Wednesday, July 01, 2020 8:54:56 AM

For standard AIM, 50% initial cash, 10% of stock value minimum trade size over the same period, looks to me that AIM opted to migrate to a overall 40/60 type average weighting. Only had 1 trade, a sell trade.

Whilst less rewarding than both Buy and Hold (all stock) and 50/50 constant weighted the rewards were still acceptable i.e. pretty much supported a 4% Safe Withdrawal Rate (SWR) and still had (most of the) inflation adjusted portfolio value having kept up with inflation.

Under other circumstances it could have been quite different. Sequence of Returns (SoR) risk tends to he highest in yearly years, if for instance stocks and dividends halve shortly after buying then a former 4% withdrawal rate intent in effect becomes a 8% withdrawal rate desire in order to compare - which is far far less likely to succeed.

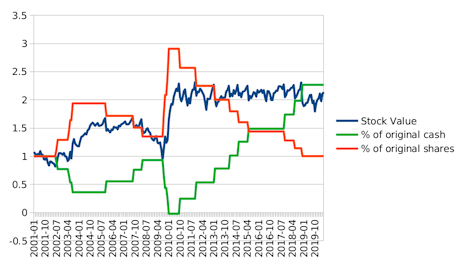

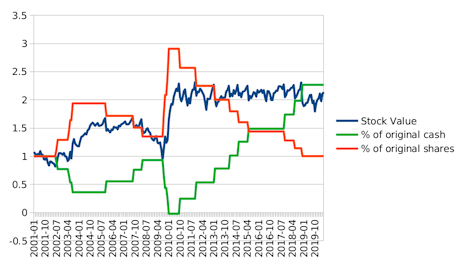

If you look for instance at AIM of SPY (S&P500), 50% initial cash, dividends and cash interest excluded (standard AIM) since 2000

and how it varied things over time in terms of the increase/decrease in cash and shares relative to the start date i.e. cash could also be considered as being a 'share' of $1 value/price and AIM revises how many of cash 'shares' it holds over time. Basically AIM over doubled up on the number of cash shares it held, and ended with around the same number of stock shares as at the start. It sort of constant weights the stock value, but with interim/periodic increases in that level. In the above case that constant value rose and then sideways ranged at around the 2 times level ... which pretty much offsets inflation.

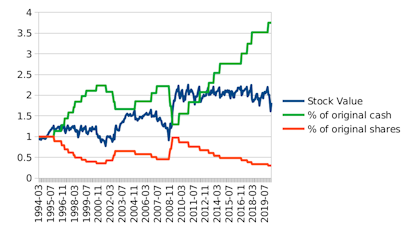

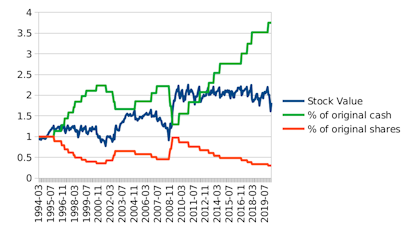

2000 was somewhat a bad time to have started. Over another period AIM can direct the portfolio to another overall balance. This for instance moves the start back back 5 years to 1995 i.e. during a Bull run (up to 1999 highs).

In that case AIM opted to end up holding only around 30% of the number of shares it started off with, and it also opted to massively expand cash 'shares'. More so as those values exclude also having dividends and cash interest added on top.

If you have been retiring back in 2015 and opted for all in on IYH then so far that would have been OK at supporting a 4% SWR, but that would be high risk. Yes you'd have been rewarded more for having taken on that risk, however AIM could have provided the same income with considerably less risk. If IYH had endured a bad SoR following purchase it was far better placed to achieve the 4% withdrawal income goal than might a all in buy-and-hold of IYH that (could have) endured a dive/dip in the earlier years/period.

A tendency with AIM is that it improves (reduces) risk even more over time, it has the tendency to be a constant stock value type method, but where that is periodically stepped up to a higher level (that tends to offset inflation), which broadly tends to result in large amounts of cash being accumulated and where cash accumulation/expansion can exceed its burn rate (withdrawals for spending). So you can either start a new AIM when cash reserves are considered too high, or Pull Vealies, or simply just sit back on holding a portfolio with less risk (relatively high levels of cash/low levels of stock).

Health/pharmaceuticals have tended to hold up well across the Covid-19 period - likely due to potential anti-virus drug/procedures potentials. Others such as banking and oil (at least in the UK) have been dismal, halving down type movements, along with dividends also being totally cut in many cases (UK state policy is to 'assist' firms financially but not if the intent is to pay dividends (reward shareholders) potentially with those sums. Very likely is that buy and hold of a oil stock would have seen a serious hit, whereas AIM would likely have made the best it could under the circumstances and been vastly better for the investor.

