make it make sense!

I'm buying more months of private messaging here, since we're treading on stuff attorney's will want quiet until they file for a hearing date.

When our website launches, you'll have a direct pipeline to the matter in progress. Some reading our board think they're getting a heads-up on some critical information to try and protect Adnexus-whatever.

Not really, no. ![]()

GLTA

"It could"..... but Harry Z would have to be convicted first, then a new-ownership-transaction of such a type could occur, but it's a longshot. The SEC case is pretty strong and comprehensive against Harry and his past partners. The SEC, instead of allowing minority members to takeover ENZC, may just shut it down as in-debted hopelessly, and in a manner to recover whatever they could to pay fines and penalties. Restoring investors somewhere well down the road after that.

Our plan is to offer CCC a way out, in an out-of-court settlement, that would in-effect take care of the investor's share loss and not cost them much of anything at all. Their primary worry is that their new investor may see this as a troublesome situation they might not want to be involved in.

Once the lawyers prepare to file, GHS, Singlepoint, a lot of folks will know exactly what is going on.

GLTA

Doc, could GHS funding be used to potentially buy all the shares of ENZC once the issues with the known bad actors are resolved? I'm NOT saying this is going to happen to all the NEGATIVE folks on this board, but is it something to think about? Would this approach then satisfy all the parties involved? What are your thoughts?

Dang, have fun in Spain man! Me, I've got Mexico coming up in a few weeks.

My pleasure. I think to fade heat, CCC will let the ENZC acquisition or merger rumors fly again, hoping there's no more litigation coming after them. Too bad.

I've got a couple of final reviews with the two class action firms, see what they want to do and what steps, if they'll take any, are next. They did tell me, if they take the case or assign it to an associate-partner firm, they have enough to get a fast-hearing date and lock in a trial at the very least. They're still mulling over success probabilities. They seem to agree the case is strong, and the defrauding of investors as I put it to them is obvious & accurate, but it's also a little into 'new territory' even for an OTC case.

Any further details coming from any attorney will be on private messaging only, or will be worded to go public on the new website for this matter.

We'll see. Too bad the former principals on both sides of ENZC don't have the ethics or the professional demeanor to handle this a LOT better.

GLTA

Waiting for a flight. Haven't really been watching this for awhile. Thanks docsetc for taking the lead on a possible legal solution. I still have a few hundred thousand shares of this turkey sitting around. I did well on the initial pump and on the trade side, but you can count me in on any legal action. I am willing to throw a few bucks at it. All for now. Gotta go. In Spain for the next few weeks. Take care everyone. I'll chime in when I get back stateside.

Cheers,

Coach

Yeah, the longer Chandra's pimps go quiet over on X and Discord, the more we know they've been tipped off to something. Just for those who don't know here yet, CCC, all 3, avoided the certified mail legal notices and USPS doesn't do squat to get more info when they close it out as undeliverable.

So, we sent those same notices out FedEx this morning, to some addresses they'll be hard pressed to avoid getting it.

The Website developers have my order to complete the class-action website and launch it ASAP. I should have dates later today.

GLTA

I was told the Chandra Pimps on 'X', who managed the old discord site, closed the one down, opened a more private one where they gossip up their plans to pump CBDW and trash ENZC further, which is in a total contradiction in telling the rest of us to give up on pursuing CCC. They seem to think hammering Harry Z, and presenting CCC in the light of angels will make them more $$$ over in CBDW.

So, in effect, they're lying through their teeth about the defrauding lawsuit against CCC.

Their new Discord group is private, I am told. I never work over there.

"If that LOI closes, you can bet the private trials, the full patent award, and a beginning of the Gilead licensing partnership will happen in fairly short order."

You really believe this huh? You tried to slip this in there hahahahahaha OK I've heard enough

Total BS kid. Push that crap somewhere else. BonnieMac and MagaPatriot have stayed in regular touch with me, will be part of the lawsuit.

Simply put, you can't constantly get new funding if you don't have the goods. If Adnexus gets the stake from CBDW/GHS Investment Partners, they've got Clone3, Clone7 and Sutra working pretty well. I see this, merger, is my suspicion, of the former ENZC IP's staff and operations with the GHS Investment portfolio as significant IF it happens.

GHS has a few stinkers and a few winners in their current portfolio. None of it, however, makes one thirst to invest in any of their companies. They need a clear winner to bring returns for their investment board. If they land this funding, that stinker Chandra has what he's been boasting, and his buddies at Sanctum are ready to elevate the entire game.

If the LOI busts, and GHS was still cash flush, then Chandra gets caught being a con. If that LOI closes, you can bet the private trials, the full patent award, and a beginning of the Gilead licensing partnership will happen in fairly short order.

Can't say for absolutely sure that he's a con or not a con, but the inappropriate way CCC has operated and the unprofessional Twitter Pimps he uses over on "X", sure prove his business acumen and business ethics leave a LOT to be desired.

Nope all those people like Mutat, Puma, MAGA patriot and Bonnie etc just disappear when the scam is exposed

I thought there would be more input here after the discord server closed.

Shame is the wrong word ,criminal is correct word. We shall see but from what I can tell ,when you hang out with criminals ........

|

Followers

|

1245

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

200124

|

|

Created

|

01/07/10

|

Type

|

Free

|

| Moderators Homebrew Timing101 archilles SeniorApollo | |||

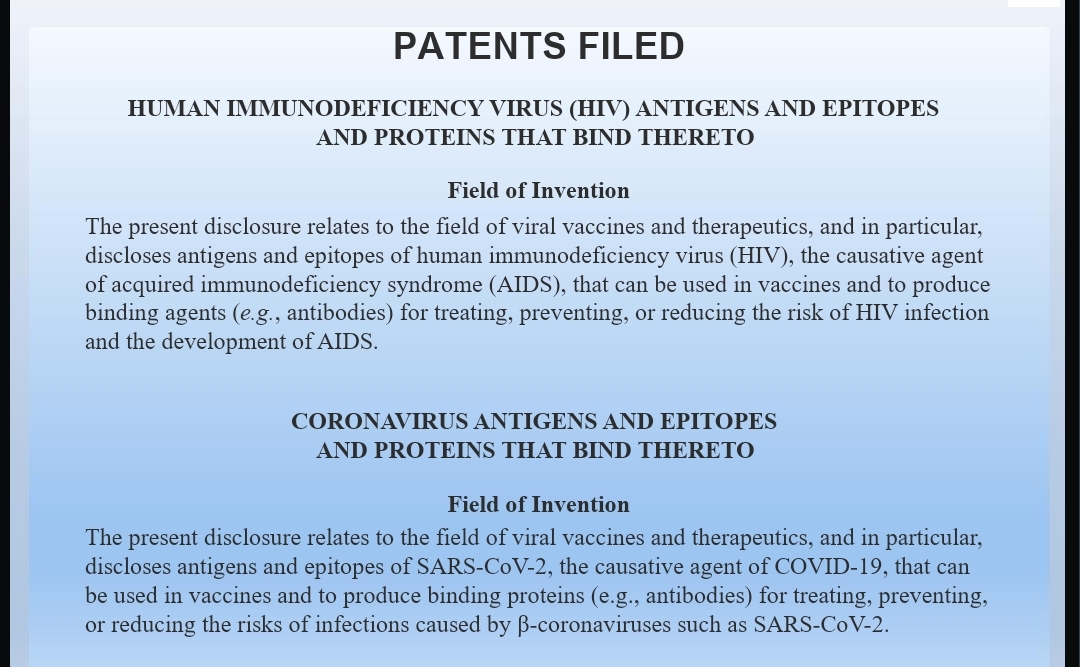

Independent Valuation Report Pre Clinical Studies

Investments

___________________________________________________________________________________

Press Release July 20-2021

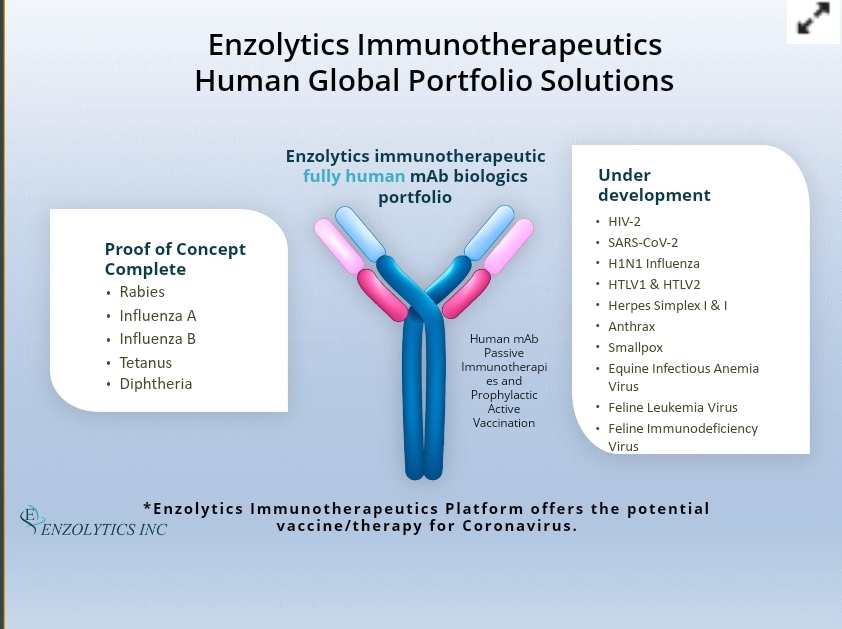