Less so in the US due to the greater tendency to retain more of earnings, but in the UK broadly you might anticipate price appreciation, dividends and cash interest to all broadly compare to inflation. So you might consider share price only as being the inflation offset, and a income that broadly might compare to inflation. Or you could flip that around and assume that cash interest and dividends would offset inflation and the share price appreciation was the real (after inflation) reward. AIM without dividends and cash interest considered might typically see something like cash and stock values doubling up perhaps over 20 year periods which equates to a 3.5% annualised rate. Separately there will be cash interest and dividends being provided, along with AIM throwing off cash by reducing down the number of shares it holds. I guess investors could opt to use AIM either way, i.e. pure AIM without cash interest and dividends included (spending the interest/dividends) and leaving the AIM to offset inflation, or investors could spend the AIM gains, and leave the dividends/interest as the inflation offset 'growth' element (and adding new AIM's along the way as part of that, or pulling Vealies). Fundamentally they're the same, just mental accounting/partitioning.

Clive.

PS whilst IYH under standard AIM traded very little since 2015, Lichello was OK with that. He even dedicated a chapter indicating such for the Retired Individual, where IIRC he indicates that balanced funds are OK for the retired AIM'er even under AIM-HI (20% initial cash). I guess if the balanced fund you AIM is a 50/50 stock/bond blend then that halves the volatility so AIM trades less frequently, but where it throws off much more cash (dividends and bonds). AIM HI against a 50/50 stock/bond asset would be somewhat like a 40/60 stock/bond holding initially, in contrast to being a 25/75 stock/bond holding if standard AIM (50% initial cash) was being applied. Again both of those are likely to be very safe for a retired investor. Better than all in bonds/cash, with way less risk than a stock heavy portfolio. Whilst the rewards might still be reasonable. Perhaps 3% type real gains, such that a all bond investor that drew down bonds over 33 years to zero and had nothing remaining, even with a standard AIM against a balanced fund that perhaps generated 3% real could have the investor still sitting on a portfolio similar to the start date inflation adjusted amount after the 33 years, despite perhaps just having held relatively little stock (low risk).

Going back to 1972 and looking at the difference between a 3% SWR applied to 25/75 stock/cash compared to all cash https://tinyurl.com/ydbn4sc5 i.e. a time when high inflation and drawdown was a considerable danger (one of the main reasons why Lichello devised AIM) and in inflation adjusted terms even to date that would still be chugging along quite nicely whilst the all-cash investors money would have been exhausted in 2015 (which in itself wasn't too bad) i.e. lasted around 43 years. All stock also survived through that 3% SWR rate, but a couple of years after starting in 1972 were seeing their portfolio value down more than half in inflation adjusted terms (-52% down at the end of December 1974). Likely some would have capitulated at around that point, such that whilst they would have been better to stick with it, instead capitulation would have left them with bonds of less than half of the value of their lifetime savings after just a couple of years of having been hoping for stocks to cover their retirmeent.

Whilst less rewarding than both Buy and Hold (all stock) and 50/50 constant weighted the rewards were still acceptable i.e. pretty much supported a 4% Safe Withdrawal Rate (SWR) and still had (most of the) inflation adjusted portfolio value having kept up with inflation.

Under other circumstances it could have been quite different. Sequence of Returns (SoR) risk tends to he highest in yearly years, if for instance stocks and dividends halve shortly after buying then a former 4% withdrawal rate intent in effect becomes a 8% withdrawal rate desire in order to compare - which is far far less likely to succeed.

If you look for instance at AIM of SPY (S&P500), 50% initial cash, dividends and cash interest excluded (standard AIM) since 2000

and how it varied things over time in terms of the increase/decrease in cash and shares relative to the start date i.e. cash could also be considered as being a 'share' of $1 value/price and AIM revises how many of cash 'shares' it holds over time. Basically AIM over doubled up on the number of cash shares it held, and ended with around the same number of stock shares as at the start. It sort of constant weights the stock value, but with interim/periodic increases in that level. In the above case that constant value rose and then sideways ranged at around the 2 times level ... which pretty much offsets inflation.

2000 was somewhat a bad time to have started. Over another period AIM can direct the portfolio to another overall balance. This for instance moves the start back back 5 years to 1995 i.e. during a Bull run (up to 1999 highs).

In that case AIM opted to end up holding only around 30% of the number of shares it started off with, and it also opted to massively expand cash 'shares'. More so as those values exclude also having dividends and cash interest added on top.

If you have been retiring back in 2015 and opted for all in on IYH then so far that would have been OK at supporting a 4% SWR, but that would be high risk. Yes you'd have been rewarded more for having taken on that risk, however AIM could have provided the same income with considerably less risk. If IYH had endured a bad SoR following purchase it was far better placed to achieve the 4% withdrawal income goal than might a all in buy-and-hold of IYH that (could have) endured a dive/dip in the earlier years/period.

A tendency with AIM is that it improves (reduces) risk even more over time, it has the tendency to be a constant stock value type method, but where that is periodically stepped up to a higher level (that tends to offset inflation), which broadly tends to result in large amounts of cash being accumulated and where cash accumulation/expansion can exceed its burn rate (withdrawals for spending). So you can either start a new AIM when cash reserves are considered too high, or Pull Vealies, or simply just sit back on holding a portfolio with less risk (relatively high levels of cash/low levels of stock).

Health/pharmaceuticals have tended to hold up well across the Covid-19 period - likely due to potential anti-virus drug/procedures potentials. Others such as banking and oil (at least in the UK) have been dismal, halving down type movements, along with dividends also being totally cut in many cases (UK state policy is to 'assist' firms financially but not if the intent is to pay dividends (reward shareholders) potentially with those sums. Very likely is that buy and hold of a oil stock would have seen a serious hit, whereas AIM would likely have made the best it could under the circumstances and been vastly better for the investor.

Less so in the US due to the greater tendency to retain more of earnings, but in the UK broadly you might anticipate price appreciation, dividends and cash interest to all broadly compare to inflation. So you might consider share price only as being the inflation offset, and a income that broadly might compare to inflation. Or you could flip that around and assume that cash interest and dividends would offset inflation and the share price appreciation was the real (after inflation) reward. AIM without dividends and cash interest considered might typically see something like cash and stock values doubling up perhaps over 20 year periods which equates to a 3.5% annualised rate. Separately there will be cash interest and dividends being provided, along with AIM throwing off cash by reducing down the number of shares it holds. I guess investors could opt to use AIM either way, i.e. pure AIM without cash interest and dividends included (spending the interest/dividends) and leaving the AIM to offset inflation, or investors could spend the AIM gains, and leave the dividends/interest as the inflation offset 'growth' element (and adding new AIM's along the way as part of that, or pulling Vealies). Fundamentally they're the same, just mental accounting/partitioning.

Clive.

PS whilst IYH under standard AIM traded very little since 2015, Lichello was OK with that. He even dedicated a chapter indicating such for the Retired Individual, where IIRC he indicates that balanced funds are OK for the retired AIM'er even under AIM-HI (20% initial cash). I guess if the balanced fund you AIM is a 50/50 stock/bond blend then that halves the volatility so AIM trades less frequently, but where it throws off much more cash (dividends and bonds). AIM HI against a 50/50 stock/bond asset would be somewhat like a 40/60 stock/bond holding initially, in contrast to being a 25/75 stock/bond holding if standard AIM (50% initial cash) was being applied. Again both of those are likely to be very safe for a retired investor. Better than all in bonds/cash, with way less risk than a stock heavy portfolio. Whilst the rewards might still be reasonable. Perhaps 3% type real gains, such that a all bond investor that drew down bonds over 33 years to zero and had nothing remaining, even with a standard AIM against a balanced fund that perhaps generated 3% real could have the investor still sitting on a portfolio similar to the start date inflation adjusted amount after the 33 years, despite perhaps just having held relatively little stock (low risk).

Going back to 1972 and looking at the difference between a 3% SWR applied to 25/75 stock/cash compared to all cash https://tinyurl.com/ydbn4sc5 i.e. a time when high inflation and drawdown was a considerable danger (one of the main reasons why Lichello devised AIM) and in inflation adjusted terms even to date that would still be chugging along quite nicely whilst the all-cash investors money would have been exhausted in 2015 (which in itself wasn't too bad) i.e. lasted around 43 years. All stock also survived through that 3% SWR rate, but a couple of years after starting in 1972 were seeing their portfolio value down more than half in inflation adjusted terms (-52% down at the end of December 1974). Likely some would have capitulated at around that point, such that whilst they would have been better to stick with it, instead capitulation would have left them with bonds of less than half of the value of their lifetime savings after just a couple of years of having been hoping for stocks to cover their retirmeent.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.