Enzolytics Announces the Signing of a Letter of Intent with Creative Biolabs, Inc.

for Licensing and Commercialization of anti-HTLV-1 Monoclonal Antibodies

https://www.creative-biolabs.com/

https://finance.yahoo.com/news/enzolytics-announces-signing-letter-intent-113000339.htm

________________________________________

Press release July 21-2021

Enzolytics and Lonza Bioscience Combine Technologies to Fast-track Development and

Production of Anti-HIV and Anti-SARS-CoV-2 Monoclonal Antibodies produced by Enzolytics

https://www.lonza.com/

https://www.bloomberg.com/press-releases/2021-07-21/enzolytics-and-lonza-bioscience-combine-technologies-to-fast-track-development-and-production-of-anti-hiv-and-anti-sar

_________________________________________

July 22 INTERVIEW

with

James Hicks, Charles Cotropia and Gurav Chandra

http://www.youtube.com/watch?v=mdljO9VLgj0

______________________________________________________________

COLLEGE STATION, TX August 25, 2021

Important Excerpt from this news progress update.

>>>>>><<<<<<

"The monoclonal antibodies being produced by Enzolytics against the CoronaVirus target 19 conserved immutable sites on the virus, sites which the Company has now confirmed are conserved sites not only on the initial virus strains but also existing in the Delta and Lambda variants, as well as in the Alpha, Beta and Gamma variants."

Enzolytics Inc. and Samsung Biologics Announce

Development and Manufacturing Agreement for Anti-

HIV and Anti-SARS-CoV-2

Important Excerpt from this news progress update.

>>>>>><<<<<<

"Samsung Biologics (KRX: 207940. K.S.), a leading contract development and manufacturing organization and Enzolytics (ENZC), a drug development company committed to commercializing multiple proprietary therapeutics to treat debilitating infectious diseases, announced the signing of a strategic CDMO partnership agreement."___

____

____

2000 North Central Expressway

Plano, TX 75074

972-292-9414

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |